Boost customer satisfaction with data and AI-powered experiences.

Deliver connected experiences from customer acquisition to service with a purpose-built CRM for retail banking. Use AI and data to build trust and increase loyalty, while improving efficiency and speed with automation. Drive customer satisfaction through simplified onboarding, scaled service, and real-time personalized engagement.

The digital banking platform transformation has helped us produce 3x the output we had in the past.

Olivia BolesDirector, Operations Projects, PenFed

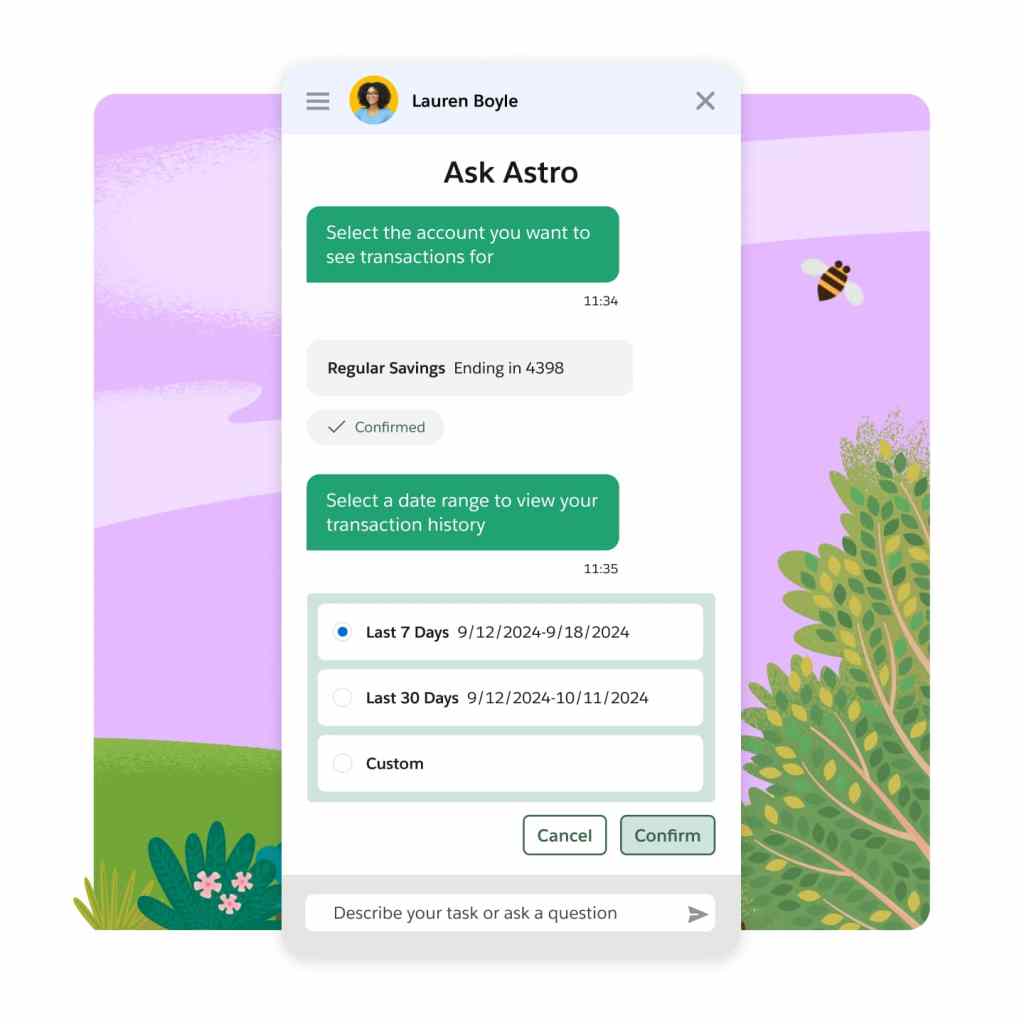

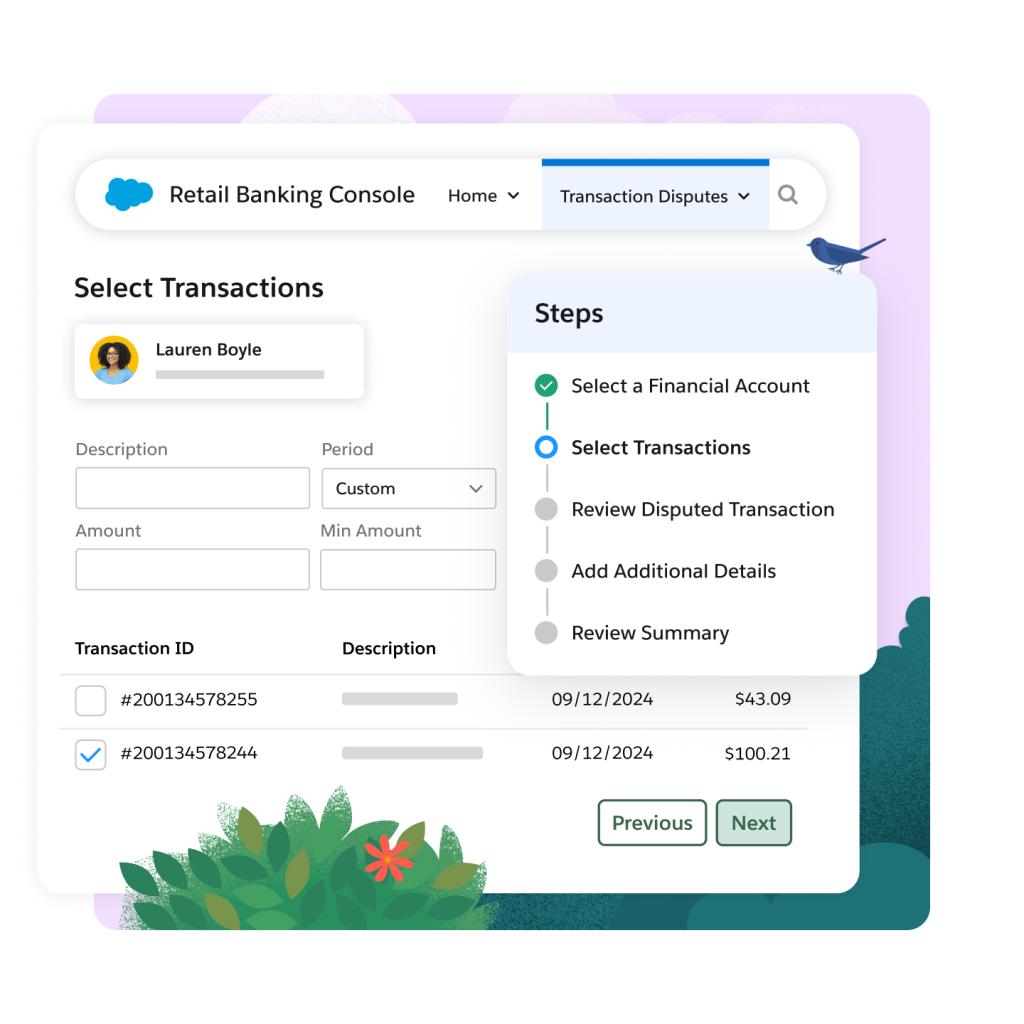

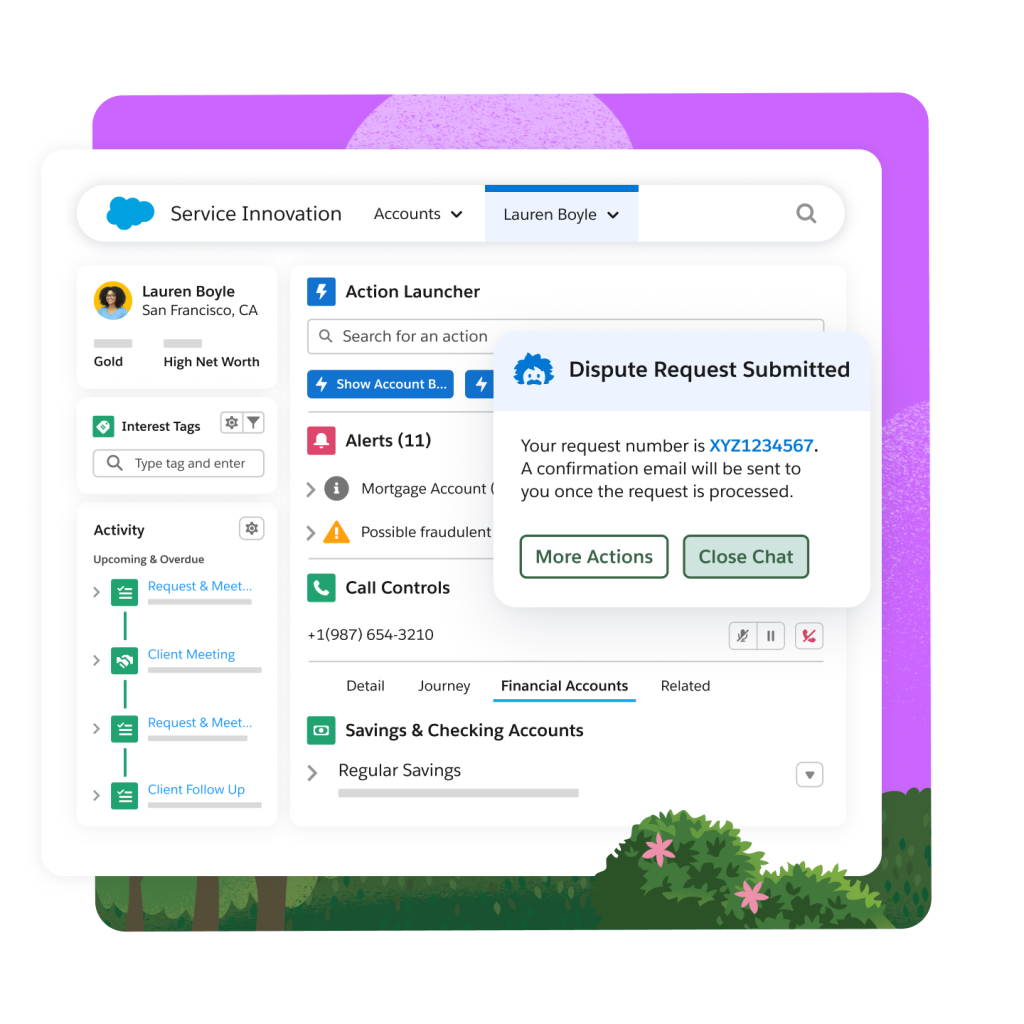

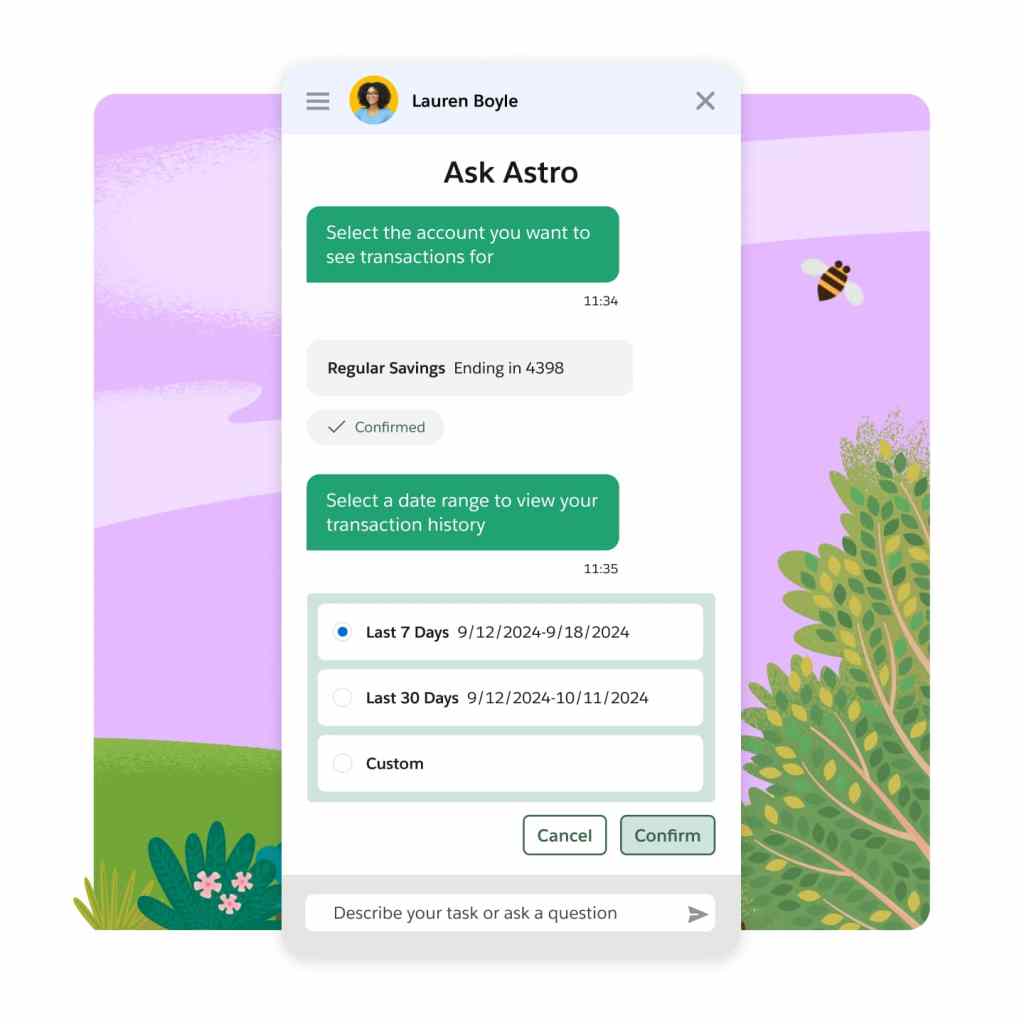

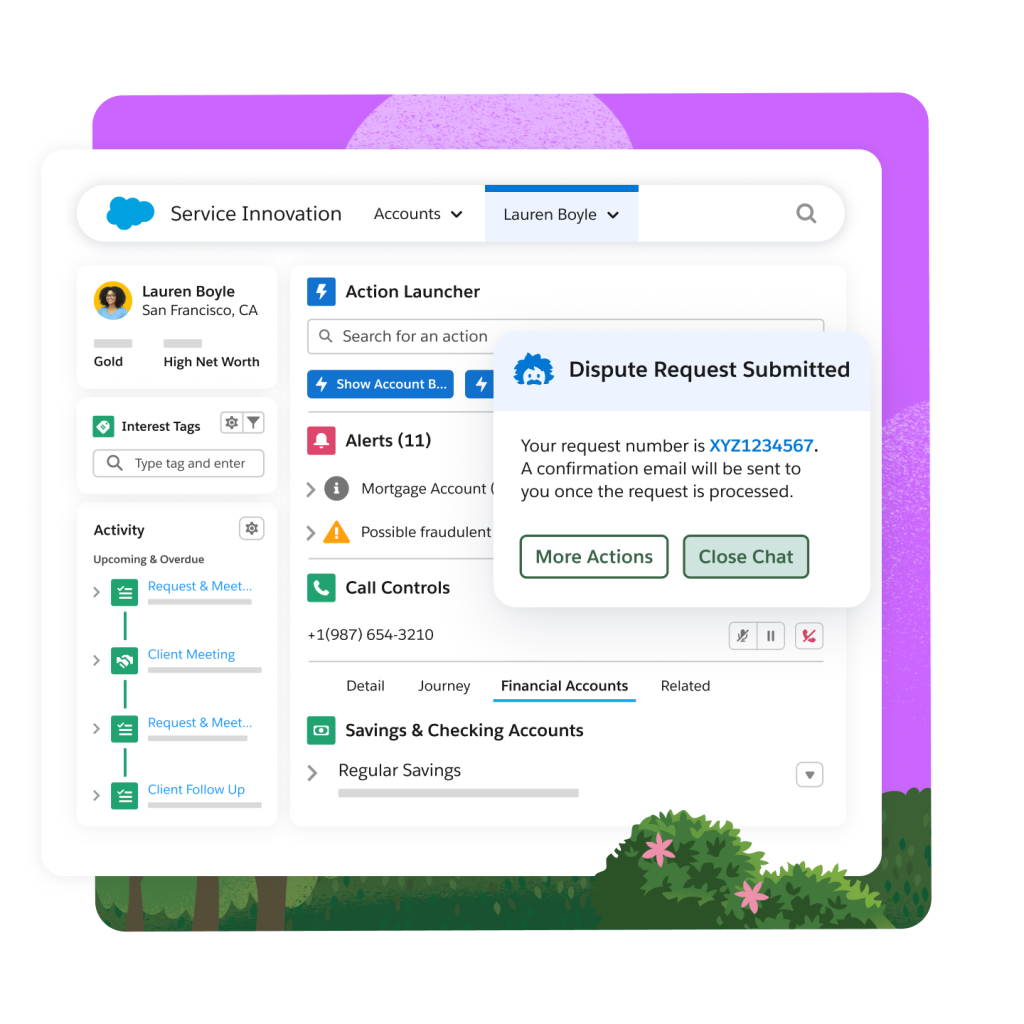

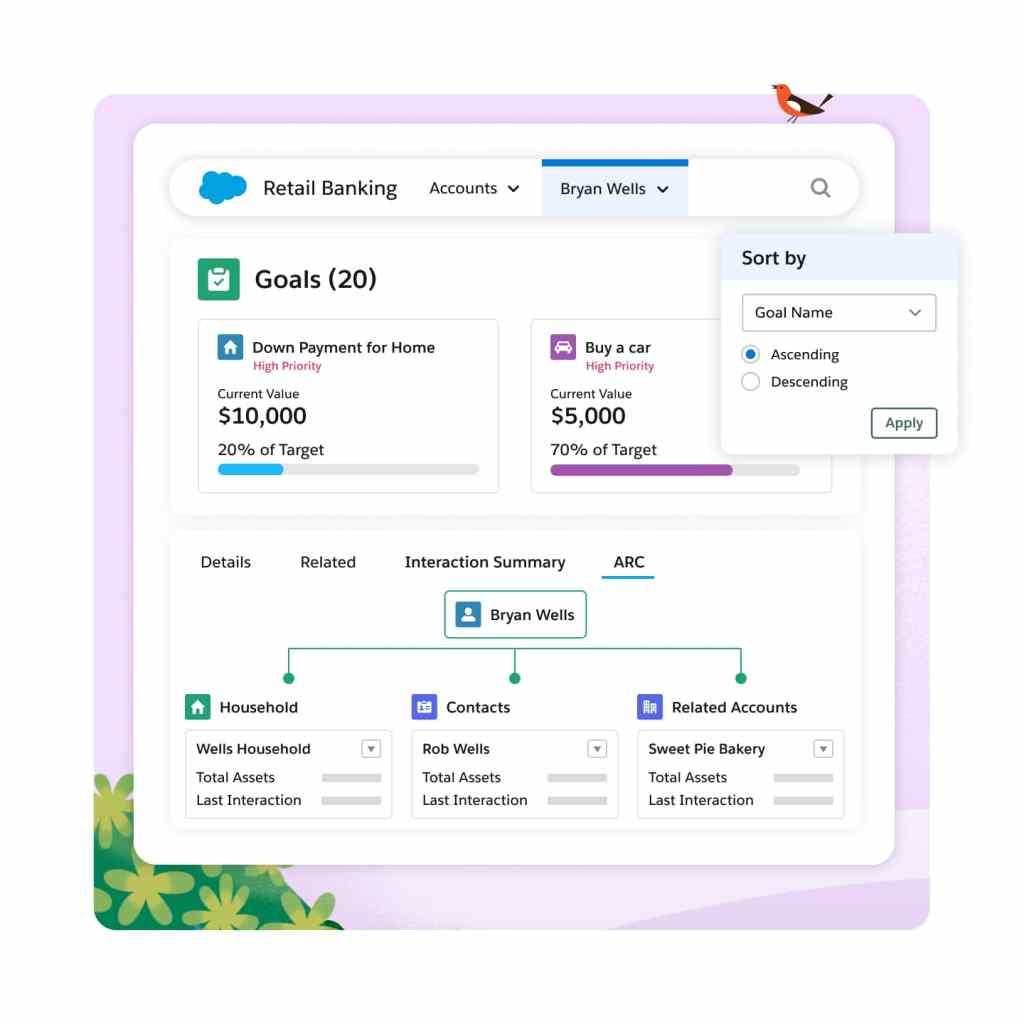

Scale service for retail banking.

Deliver personalized service in retail banking with automation, AI, and data. Leverage a purpose-built retail banking CRM that helps you simplify processes, increase efficiencies, and anticipate customer needs.

How it works:

Provide a knowledge base and chatbots with modern, conversational UI.

Allow CSRs to pull up information right away, all in a unified system.

Connect to the middle and back office with workflows that improve orchestration across teams.

Understand what's important to your customers with unified interaction data and AI.

Build your service solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Service Cloud

Automate financial transactions and processes, and streamline workflows that drive customer satisfaction.

Einstein

Experience AI built into the flow of work, for any workflow, user, department, and industry.

Flow

Generate real-time, intelligent workflows with CRM + AI + Data + Trust.

Slack

Bring together the right people, information, and tools to drive business.

Intelligence for Financial Services Cloud

Help your entire team find important answers and start making data-driven decisions.

Experience Cloud

Quickly launch data-powered sites, portals, and apps, connected across the customer journey.

