Financial Services Cloud

Discover the power of the world’s #1 AI CRM for financial services. Financial Services Cloud unlocks data from core banking, wealth, and insurance platforms and unifies it around the customer. Activate data to personalize engagement using purpose-built automation with industry-specific AI.

What can you do with Financial Services Cloud?

Accelerate your customer onboarding. Increase retention and loyalty with AI-powered service. Unlock your data to deliver intelligent insights for financial planning, empowering your customers’ financial success with trusted AI.

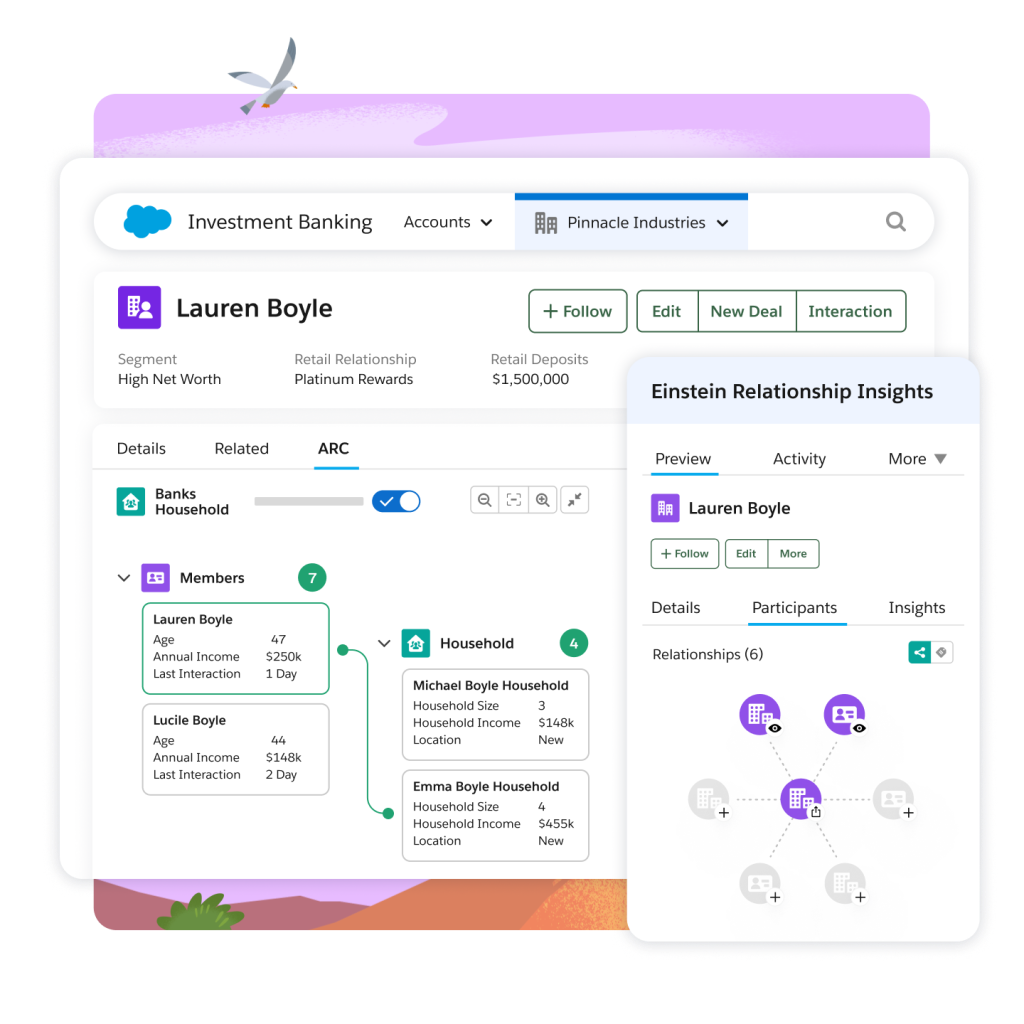

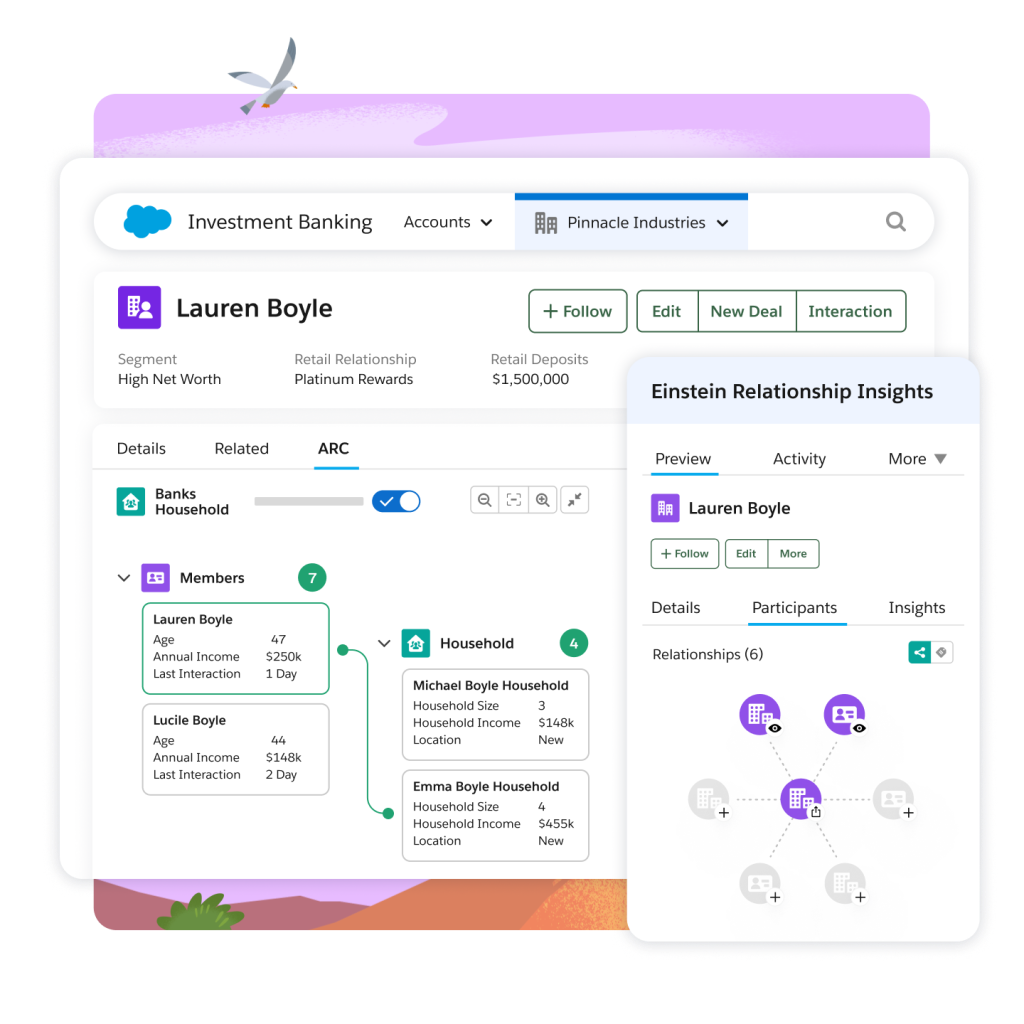

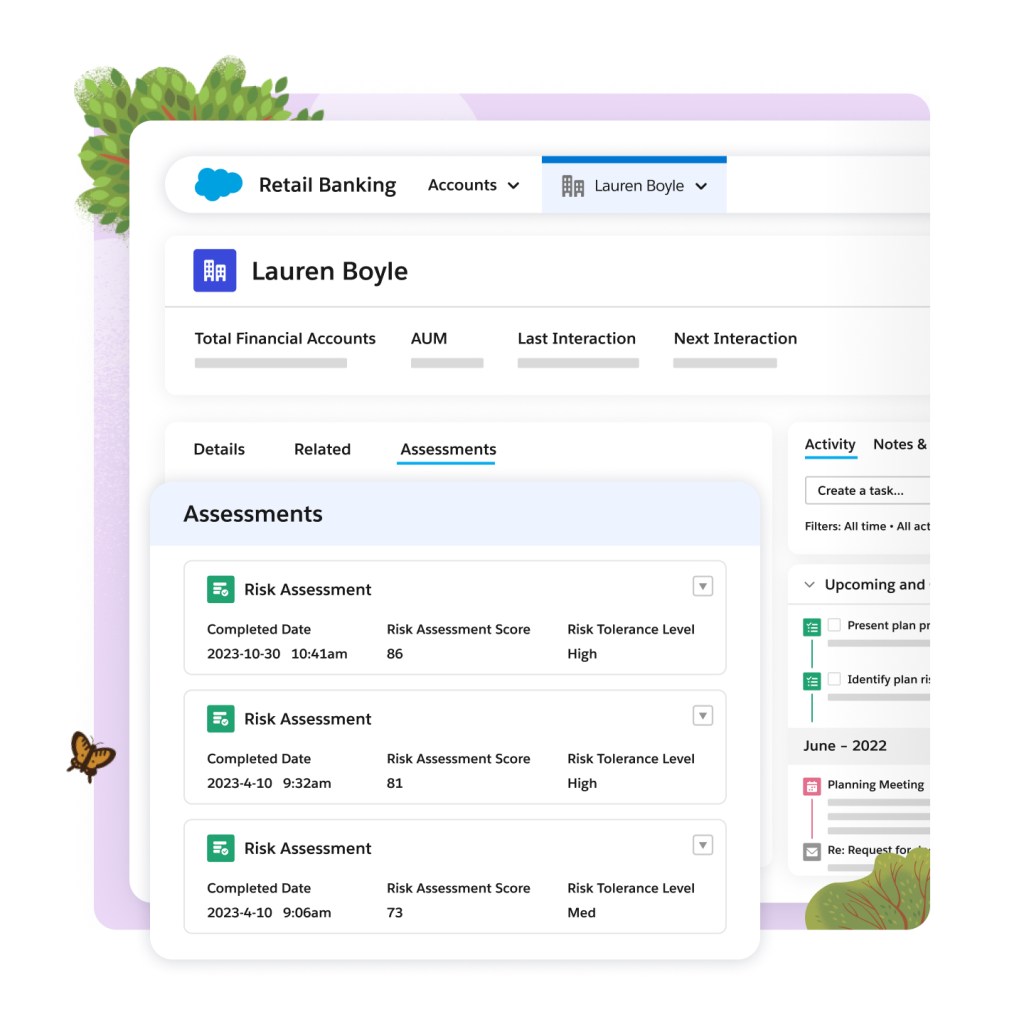

Grow revenue with trusted relationships.

