- Less than 20% of customers across banking, insurance, and wealth management say they get the assistance they need when transferred to financial services customer support.

- With new Client 360 capabilities, Salesforce for Financial Services enables financial institutions to automate common tasks, personalize service engagement, and unlock insights with AI to better anticipate customer needs.

- Client 360 is one of 12 industry-specific solutions, like Patient 360 for healthcare and Education 360 for learning, that brings the full power of Customer 360 to life for any industry and delivers a single source of truth for financial services.

Salesforce today announced expanded financial services offerings built specifically for banking, wealth management, and insurance institutions. Salesforce for Financial Services now offers more targeted and trusted automation and AI powered by Client 360 to help every team unlock insights, deliver great customer service, and drive operational efficiencies – whether they deal directly with customers, underwrite loans, or manage administrative duties like human resources.

A new Salesforce survey of more than 2,000 consumers shows that financial services customers increasingly prefer digital experiences. In fact, 78% of banking customers now establish their first connection with a financial institution via website or app. However, the experience of being a customer in the digital age isn’t matching up. On average, fewer than 15% of customers across banking, insurance, and wealth management feel that their financial needs are being anticipated.

With Salesforce for Financial Services innovations — including Customer Data Platform, Intelligent Virtual Assistant, Intelligent Agent Desktop, Customer Service Coordination, and Analytics for Financial Services — firms can better serve their customers for life and boost satisfaction in this new digital economy.

“Financial services institutions are trying to keep pace with the digital acceleration that occurred as a result of the pandemic,” said Eran Agrios, SVP and GM, Financial Services at Salesforce. “At the same time, consumers are demanding more tailored services. New Client 360 capabilities are designed to meet these complex needs head-on, creating more efficiency across internal teams. This gives employees and customers the time and tools they need for a better experience overall.”

Scale personalized service with automation and connected client data

Financial institutions can drive new efficiencies by automating complex tasks across employees, workflows, and systems. New features like proactive service and call deflection also help financial services firms reduce operating expenses while maintaining quality service experiences:

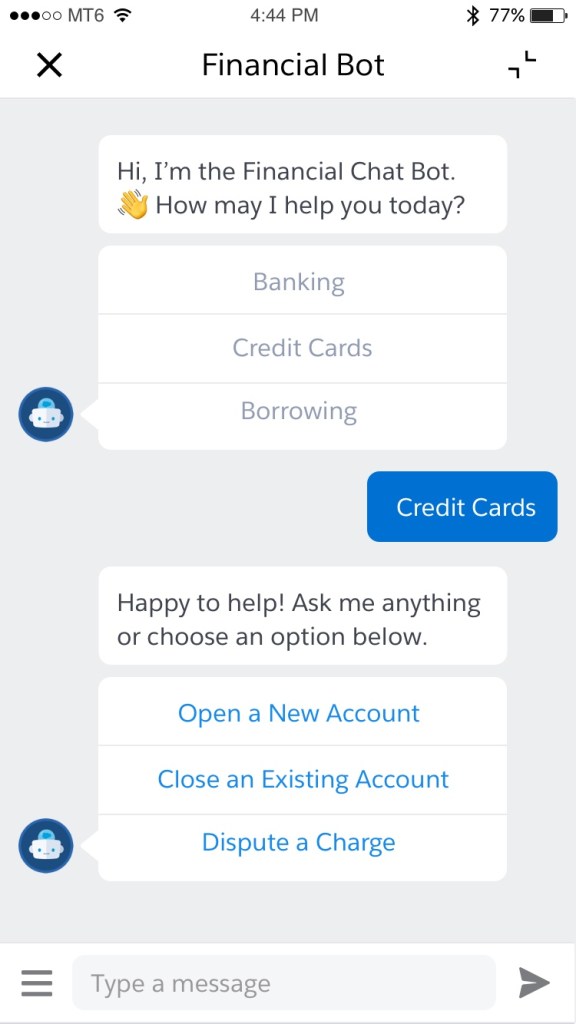

- Last year, Salesforce customers reported seeing a 27% increase in case resolution using self-service, automation, and/or artificial intelligence, including Service Cloud-powered chatbots. Virtual Assistant*, an intelligent Einstein-powered chatbot solution for Financial Services, is designed to automate routine requests faster across digital channels, like text and messenger platforms, so agents can focus on tasks that require human interaction.

