Consumer Goods Industry Insights Report

We surveyed 1,500 global decision makers to surface the trends and challenges shaping the consumer goods industry.

Looking for the complete Consumer Goods Industry Insights Report? Fill out the form to read now.

Looking for the complete Consumer Goods Industry Insights Report? Fill out the form to read now.

Innovative product and business strategies counter the effects of challenging macroeconomic conditions.

With supply chain snarls, more competition, and higher costs pressuring margins, companies are thinking outside the box to capture consumers’ attention and keep them coming back for more.

Filter selections that yield a sample size below 25 will not be shown.

Companies spend big money in stores to get more customers.

To spark consumer demand and win wallet share from competitors, companies invest a significant portion of gross revenue on trade promotions.

Filter selections that yield a sample size below 25 will not be shown.

Trade promotion execution shows room for improvement.

Despite carefully planning product and marketing strategies for brick-and-mortar retailers, many brands fail to achieve their stated objectives.

Filter selections that yield a sample size below 25 will not be shown.

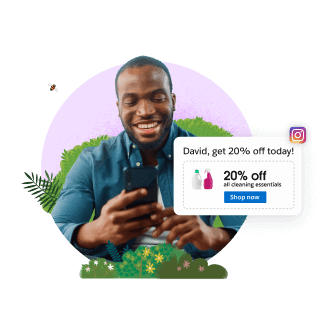

Digital marketing takes the lead.

CG marketers drive demand by meeting consumers where they spend their time — and increasingly, that’s online.

Filter selections that yield a sample size below 25 will not be shown.

More Resources

CUSTOMER STORY

Ordering snacks? Kellogg's can fill your cart for you, thanks to data.

GUIDE

Boost Revenue and Profitable Growth with Trade Promotion Management

Webinar

Deliver commercial excellence with perfect retail execution.