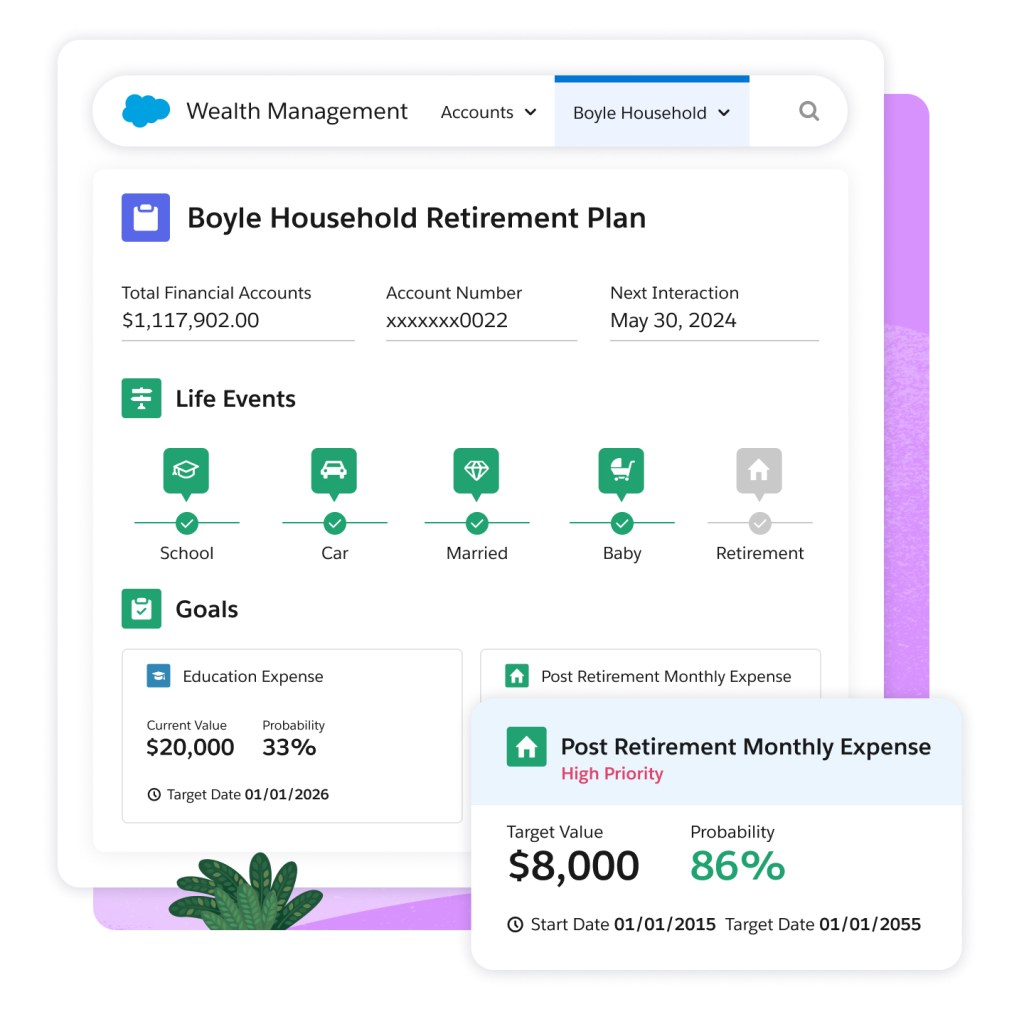

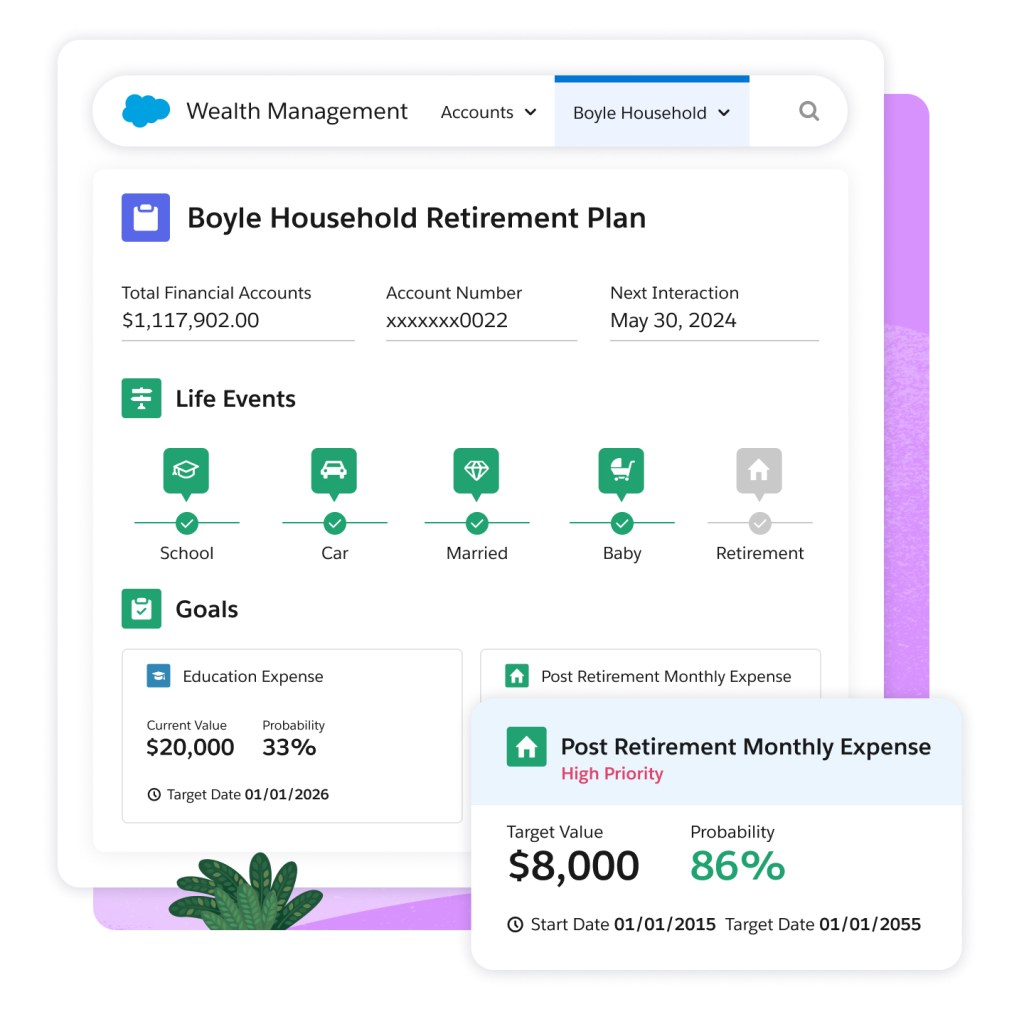

View multiple layers of relationships and related key information in one place to identify areas of opportunity and drive contextual action.

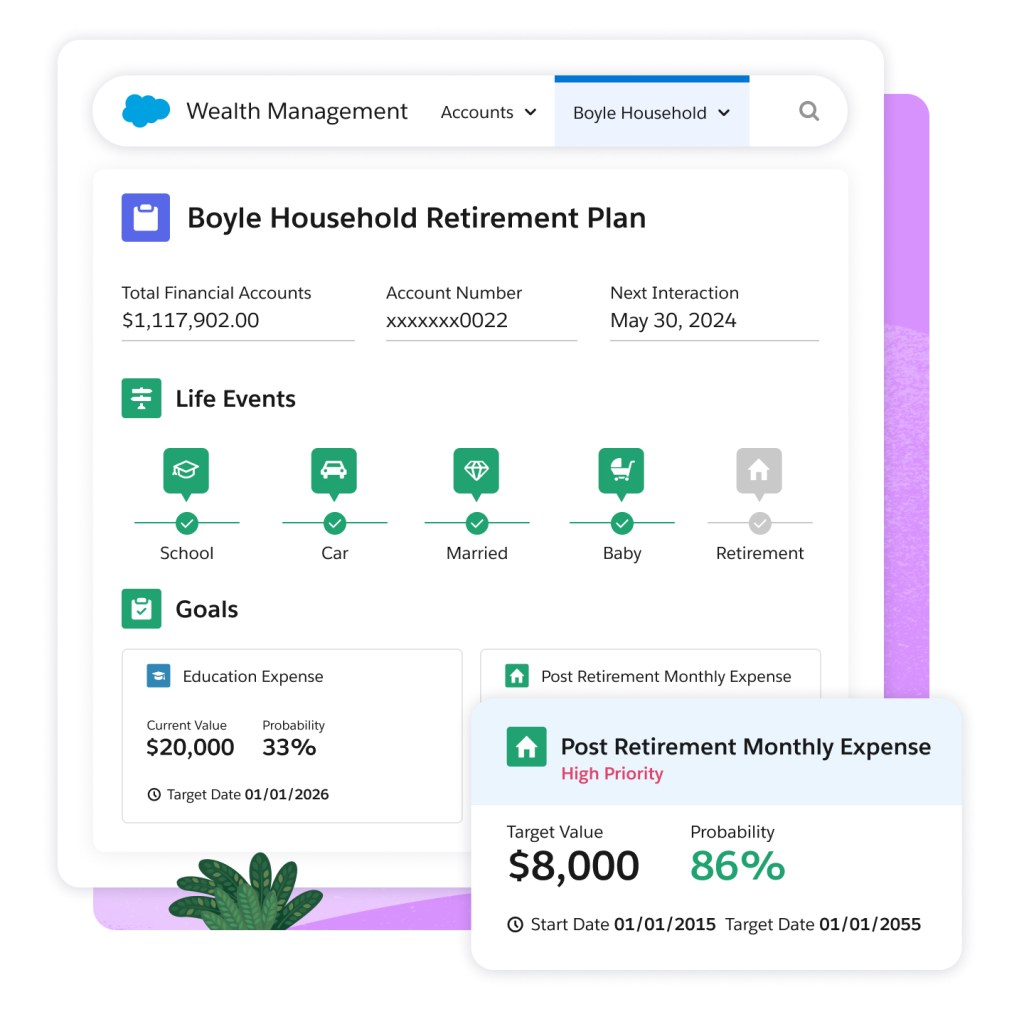

Empower financial success with actionable financial goals.