- With Customer Service Coordination*, service agents collaborate in Slack as their digital HQ to accelerate customer case resolution. Using automated workflows and custom bots, Customer Service Coordination generates critical alerts and gathers customer data into a central Slack channel so teams can mobilize around time-sensitive requests, such as fraud incidents, trade execution, and claims processing. For example, service agents at brokerages supporting high net worth individuals who are having trouble executing a large trade can quickly bring the right brokers into a single channel to quickly address the client’s case.

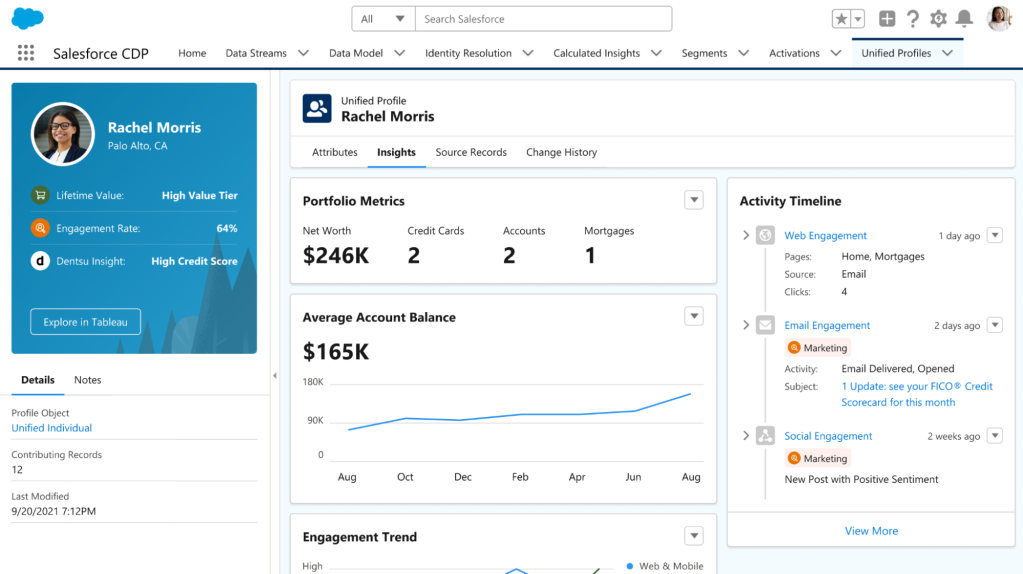

- Customer Data Platform (CDP) helps marketing teams at financial services institutions unify their customer data from different sources into a client profile using clicks, not code. This helps teams deliver personalized engagement at scale across every channel, including email, mobile, advertising, and the Web. And, with enhanced Streaming Insights and Data Actions, transactional emails, journeys, and 1:1 advisor interactions can be triggered in real time. For example, a bank’s marketing and sales teams can use CDP to unify data across channels and identify individuals who are engaging with mortgage-related content. The marketing team then creates a ‘first-time home buyer’ mortgage segment and engages them with personalized advertising and emails. With that complete, the mortgage advisor can then see if a client interacted with the campaign and reach out in real time to see if they need advising around buying their first home.

