Frollo

“Heroku not only provided the infrastructure we needed to build on, but also the management of that infrastructure and the assurance of resilience and redundancy.”

Frollo uses Heroku to help businesses and consumers realise the benefits of Open Banking

Frollo is an open banking platform which builds money management apps to help people get—and keep—their finances on track. As the first fintech in Australia to become an accredited data recipient under Open Banking regulations, it is also leading the way towards a more transparent financial sector and helping others in the industry power new, innovative customer experiences.

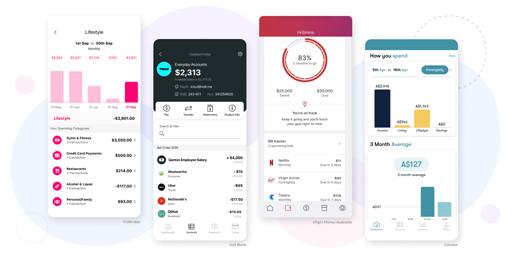

With its Personal Finance Management Platform (PFM), for example, Frollo enables other fintechs, banks, and lenders to use AI and data from Open Banking to help consumers control their money. It starts by linking consumers' financial accounts and categorising their transactions to provide a complete picture of their finances. Then, they’re provided with smart insights to help them understand their financial positions and how to improve. Lastly, the Frollo PFM platform offers budgeting and goal setting tools to make it easy for consumers to take action and turn their finances around.

The PFM Platform and Frollo’s other apps for businesses and consumers are built on Heroku which provides the security and reliability needed to meet the demands of the finance industry. Heroku also helps Frollo comply with the comprehensive security and privacy requirements of Open Banking.

Empowering developers to do what they do best

Starting out, Frollo decided to build an app for consumers so it could show others in the finance industry what its technology could do. Frollo chose to build on Heroku which took care of its infrastructure and security requirements, thereby helping it avoid hiring a full-time employee to manage DevOps in the early stages of its growth.

“Heroku not only provided the infrastructure we needed to build on, but also the management of the infrastructure and the assurance of resilience and redundancy,” said Tony Thrassis, CIO of Frollo. “That management aspect was really important for us as a start-up without a large operational team to handle things like databases and data pipelines.”

With the infrastructure taken care of, Frollo’s developers were able to concentrate on building apps and its first one—the money management app for consumers—has helped tens of thousands of users take control of their finances.

Piet van den Boer, Head of Marketing at Frollo shared how a broadcast news feature on the app had put Heroku’s scalability to the test: “Our app went from 19 downloads a day to 19 downloads a second without any problems. We were happy to be able to rely on Heroku’s performance to support this growth,” he said.

The app has now gained 140,000 users with the typical user reducing their credit card debt by 30% within six months. Many users have also gone on to start saving, and the average user increases their savings by $1,100 within three months.

Building secure and trusted apps

Since launching its consumer app, Frollo has used Heroku to deploy a host of other solutions. These include the PFM Platform which is used by clients like Canstar, Beyond Bank, P&N Bank, and Virgin Money Australia to offer financial wellbeing features to their customers—either by launching a branded white label app or by integrating the platform into their own app.

These apps rely on Open Banking, direct bank feeds and Electronic Data Capture to provide consumers with a complete picture of their finances. And with the use of Heroku and other security controls in place, Frollo has maintained its Open Banking accreditation and become a trusted partner in this space. In fact, Frollo has facilitated 14 million Open Banking API calls which account for around 95% of the industry total.

“One of the requirements in becoming an accredited data recipient is being able to show that you have all of the right security controls in place and a lot of that comes down to your infrastructure,” said Thrassis. “Heroku puts us in a strong position as it offers more granular controls than typical cloud providers.”

Of course security is also a critical requirement for Frollo’s business clients and it uses Heroku Private Spaces to quickly establish dedicated environments for each app it creates. These environments offer the privacy and control of a private network, giving Frollo’s clients added assurance their data is secure.

Leveraging these features and others like Heroku’s continuous delivery workflows, Frollo is continuing to build new apps and enhance its existing ones. In doing so, one of its key priorities is helping more businesses and consumers to realise the benefits of Open Banking.

“One of the biggest opportunities we see right now is helping businesses use the data available through Open Banking to deliver better outcomes for their customers, whether by reducing the time and cost of mortgage processing or by recommending actions to help them save money,” said van den Boer.

Keep exploring stories like this one.

Questions? We’ll put you on the right path.

Ask about Salesforce products, pricing, implementation, or anything else — our highly trained reps are standing by, ready to help.