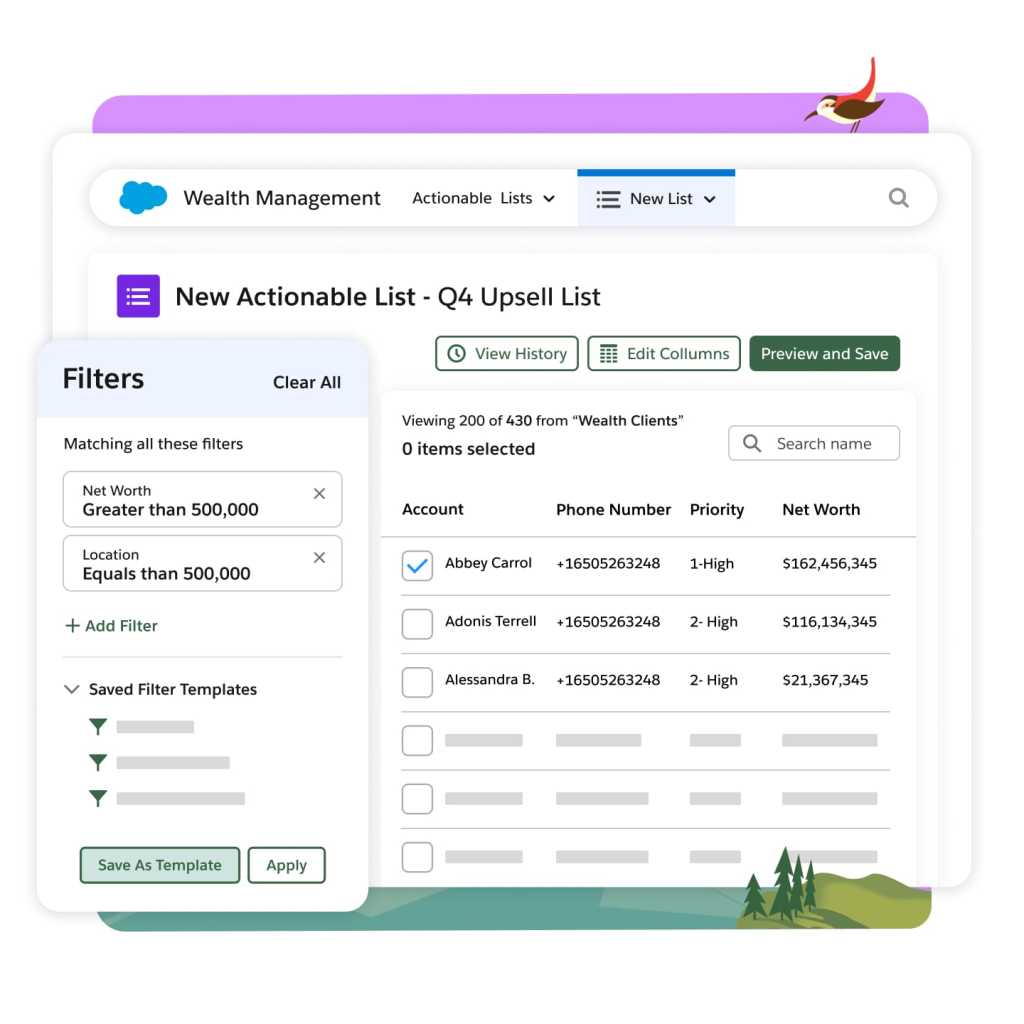

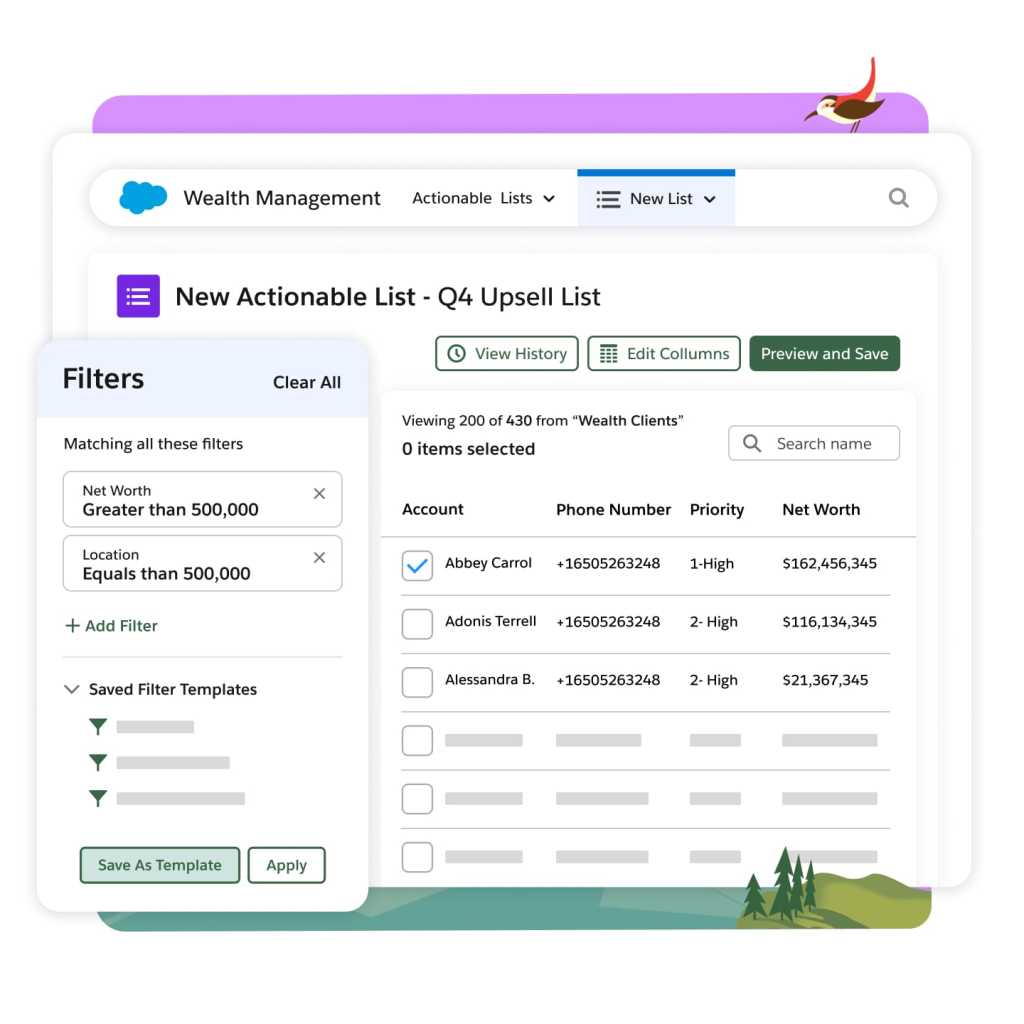

Cultivate strong relationships at scale by creating targeted lists of contacts for priority engagement.

