The Economist:

Integrated Transformation

The Economist Intelligence Unit

Integrated Transformation is an Economist Intelligence Unit Report, sponsored by Salesforce. In this paper, The Economist Intelligence Unit explores how companies are adapting to evolving customer expectations and preferences, and how this has affected operations, business processes, decision-making and business models.

Chapter 2: Closing the feedback loop

Companies are increasingly putting customers into the driving seat, integrating feedback into core decision-making

To achieve true customer-centricity, opinions and feedback must form the basis for decisive action. And herein lies a common problem with corporate efforts to become more customer-centric: they are often confined to frontline customer service and support staff who deal with customers on a day-to-day basis.

While these frontline employees are undoubtedly very important, a truly customer-centric organisation incorporates customer feedback into decision-making right across the business.

After all, customers typically form their impression of a product or service not from a single point of contact, but through multiple interactions with an organisation. It might begin, for example, through exposure to advertising or the experience of browsing the organisation’s website when researching a product. The design of products is important, as is the experience of making a purchase, regardless of channel. Customer service and support matters, of course, but this typically comes further down the line.

This means that a wide range of functions across an organisation must take responsibility for delivering the best customer experience at every stage of a journey and requires all parts of the organisation to get involved.

“Too often, corporate efforts to become more customer-centric are confined to frontline customer service and support staff who deal with customers day-to-day.”

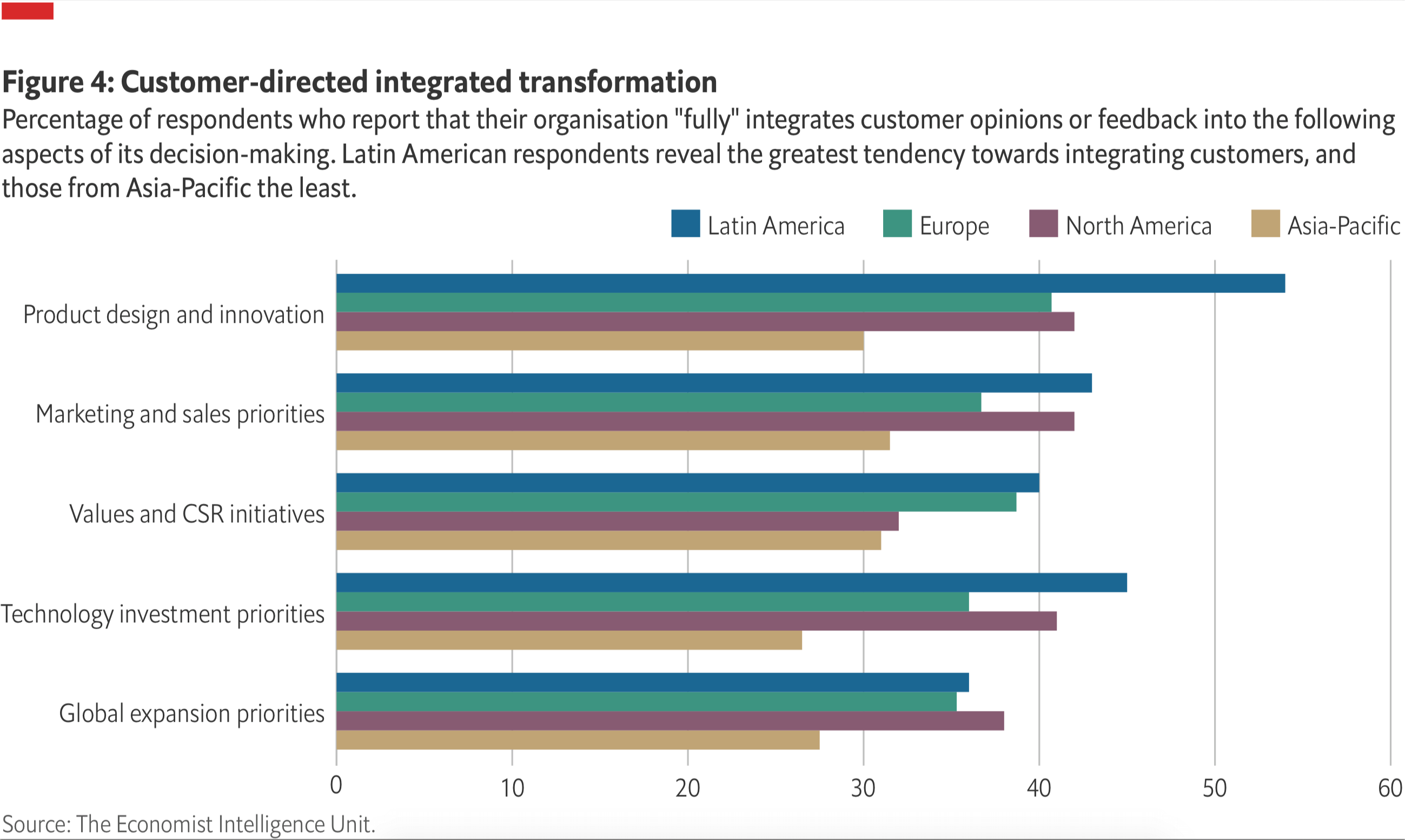

The survey shows that many companies already integrate customer opinions and feedback into decision-making in many areas of the business. Product design and innovation is the area of decision-making where they are most likely to be fully integrated: four in ten respondents say that this is the case at their organisation, while almost the same proportion (38%) describe customer feedback as moderately integrated.

