Streamline Onboarding

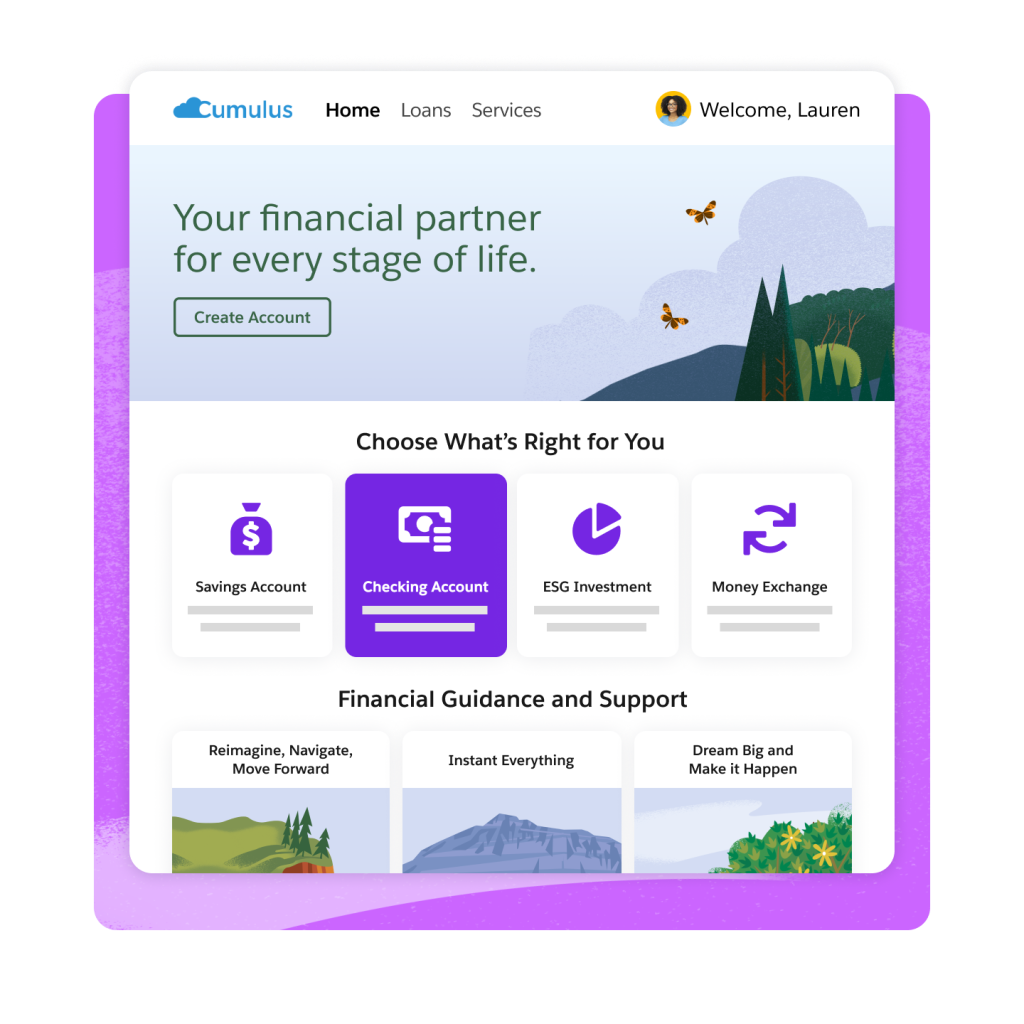

Modernize digital onboarding for financial services with a purpose-built solution for the industry. Lead with positive-first impressions and reduce onboarding abandonment by simplifying the application process with data and AI. Reduce costs on a traditionally labor-intensive process with automation and integration.

Power client onboarding in financial services.

Offer a frictionless onboarding experience for your customers, internal users, and IT.

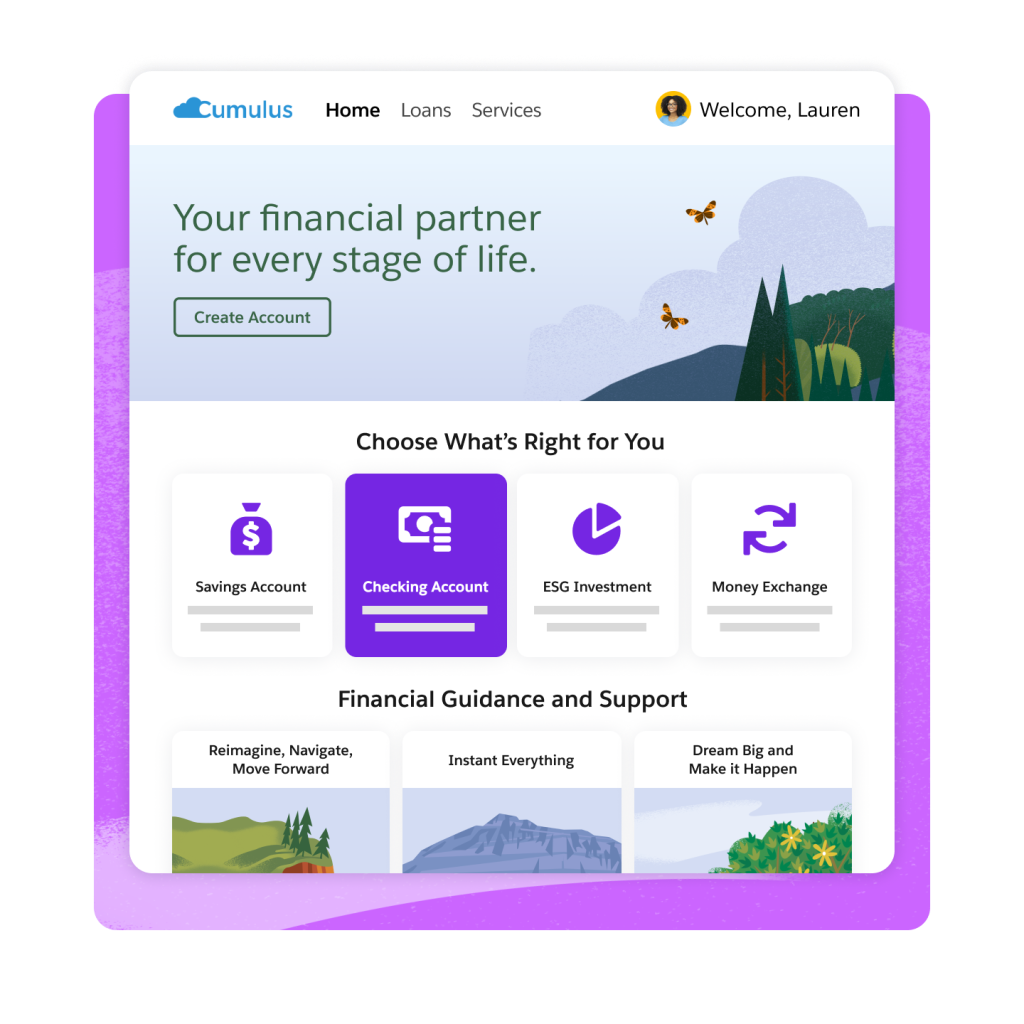

Improve the customer experience.