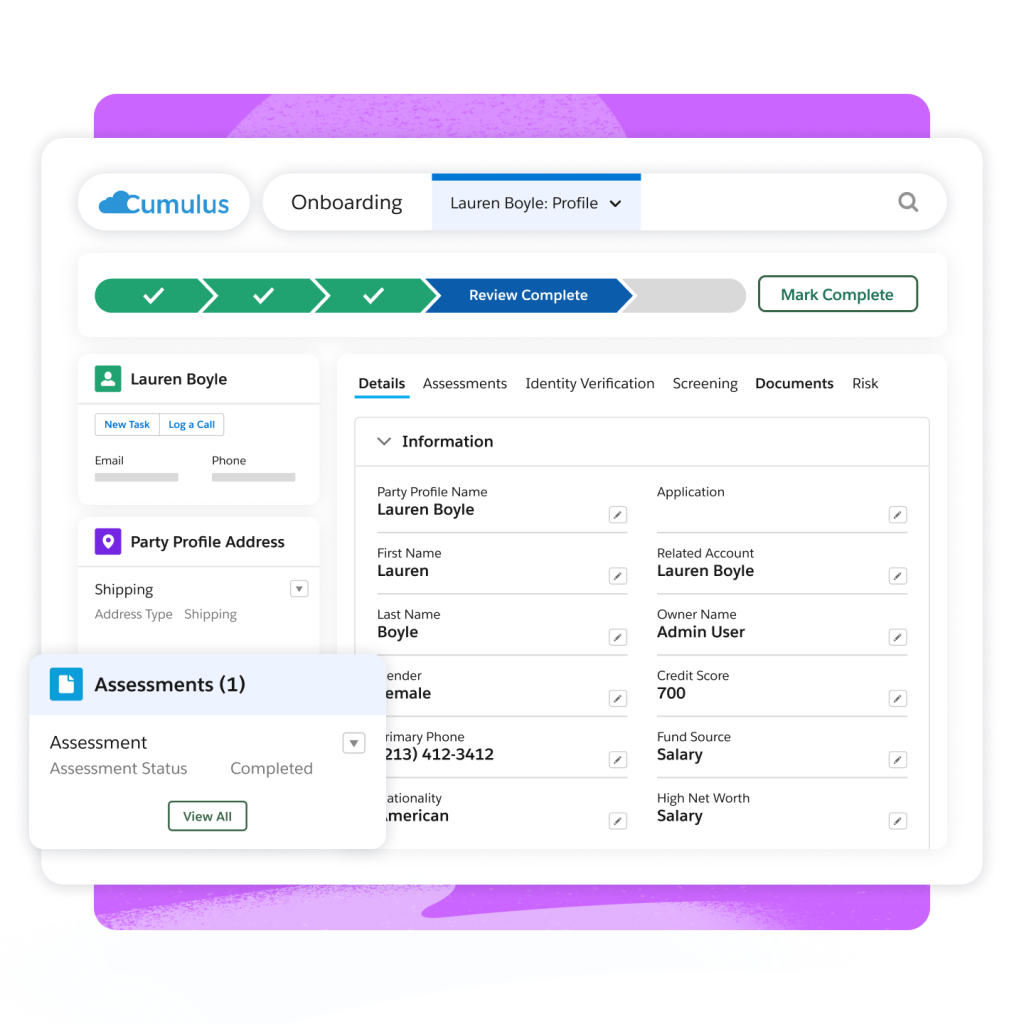

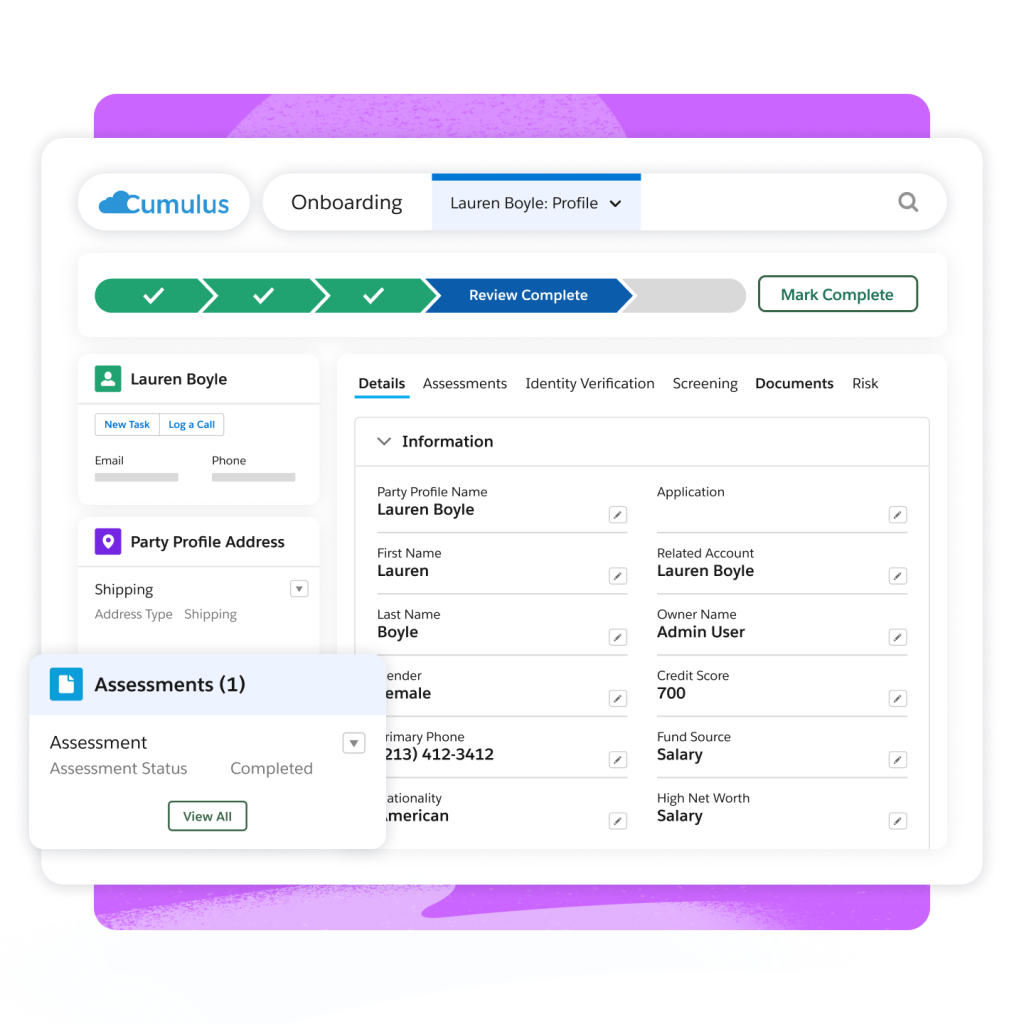

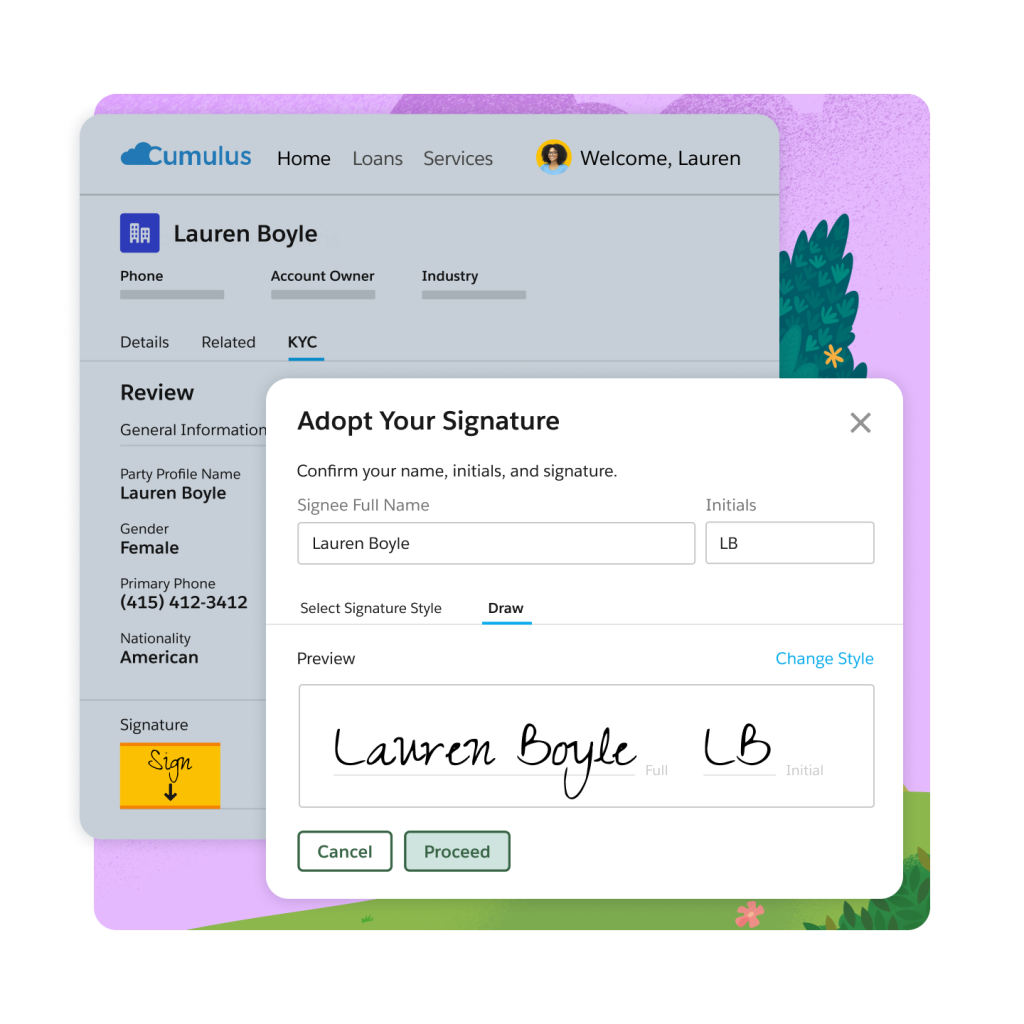

Streamline onboarding with data and trusted AI.

Accelerate onboarding implementation with a pre-configured template.

Deploy intelligent financial discovery processes across any channel.

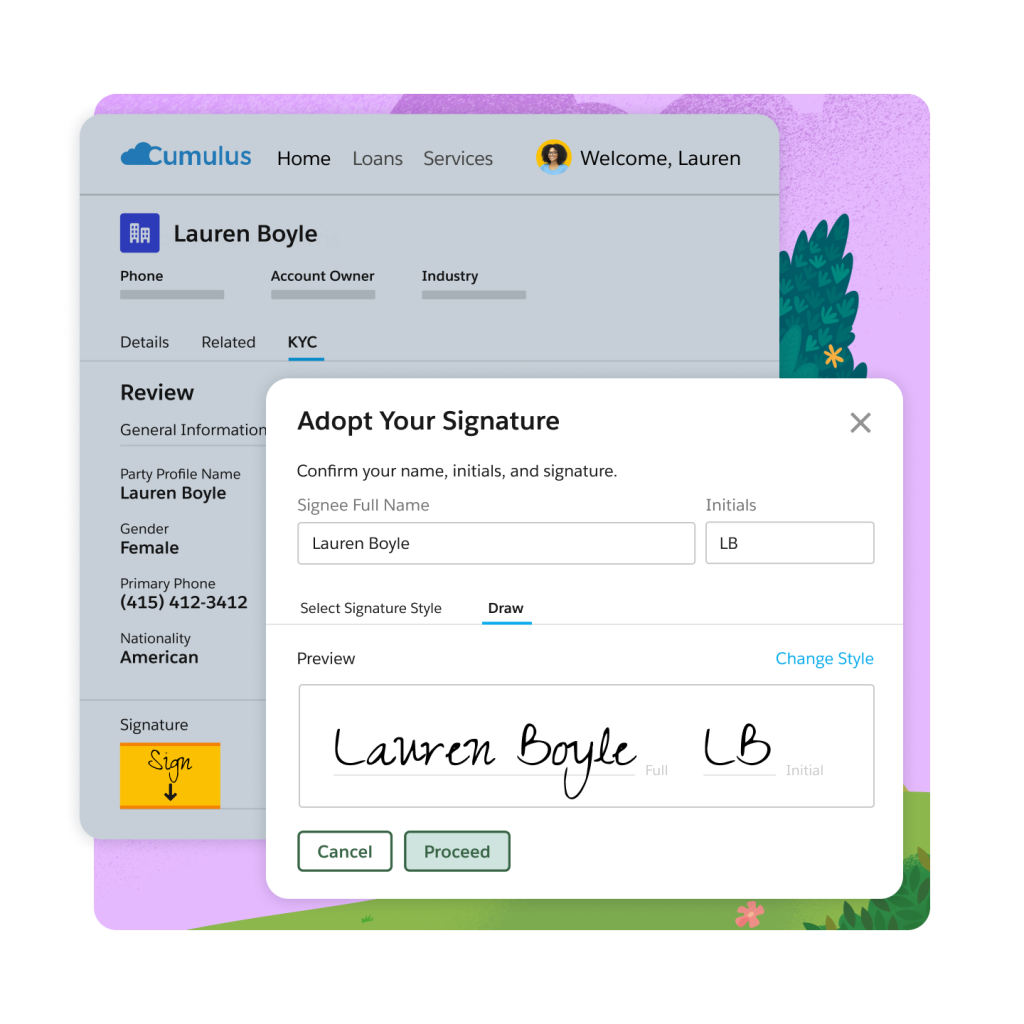

Streamline disclosure and consent processes with templates for common disclosures and consent to open accounts, share data with third-parties, and more.

