Global Digital Sales Grow 36% on Cyber Week: 4 Findings and What They Mean for the Rest of the Shopping Season

Shoppers across the globe spent a record $270 billion online this Cyber Week, outpacing bullish projections.

Caila Schwartz

Cyber Week online sales unfolded in the pattern we expected after the first three quarters of the year. Digital sales surged an unprecedented 71% in Q2 globally and significantly grew 55% in Q3 globally. We forecast 30% growth for the entire holiday season, November 1 – December 26. For the largest two digital days of the season, specifically, Black Friday came in right on target with 30% growth and Cyber Monday grew at a lower rate of 18% year-over-year (YoY) globally.

Black Friday and Cyber Monday growth was impressive, especially given the sizable baseline, but not unexpected as Cyber Week was markedly different in 2020 compared to previous years. Holiday merchandising and marketing made a major shift to the digital realm and with COVID-19 still raging in many parts of the world, major factors played a role in digital’s rise during Cyber Week:

- Retailers limited store traffic and hours

- More consumers shopped in the comfort and safety of their homes

- An increasing number of people shopped online for the first time

- Retailers provided a steady drumbeat of promotion to pull demand earlier in the season

See the stats for yourself:

Shoppers across the globe spent a record $270 billion online this Cyber Week, growing an astonishing 36% YoY — outpacing even our most bullish projection. In the U.S., that growth rate came in at 29%, slightly lower than our projection of 34%, and the total digital sales were a record $61 billion. Brands and retailers stepped up and met this challenge with some creativity, patience, and a whole lot of ecommerce.

Retailers often ask about how to mark this massive growth as we inch closer to one year into the pandemic. Based on our data and analysis, we anticipate the industry will experience further deceleration — perhaps into the mid-teens — as growth normalizes and we settle into this new digital baseline.

Keep reading for our top four takeaways from Cyber Week and what they mean for the rest of the holiday season and beyond.

Insight 1: Earlier start to holiday doesn’t slow Cyber Week demand

COVID-19 and Amazon Prime Day in the fall created a compelling reason for consumers to make digital purchases earlier in the holiday season than ever before. It was successful, but didn’t diminish Cyber Week digital sales.

No longer constrained to the doorbusters of Black Friday or the office internet speeds on Cyber Monday, consumers steadily discovered and purchased gifts throughout the holiday week. A trend that has been increasing over the year thanks to access and convenience from mobile phones is spending online was smoothed out with shoppers purchasing throughout Cyber Week.

Whether compelled by looming shipping deadlines or great deals, one thing was clear this year: shoppers weren’t holding back. Key global digital traffic and sales insights throughout the week include:

- Online traffic increased by 28% on Tuesday and 18% Wednesday before Thanksgiving.

- Thanksgiving saw a moderate increase in traffic and sales — 7% and 27% respectively — perhaps due to the higher volume we saw earlier in the week and the desire to disconnect the digital world.

- Black Friday, once again, was the largest digital shopping day of the holiday week driving $62.2B in global sales and $12.8B in the U.S.

Insight 2: Shipping defines winners and losers

With our analysis of digital shopping in the first three quarters, we predicted traditional shipping capacity would be 5% over capacity — putting 700 million packages at risk over the holiday season. To avoid shipping delays and decrease costs, retailers got creative with last-mile delivery options and marketing.

Many retailers instituted the ability to buy gifts with confidence online and pick up with the convenience in and around the store. By outsourcing last-mile delivery — via in-store, drive through, or curbside options — retailers reduced costs while consumers received their merchandise sooner. From the data we gathered, U.S. retailers offering creative pickup options experienced 29% growth in sales compared to 22% in retailers who had a simple fulfillment option.

To avoid late deliveries and disappointed shoppers as Christmas gets closer, retailers attempted to manufacture demand, urgency, and exclusivity via creative messages and promotions. Another motivation to shop during Cyber Week is the fact many retailers are moving shipping cutoff dates for online orders into early December. An analysis of the top IR200 revealed retailers communicated creative shipping options with consumers across multiple touchpoints. Seven percent of emails sent throughout Cyber Week (November 24 – November 30) referenced “shipping” in their subject line and 8% mentioned “BOPIS” or “curbside” within their emails. Meanwhile, 24% of IR200 retailers referenced shipping challenges and BOPIS options to bypass expected delays directly on their homepages.