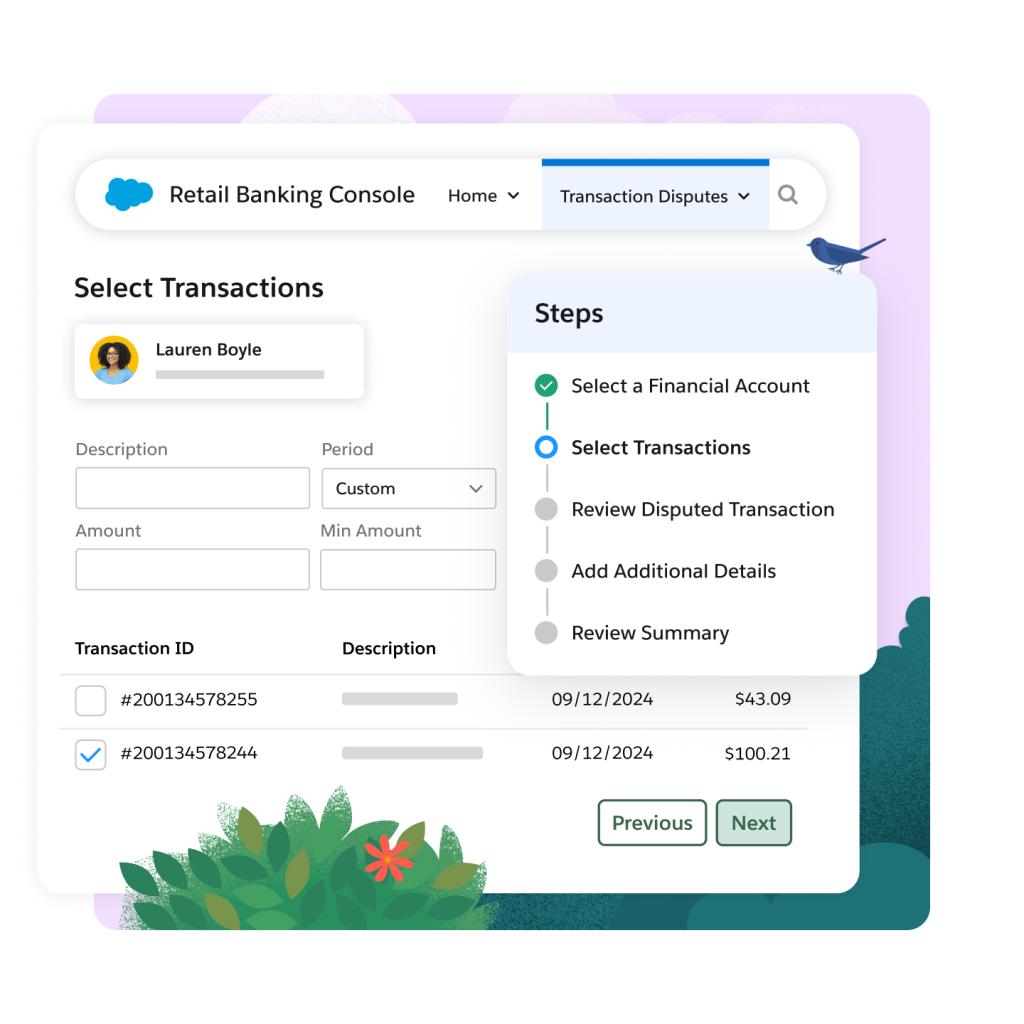

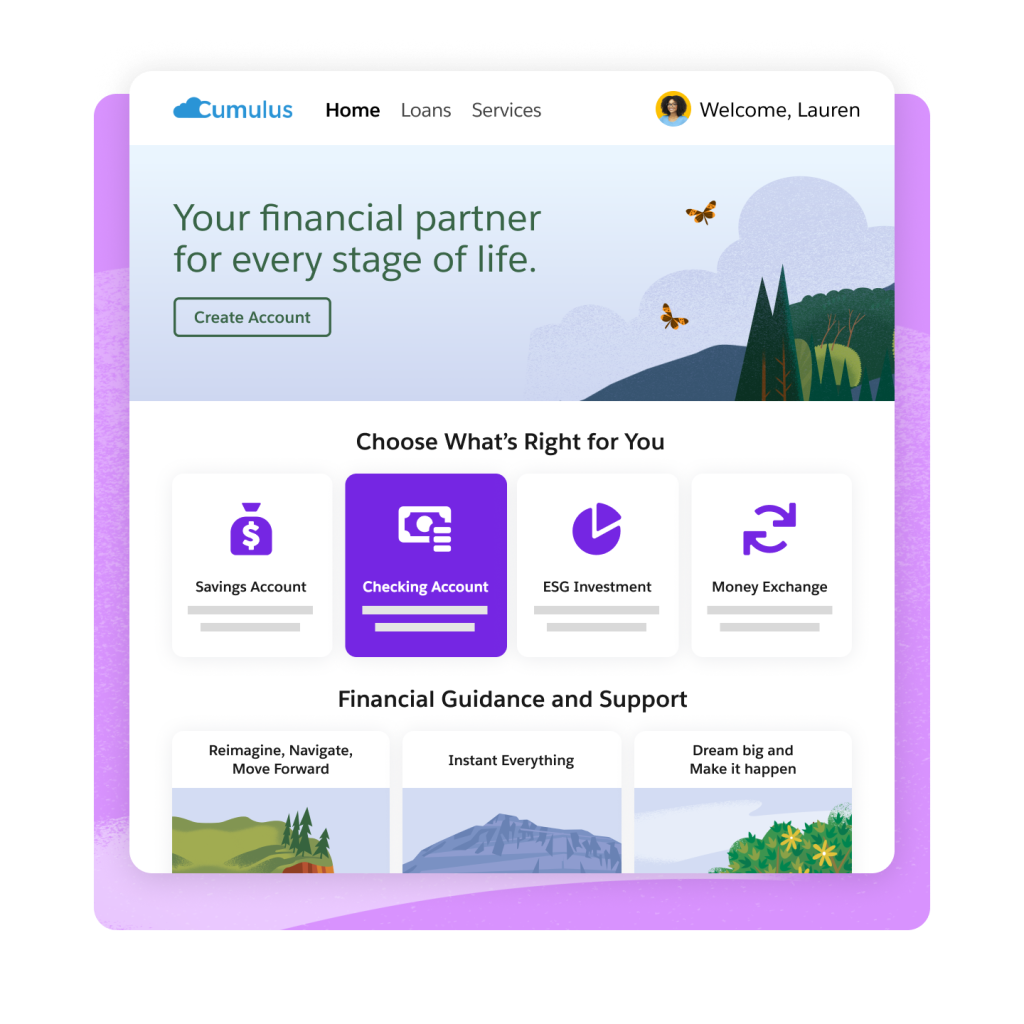

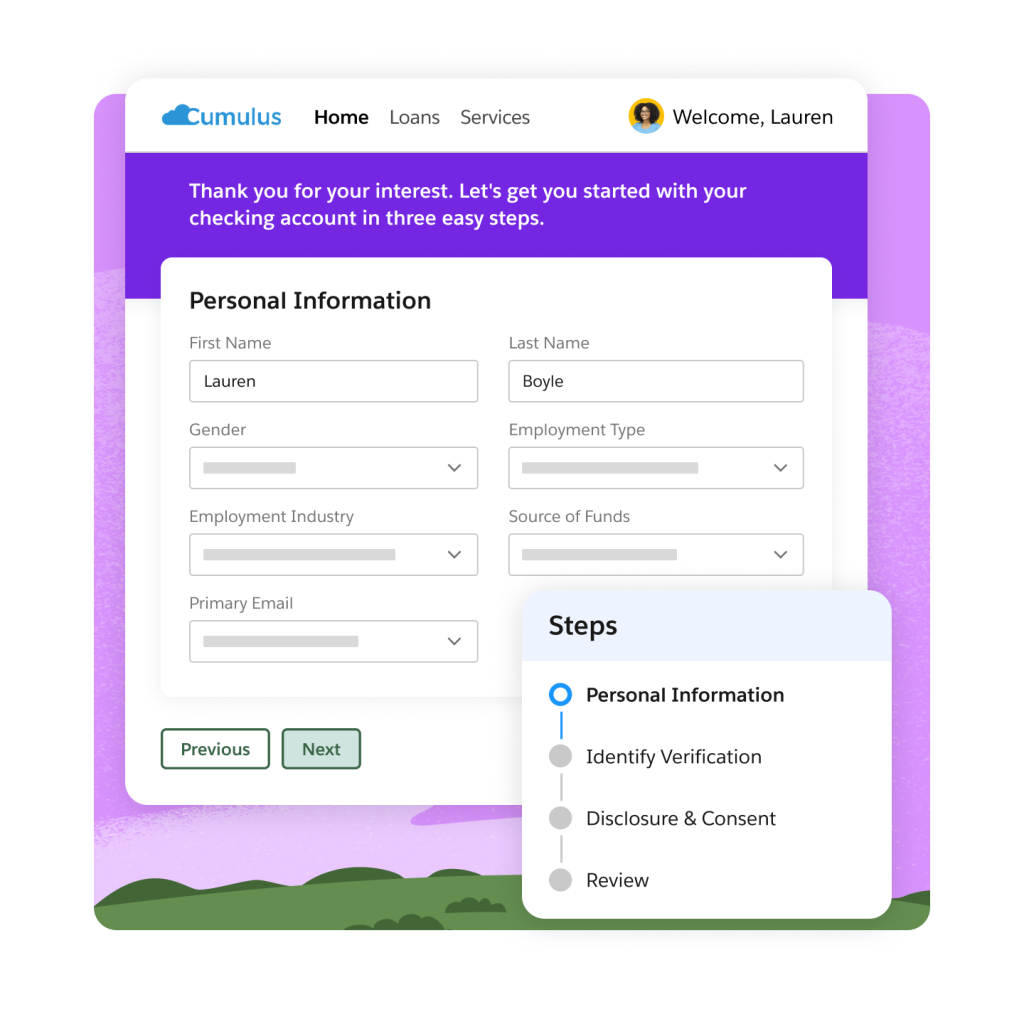

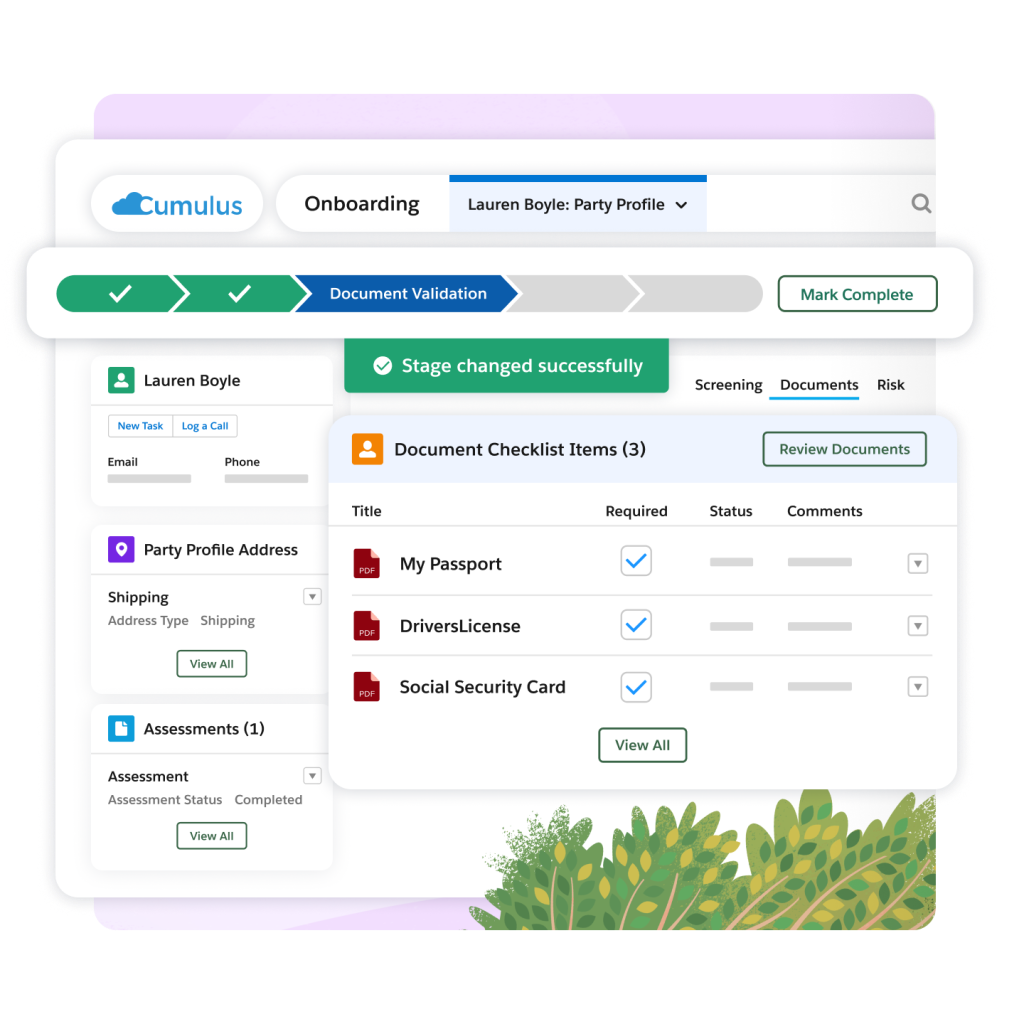

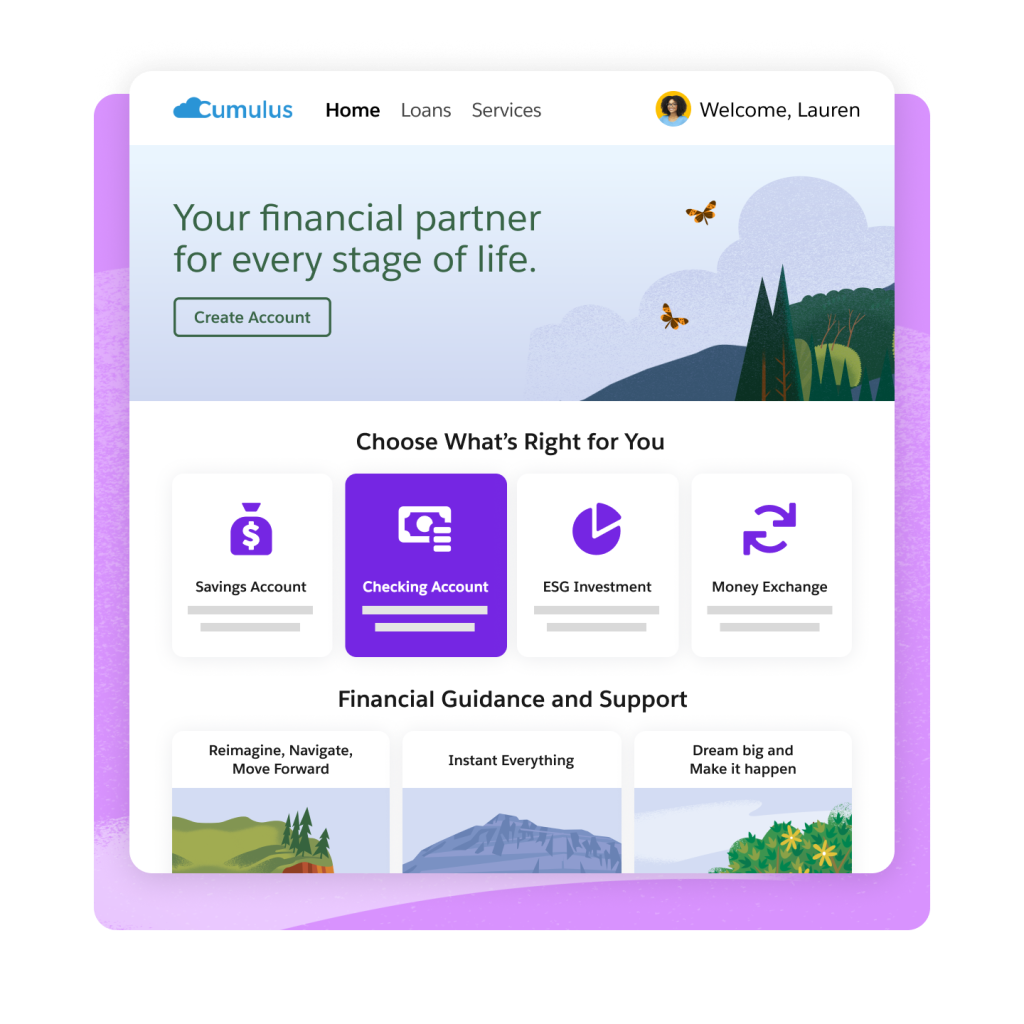

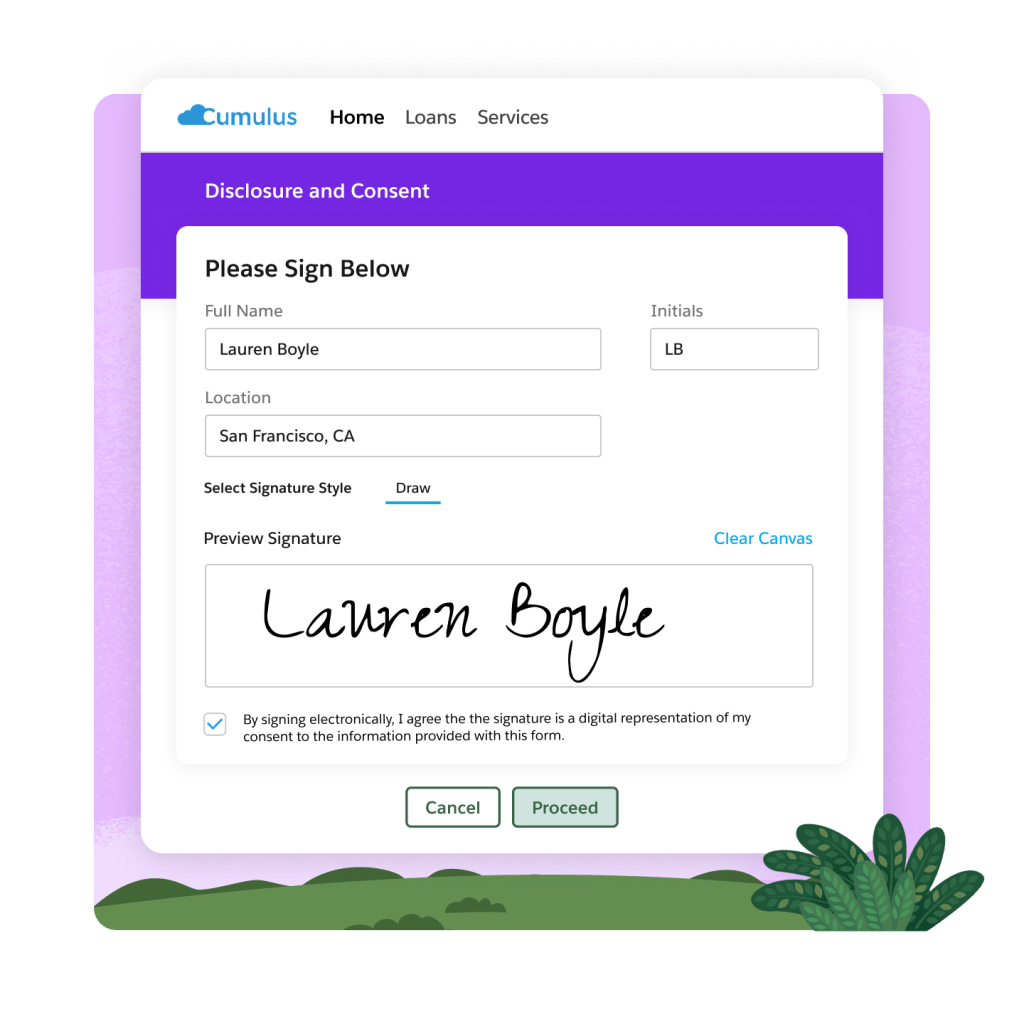

Streamline customer onboarding and compliance.