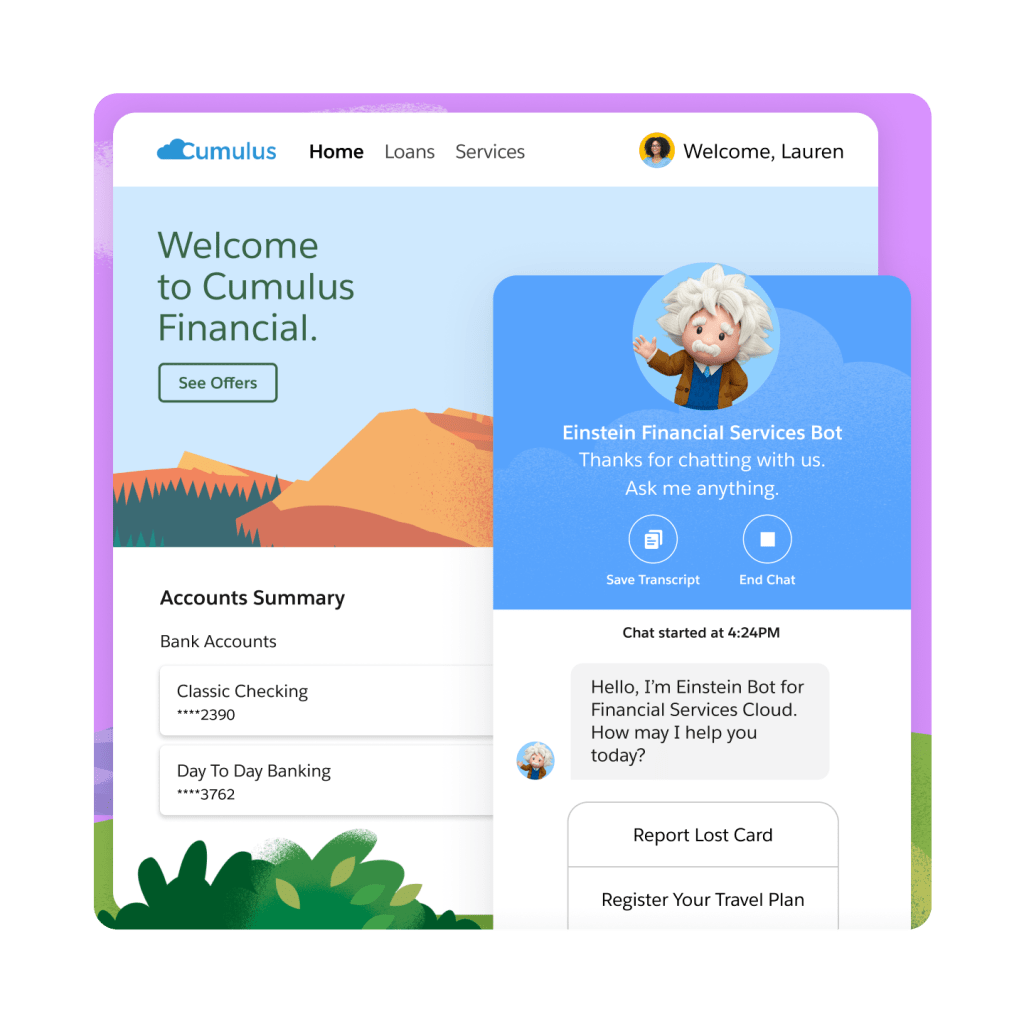

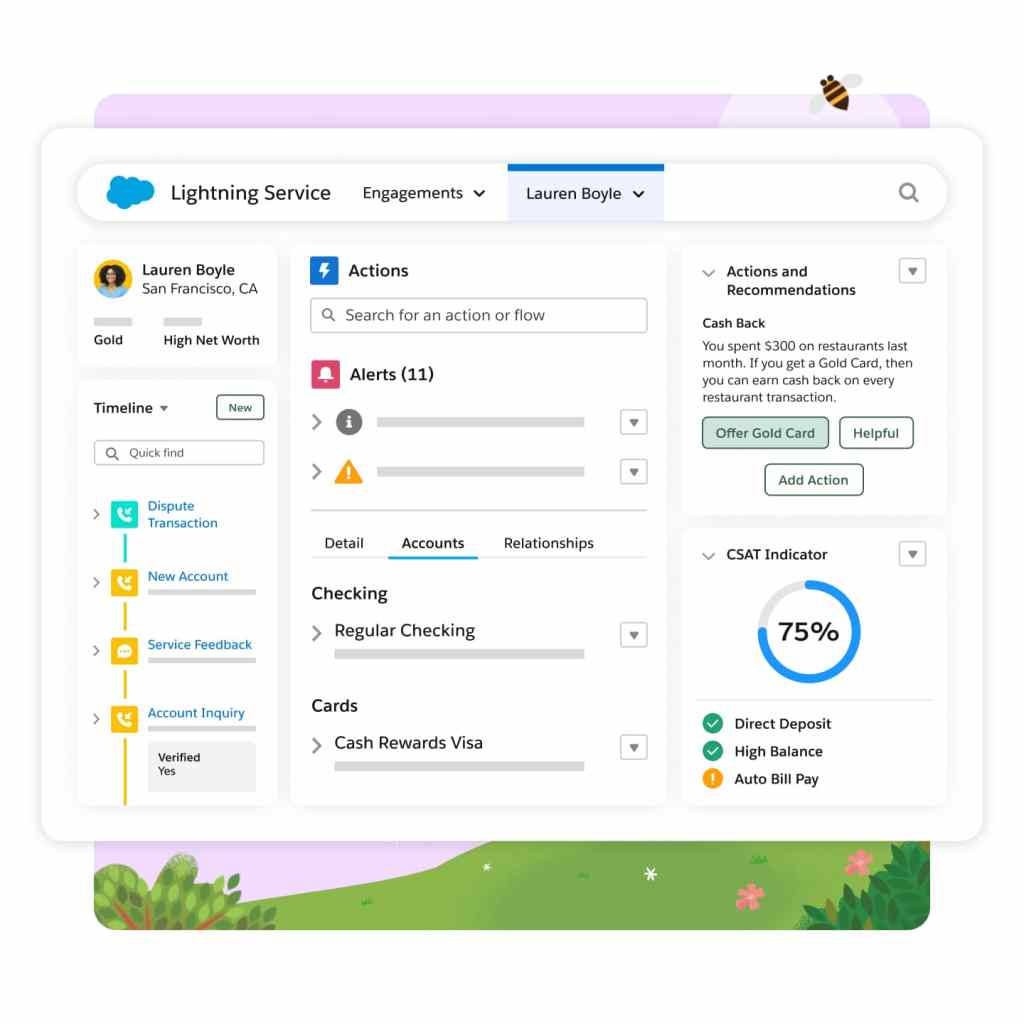

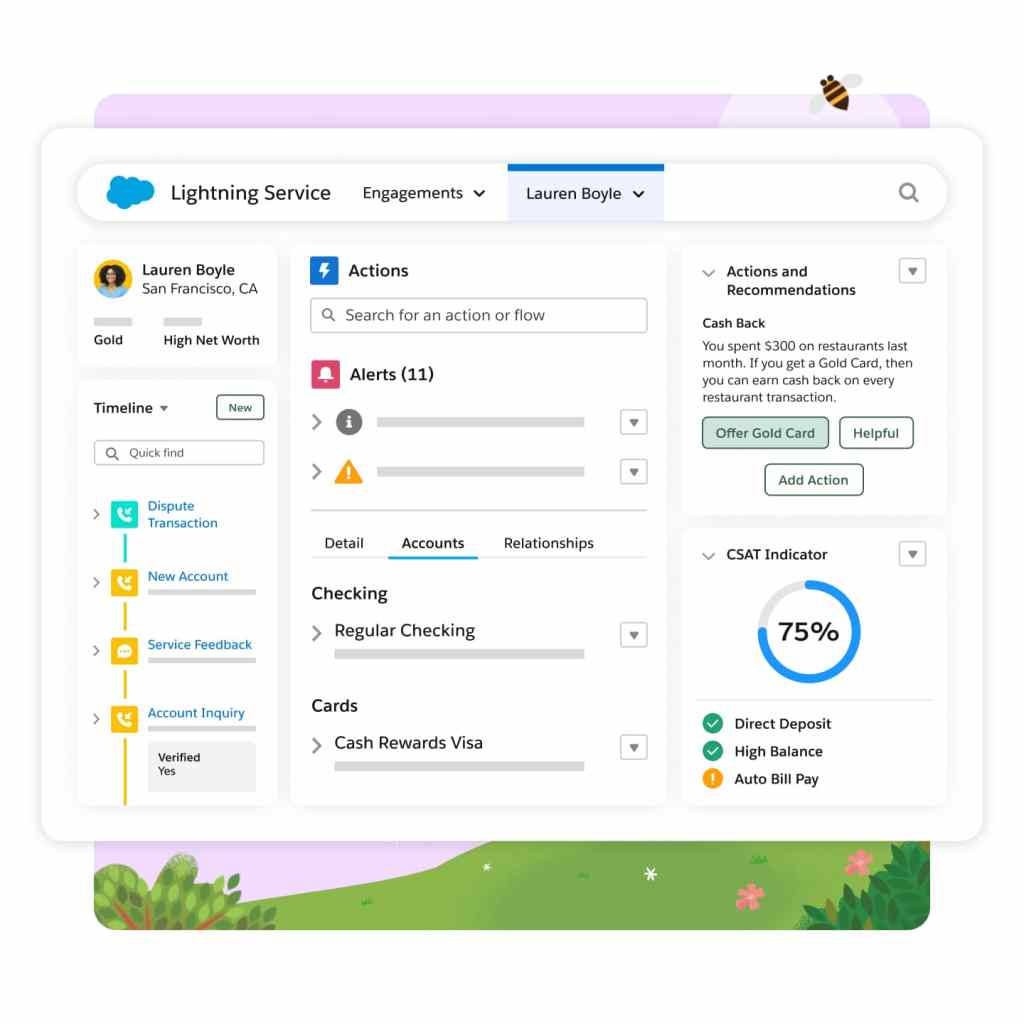

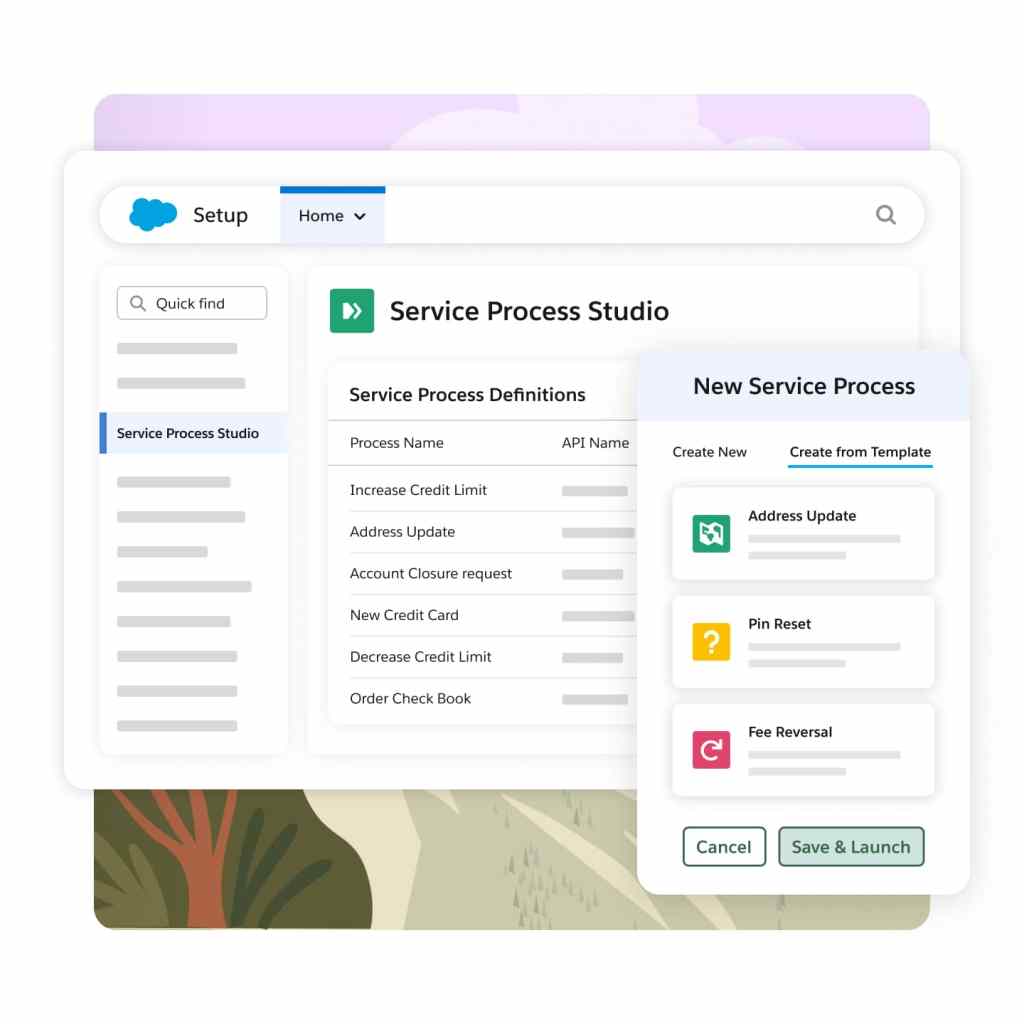

Scale service and boost productivity with AI-powered automation.

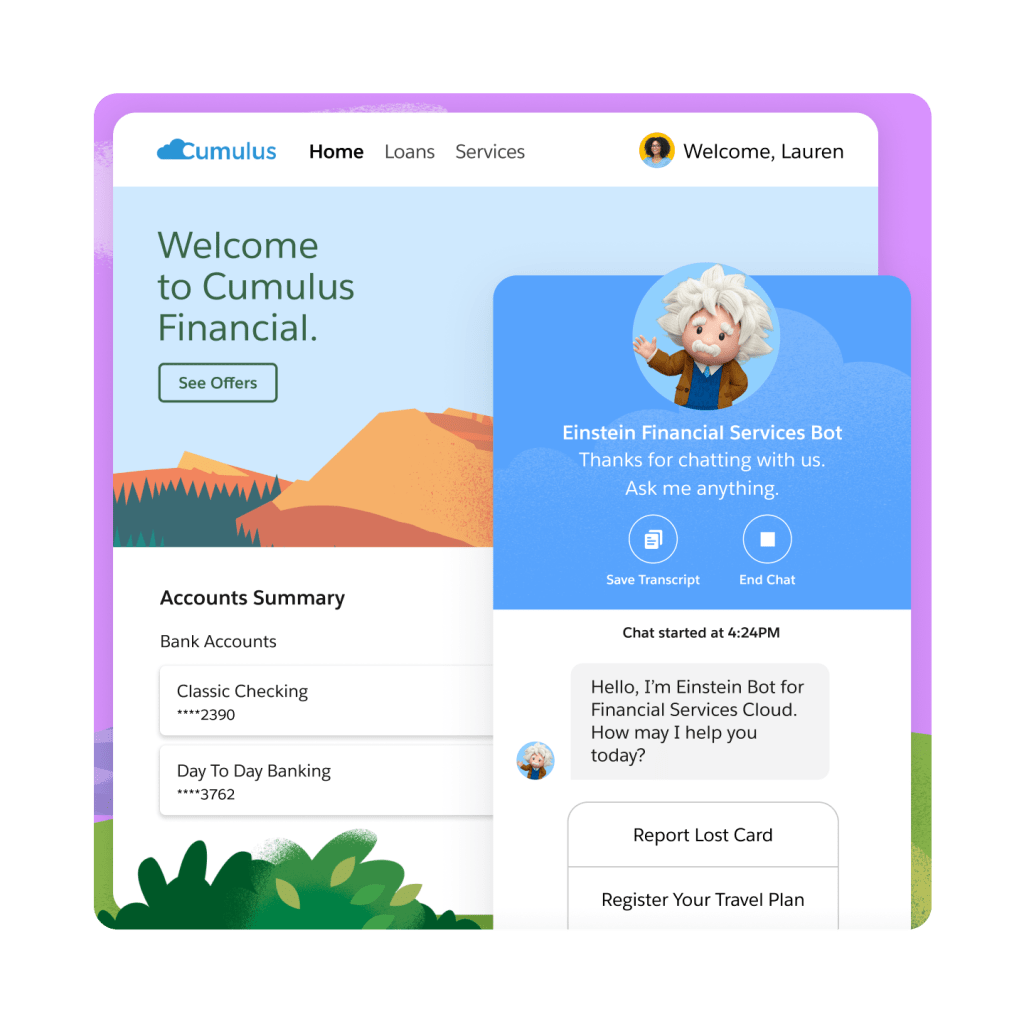

