See RBC Wealth Management’s digital transformation journey.

A SINGLE SOURCE OF TRUTH

RBC Wealth Management advisors wanted a 360-degree view of each client to personalize every interaction

See how RBC Wealth Management transformed its technology.

Learn how Financial Services Cloud can help you deliver faster, more personalized financial advice.

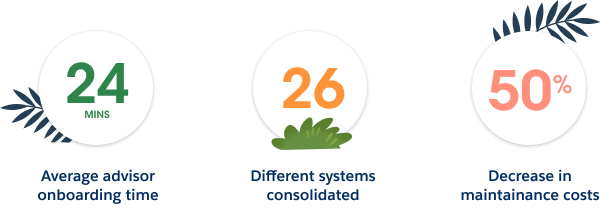

STREAMLINING CLIENT ONBOARDING

Find out how RBC Wealth Management reduced onboarding time for better client and employee experiences.

Learn more about how RBC Wealth Management supercharged their client onboarding with Mulesoft.

Join RBC Wealth Management at Dreamforce ‘21 to learn how they used data to strengthen advisor-client relationships.

ACTIONABLE SMART DATA

See how RBC Wealth Management used AI and analytics to uncover powerful insights.

Learn more about how RBC Wealth Management streamlined processes.

Join RBC Wealth Management, Salesforce, MuleSoft, and Deloitte Digital to learn about using data to create a single view of the client and more.

See the results that created better experiences and stronger relationships.

Interested in learning more about Financial Service Cloud solutions for Wealth Management?

WHITE PAPER

Explore the advantages of Financial Services Cloud for Wealth Management.

WEBINAR

How regulations impact trust and transparency for firms during times of uncertainty.

DEMO

Build trust and unify the customer experience with Salesforce Financial Services Cloud.