Personalize Engagement

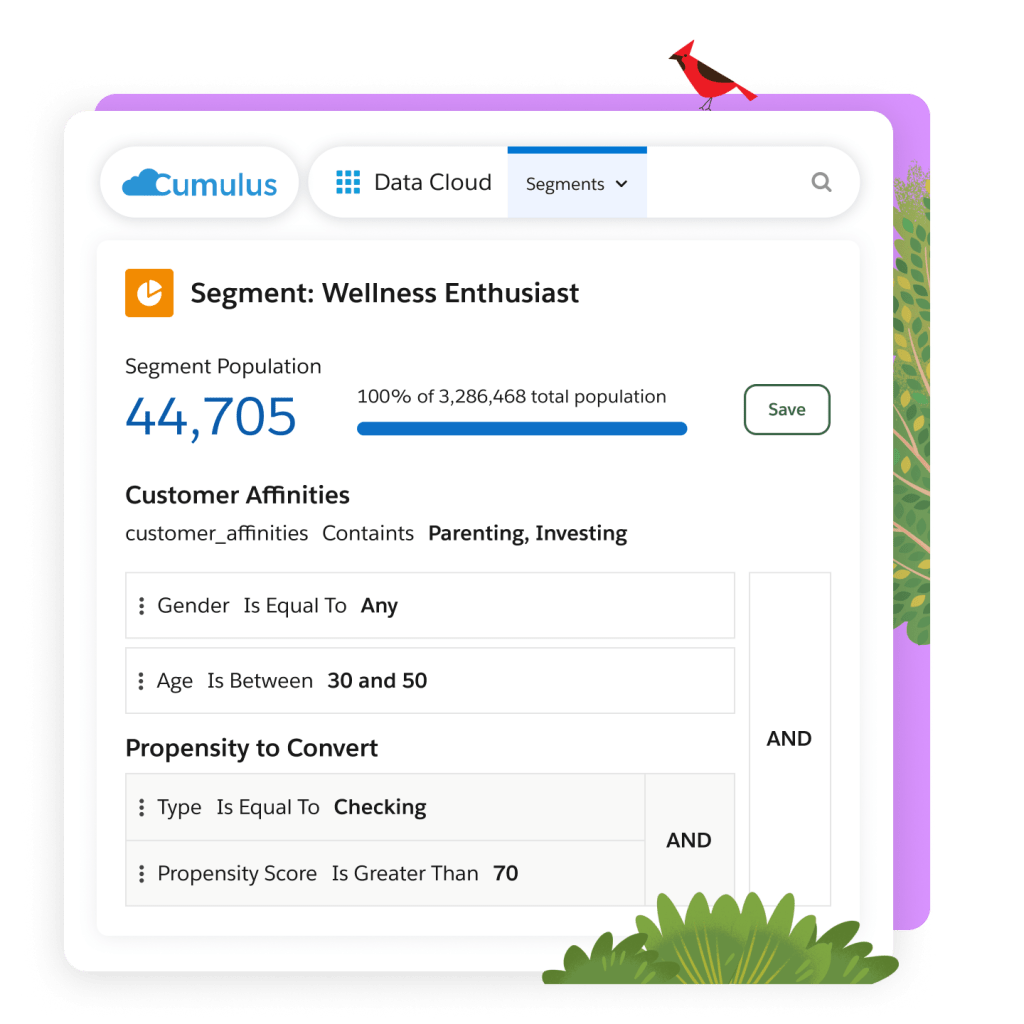

Unlock terabytes of trapped customer data across legacy and third-party systems into a single view that changes as customers interact with your business. Use out-of-the-box calculated insights and create targeted segments to deliver financial services personalization at scale.

Increase loyalty using data for financial services personalization.