Deploy self-service automation capabilities that can be embedded into existing internet and mobile banking experiences.

Deliver everything agents need to close cases faster, all on one screen.

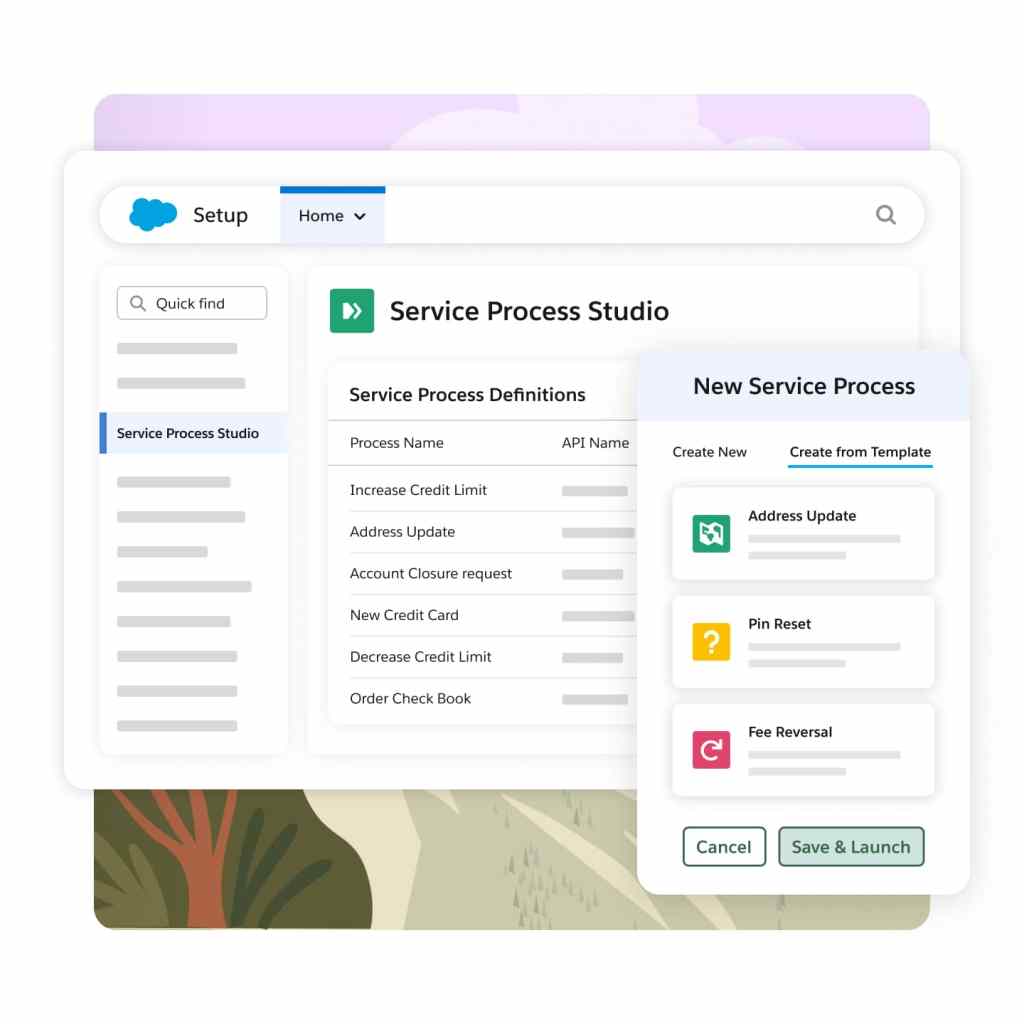

Build end-to-end service processes with low- to no-code tools.