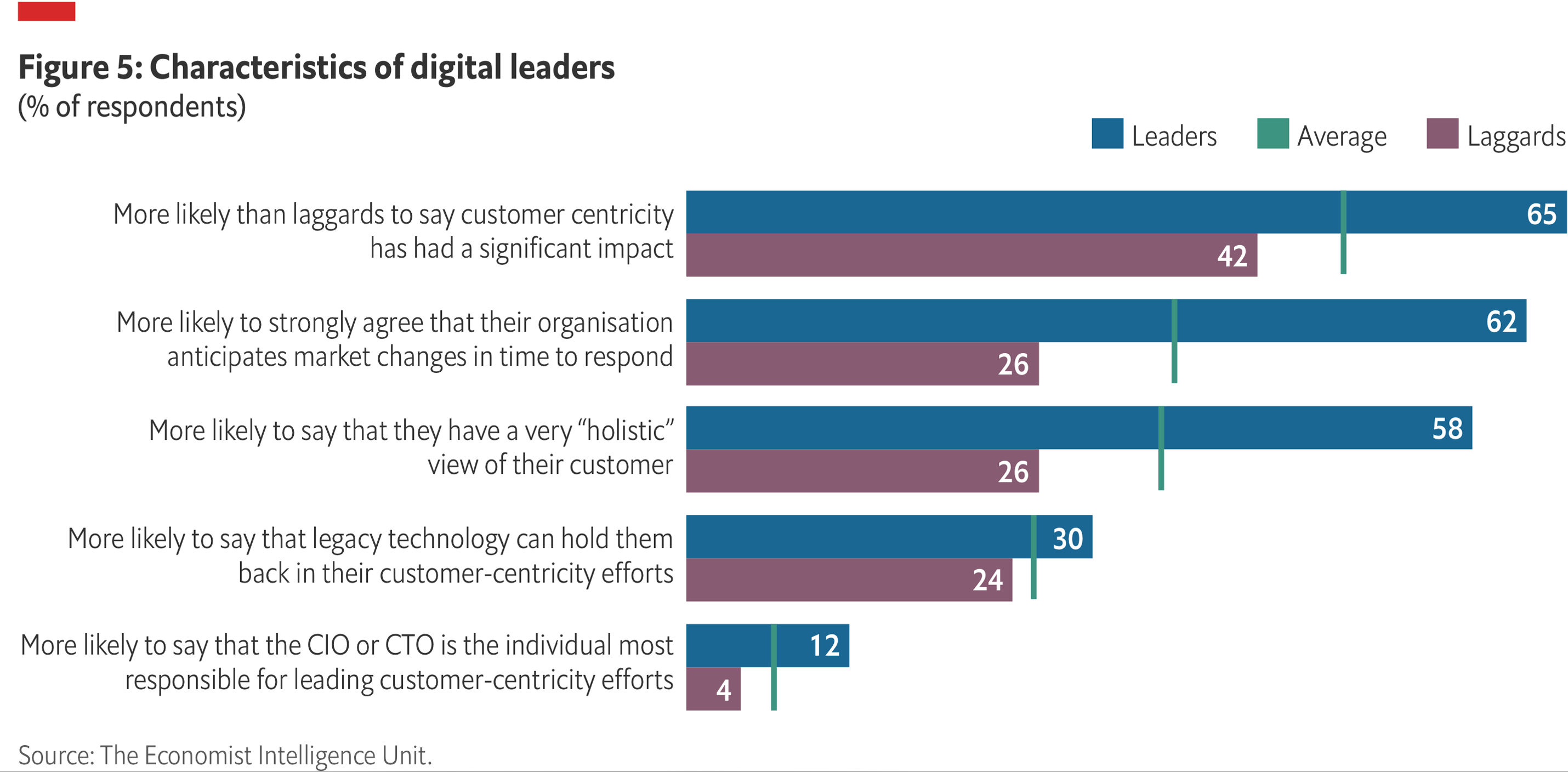

Comparing leaders and laggard segments of the survey sample, leaders—identified by their perceived success in adopting to a number of technological trends—are much more likely to integrate customers fully into various measures of decision-making (see chart on page 14). For instance, 59% of leaders say that they fully integrate customer feedback into product design and innovation—nearly double the number of laggards (32%).