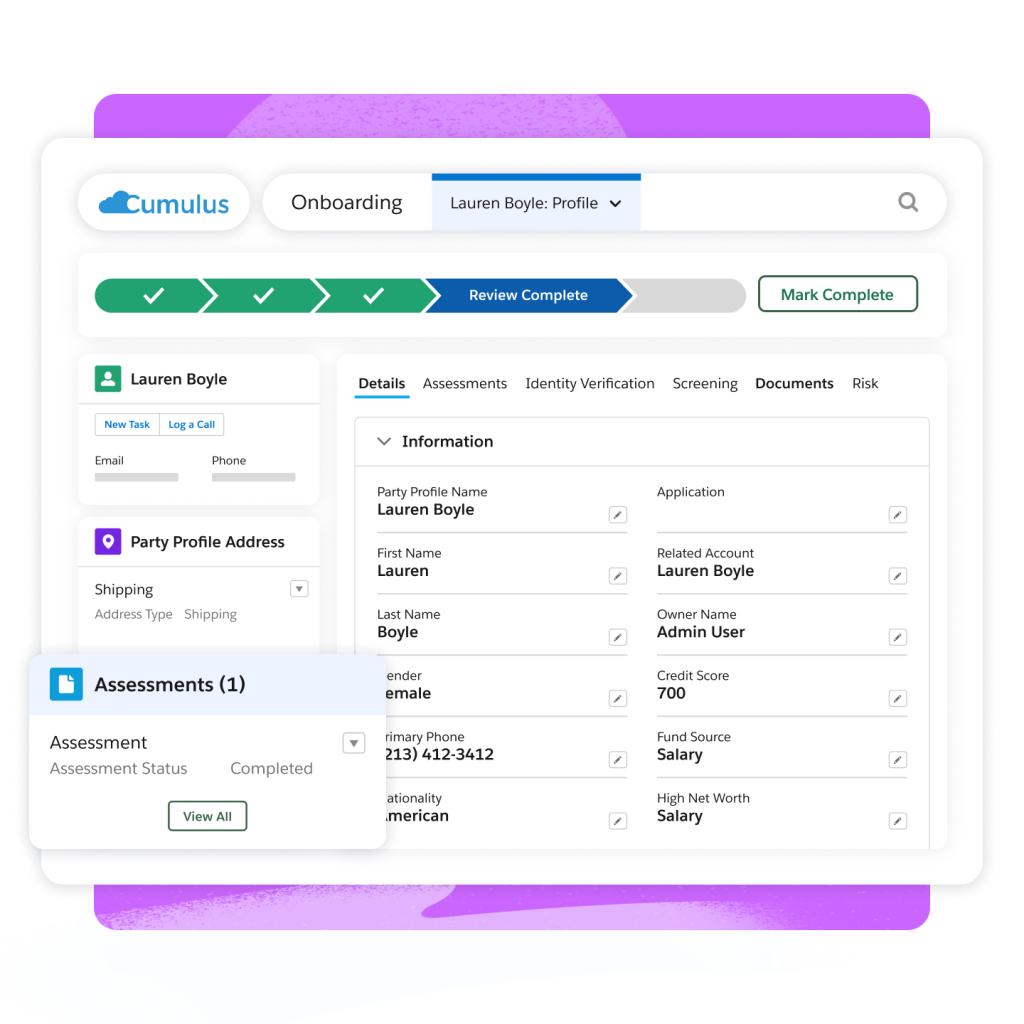

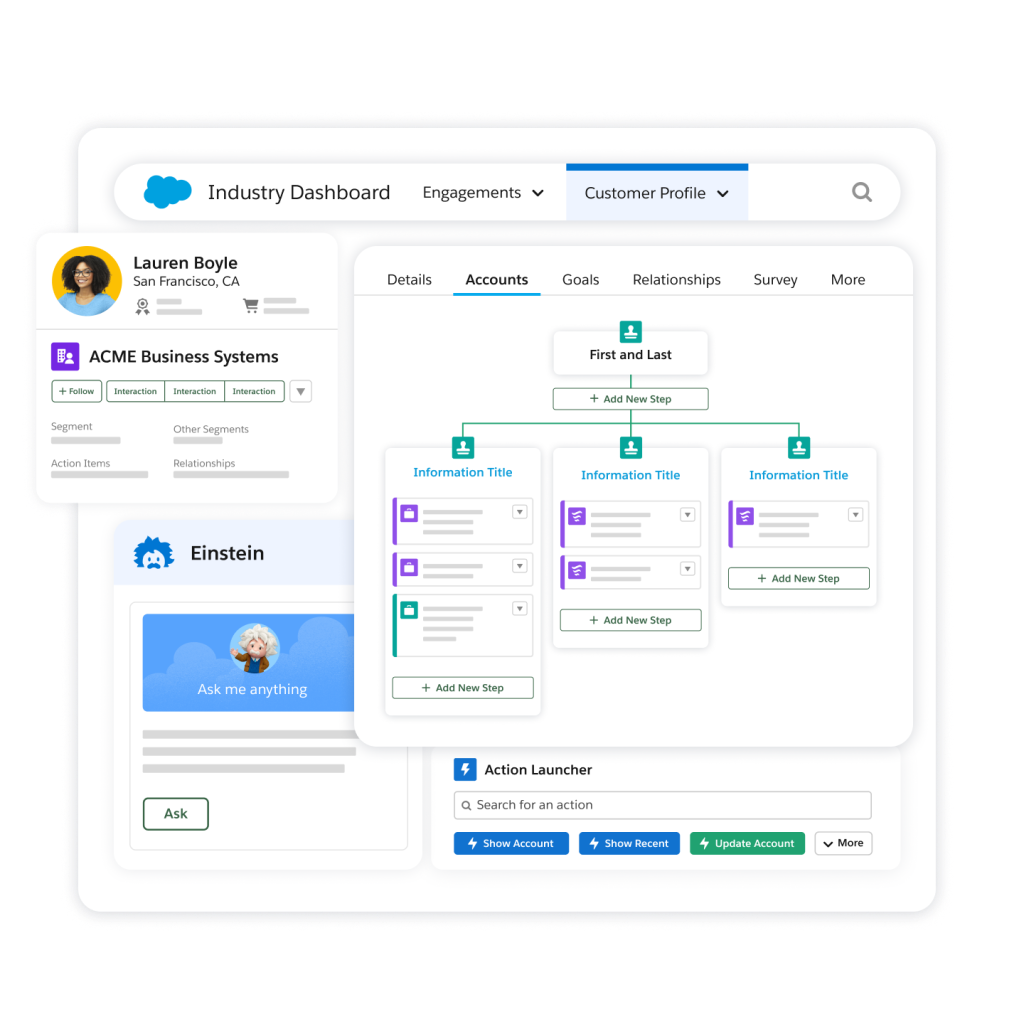

Onboard customers right from your CRM, in the context of all your customer data. Start new financial relationships by delivering customer-centric experiences, all on one platform. Truly get to know customers — beyond KYC details.

Easily deploy customer experiences on our digital experience platform, or leverage pre-configured APIs to sync Salesforce to your own mobile or web experiences.