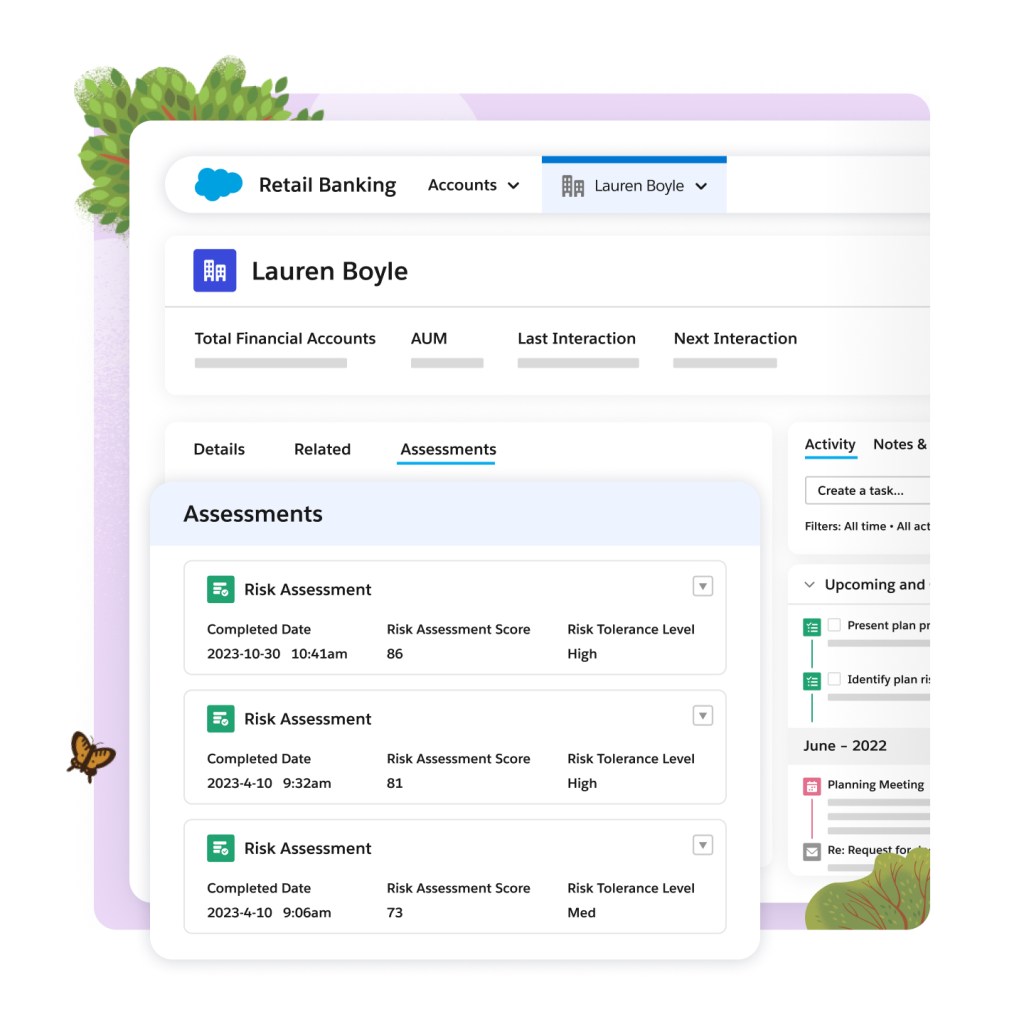

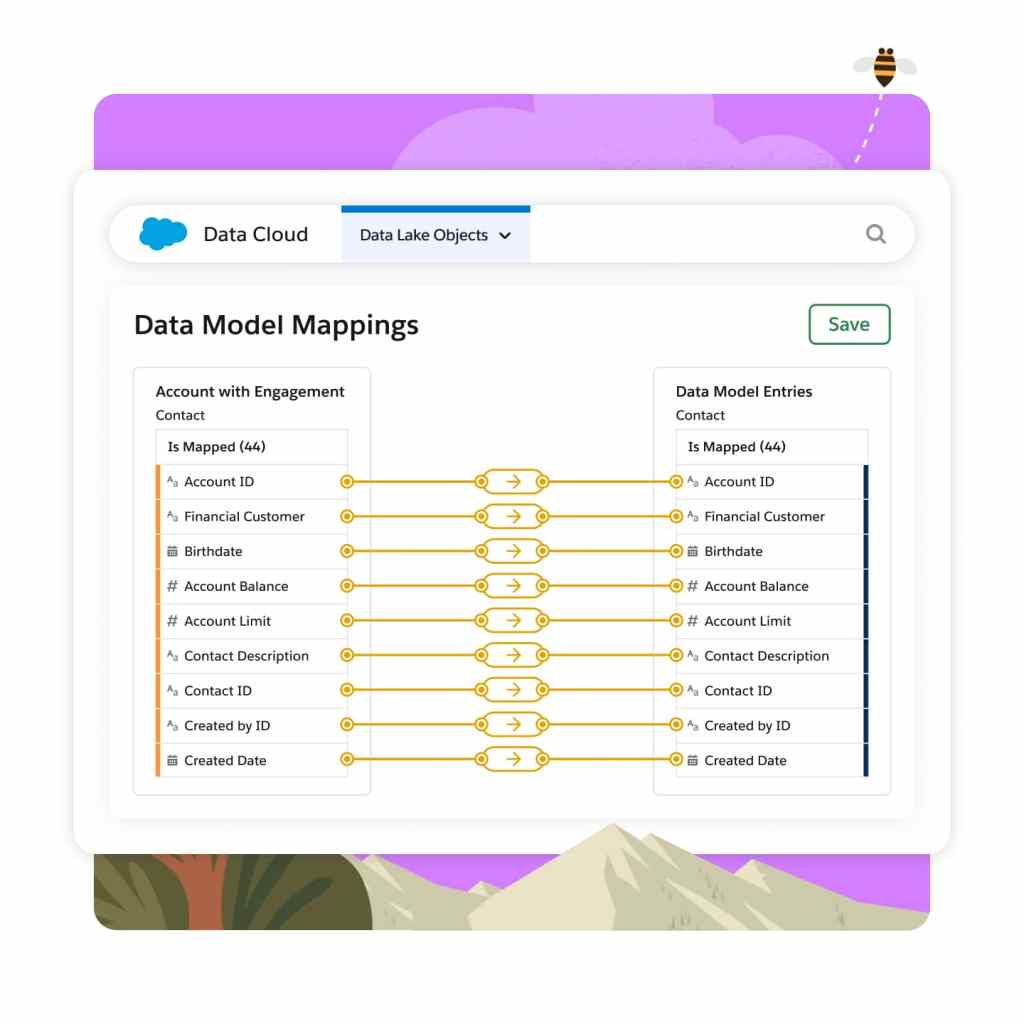

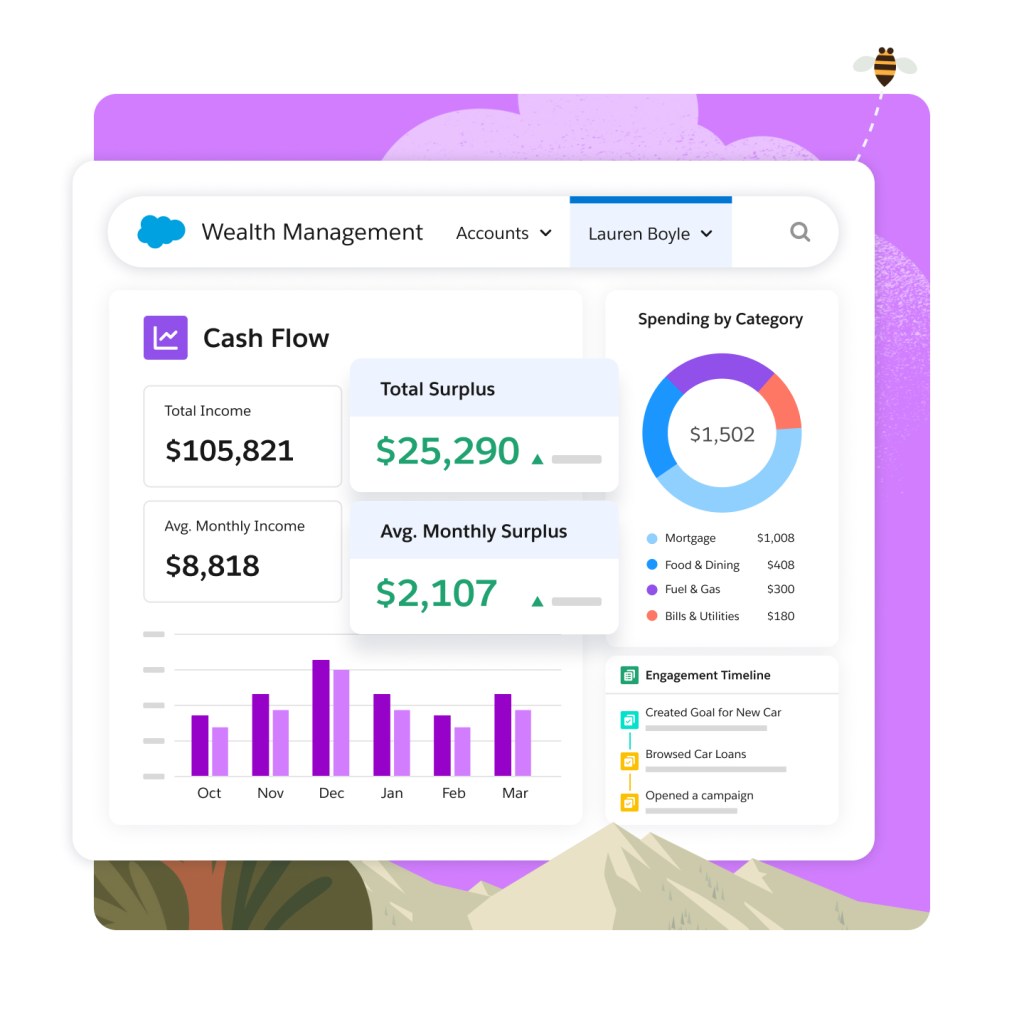

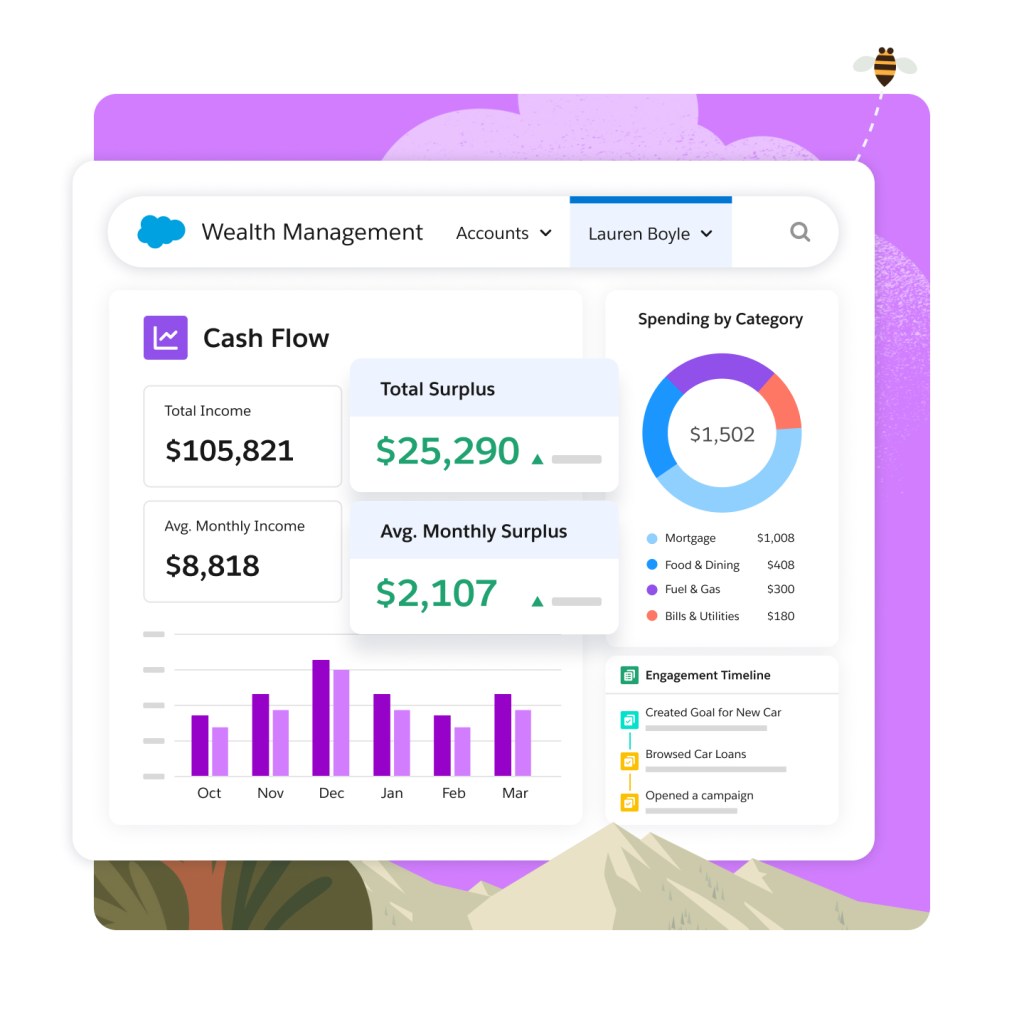

Unlock your data to personalize financial engagement.

Unlock data from core banking and financial planning to create a unified financial profile.

Understand household income, expenditures, and net worth, based on calculated transaction insights and trends.

Empower financial success with actionable financial goals.

Extend the power of Financial Services Cloud with these related products.

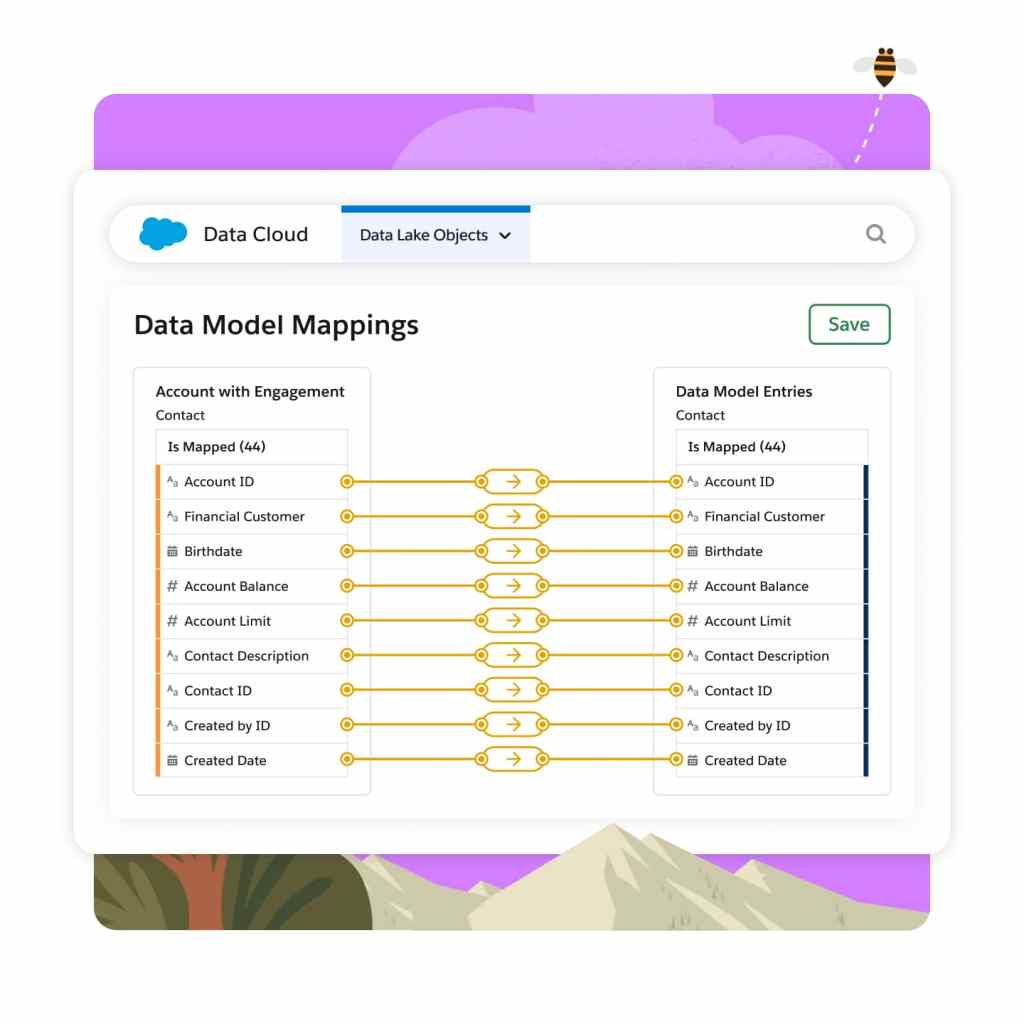

Data Cloud

Activate all your customer data across Salesforce applications.

Service Cloud

Automate financial transactions and processes, and streamline workflows that drive customer satisfaction.

Sales Cloud

Engage buyers effectively, improve seller productivity, close deals faster, and grow revenue on the most complete sales platform.

Intelligence for Financial Services Cloud

Help your entire team find important answers and start making data-driven decisions.

MuleSoft Direct for Financial Services Cloud

Bring MuleSoft flows directly into Salesforce for seamless connectivity and enhanced capabilities for financial institutions.

Experience Cloud

Quickly launch data-powered sites, portals, and apps, connected across the customer journey.

Salesforce Scheduler

Embed appointment scheduling into workflows like leads and referrals, cases, opportunities, and accounts.

Financial Services Cloud Pricing

Find the right version of Financial Services Cloud for your business needs.

Sales

Starting at

- Industry-Specific Data Models Ready Today

- Actionable Segmentation for Efficient Outreach

- Financial Goals and Plans to Empower Your Customers’ Financial Success

Service

Starting at

- Easy-to-Use CSR Console for Single Pane of Glass

- Service Process Studio for Low-Code Customization

- AI-Powered Chatbots

Sales and Service

Starting at

- Industry-Specific Data Models Ready Today

- Easy-to-Use CSR Console for Single Pane of Glass

- Onboarding Console Application Built for Faster Customer Intake

Einstein 1 for Sales and Service

Priced at

- Performance Management, Scheduler, Enablement, Digital Engagement, Scheduler, and Team Collaboration with Slack.

- Connect Salesforce and External Data with Data Cloud and Financial Services Cloud Intelligence

- Additional Einstein AI Requests