This approach has paid off to impressive effect at Xiaomi, a Chinese firm that has in recent years grown from being a marginal player in the Asian smartphone market to become a globally recognised brand and the world’s fourth largest smartphone manufacturer in terms of market share.

A crucial element in the nine-year-old company’s success has been its MIUI forums, named after the company’s mobile operating system, where some 10m registered users of its products give regular feedback on new product releases, submit their own ideas for new features and functions, and raise issues with existing ones.

“We owe so much of our success to our fan base and their ideas, and members of our leadership team, as well as many of our employees, visit the forums every day to see the best ideas and to incorporate them into our product as quickly as possible,” says Xiang Wang, Xiaomi’s senior vice-president.

“From the very start of the business nine years ago, our CEO Lei Jun wanted to create a company with the customer at its centre, so before Xiaomi even had any hardware to offer, he worked with 100 beta testers on delivering our operating system MIUI,” he says. That built a strong foundation for how the company would proceed on innovation.

Today, once the most pressing customer requirements for the next release have been identified, Xiaomi publishes these on the forums and they are put to the vote by users. Those that receive a particularly enthusiastic response are sometimes incorporated into the software in as little as a week, Mr Wang says.

“This way, we build products that users are asking for but we also create awareness and engagement around product development in a way that makes our customers passionate about what we bring to them,” he says.

This co-creation model will doubtless guide Xiaomi’s thinking as it increasingly brings smart devices to market, including robot vacuum cleaners and smart toothbrushes. The company now has over 170m of these smart devices (excluding smartphones and laptops) connected to its IoT platform, and will be able to leverage insights from such customer usage data to direct product design. Already, customers are using dedicated threads on Xiaomi’s forums to discuss these products, leading to new opportunities for product design ideas.

“In many cases, these are very much lifestyle products, so of course we want and need to truly understand our customers’ lifestyles and what we can do to make them better, more enjoyable,” says Mr Wang.

Let your customer be your guide

A close customer relationship helps Xiaomi and other businesses not just with design features or short-term customer needs, but longer-term technology investment priorities too. More than a third of survey respondents reported customer input to be fully integrated into such decision-making, and the integration of customer input in technology investment decisions has grown more over the past five years than in any other area, with 84% of respondents saying that it has increased “significantly” or “somewhat”.

At AXA Insurance in Singapore, former chief customer officer Leo Costes says that the company has made significant investments in technology in recent years, in support of its goal of becoming more customer-centric.

“What I’ve learned is that the work of getting closer to the customer is really a transformation journey. In the past, the insurance industry has not been known for being close to the customer and the customer hasn’t been part of the full product development lifecycle,” he says. “These are things that we are trying to change and technology is a vital part of that.”

The traditional insurance journey for customers has typically been slow and heavily paper-based, but they are actively looking for more digital ways of interacting with providers, more convenience and more personalised pricing. In order not to lose them to newer fintech providers who have focused on these things from the start, insurance companies need to change. And a big obstacle to change for many is the legacy IT systems on which they run.

At AXA Insurance, says Mr Costes, the focus has been on moving away from inflexible, siloed back-end systems towards a more modern, agile architecture based on microservices—components of code that represent different touchpoints in customer journeys. These microservices can be combined with each other to quickly and efficiently build new digital services and expand the scope of existing ones. Application programming interfaces, meanwhile, enable these microservices to communicate with each other and with the back-end systems of both those belonging to AXA Insurance and those belonging to key partners.

UK-based banking service Monese, meanwhile, has integrated a “translation as a service” platform from Lisbon-based tech start-up Unbabel with its own customer support platform, so that it can handle enquiries from customers in a range of different languages.

That’s important, explains Monese ’s CEO Norris Koppel, because when he launched the mobile banking service in 2015, it was with the initial aim of helping newcomers to the UK access banking facilities. This is something that many high-street banks made difficult for visiting students and those who live and work abroad without established UK addresses.

So far, over 1m people have signed up to Monese. The service is available in 12 languages and 60% of users don’t use the app in English. When they have questions or issues, they want to interact with Monese in their own languages, so incoming customer communications, in the form of emails or chat messages, first pass through Unbabel’s platform, which translates them and passes them on to a Monese customer agent. Their response, meanwhile, also passes through this platform on the way back to the customer, so they receive the response in their own language.

“It’s a really important aspect of our mission to provide customers with ‘banking without borders’ and we find that it makes them incredibly loyal to us,” says Mr Koppel.

Technology investments in pursuit of increasingly more sophisticated customer experiences look set to continue. In fact, more than four out of five respondents (83%) agree that businesses that are not including customers in innovation processes will fall behind, with 50% strongly agreeing that this is the case. Technological leaders tend to be customer-centric leaders, too. The survey shows a strong correlation between how well an organisation believes it has adapted to various recent technology trends, compared with its industry peers, and its preparedness for greater customer-centricity.

Questions? We’ll put you on the right path.