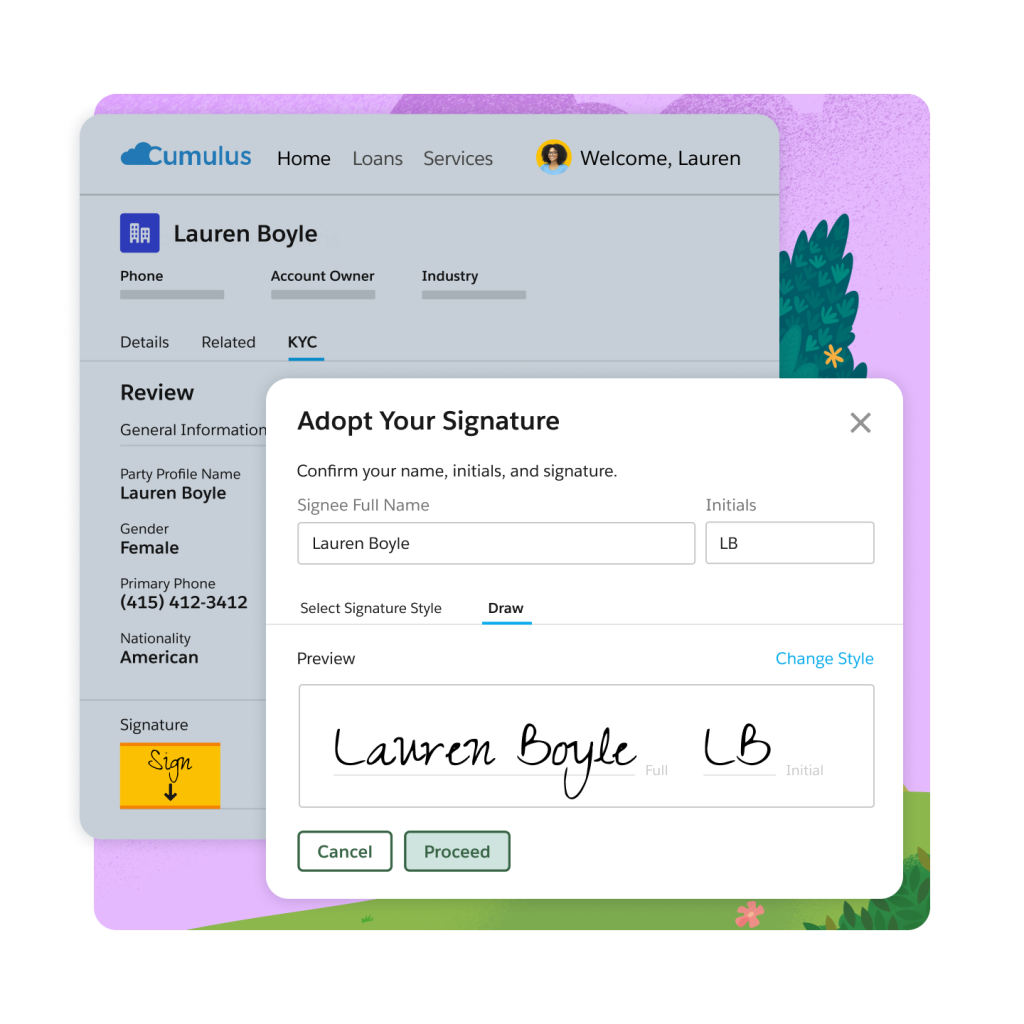

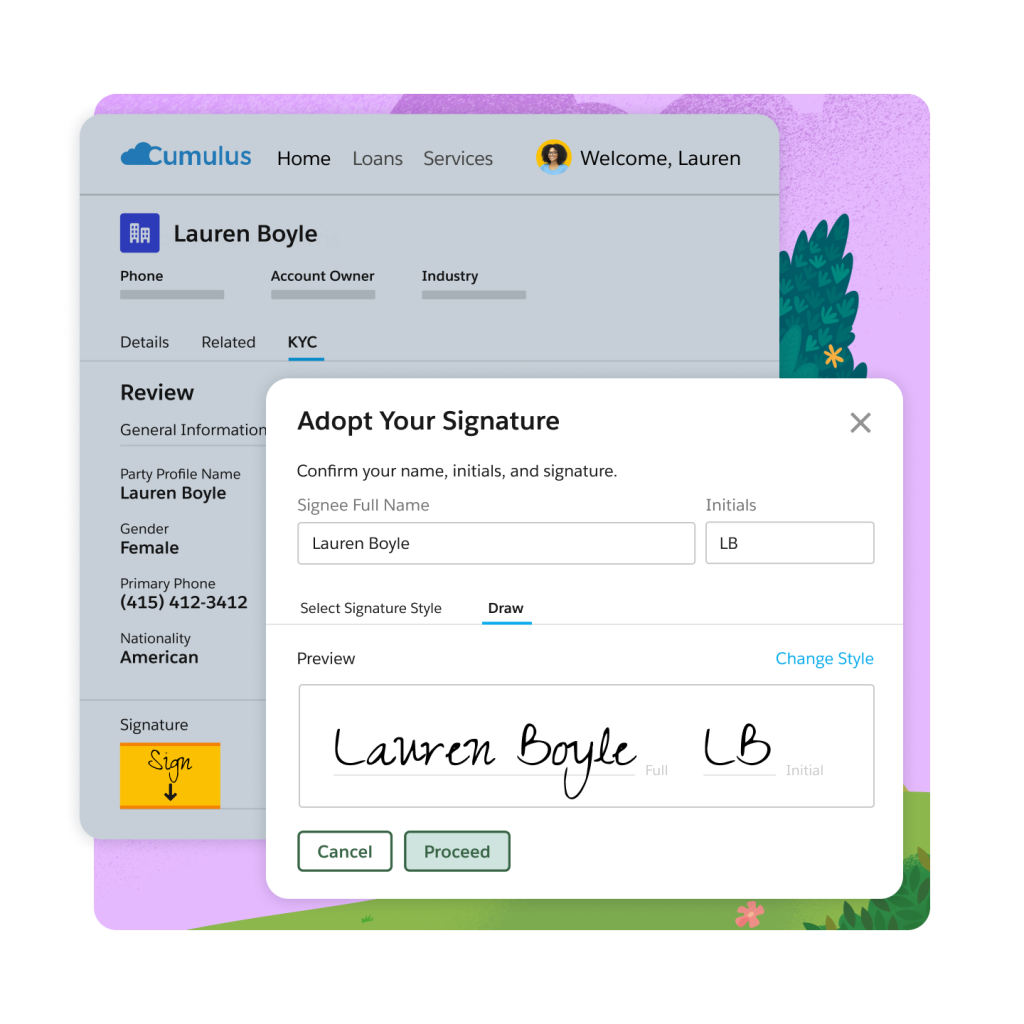

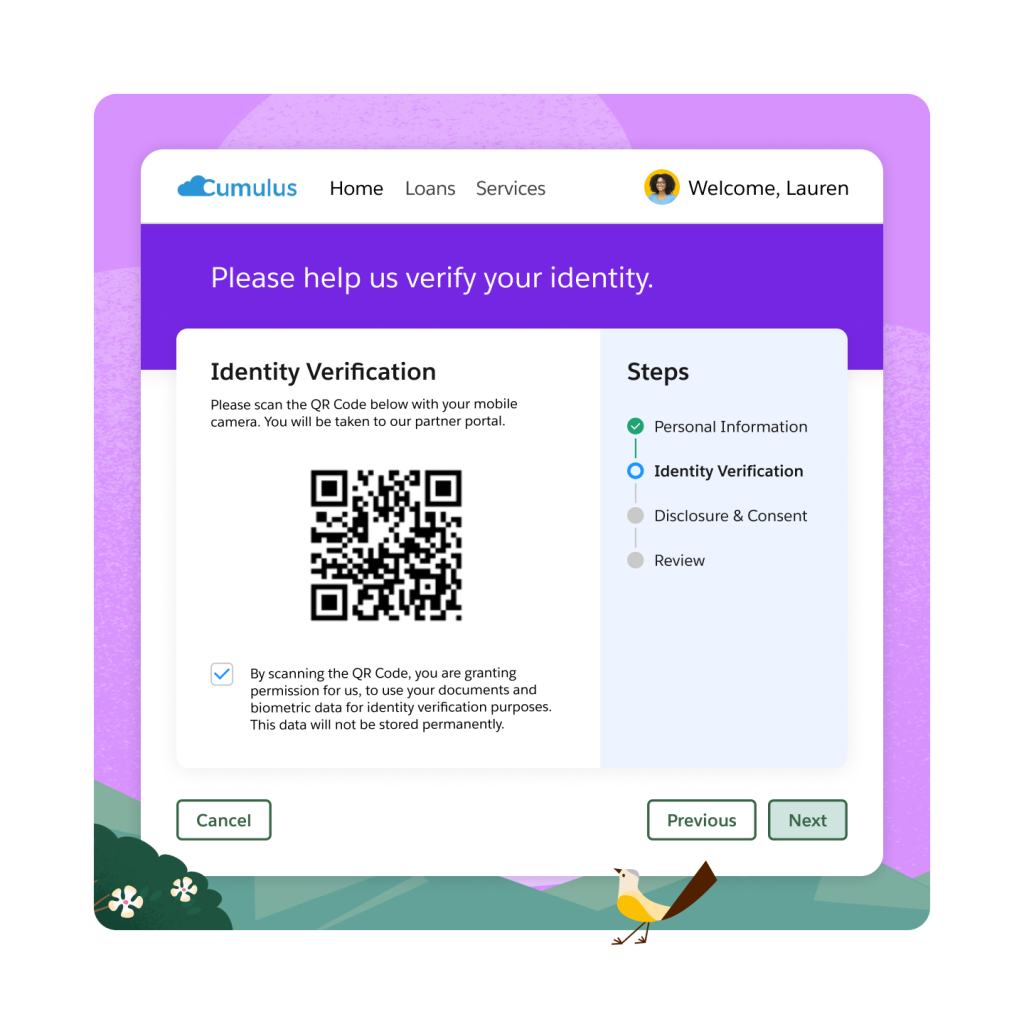

Reduce friction in completing the onboarding process by automatically providing the right disclosures and consent forms based on the financial relationship at hand. Allow customers to sign forms right then and there with a secure, digital signature.

Boost onboarding efficiency internally.