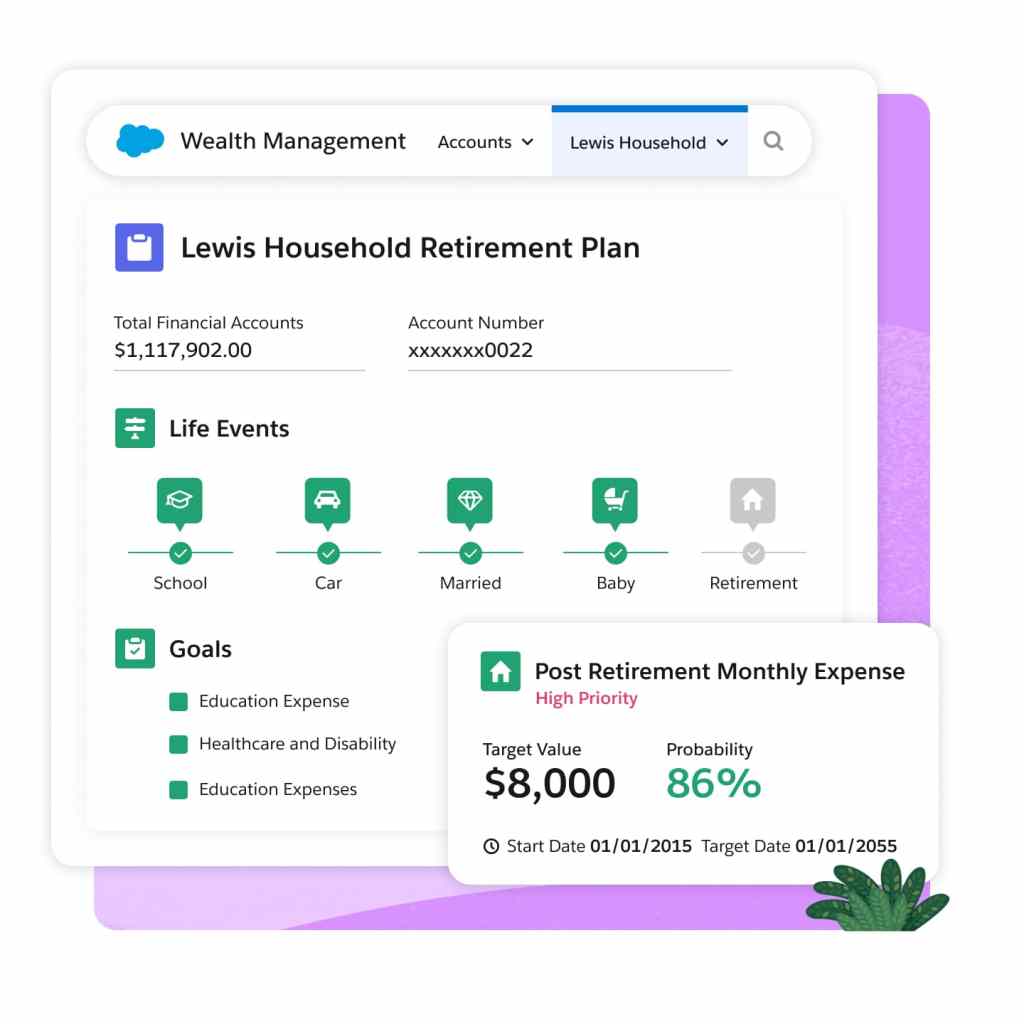

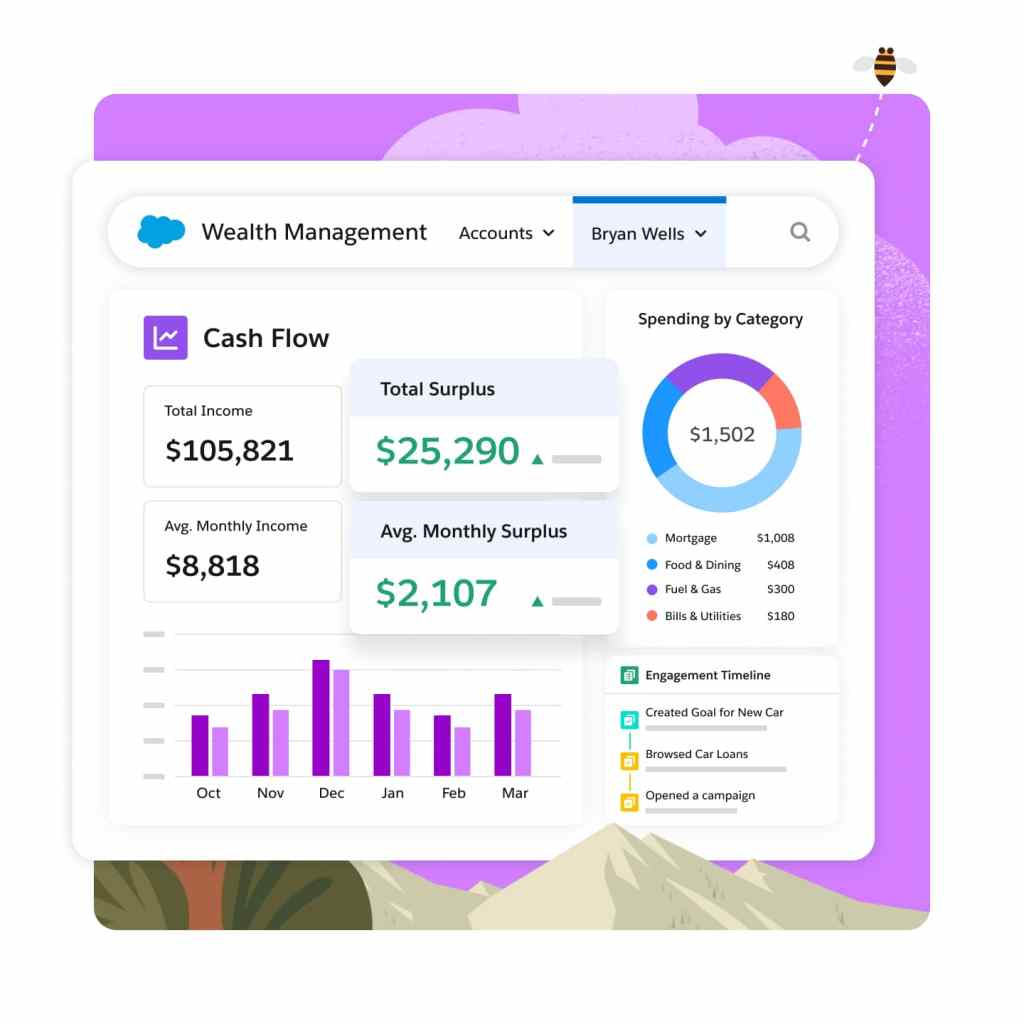

Combine customer behavioral and financial data into a single view. Help your customers optimize financial planning experiences with a full view of financial goals in Financial Services Cloud. Drive actionability using out-of-the-box insights to help your customers achieve financial wellness.

Bring together customer behavioral and financial data.