Insight 3: Early promos and discounts catch attention of anxious consumers

Marketing ramped up early this year, undoubtedly to curb the unprecedented demand on distribution centers and traditional carriers but also because the flexibility of launching promotions on digital and the need to spur holiday sales created a large amount of shopping growth the week of — and the week before — Cyber Week on Tuesday and Wednesday prior to Thanksgiving. Key stats include:

- The week before Thanksgiving saw a 80% growth in digital sales globally — Friday representing the largest YoY growth with 95% globally.

- Total combined digital sales of Tuesday and Wednesday reached $50 billion globally ($11 billion U.S.), which was roughly equivalent to Cyber Monday’s volume this year.

- Thanksgiving was a bit softer than anticipated with 27% of growth globally YoY ($30 billion of sales) and 7% of traffic growth globally YoY.

And the retailers reached out aggressively to make a spread out Cyber Week happen. Global marketing communications surged throughout the week with push notifications increasing by 131% YoY, SMS increasing by 171% YoY, and emails increasing by 9% YoY as retailers looked to drum up demand as shipping windows inch toward closing.

Insight 4: Growth in digital traffic driven by influx of new digital shoppers

With fewer people going to stores — and remaining in the comfort and safety of their homes — shoppers turned to their phones and desktops throughout Cyber Week. Twenty-two percent growth in unique digital shoppers globally contributed to increases in traffic and sales. This comes on the heels of a 40% increase in unique shoppers in the first half of the year.

Mobile comprised 71% of traffic and 55% of orders, while desktop saw 26% of traffic and 41% of orders YoY globally during Cyber Week. Despite economic and health uncertainty abound, average order value (AOV) during Cyber Week remained essentially flat from last year across all devices — $103 AOV globally and $104 AOV in the U.S.

The top three categories for digital sales growth globally on Black Friday, specifically, were Food and Beverage (+112%), Home (+70%), and Electronics (+68%). The acceleration of people buying essential products online (e.g., groceries, spirits, snacks) translated to massive growth on Black Friday. For a historical perspective, Food and Beverage grew a mere 15% YoY in 2019.

What’s next for the holidays?

Ordering merchandise may be easy and you’ve already paid for it. But have you received it yet? Do you know when it will arrive? Can you trust that date? These are the questions that are now the center of attention for retailers and customers.

The unprecedented demand we saw on digital this Cyber Week means there will be a surge in shipping — and returns. Here’s how to turn challenges into opportunities.

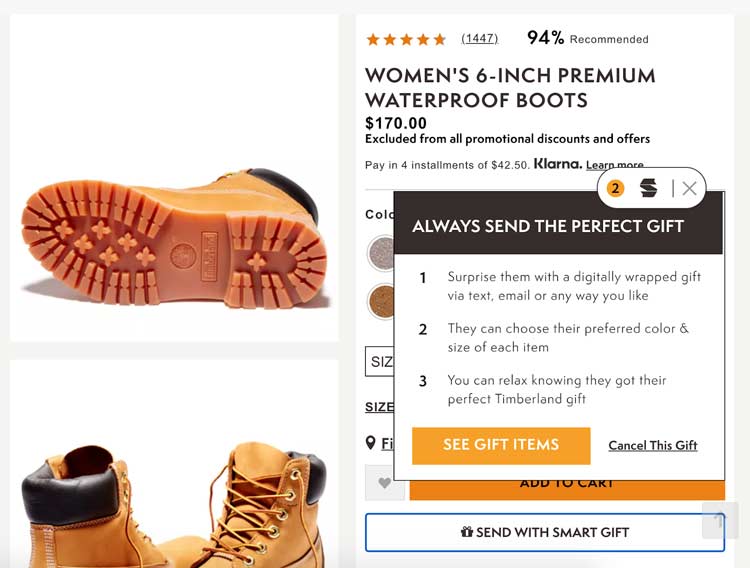

Creative gifting

A lot of retailers are getting creative to get the order right the first time and if possible, avoid shipping altogether. For example, with Timberland, you can send a digitally wrapped gift via text or email. The recipient still feels like they got to unwrap a virtual present and the gift giver doesn’t need to worry about getting the color or size wrong.

Frequent and transparent communications

The use of SMS for customer communication exceeded 100% growth on Black Friday and Cyber Monday, much more than email. When it comes to communication about merchandise the customer is anxiously waiting for, more communication is a good thing.

Customer visibility across all touchpoints

Consistency is key in ensuring customer experience when it comes to fulfillment and returns. Ensure that the customer information you gather on the digital channel is the same as what the store associate sees when customers come for store pick up and/or returns.

Sign up for our Cyber Week 2020 wrap up webinar and get more data insights from a billion global shoppers for even more extra shopper delight in every holiday insight.