Simplify one of the most complex processes while making a great first impression with your customers. Modernize onboarding experiences with guided discovery and automation.

How it works:

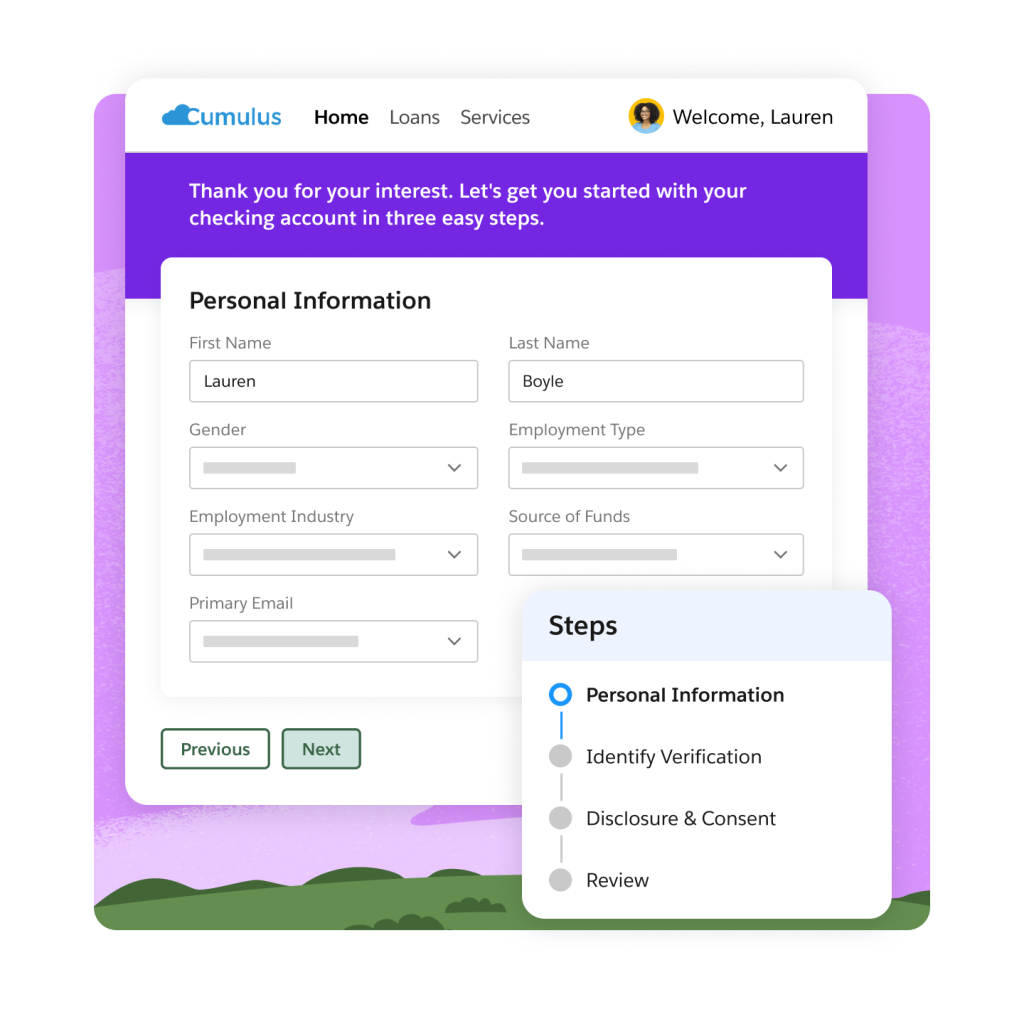

Create campaigns, identify leads, mature prospects, and more. Begin to build customer profiles from the first touch and streamline the onboarding process.

Use guided discovery to gather the information you need to satisfy KYC requirements and help your customers select the products and services that best fit their needs.