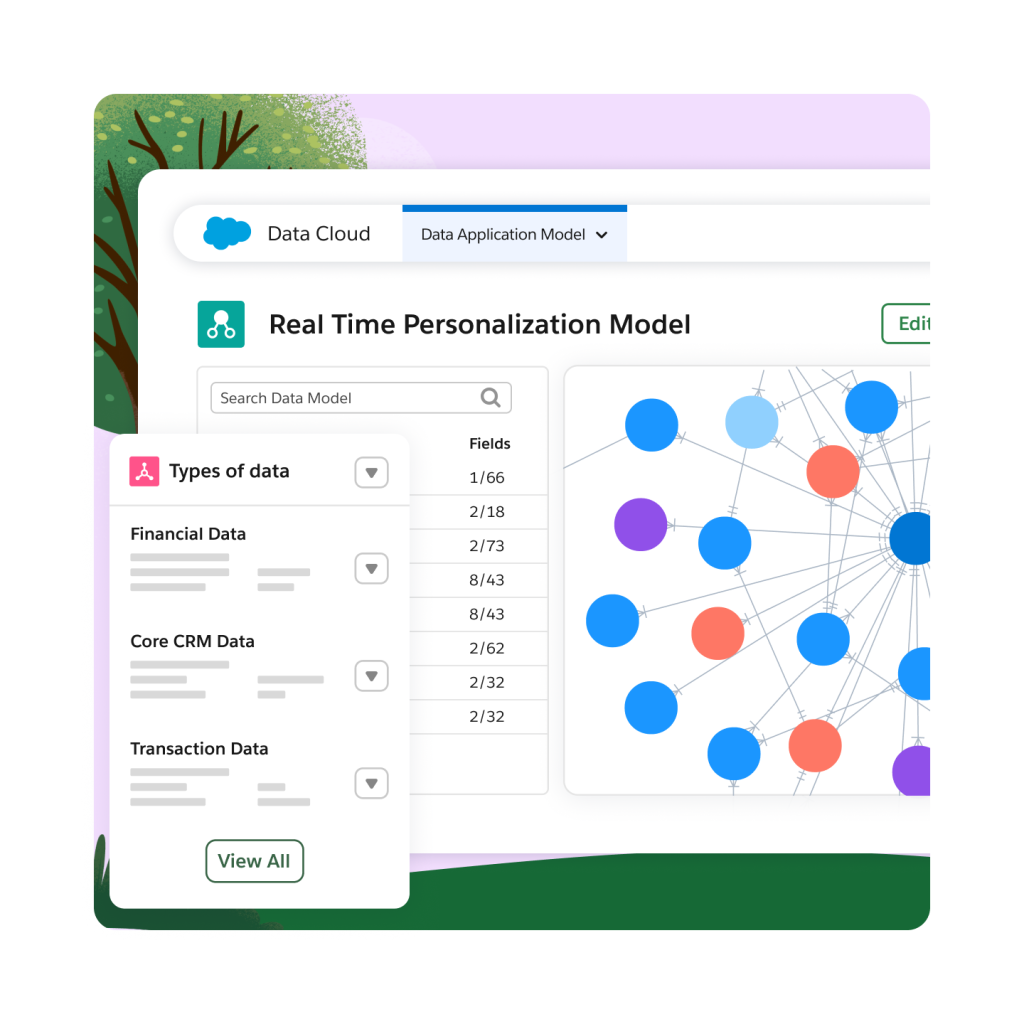

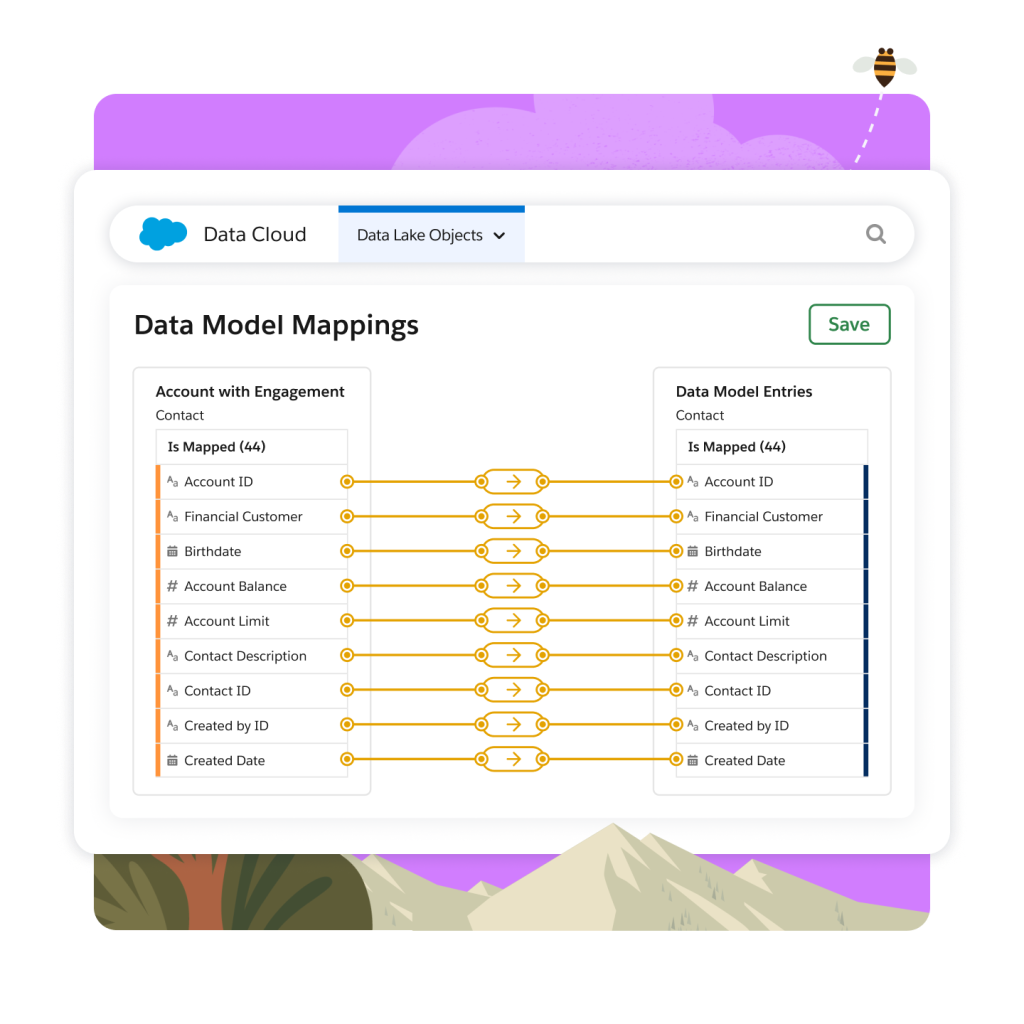

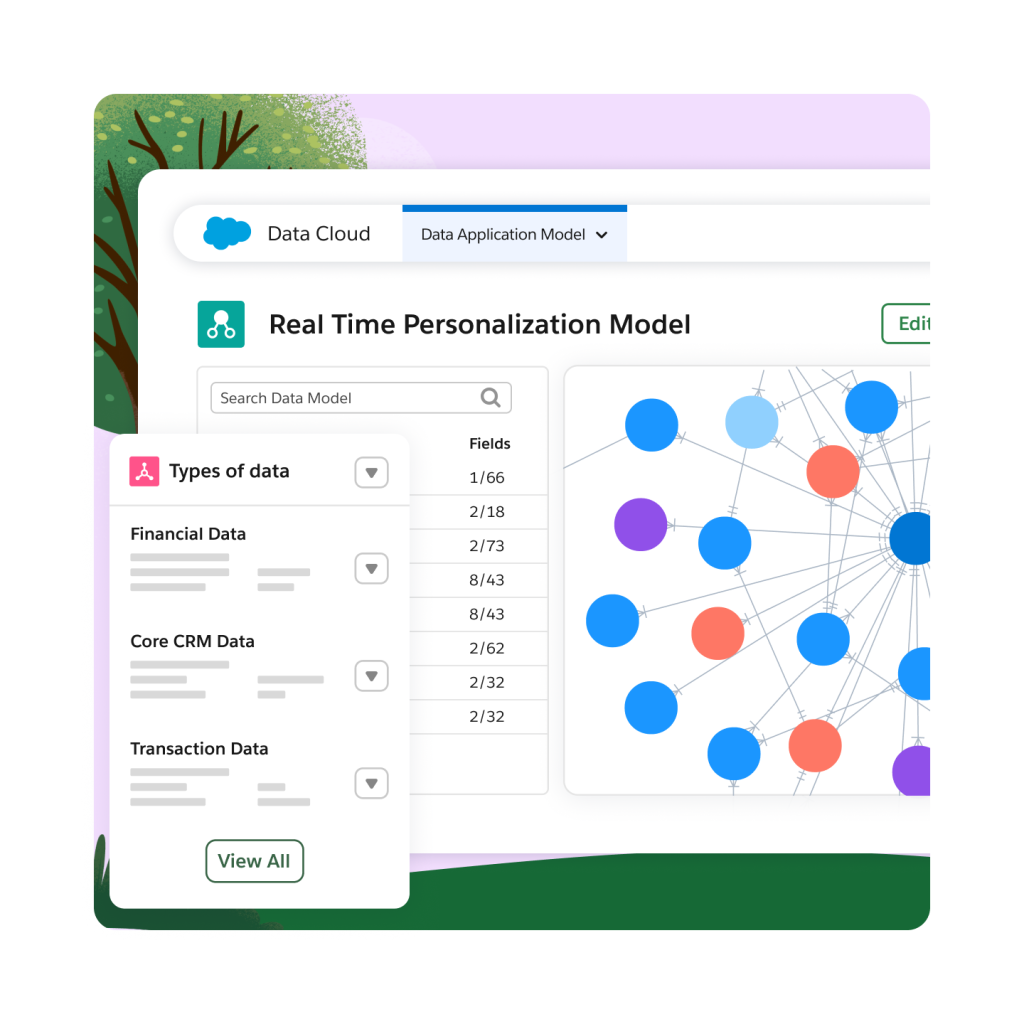

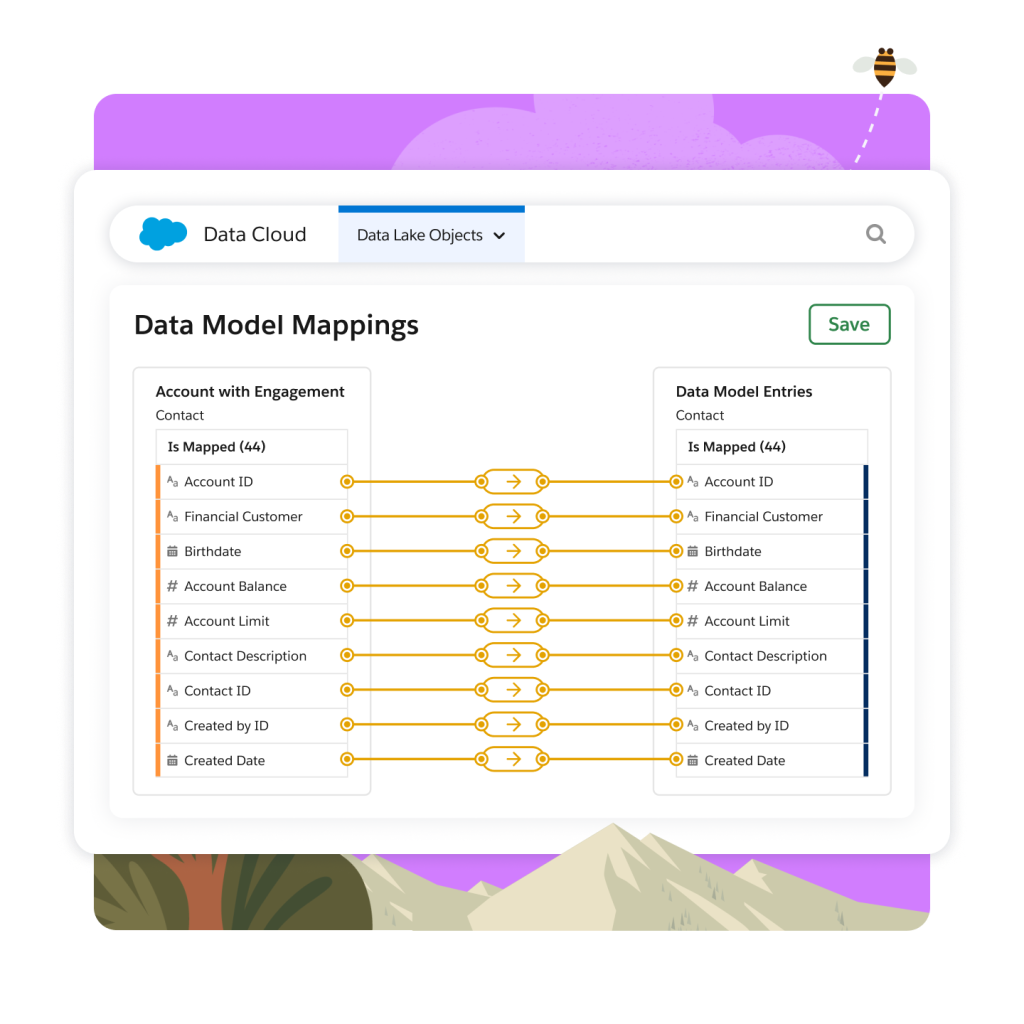

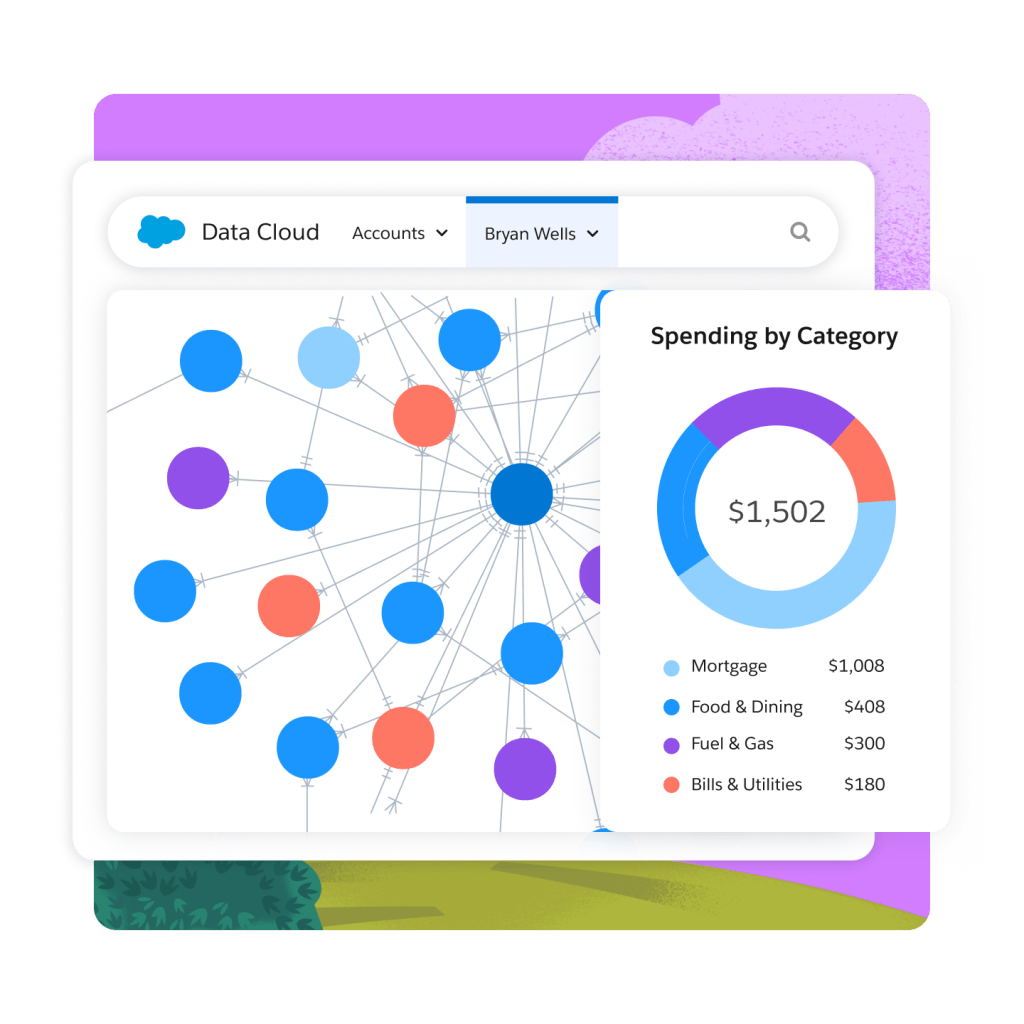

Unify your customers’ financial and transactional data, CRM data, and behavioral data using Data Cloud to bring your first-party and external data together into a single lakehouse with a data model for Financial Services Cloud.

