Digital sales remained strong as retailers closed out the 2021 holiday shopping season, with consumers around the globe maintaining or increasing their early December spending compared with last year. This is despite persistent economic challenges caused by inflation, low inventory, and fewer discounts.

Salesforce analyzed global shopping data from more than one billion consumers on Commerce Cloud and Marketing Cloud (including 24 of the top 30 U.S. online retailers) and found:

Key December holiday insights (November 30 — December 13)

- Early holiday season demand leads to smoother December sales: Post-Cyber Week digital sales remained flat globally year on year (YoY) at $268 billion (0% growth). U.S. digital sales grew modestly over the same time period at 3% YoY growth, with $61 billion in holiday orders placed.

- Supply chain issues continue to impact holiday inventory and sales: With product availability down 7% globally and 8% in the U.S. YoY, holiday discounts continued to trend downwards after Cyber Week. The global average discount rate dropped to 16%, a 9% YoY decrease. U.S. shoppers saw discount rates drop to 17% after Cyber Week, a 12% YoY decrease.

- In the face of higher prices, consumers financed purchases: The Average Selling Price (ASP) after Cyber Week was up 25% in the U.S. and 9% globally YoY. Buy Now, Pay Later offerings continue to trend upward to offset the higher cost of goods this holiday season. Seven percent of all online global orders were processed using this option between the first day of Cyber Week and December 13, with 48% YOY growth.

- Holiday shipping cut-off dates spur flurry of last-minute shopping: While post-Cyber Week growth was sluggish, data indicates a pick up in global and U.S. shopping activity on Friday, December 10 and continuing through to Monday, December 13 as shoppers rushed to finish online shopping ahead of the December 15 shipping cutoff. Sales over this period grew 4% YoY globally and 8% in the U.S., far outpacing the average across the previous two weeks combined.

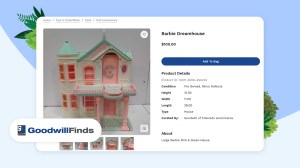

- Product categories with the strong YoY growth post-Cyber Week include:

- Luxury handbags (+34%)

- Furniture (+31%

- Electronics & Accessories (+30%)

The Salesforce perspective:

“Early December data confirms that holiday demand has smoothed out this year, with consumers shopping early and often,” said Rob Garf, VP and GM of Retail, Salesforce. “While a spike in digital sales never came during or after Cyber Week, retailers should be encouraged by how steady digital shopping habits and sales have been in the face of higher prices, fewer discounts, and less inventory.”

Explore further:

- Visit the Holiday Insights Hub to view Cyber Week data.

- Visit the Newsroom to view our final Cyber Week insights.

- View our initial predictions for the holiday season here.

2021 Salesforce Holiday Insights and Predictions Methodology

To help retailers and brands benchmark holiday performance, Salesforce analyzes aggregated data to produce holiday insights from the activity of over a billion global shoppers across more than 54 countries powered by Commerce Cloud, in addition to Marketing Cloud and Service Cloud data from retailers. Salesforce’s holiday data set includes 24 of the top 30 U.S. online retailers on the 2021 Digital Commerce 360 list and utilizes publicly available third-party data sources.

To qualify for inclusion in the analysis set, a digital commerce site must have transacted throughout the analysis period, in this case October 1, 2019 through December 13, 2021, and met a monthly minimum visit threshold. Additional data hygiene factors are applied to ensure consistent metric calculation.

The Salesforce holiday predictions are not indicative of the operational performance of Salesforce or its reported financial metrics including GMV growth and comparable customer GMV growth.