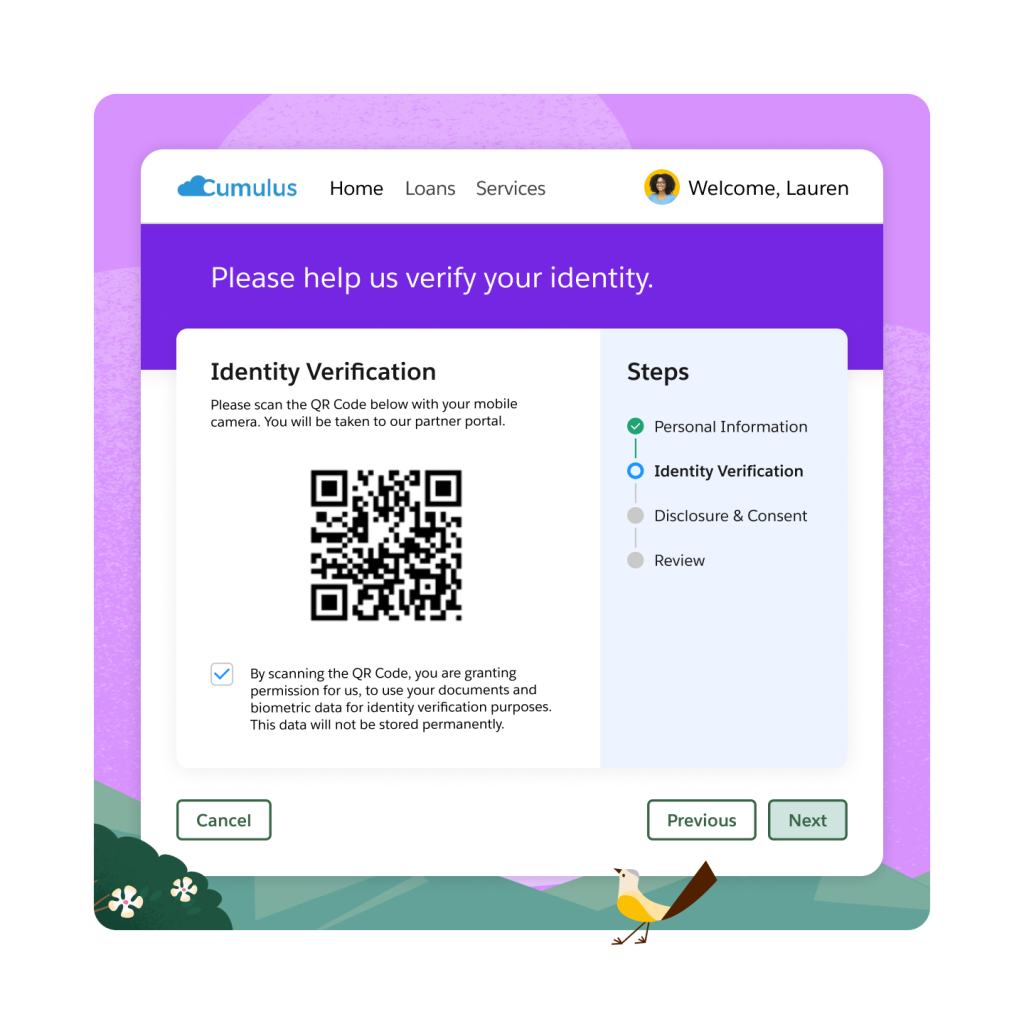

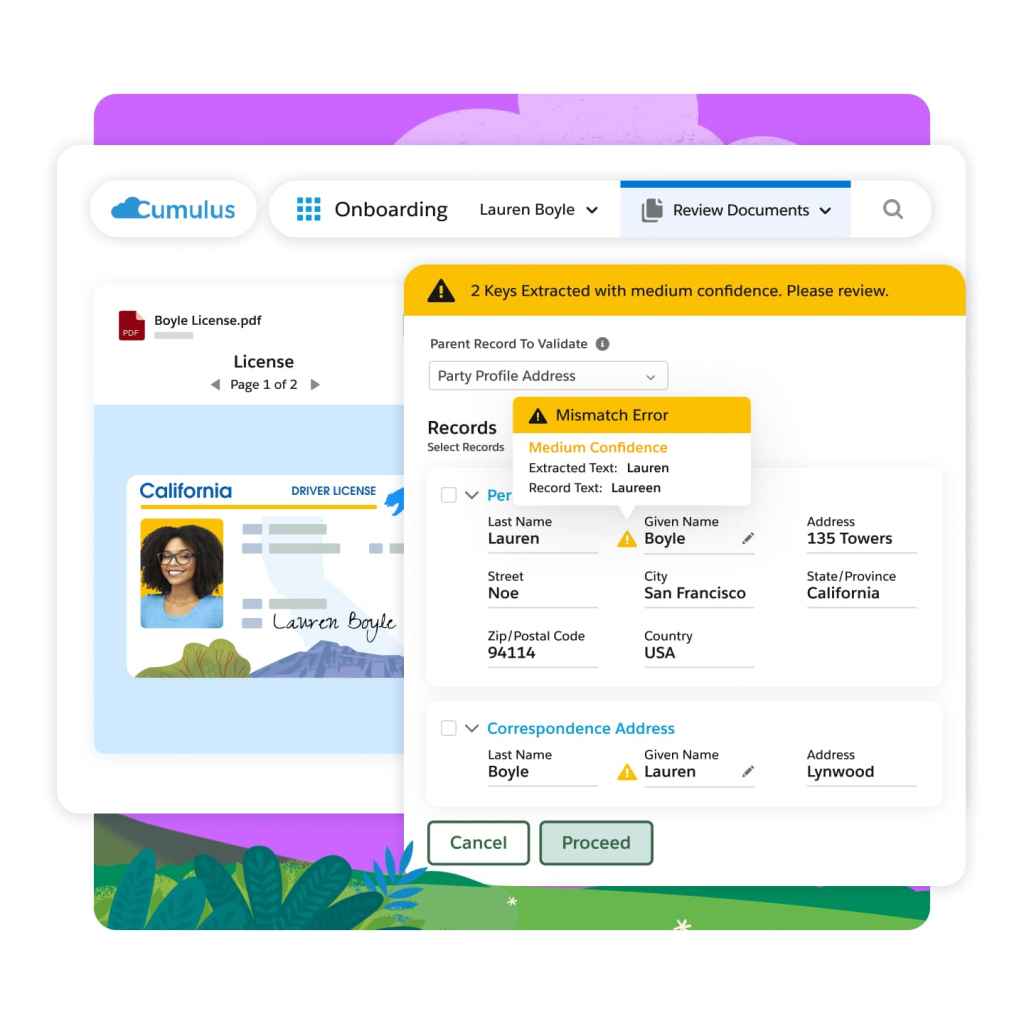

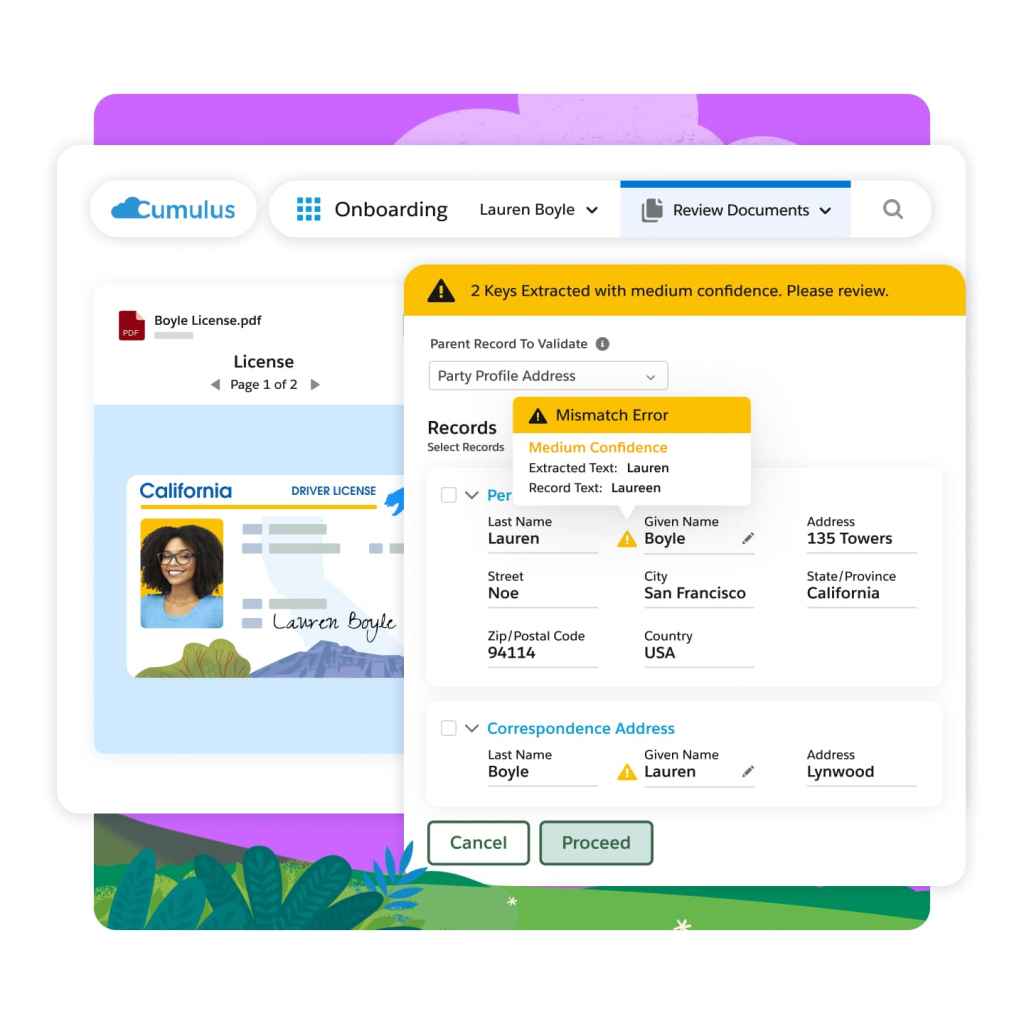

Stay vigilant around know-your-customer compliance. Integrate with third-party identity verification and screening providers of choice to evaluate customer information from the discovery process. Trigger next steps and decisioning based on returned results.