Deliver faster service with a unified desktop, actionable insights, and embedded workflows

Financial institutions can now unlock insights that anticipate and properly address customer needs in the channel where they have sought support. Features include pre-built and AI-embedded dashboards to deliver insights to employees:

- With Intelligent Agent Desktop**, agents can unlock valuable customer insights without ever leaving the console page. Features such as Customer Identity Verification, which helps agents reduce the risk of fraud, and Customer Record Alerts, which surfaces important issues that the customer may not even know about when they first call in, help to deliver faster, more comprehensive service. For example, a banking customer may reach out to the contact center to report a fraudulent transaction. With Customer Record Alerts, relevant alerts are presented to the agent, like “Low Account Balance,” so the agent can resolve multiple issues in a single call.

- Analytics for Financial Services** helps financial services institutions see and understand their customer’s data with data-driven insights to make better business decisions faster, ultimately working to deliver more predictable revenue and deepen client engagement. For example, to stay on top of a high-opportunity client in their base, a wealth advisor can leverage ready-to-use, expert-built dashboards to quickly identify and suggest how a client might add additional assets, such as a mutual fund, to their financial portfolio when they’re planning for a big life event, such as having a child.

- With Customer Address Change Automation***, service agents can expect more integrated validation, routing, and data ingestion processes across systems associated with address changes. For example, when an insurance customer updates their address in one system, Customer Address Change Automation enables faster policy updates, rate calculations, and more informed product offerings based on their region.

Customers like Prudential and KeyBank are improving operational efficiencies for front, middle, and back office teams with Salesforce for Financial Services

- Prudential, one of the largest providers of life insurance, retirement planning, and investment solutions in the U.S., is using Virtual Assistant to optimize its technology stack. To accommodate the influx of sales and service interactions during tax season, Salesforce for Financial Services innovations allowed Prudential’s agents to spend more time on complex cases while chatbots quickly addressed simple service requests. “Our ability to be there when people call ties back to being that trusted advisor,” said Bob Bastian, CIO, Enterprise Digital and U.S. Businesses at Prudential. “They can trust we’re going to answer the phone, solve their problems, and give them that digital experience they really need.”

- Ohio-based KeyBank is a leading financial services company specializing in high-touch, white-glove customer experiences across its customer segments. Specifically, Key is leveraging Salesforce for Financial Services for its wealth management and commercial banking clients to increase productivity and drive personalized interactions. By offering its employees a 360-degree view of bank clients, they can surface characteristics on lending history, account statuses and customer service interactions. For example, by taking care of core functions, the industry cloud permits [KeyBank’s] wealth management professionals to spend 27% less time on administrative tasks,’ said Brenda Kirk, EVP and CIO for commercial bank and enterprise payments at KeyBank.

Extending Salesforce for Financial Services innovations through the Salesforce Partner Ecosystem

Salesforce has an extensive partner ecosystem providing unique expertise and solutions for the global financial services industry. ISV partners such as Rocket Mortgage, Broadridge, and nCino extend and complement Salesforce for Financial Services.

Additionally, consulting partners Accenture, Deloitte Digital, Slalom, 8Squad, Gerent, Globant, Silverline, West Monroe, and VASS specialize in financial services. They are equipped to implement these solutions tailored to individual customer needs, creating great customer experiences such as digital self-service and agent engagement, along with improving efficiency across the enterprise.

Please see www.deloitte.com/us/about for a detailed description of our legal structure.

More Information:

- Virtual Assistant* is powered by Service Cloud Einstein Bots. Customer Service Coordination is powered by Slack.

- Intelligent Agent Desktop** is powered by Financial Services Cloud. Analytics for Financial Services is powered by Tableau, Financial Analytics and Financial Services Cloud Intelligence.

- Customer Address Change Automation*** is powered by MuleSoft.

- To learn more about Salesforce Customer Data Platform, click here.

- For more information about Virtual Agent and how Prudential and PenFed are increasing efficiency with chatbots and automation, go here.

- To read more about Salesforce’s 2022 Trends in Finance white paper, click here.

About Salesforce for Financial Services

With the Client 360, Salesforce for Financial Services delivers relevant solutions for banking, insurance, and wealth and asset management organizations, for more connected, digital experiences for employees and customers.