Connect your core banking transaction data, as well as other external systems, with Financial Services Cloud. Use a financial services data model with prebuilt mappings and streams in the Financial Services Cloud Data Kit.

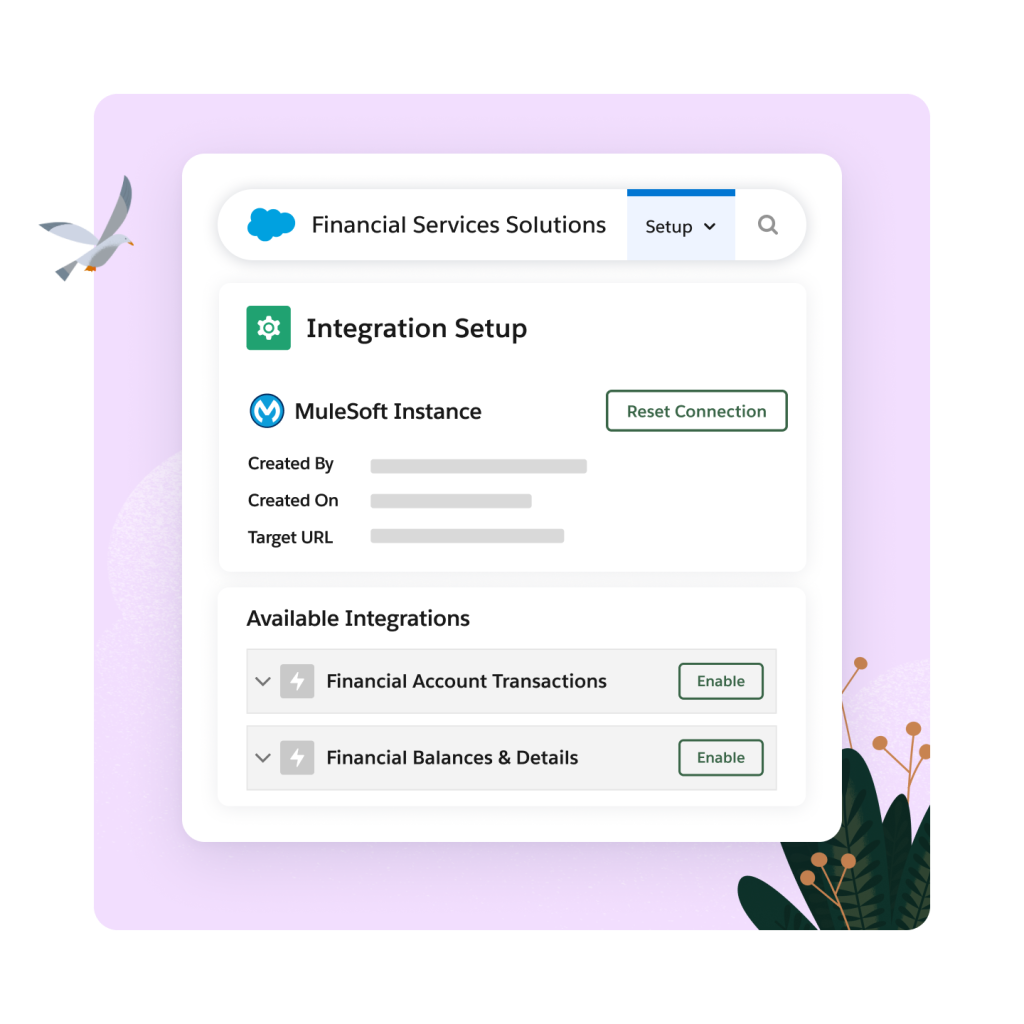

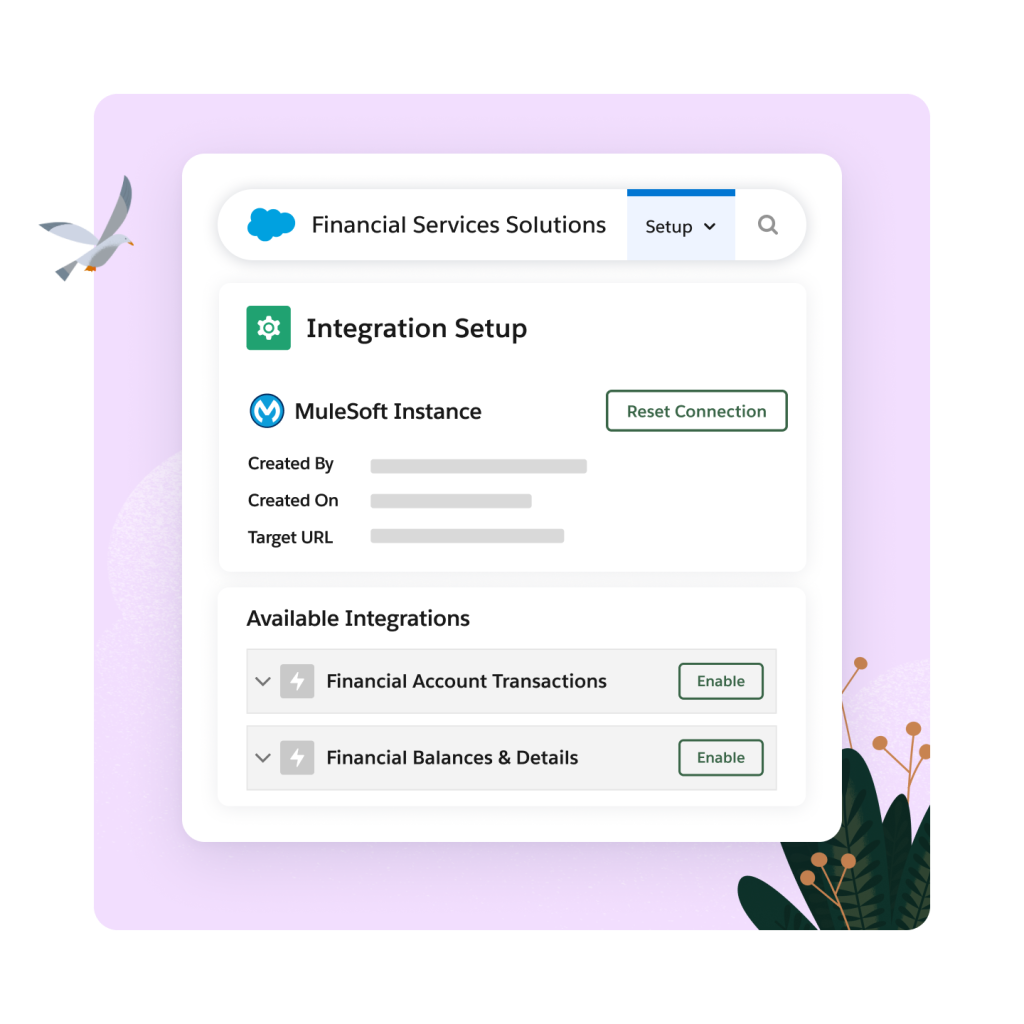

Connect your data quickly to once-siloed systems – core banking, custodial, financial planning, and portfolio management software – with accelerators and APIs. Use MuleSoft Direct for Financial Services Cloud to pipe information directly to Data Cloud.