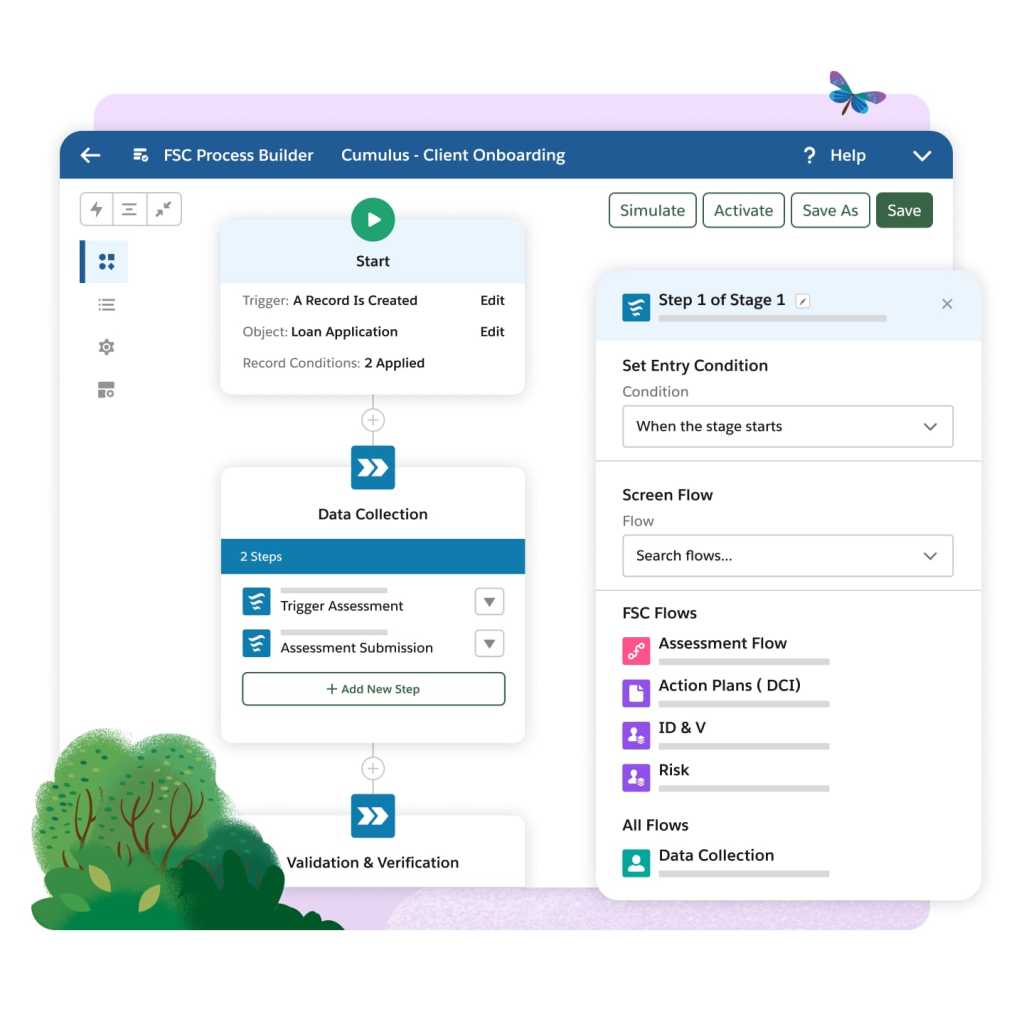

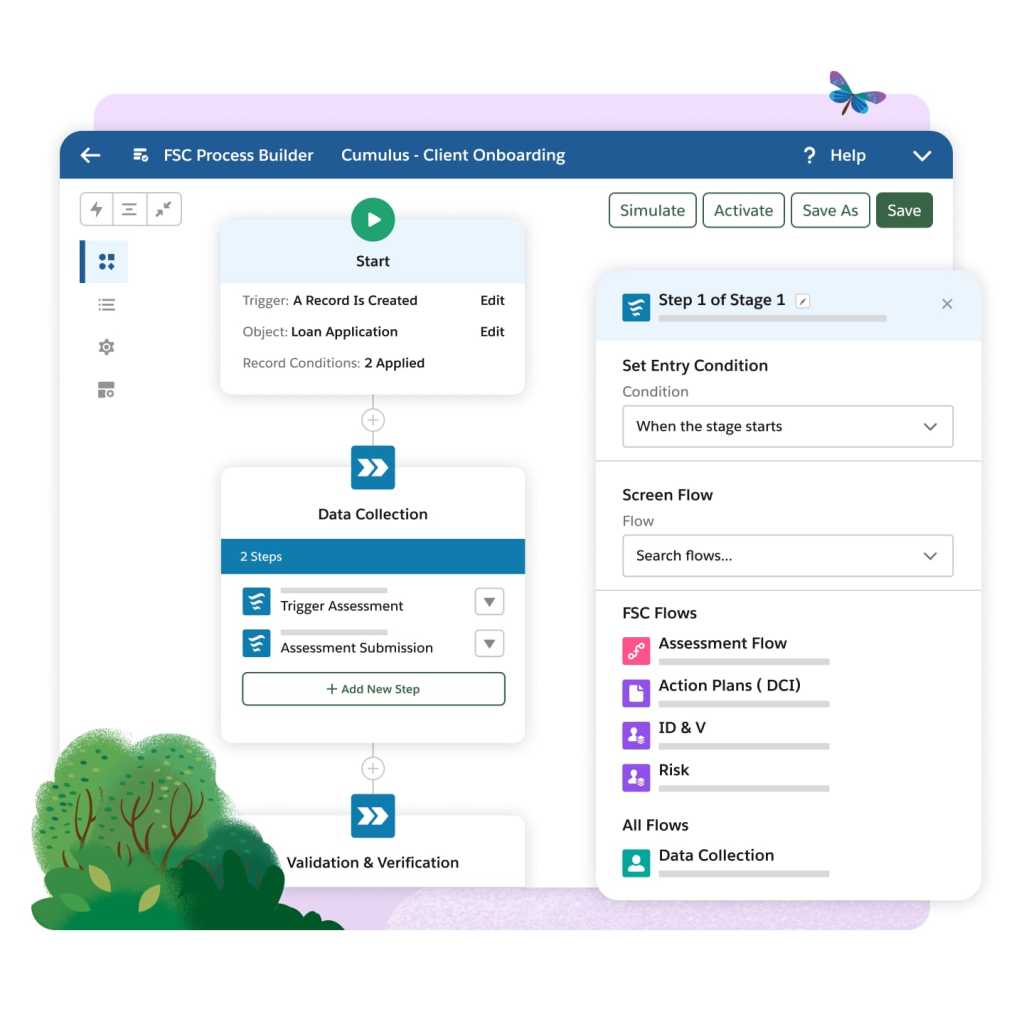

Reduce time-to-onboard and manual steps with automation. Set up intelligent workflows, whether it's straight-through processing, or more complex onboarding scenarios with parallel processes and manual checkpoints along the way.

Promote transparency on onboarding process stages and screening outcomes. Manage stage requirements to increase control over a complex process.

Reduce development costs on building and maintaining processes.

Accelerate your onboarding implementation with out-of-the-box solutions for end-to-end onboarding in financial services. Leverage prebuilt data models, integrations, and sample discovery process frameworks.