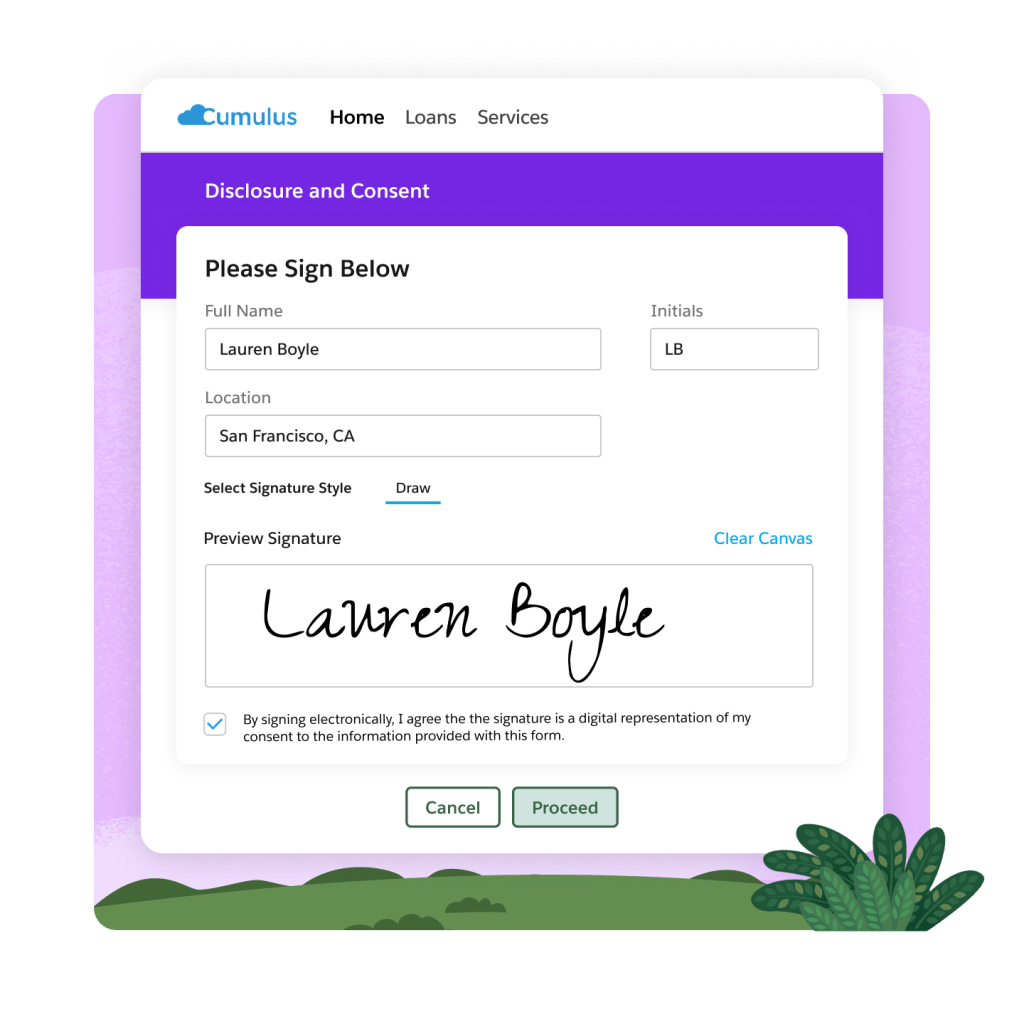

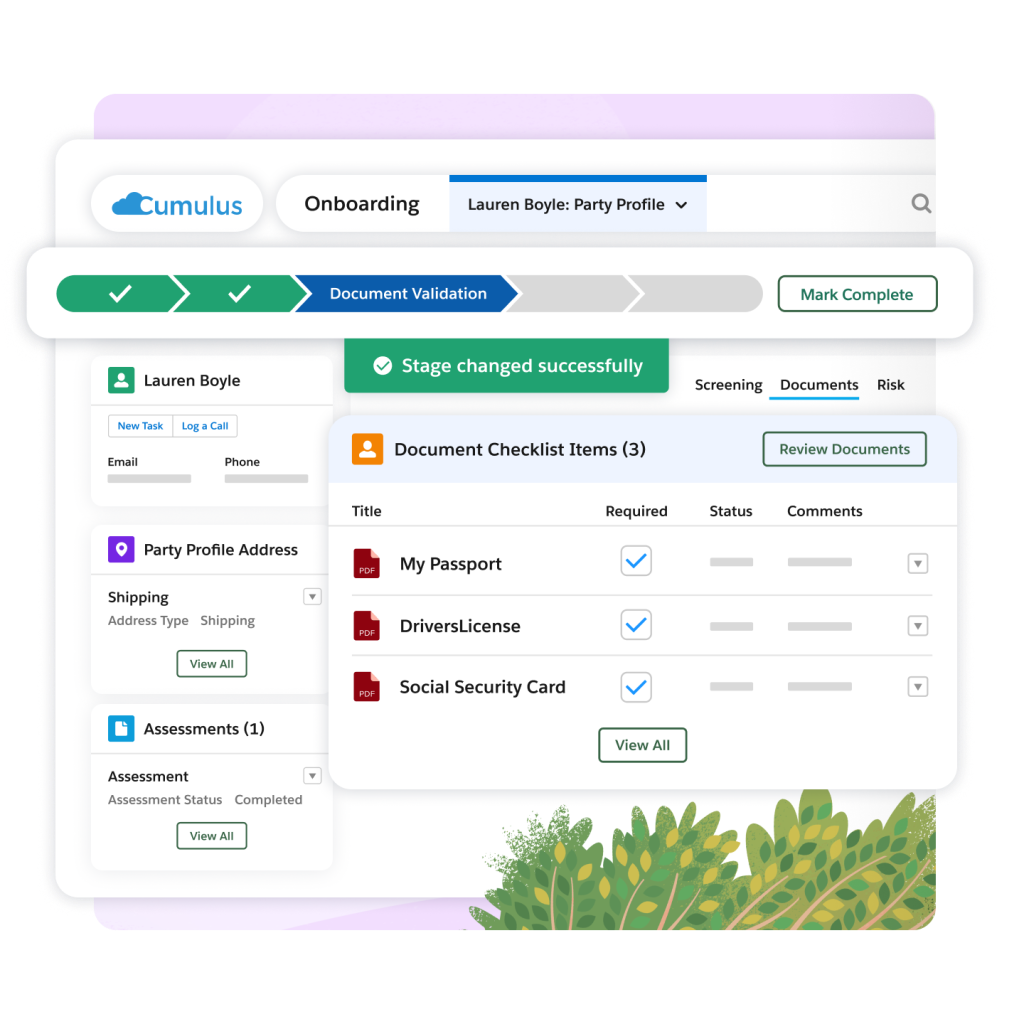

Collect documents, verify inputs, run risk screening, and more, using automation and ecosystem partners – all on the Salesforce platform.

Match the customer to appropriate products based on their needs and preferences. Generate documents, collect signatures, and connect with core systems to open accounts. Empower customers on your tools to encourage adoption.

Build your onboarding solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Marketing Cloud

Personalize customer experiences and optimize each campaign with data-first solutions for any channel and device.

Tableau

Drive predictable revenue with analytics and AI for organizations.

Einstein

Experience AI built into the flow of work, for any workflow, user, department, and industry.

MuleSoft Anypoint Platform

Integrate data from any services system to deliver critical, time-sensitive data – all with a single platform for APIs and integrations.