Above pricing is for Enterprise Edition. Financial Services Cloud is also available in Unlimited Edition and Einstein 1. Financial Services Cloud - Sales and Service also includes everything in corresponding editions of Sales Cloud and Service Cloud, Enterprise, and Unlimited Editions. For a comprehensive list of features, please visit our Sales Cloud pricing page and Service Cloud pricing page. This page is provided for information purposes only and subject to change. Contact a sales representative for detailed pricing information.

Now, instead of jumping from one system to another, our advisors and sales teams are using Salesforce Financial Services Cloud for one unified view of their clients, and are able to quickly pull insights and recommendations, servicing them quicker than ever before.

Ken ThompsonHead of Shared Services, TD Wealth

Maximize ROI with the #1 Success Ecosystem.

From support, expert guidance, and resources to our partners on AppExchange, the Success Ecosystem is here to help you unlock the full power of your investment.

Learn new skills with free, guided learning on Trailhead.

Hit the ground running with Financial Services Cloud tips, tricks, and best practices.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Financial Services Cloud FAQ

Financial Services Cloud is more than a CRM. It's the best of Salesforce, designed specifically for banks, wealth managers, and insurance companies. Instead of having to start with a generic Customer 360 that needs a lot of customization, Financial Services Cloud provides prebuilt applications with user experiences, automation, and integration designed based on industry best practices.

A financial services CRM helps you achieve business results faster and reduce development costs with prebuilt applications.

If you are currently using Sales or Service Cloud, you can activate Financial Services Cloud right in your existing org. Talk to your Salesforce Account Team or Consultant to learn more. If you aren't using Sales or Service Cloud, you can get started with our free trial here.

Users can improve efficiency and reduce risk by reusing business processes across channels and automating data collection, document generation, and workflows. Additionally, use financial services software to connect financial, transaction, and CRM data using a range of prebuilt-to-custom accelerators that scale for high volume.

Choose the financial services product that's right for you by evaluating the individual needs of your business. Consider if you need to personalize customer engagements, scale service interactions, or streamline your onboarding experience. Salesforce Financial Services Cloud has a variety of editions you can customize to your business needs. See details here.