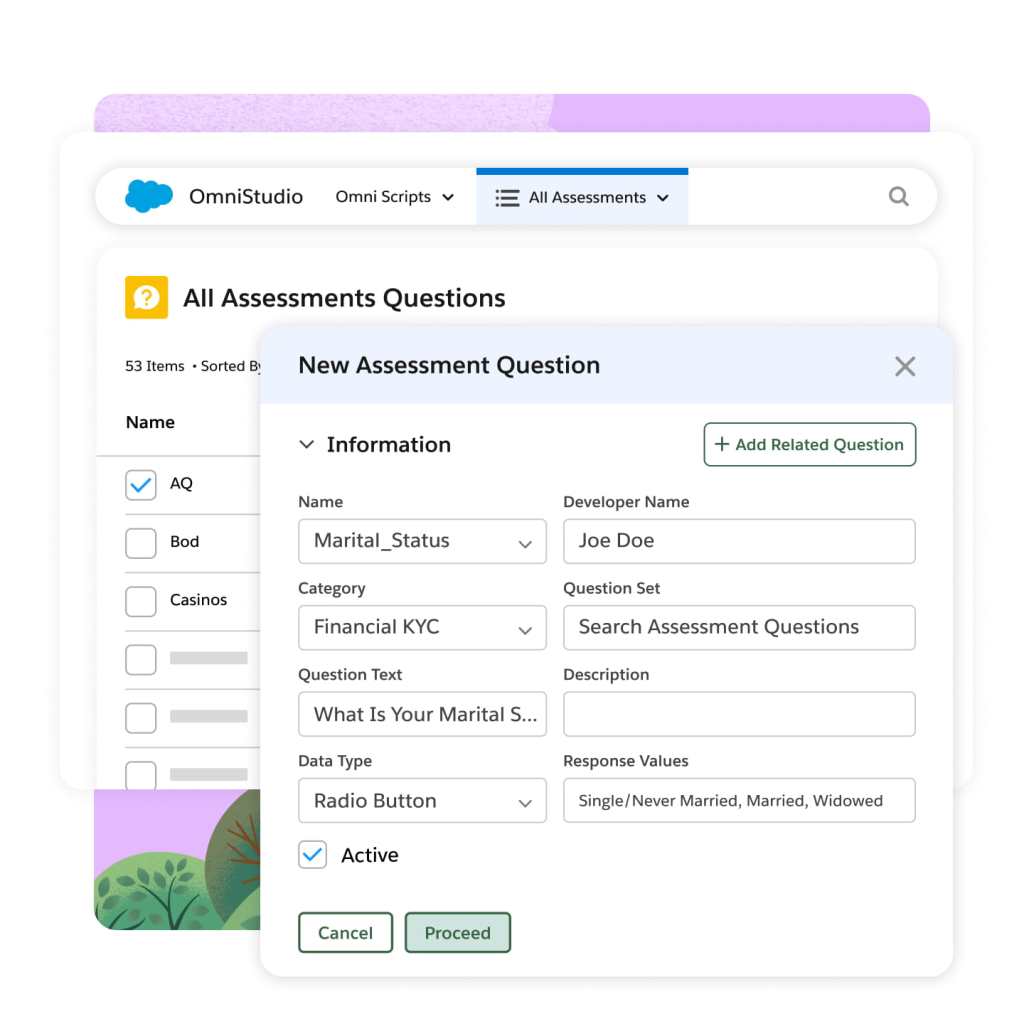

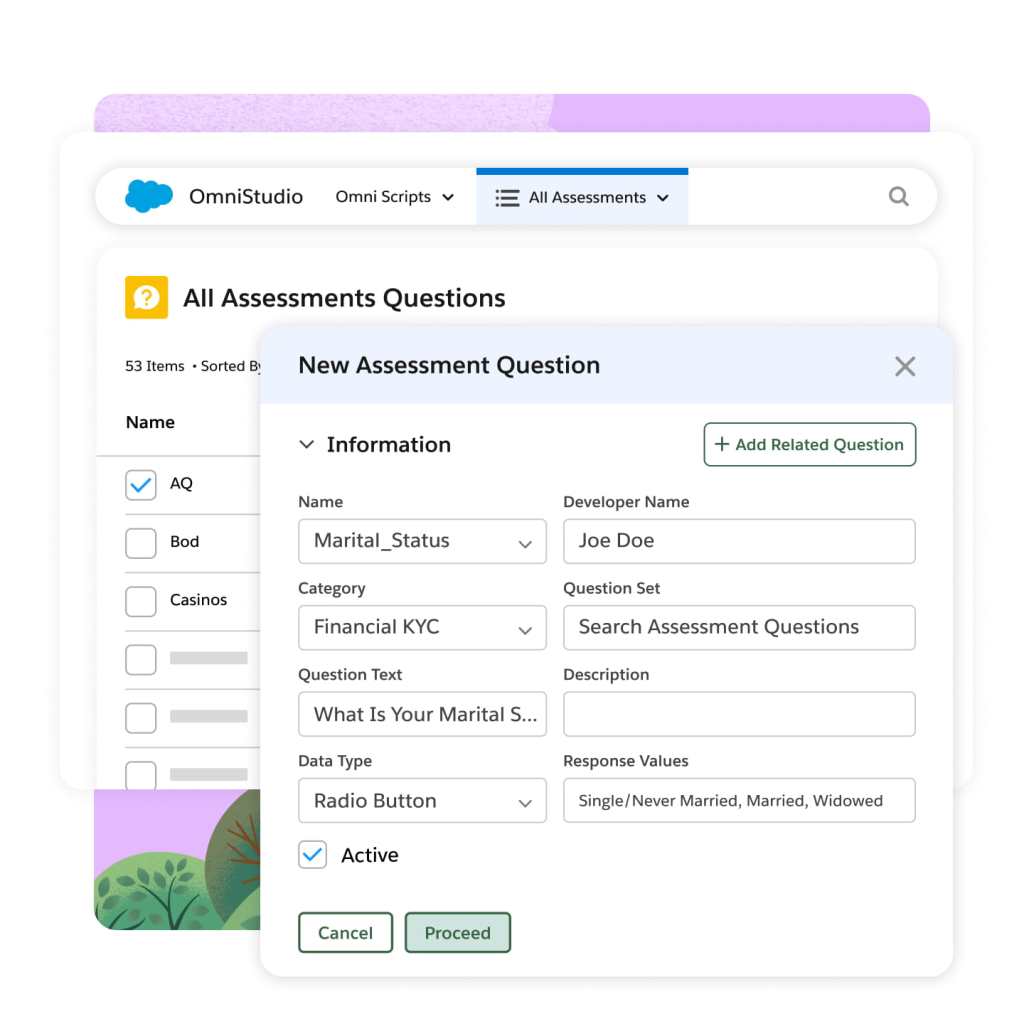

Manage intelligent discovery processes with clicks not code. Create a single-source-of-truth for questions to surface across different discovery processes. Deploy through any channel and post customer data back to Salesforce.

