Drive efficient growth for your agency or brokerage with trusted data and AI.

Salesforce Customer 360 for insurance empowers your agency or brokerage with custom-built, AI-powered technology, unified data, and automated workflows. The connected platform works with insurance agency management software to optimize costs, accelerate sales, and enhance marketing performance.

Agencies and brokerages are accelerating growth with insurance agency management software.

Our teams use automation to simplify how we handle new business, renewals, and so much more. With Salesforce, we’ve achieved millions in cost savings and saved thousands of employee hours while delivering better client experiences.

Andy Smith-JonesSalesforce Solutions Architect, Holmes Murphy

Streamline insurance claim tracking.

Personalize the claims experience for customers while providing self-service or high-touch options. Track and report on carrier claims SLAs with easily configured dashboards and communicate real-time updates via digital collaboration tools.

How it works:

- Track claims on behalf of clients. Inform broker and independent agent strategy with a producer contribution dashboard.

- Drive decisions with analytics and insights. Track and report on carrier claims SLAs.

- Communicate real-time updates. Elevate your stewardship communications by sharing real-time claim status updates with your clients.

- Empower third-party administrators. Use a full end-to-end claim system from FNOL to adjudication and payment.

Build your insurance claim tracking solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Slack

Bring together the right people, information, and tools to drive business.

Omnistudio

Deliver digital-first and industry-specific experiences across multiple devices and channels.

Grow through brokerage or agency merger and acquisition.

Increase growth efficiency by acquisition by maximizing employee retention and engagement, delivering operational excellence, and driving stakeholder alignment with insurance brokerage software.

How it works:

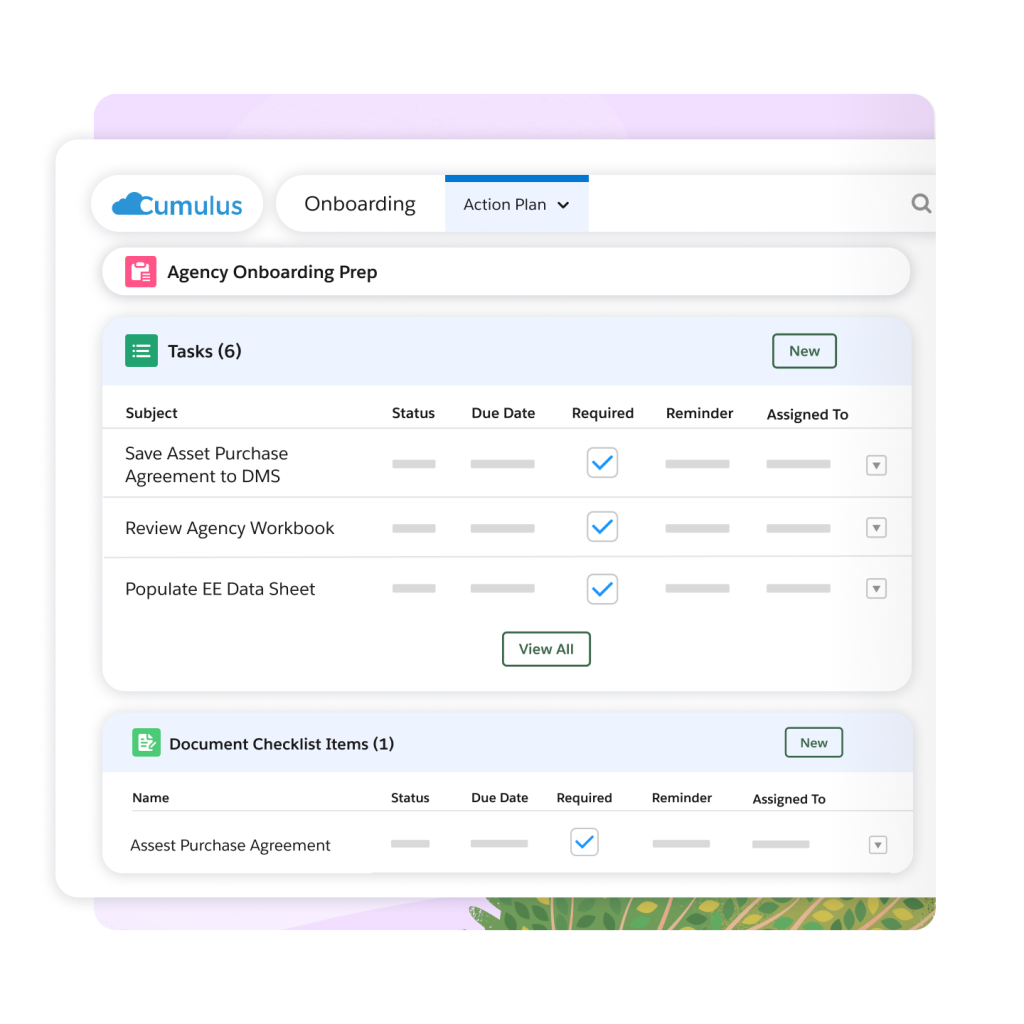

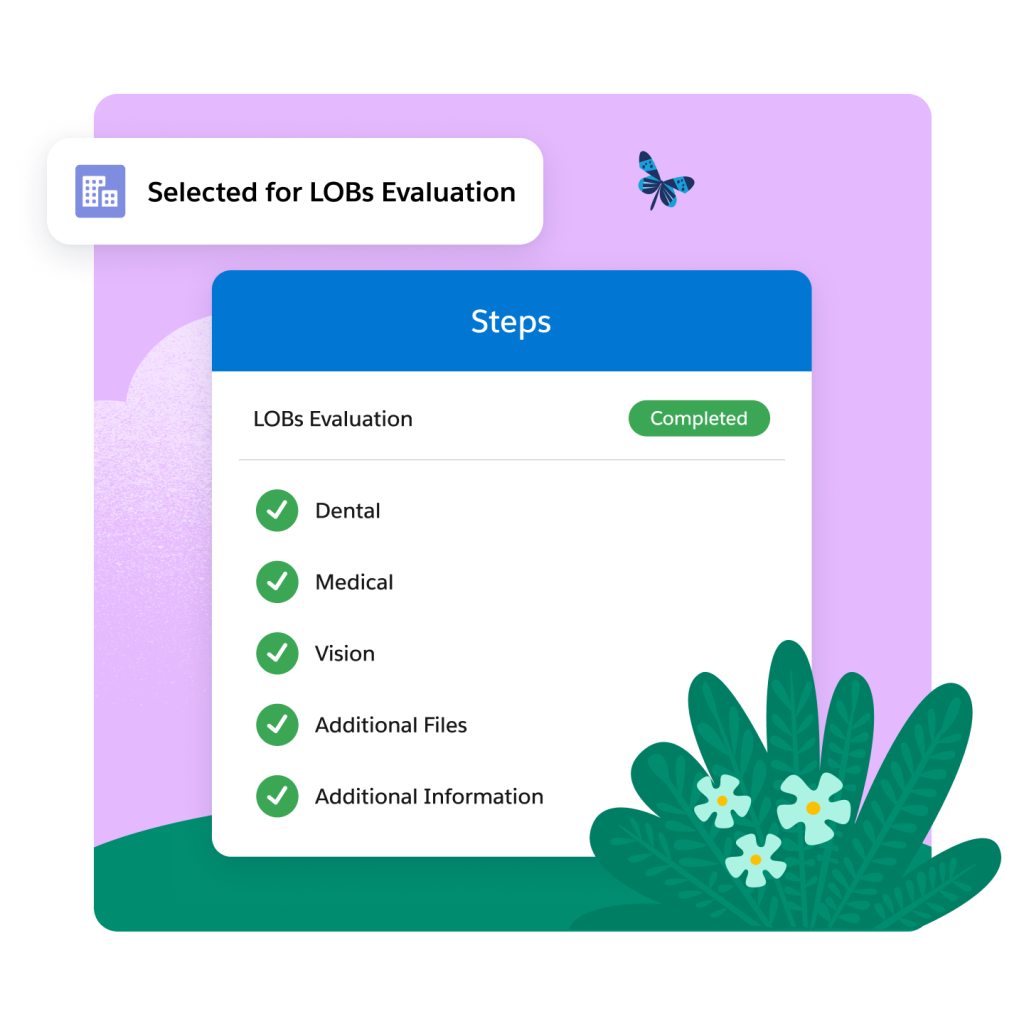

- Automate action plan creation. Once an agency opportunity is closed/won with a letter of intent, automatically create an action plan for all preparation tasks.