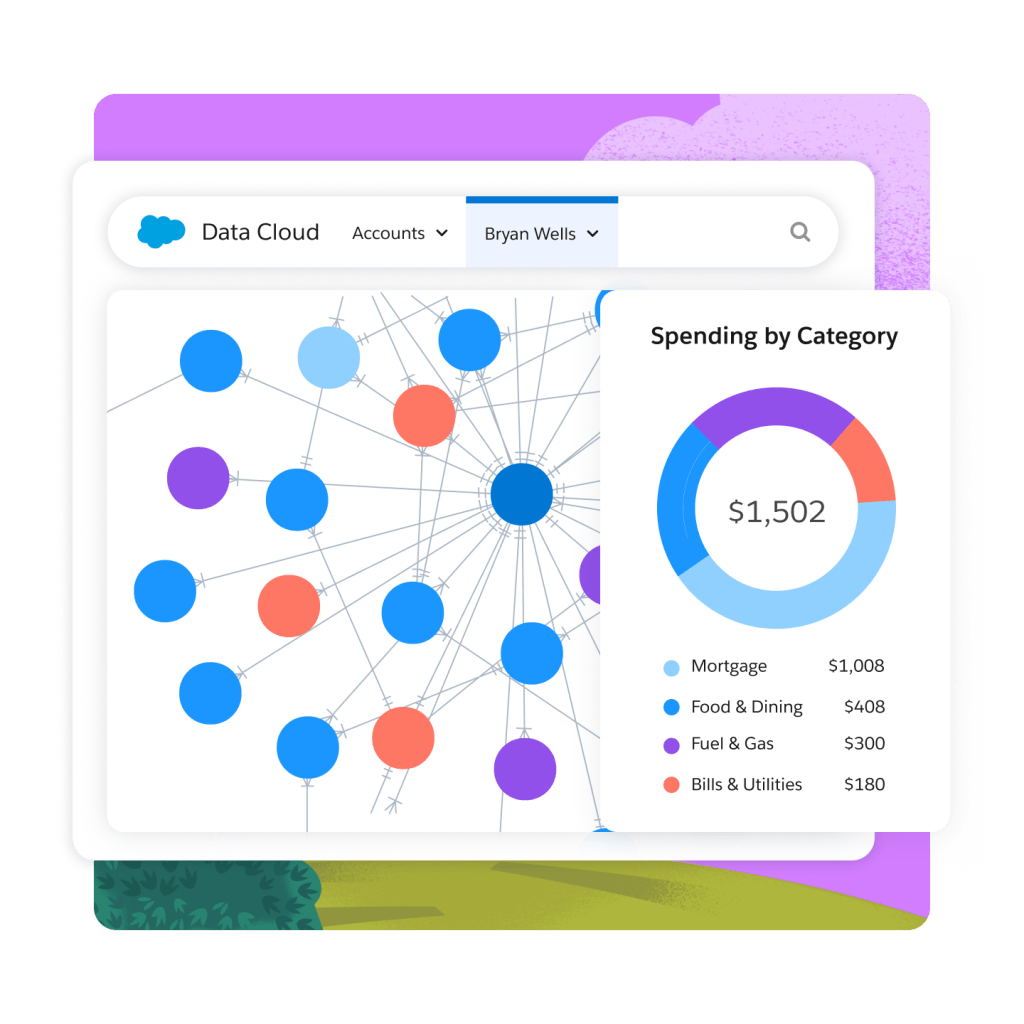

Gain insight advice from spending and savings habits through linkage to external accounts for full visibility to transactional data. Harmonize all of your data for a complete picture of your customers. Position your data for AI insights like real-time financial wellness scores and next best actions.

