Chapter 2: Providers are investing in network modernization

As more of our personal and professional lives move online, it’s imperative that providers meet business and consumer needs for greater bandwidth with faster throughput, lower latency, and improved reliability. Next-generation technologies like 5G and fiber have companies across multiple sectors excited about the opportunities these services may provide to meet consumer needs and expectations.

Making the most of your 5G network investment

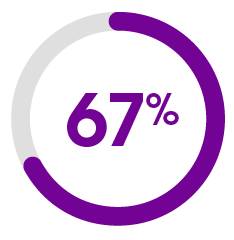

Customers will pay more for 5G. Communications service providers have had a difficult time communicating the value of 5G and, as a result, many customers are still unsure as to the opportunities it provides. Our research found only 44% of respondents were “very familiar” or “extremely familiar” with 5G technology. However, 67% of respondents said they would be willing to pay more for 5G.

Percentage of customers willing to pay more for wireless services offering 5G.

5G infrastructure will open B2B opportunities inside and outside of the industry. The B2B opportunities could be a game-changer when it comes to 5G, and most providers are exploring opportunities and investing in this area. As David Fan, Communications Industry Vice President and General Manager at Salesforce, explained, “Service providers know there is no single ‘killer app’ for 5G and are exploring a broad range of monetization strategies including new B2B applications, network-as-a-service (NaaS) offerings, and digital marketplaces with ecosystem partners.” When asked about how they believe investment in 5G infrastructure might enhance ROI, many communications providers agreed that it would encourage partnerships and bundling opportunities across multiple industries. This would allow providers to meet B2B customers’ needs by offering a broad range of value-added service propositions from multiple providers with embedded connectivity.

The vast majority of providers believe businesses would be interested in partnering with communications service providers investing in 5G infrastructure

Percentage of providers who think 5G would attract more partnerships and bundling options in the following areas

Providers see value in fiber investment

It’s widely accepted that fiber is a faster, more reliable choice when it comes to wired connectivity. Both public and private enterprise are eager to get into the game as evidenced by the influx of investment in this area from private equity, in particular. Traditional providers are prioritizing fiber infrastructure investment, and taking advantage of subsidies to bring greater access to communities worldwide. Eighty-six percent of respondents said their company invested in fiber optic connectivity and solutions in 2021, and 87% say they plan to increase that investment in 2022 and 2023. Despite the competition in the market, incumbent providers are well-positioned to maximize their market share across the fiber broadband market due to their existing rights-of-way with municipalities and regulatory authorities.

Majority of providers are investing in hyperscaler partnerships

Now that networks are being modernized and made accessible via APIs, the challenge becomes attracting developers who know how to build and connect applications with devices. Hyperscalers (companies, like AWS or Google Cloud, with the ability to scale computing resources on demand) have dedicated developer communities that could be great assets to traditional providers. These companies are also already delivering infrastructure-as-a-service (IaaS) better, faster, and cheaper. Many providers see value in partnering with hyperscalers in order to increase efficiencies. In 2021 and 2022, 88% of providers invested in hyperscaler data centers, with 85% saying they will increase their investment in 2023. Leveraging these partnerships has the potential to offset infrastructure costs for service providers, enabling them to focus investments in core capabilities — like the network and network monetization opportunities.

Next: Chapter 3: Digital transformation unlocks efficiency and customer satisfaction

Employees believe automation reduces bottlenecks and redundant processes.

See how:

- Streamlining operations reduces costs and increases efficiency

- Integrating systems improves collaboration

- Automation enables employees to focus on more complex tasks