- Increase transparency. Continue to increase efficiencies and transparency through the entire process with additional action plans.

- Collaborate efficiently and faster. Use the Digital Experience Platform to facilitate data sharing and collaboration with your new partner agency.

- Secure and monitor critical data. Protect, monitor, and retain critical Salesforce data via platform encryption, event monitoring, and field audit trail.

Build your insurance merger and acquisition solution with the following Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Omnistudio

Deliver digital-first and industry-specific experiences across multiple devices and channels.

Digitize RFP submissions.

Eliminate spreadsheet and email confusion with reusable question banks that are flexible, transparent, and trackable.

How it works:

- Accelerate end-to-end marketing. Give teams one central place to direct placement and renewal efforts with Slack. Define annual placement objectives, share results, and collaborate cross-functionally.

- Make carrier partners part of the team. Share a Slack channel with your carrier partners to collaborate asynchronously with Slack Connect.

- Generate compliance-oriented digital forms. Create complex forms with questions from a single source of truth maintaining the traceability of the questions.

Build your RFP solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Slack

Bring together the right people, information, and tools to drive business.

Omnistudio

Deliver digital-first and industry-specific experiences across multiple devices and channels.

Scale service for agencies and brokerages.

Empower agencies and brokerages to reduce handle times with insurance agency management software. Help representatives be more efficient with generative AI that creates insight-driven responses, summaries, and knowledge articles.

How it works:

- Empower clients to self-serve. Present knowledge base and chatbots with modern, conversation UI.

- Power up client onboarding. Transform the onboarding process into a seamless, client-centric experience that encompasses onboarding, client acquisition, and renewal.

- Anticipate customers' future needs. Enable account management teams to pull up information right away, all in a unified system. Uncover cross-sell and upsell opportunities by removing silos and assessing risk profiles.

- Deliver continuous data-driven engagement. Keep relationship intelligence in one place to better identify clients at risk of losing broker of record and more.

Build your insurance service solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Slack

Bring together the right people, information, and tools to drive business.

Omnistudio

Deliver digital-first and industry-specific experiences across multiple devices and channels.

Keep up with the latest insurance trends, insights, and conversations.

Ready to take the next step with the world's #1 AI CRM for insurance?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Agencies and Brokerages FAQ

Salesforce is the world’s #1 AI customer relationship management platform. Salesforce’s 360 approach for insurance empowers insurers and their distribution partners to manage all core operations – front, middle, and back office – from one system.

Salesforce has an open API architecture that integrates with other insurance agency management software. Salesforce is enabled with purpose-built solutions for processes from product modeling to policy and claims management. Harmonize data from multiple systems and gain insights for growth.

Contact centers face challenges with siloed systems, making CSRs navigate multiple platforms. Salesforce, an open platform, integrates with core policy and claims systems. AI capabilities like Einstein enable CSRs to anticipate customer needs, keep policyholders informed, and reduce call volumes.

Insurance agency and brokerage management software streamlines operations, automates policy administration, enhances client interactions, and ensures compliance, providing a centralized platform for efficient insurance business management and growth.

Property and casualty insurance software is crucial for insurers, optimizing policy management, claims processing, underwriting, and overall operational efficiency. It enhances accuracy, compliance, and customer satisfaction in the insurance industry.

Insurance agency and brokerage management software is crucial for optimizing operations, automating tasks, enhancing client service, ensuring compliance, and fostering growth, ultimately improving overall efficiency and profitability.

Insurance management software is vital for streamlined operations, policy handling, client relationship management, and compliance adherence. Salesforce enables agencies and brokerages to connect and empower their entire organization, spanning marketing, sales, service, data, IT, and analytics.