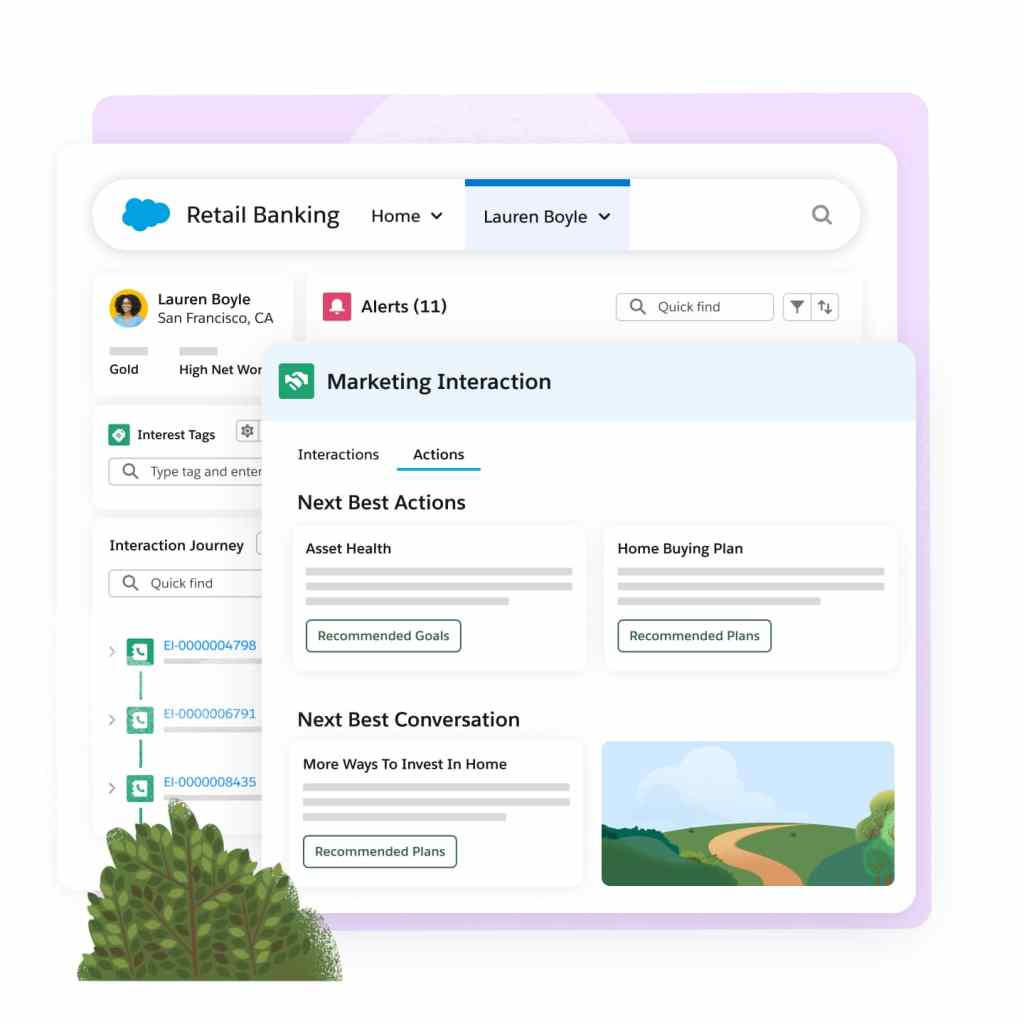

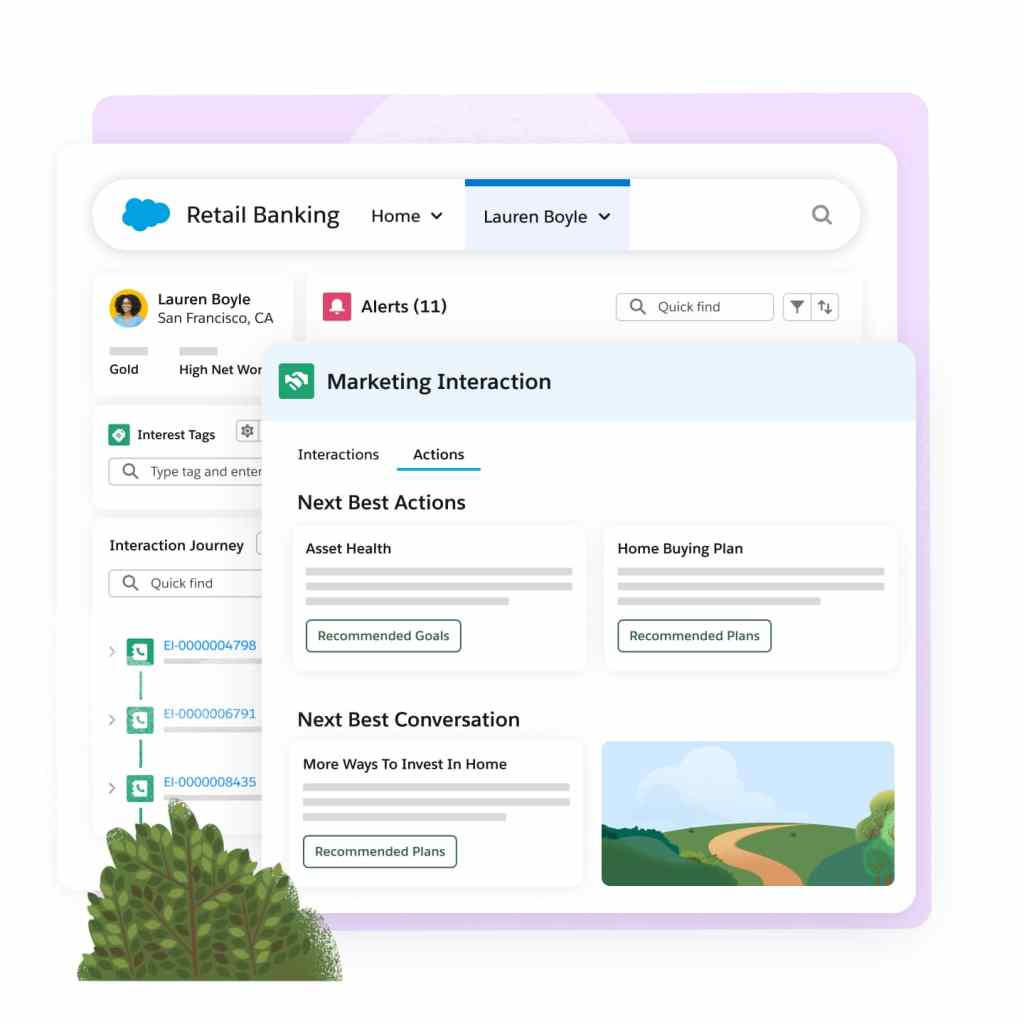

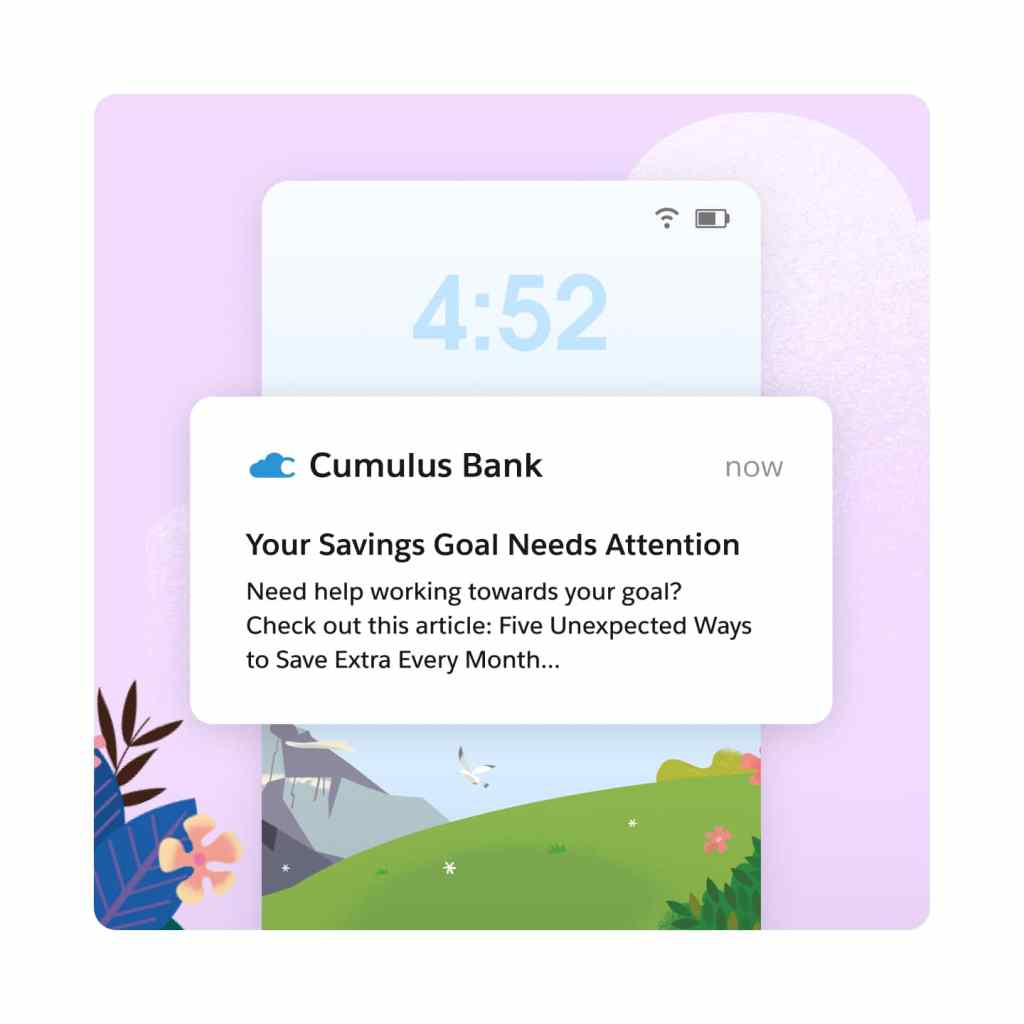

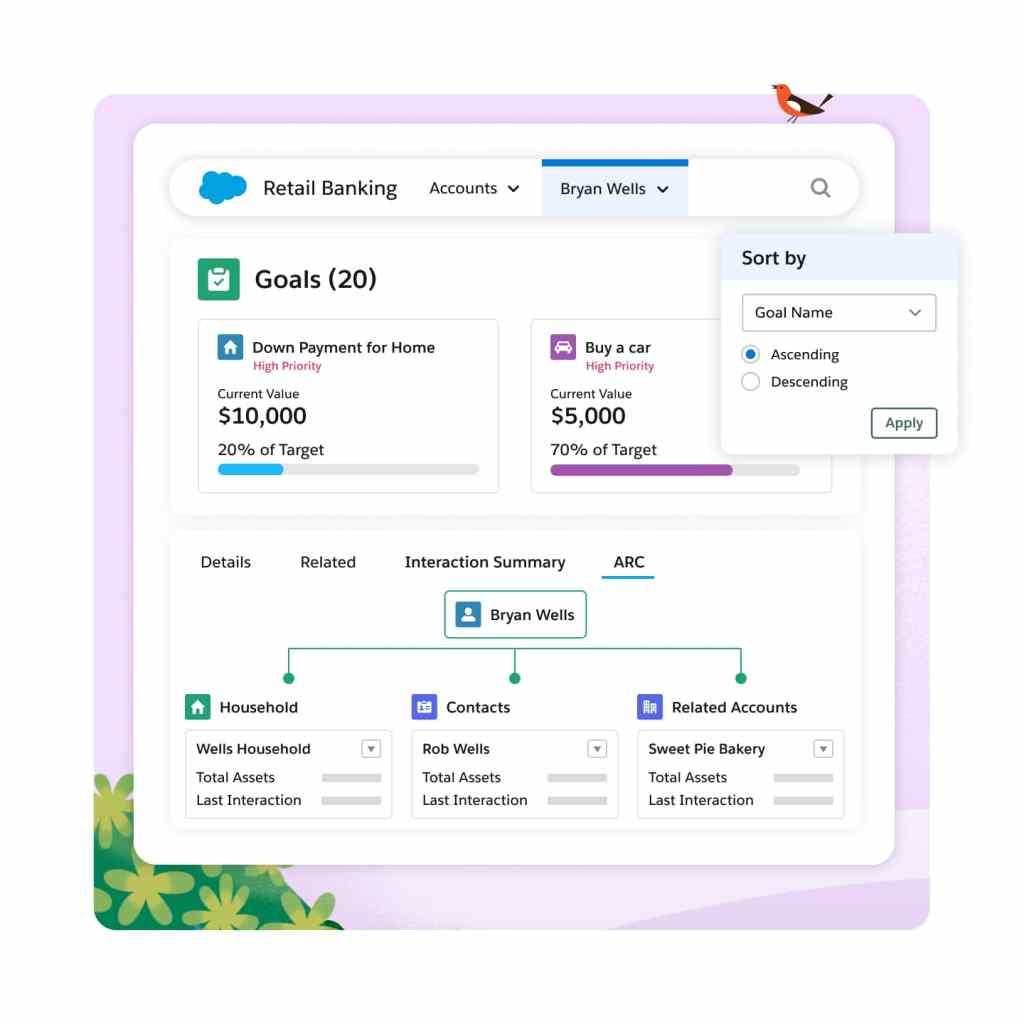

Personalize intelligent, data-driven engagement.