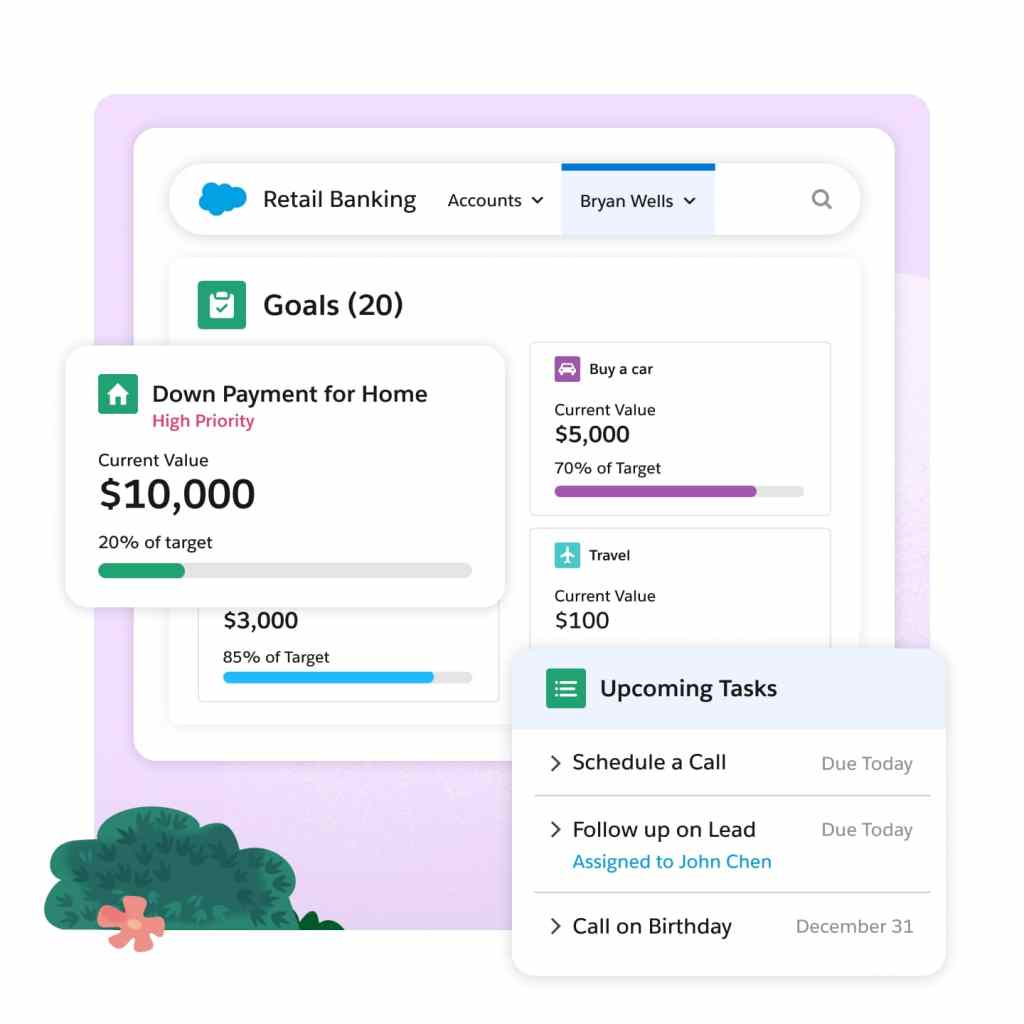

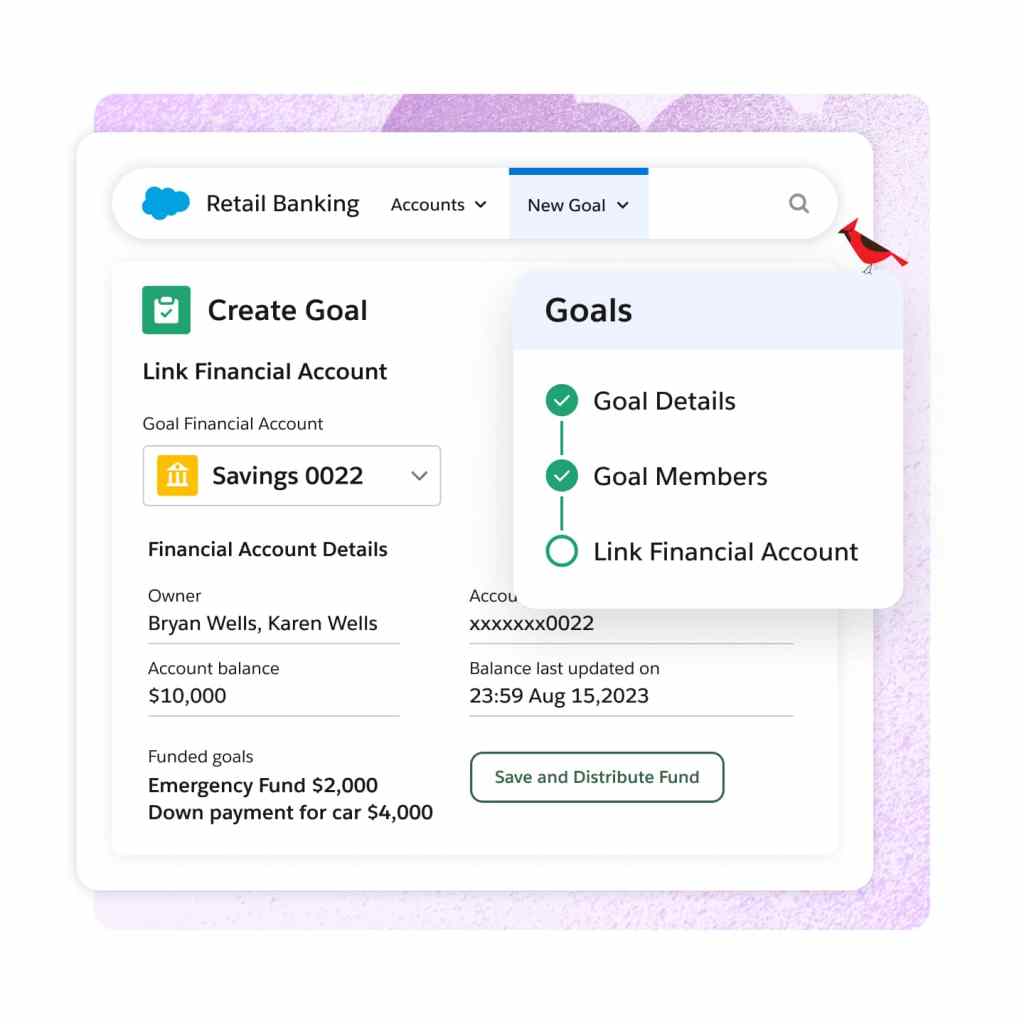

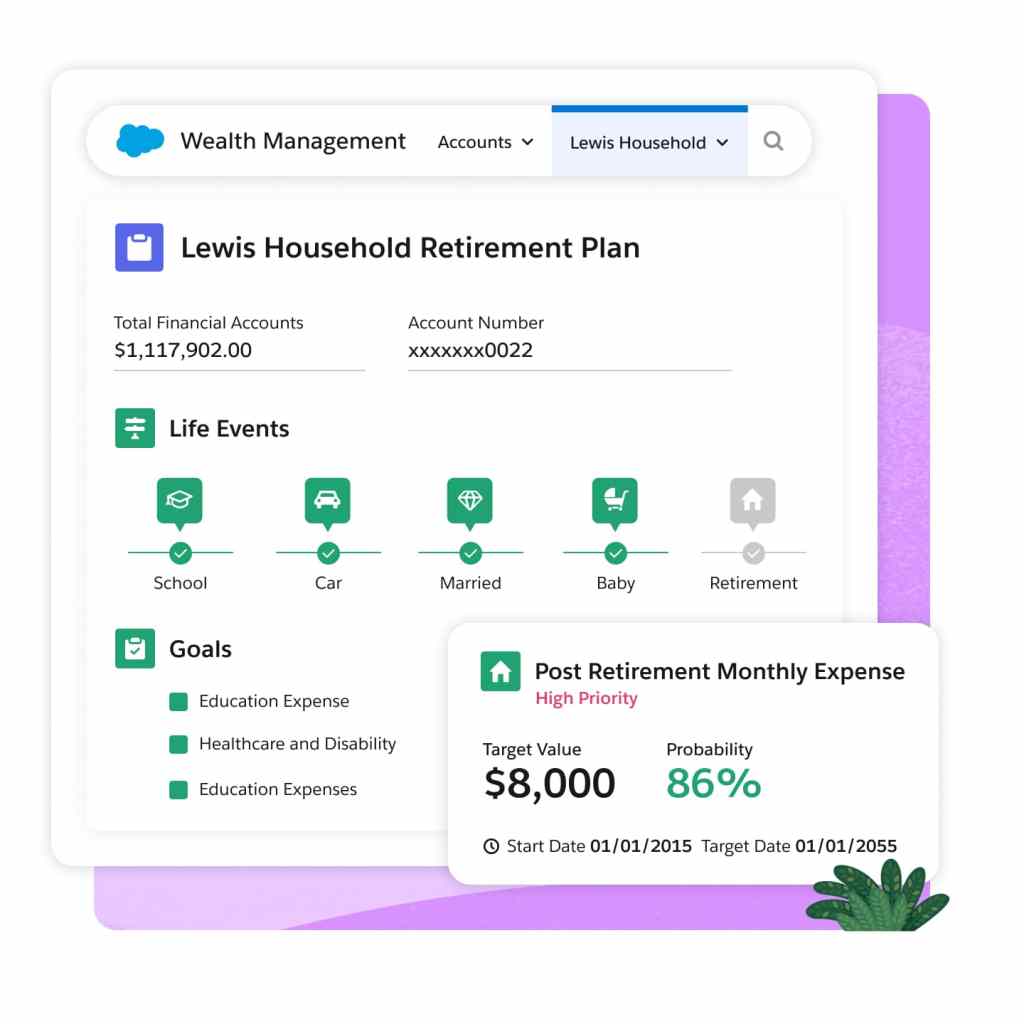

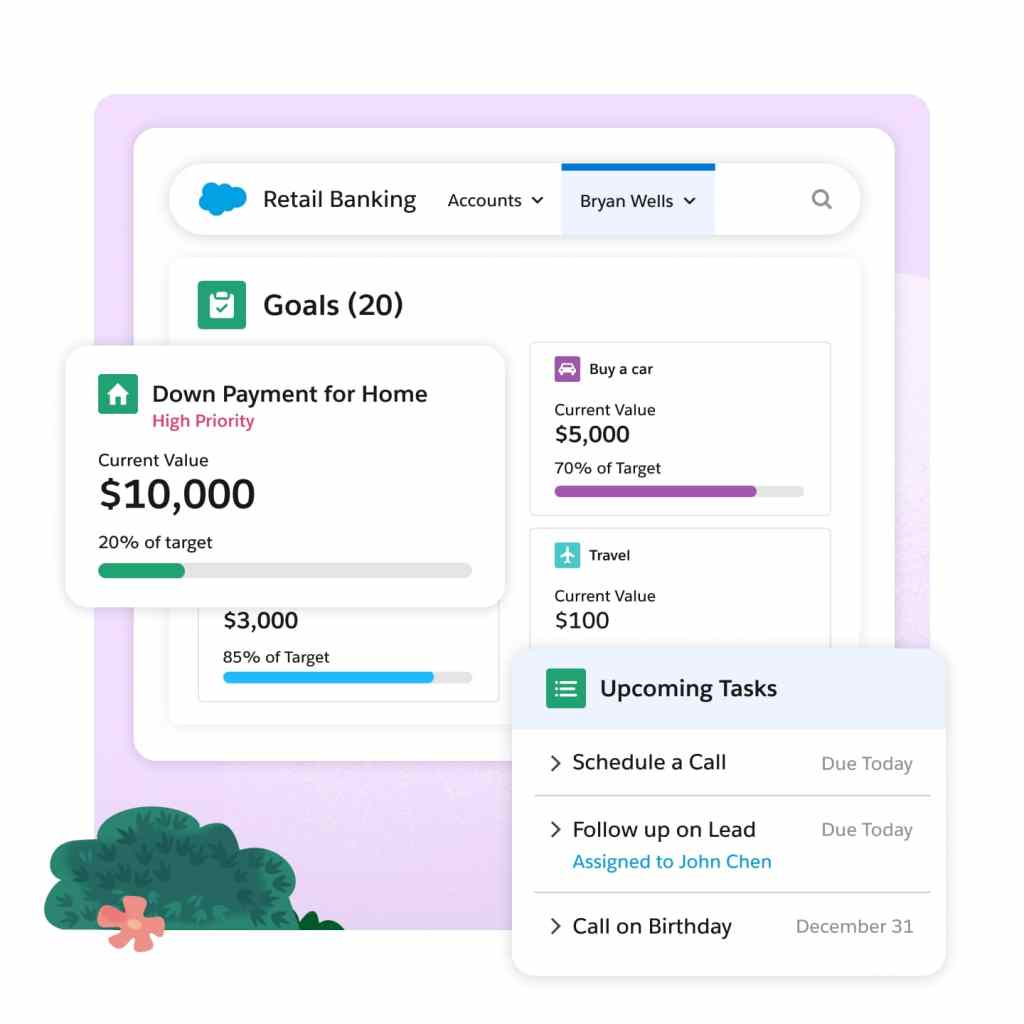

Optimize financial planning experiences.

