Automate financial services with Flow.

Simplify complex financial processes and create seamless customer experiences.

Banking

Streamline banking experiences.

Easily onboard customers, automate complaint processing, and dispute fraudulent transactions quickly.

Insurance

Drive underwriter productivity.

Drive straight-through processing of digital applications and automate referrals.

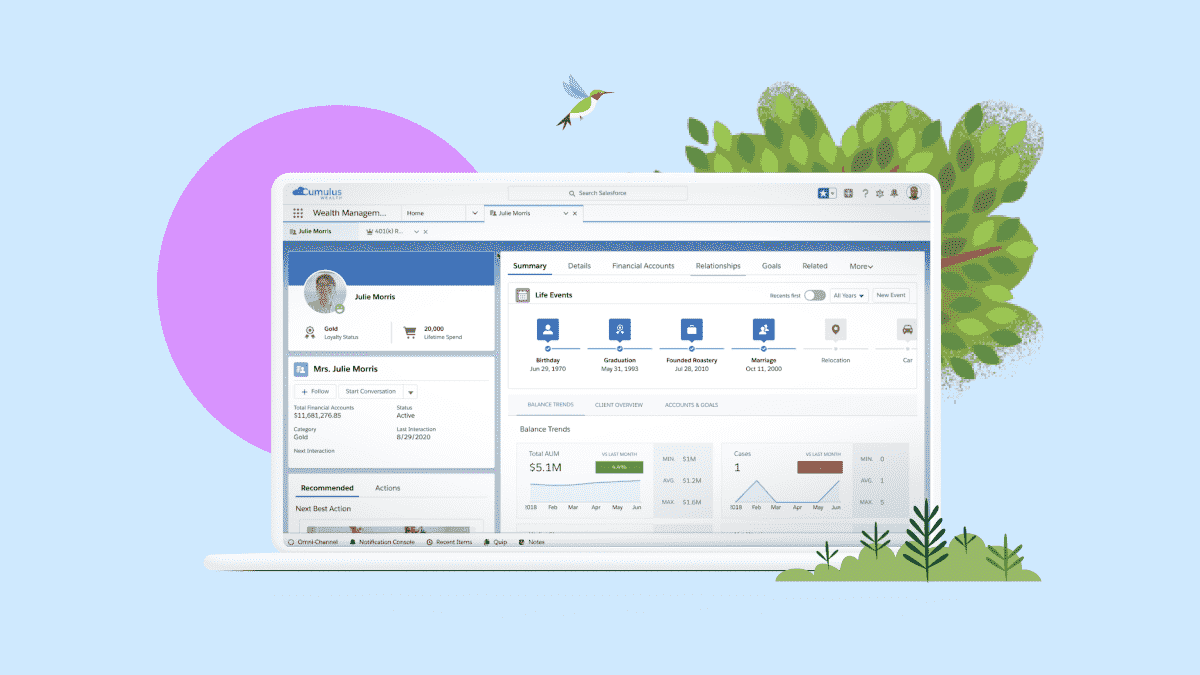

Wealth & Asset Management

Deliver premium guidance.

Proactively advise and easily deliver modern client engagement with automation.

The scalability of the platform helps our admins and developers build the automations and tools that really help the advisors serve their clients’ needs.

Rohit Gupta

Director, RBC Wealth Management, U.S.

Director, RBC Wealth Management, U.S.

What would you like to automate?

Explore our top three flows for financial services.

Financial Discovery

Streamline the complicated mortgage process with a workflow template to easily capture borrower assets, expenses, and relevant financial details.

Digital Policy Self-Service

Give customers their policy info however they want it. Use prebuilt workflows to let customers quickly view details and complete transactions without needing a contact center agent.

Common Insurance Tasks

Make policy additions, removals, and cancellations automatically. Let customers update details and communication preferences on their own. Clear out the tedium and automate a variety of time-consuming processes with workflow templates for insurance.

Get started with prebuilt automations for financial services.

| Activate Card | Activate a new debit or credit card linked with a financial account. | |

| Close Account | Close a financial account. | |

| Dispute Transactions | Dispute one or more transactions for a financial account. | |

| Order Checks | Send checks for a financial account to the customer’s billing or shipping address. | |

| Send Documents | Send various financial documents for an account to the customer’s billing or shipping address. | |

| Send Statement | Email an account statement or send it to the customer’s billing or shipping address. | |

| Update Billing Date and Frequency | Change the billing date and frequency for a financial account. | |

| Update Card Limits | Update the daily withdrawal or credit limit for a card associated with a financial account. | |

| Update Communication Preferences | Update a customer’s communication preferences. The preferences include email, phone, marketing, and fax. | |

| Fee Reversal | Allows the CSR to reverse a fee on an account or escalate the case to a manager. | |

| Address Update | Allows a CSR to capture a customer’s new address for one or more financial accounts and collect documents for updating the address. | |

| Add Beneficiary to Policy | Add a beneficiary to a life or home insurance policy. | |

| Add Driver to Auto Policy | Add a driver to an auto insurance policy. | |

| Cancel Policy | Cancel an insurance policy. | |

| Initiate FNOL | Initiate the first notification of loss for an insurance policy. | |

| Initiate Loan Against Policy | Initiate a loan against a policy at the customer’s request. | |

| Send Documents | Send policy-related documents for an insurance policy to the customer’s billing or shipping address. | |

| Update Communication Preferences | Update a policyholder’s communication preferences. The preferences include email, phone, marketing, and fax. | |

| Update Customer Details | Update policyholder information, such as name, email address, and phone number. | |

| Update Lienholder | Change the lienholder on a home or auto insurance policy. | |

| Update Policy Beneficiary Details | Update a policy beneficiary’s information, such as name, email address, phone number, and share percentage. | |

| Update Premium Payment Date and Frequency | Change the premium payment date and frequency for an insurance policy. | |

| Update Premium Payment Method | Change the current method or add a method for paying the premium of an insurance policy. | |

| Assets and Liabilities | Collects borrower financial details like account assets, real estate assets, other assets, liabilities, and monthly expenses. | |

| Borrower Information | Collects personal borrower details like name, address, military service, employment history, other income, application property details, declarations, and demographics. | |

| Lender Loan Information | Collects general application details like property, title, loan, borrower qualification details, and homeowner education or housing counseling attendance. | |

| Mortgage Flow Launcher | Collects borrower details of a request for help with loans or loan applications. Supports borrower document uploads. | |

| Summary View | Displays summary sections for selected mortgage objects based on the Unified Residential Loan Application (URLA). | |

Deliver exceptional customer experiences at scale with Flow for Industries.

Explore automation resources for financial services.

Webinar

Learn how automagic increases efficiency and reduces costs.

Report

Prepare for the digital-first future of the financial services industry.

Demo