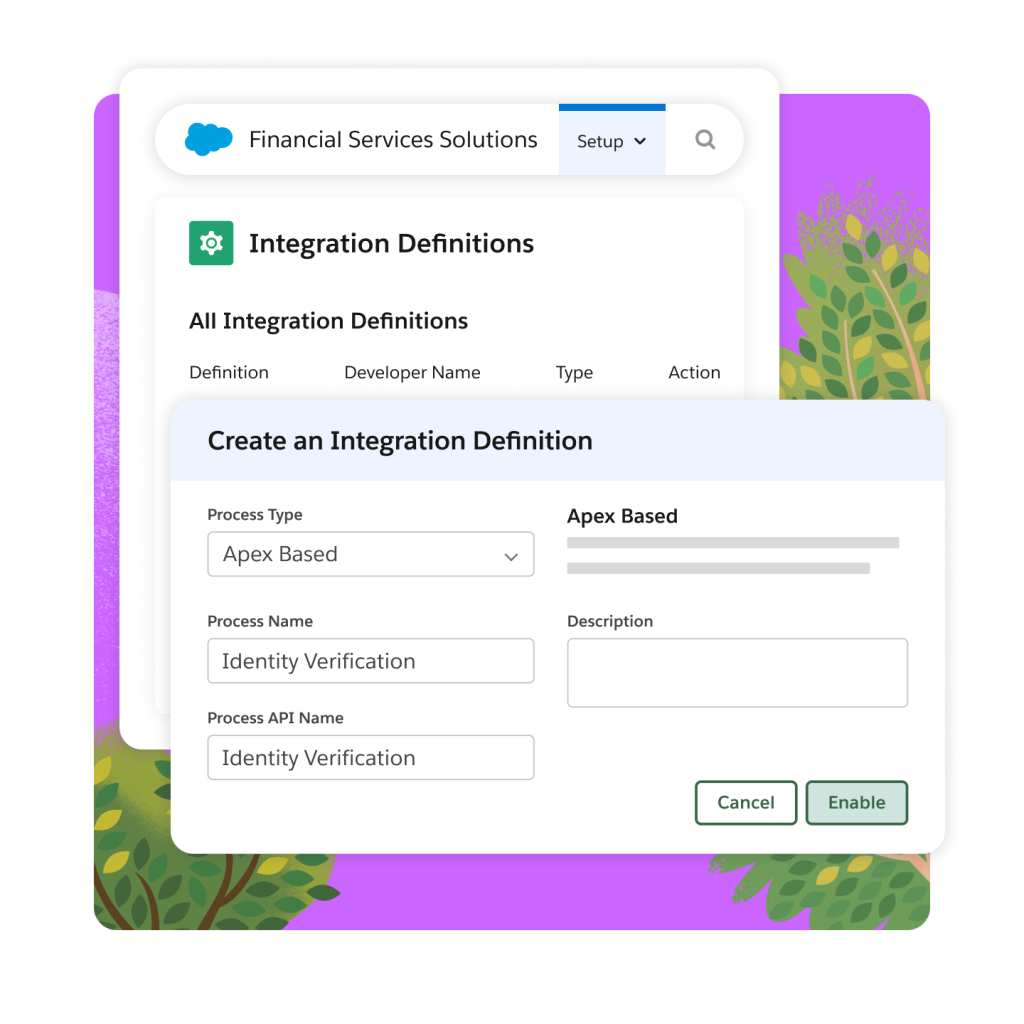

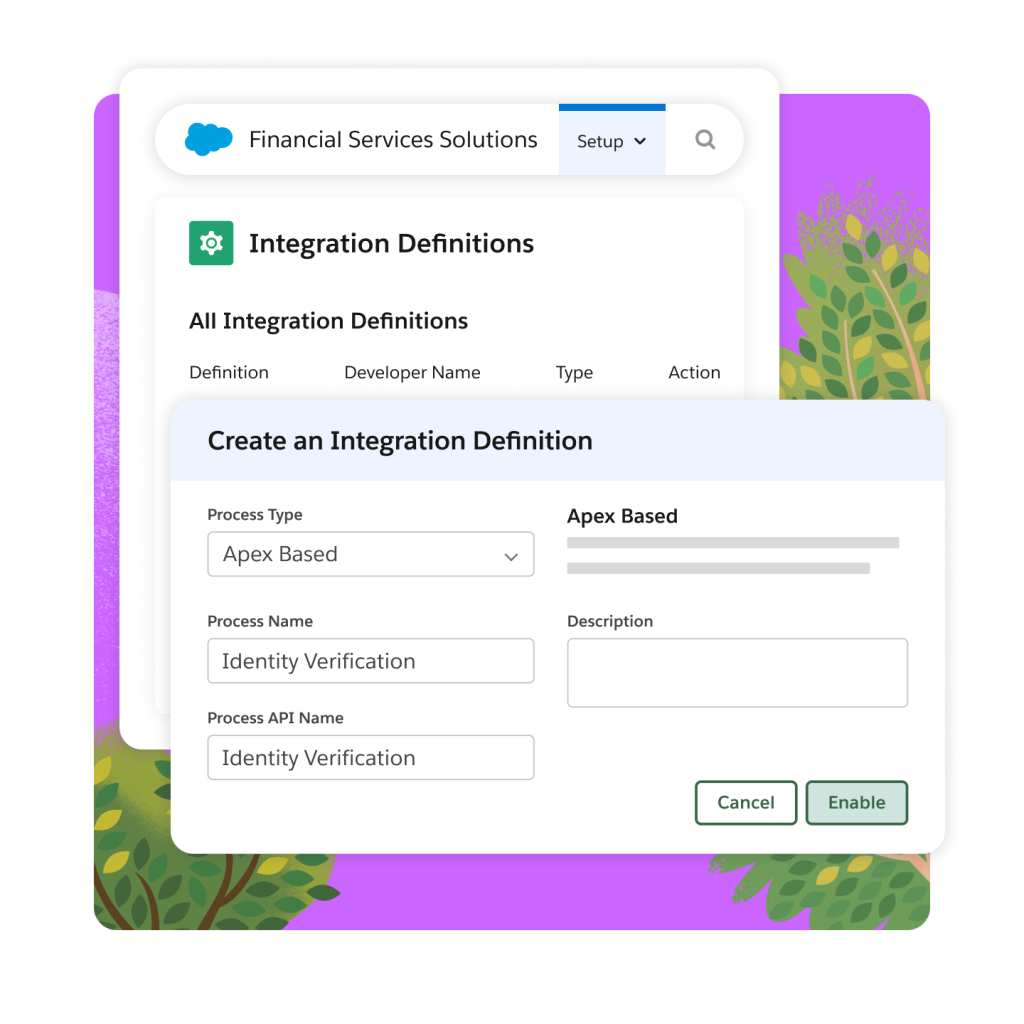

Easily connect to third-party systems necessary for your onboarding process using no-to-low-code configuration. Use predefined integrations with leading identity verification and screening providers, and with core systems for account origination.

Complete your digital onboarding solution with products from across the Customer 360.

Experience Cloud

Quickly launch data-powered sites, portals, and apps, connected across the customer journey.

Marketing Cloud

Personalize customer experiences and optimize each campaign with data-first solutions for any channel and device.

Slack

Bring together the right people, information, and tools to drive business.

Financial Services Cloud Intelligence

Drive predictable revenue with analytics and AI for organizations.

MuleSoft Anypoint Platform

Integrate data from any services system to deliver critical, time-sensitive data – all with a single platform for APIs and integrations.

AppExchange

The world’s leading enterprise cloud marketplace of proven apps and experts. Easily find financial services solutions that are right for you.

Data Cloud

Activate all your customer data across Salesforce applications.

Build the perfect client onboarding for financial services solution with our help.

Get in touch today and our experts will guide you through the process step by step:

- Choose the right Financial Services Cloud edition as your foundation.

- Add products/services needed, if not already included.

- Customize the final result with apps, services, and support.

Our number one priority is to deliver world-class wealth management services. For us, this meant we needed to enhance our client and advisor experiences by moving away from inefficient and manual processes.

Greg BeltzerHead of Technology, RBC Wealth Management – U.S.

Discover how integrated onboarding helps retail and commercial banks.

Retail Banking

Deliver connected and personalized experiences to customers with automation.

Commercial Banking

Customize experiences and simplify onboarding to strengthen relationships, generate referrals, and scale fast.

Learn new skills with free, guided learning on Trailhead.

Hit the ground running with digital onboarding for financial services tips, tricks, and best practices.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Streamline Onboarding FAQ

Our client onboarding for financial services solution offers an end-to-end digital solution – from data collection experiences to KYC checks and account origination. It provides out-of-the-box capabilities to get started, and is fully customizable to ensure your onboarding process fits your brand.

Our customers have found that our onboarding solution helps boost customer satisfaction ratings, reduce onboarding attrition and stagnation, and lower onboarding costs from time spent to technology spend.

Consider if the solution spans the customer lifecycle, or just onboarding. You may consider a no/low configuration for easier building and maintenance, based on technology resources. Much of onboarding requires data or processes from other systems, so consider the ability to integrate the platform.

Our solution can help improve the customer experience by streamlining the application process, making the internal process more efficient, and reducing the number of systems involved.