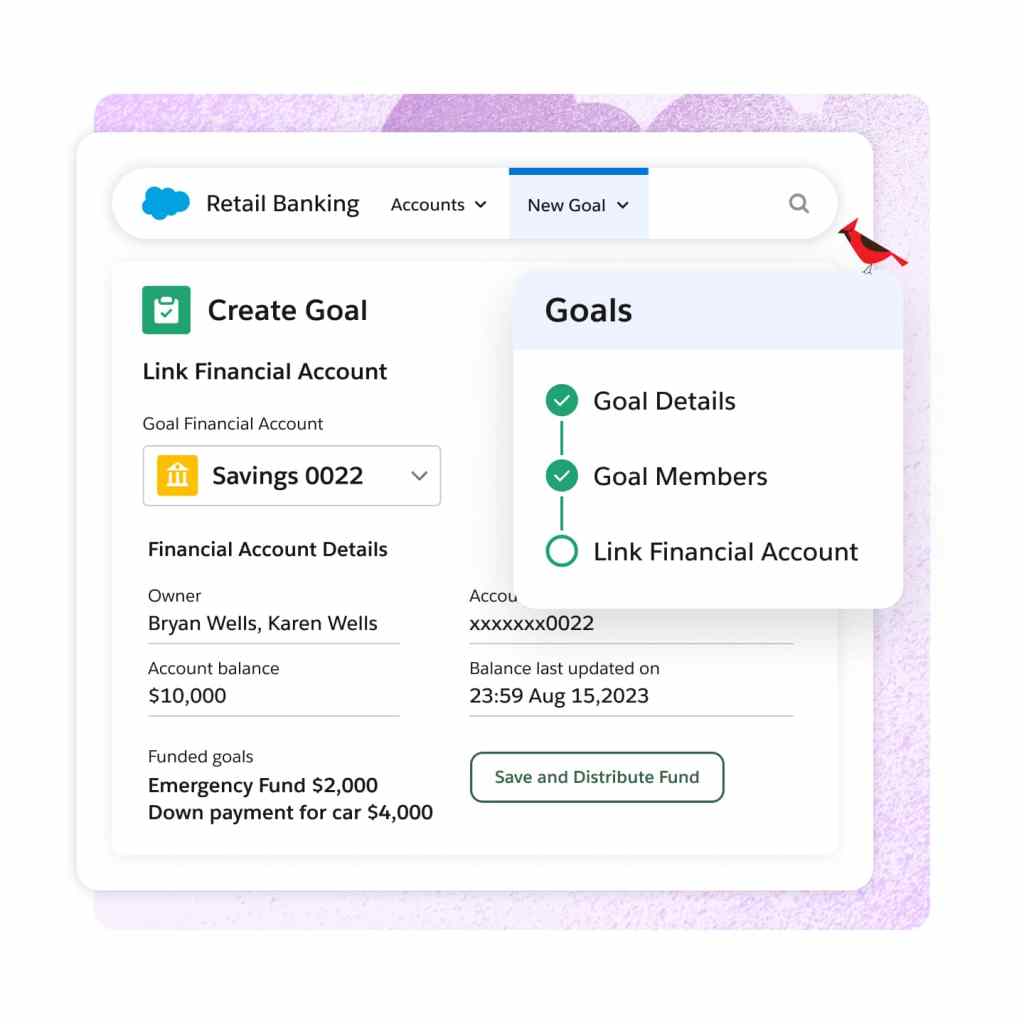

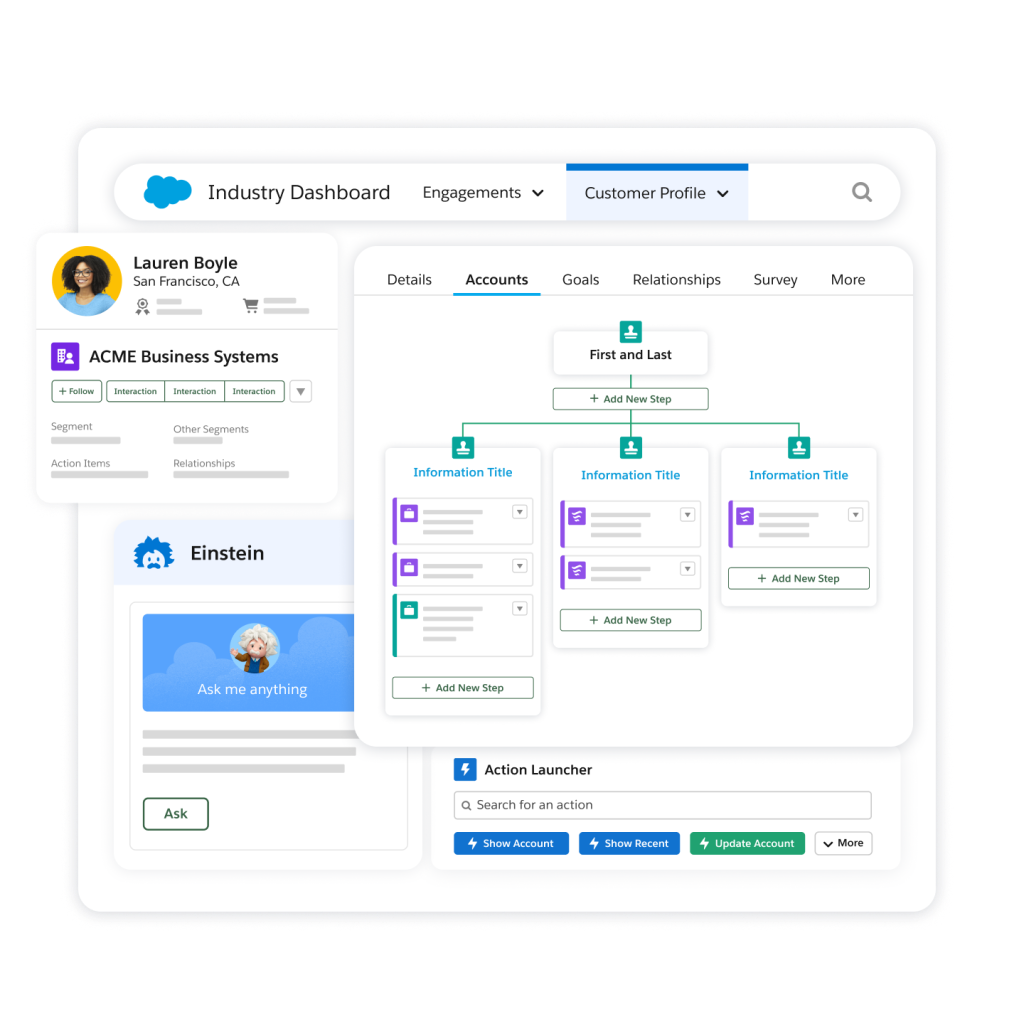

Anticipate your customers’ needs by understanding their financial aspirations. Use prepackaged goal capture experiences to record customers' goals right in Financial Services Cloud. Get a complete picture that drives relevant customer interactions.

Bankers and wealth advisors can view and action on financial plans from a financial planning platform, right in Financial Services Cloud by using our business APIs. Advisors can also pull household information into financial platforms, eliminating the need to ask for the same information repeatedly.

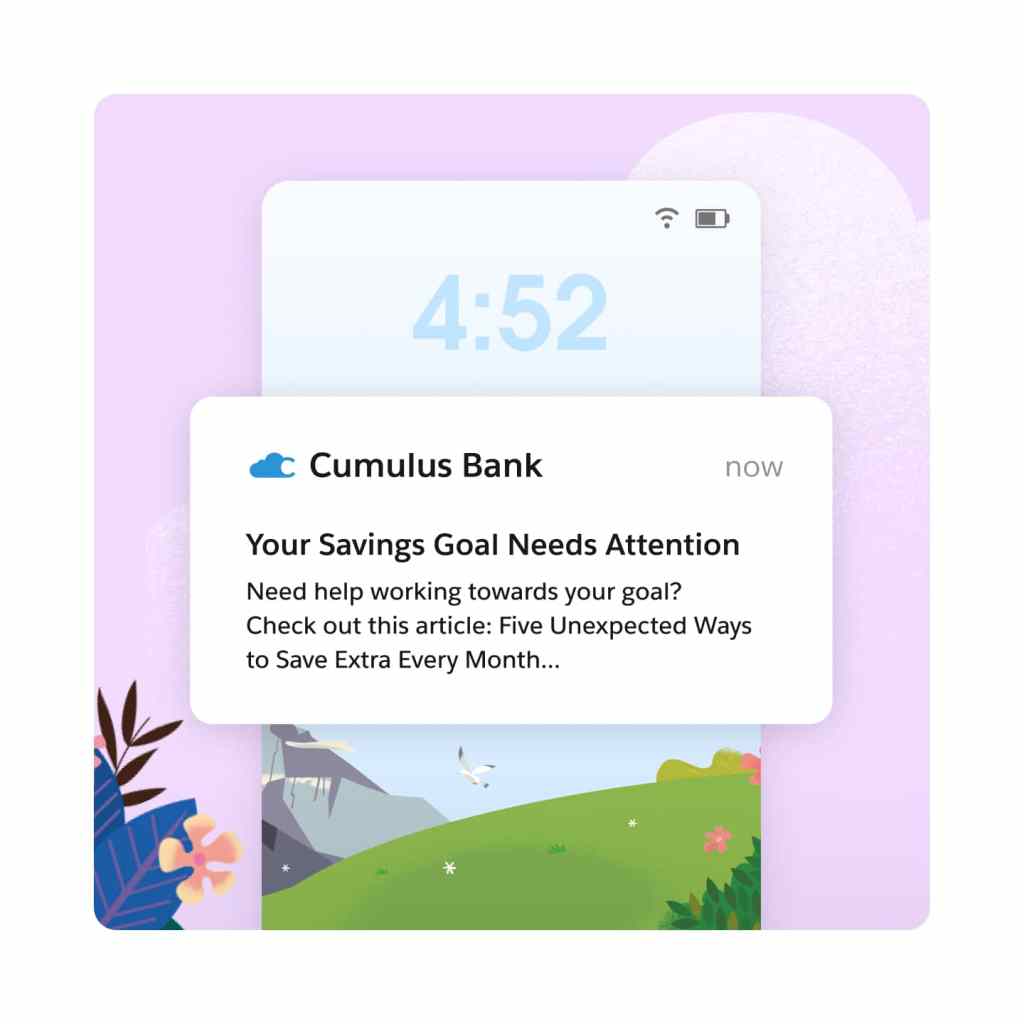

The best thing about managing goals in Financial Services Cloud is that they are actionable – you can drive workflows around them. Personalized engagement and proactive actions will help drive the financial outcomes that will create lifelong customers.

Drive financial wellness with insights.

Understand household income, expenditures, and net worth based on calculated transaction insights and trends from Data Cloud that surface in Financial Services Cloud on FlexCards. Develop a deeper understanding of your customers and drive actions anywhere in Financial Services Cloud.

Harmonize data in Financial Services Cloud and Data Cloud with custom components in Financial Services Cloud for specific visualizations and an alerting framework. Deliver alerts with financial services personalization to help your customers stay on track for financial wellness.

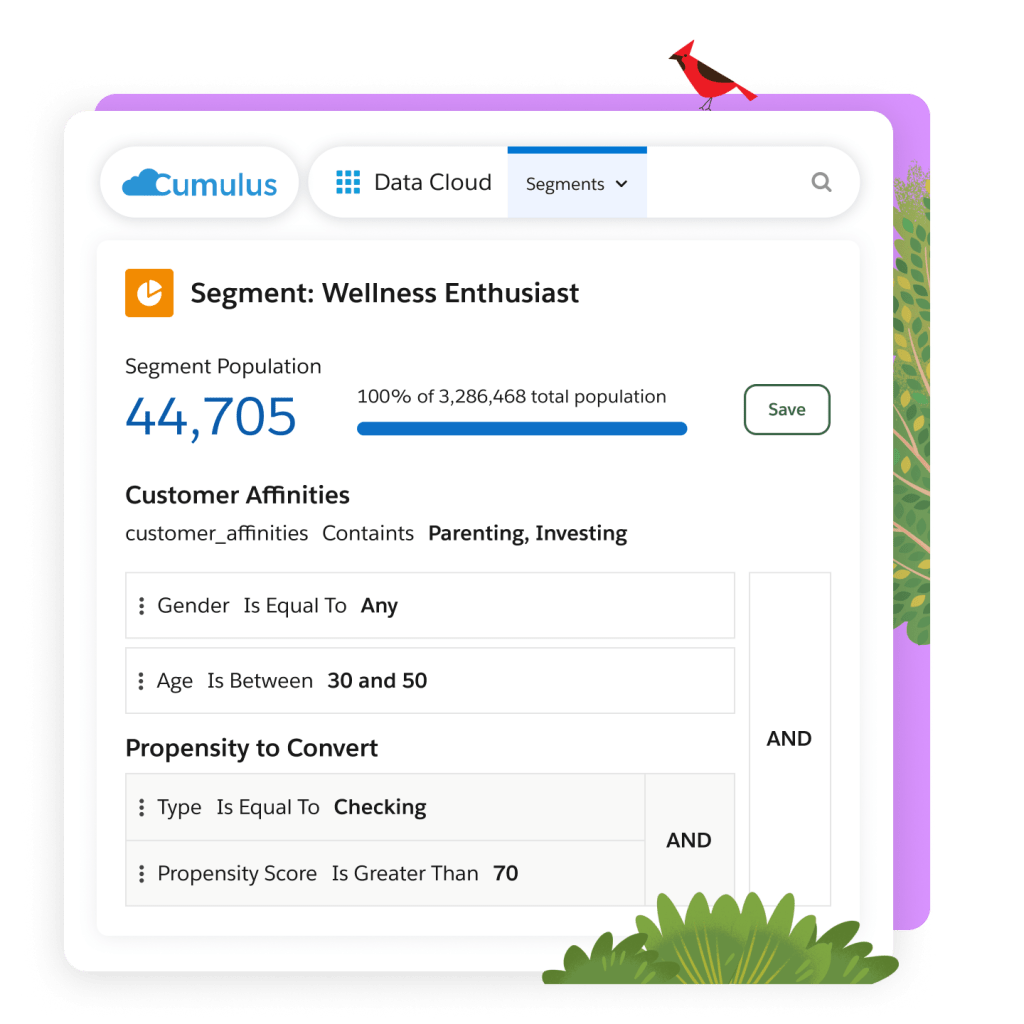

Leverage Data Cloud to support high-volume scenarios of segmentation. Build actionable lists with Data Cloud using Actionable Segmentation in Financial Services Cloud to engage customers and prospects based on signals for financial life journeys.

Complete your financial services personalization solution with products from across the Customer 360.

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Data Cloud

Activate all your customer data across Salesforce applications.

Marketing Cloud

Personalize customer experiences and optimize each campaign with data-first solutions for any channel and device.

Financial Services Cloud Intelligence

Drive predictable revenue with analytics and AI for organizations.

MuleSoft Anypoint Platform

Integrate data from any services system to deliver critical, time-sensitive data – all with a single platform for APIs and integrations.

Experience Cloud

Quickly launch data-powered sites, portals, and apps, connected across the customer journey.

AppExchange

The world’s leading enterprise cloud marketplace of proven apps and experts. Easily find financial services solutions that are right for you.

Build the perfect financial services personalization solution with our help.

Get in touch today and our experts will guide you through the process step by step:

- Choose the right Financial Services Cloud edition as your foundation.

- Add products/services needed, if not already included.

- Customize the final result with apps, services, and support.

By leveraging Salesforce as our single system of record for all customer, account, and transaction data, bankers are now better equipped to help their clients reach their financial wellness goals.

Samantha PauseChief Innovation and Brand Officer, Mascoma Bank

Personalize engagement for retail banking.

Retail Banking

Deliver connected and personalized experiences to customers with automation.

Learn new skills with free, guided learning on Trailhead.

Hit the ground running with financial services personalization tips, tricks, and best practices.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Personalized Financial Engagement FAQ

Personalization gives financial services firms the ability to connect their disparate data systems and gain a complete view of their customers so they can deliver personalized experiences at scale.

Personalized financial engagement can help you gain incredible insights from your data so you can deliver impactful, personalized customer experiences at scale. Helping customers achieve financial success increases customer loyalty and drives measurable business value.

Evaluate your company’s current data challenges and think about the different data sources you want to combine. Identify personalization use cases for your end users' experiences and your marketing, sales, and services teams' experiences. Then, choose the software that will fulfill those demands.

Financial institutions can unify their customers’ complete financial data and their CRM data. This positions them for AI insights like real-time financial wellness scores and next best actions, so they can deliver financial services personalization.