Unify data and leverage AI to deliver relevant, personalized experiences at scale. Improve loyalty and increase retention by exceeding customer expectations with retail banking software.

How it works:

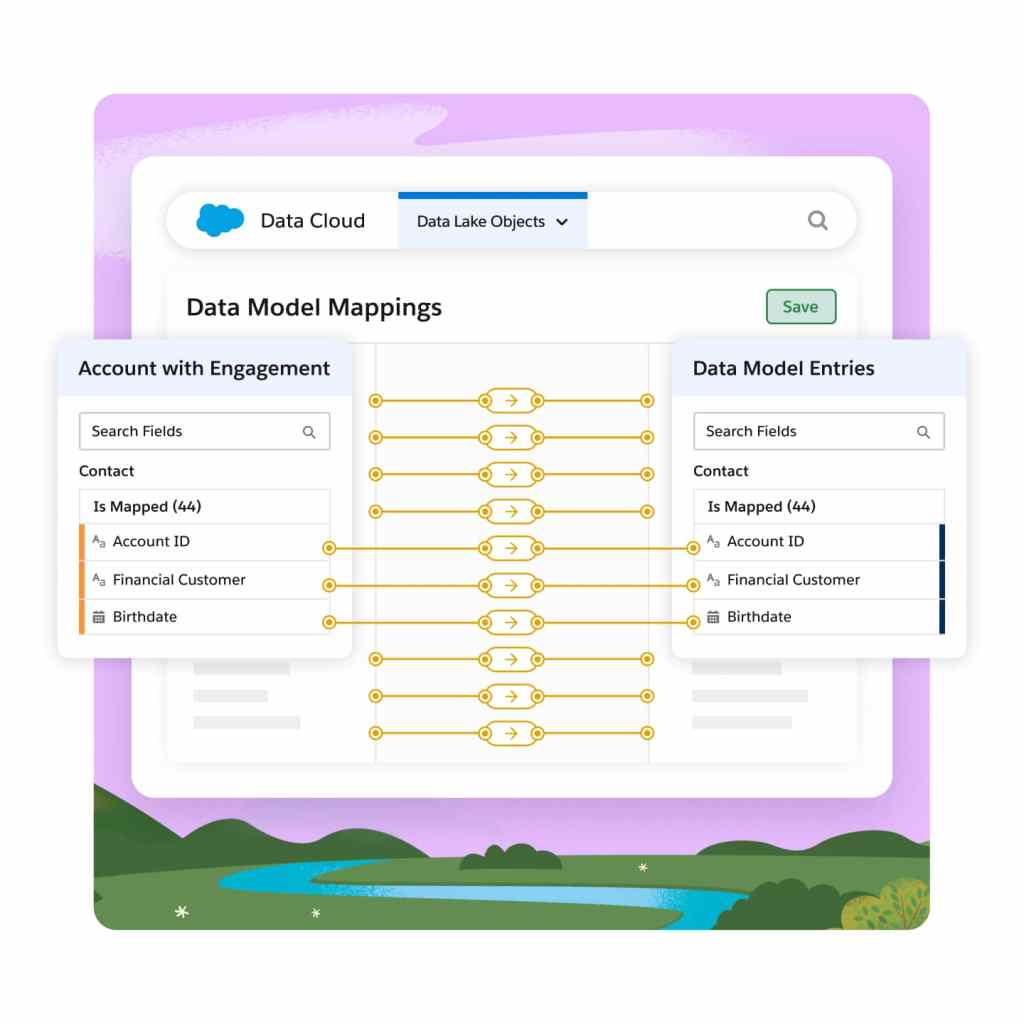

Bring relevant behavioral and financial data together to create a comprehensive customer view.

Easily know what's important to your customers with AI-driven insights.

Drive better customer engagement and improve financial well-being with relevant, real-time guidance.

Build your personalized engagement solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

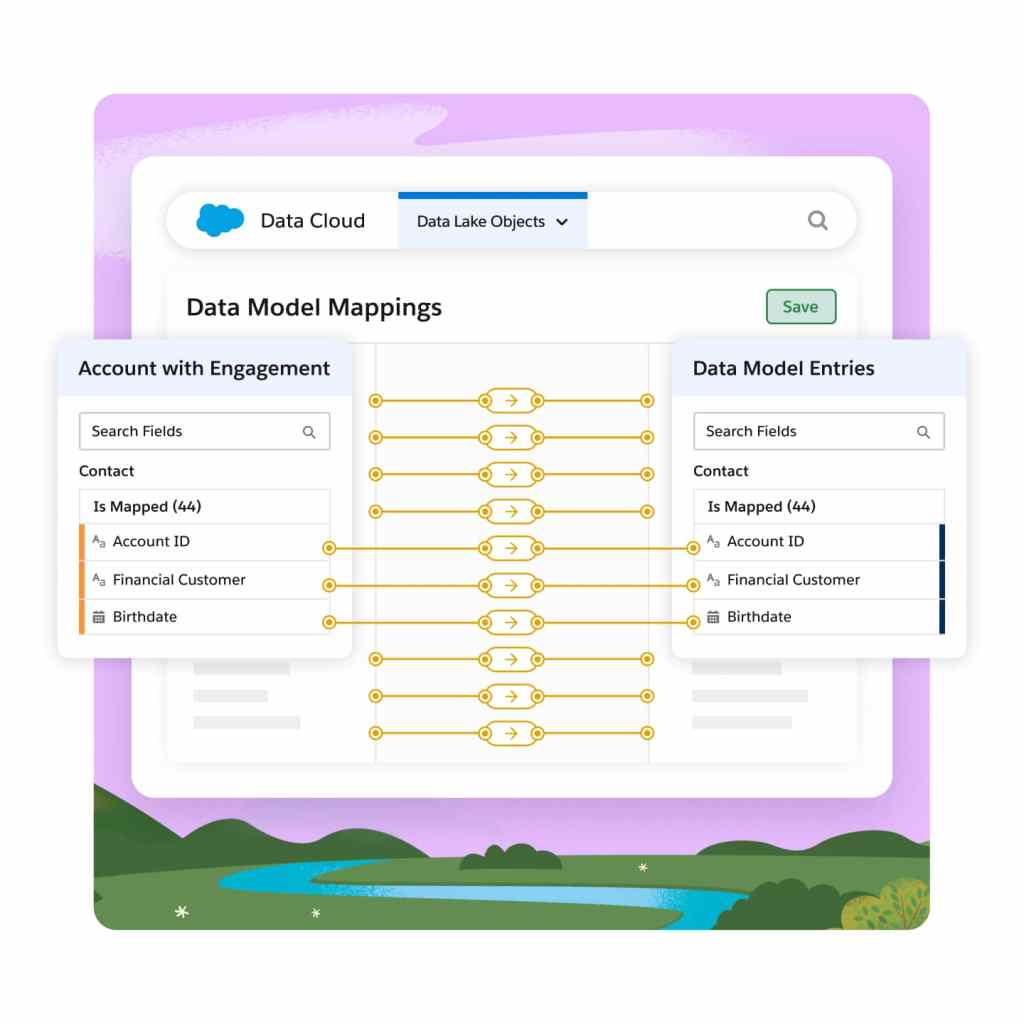

Data Cloud

Activate all your customer data across Salesforce applications.

Einstein

Experience AI built into the flow of work, for any workflow, user, department, and industry.

Marketing Cloud

Personalize customer experiences and optimize each campaign with data-first solutions for any channel and device.

MuleSoft Anypoint Platform

Integrate data from any services system to deliver critical, time-sensitive data – all with a single platform for APIs and integrations.

Keep up with the latest retail banking trends, insights, and conversations.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Retail Banking FAQ

Salesforce is used by retail banks, credit unions, and others that require acquisition, onboarding, personalization, and service capabilities. Our solutions streamline operations and improve customer and member experiences with data, AI, and a purpose-built retail banking CRM built on a trusted platform.

The benefits of retail banking software include scaled acquisition and onboarding, automated service functions, personalized communication across multiple channels, increased customer and member satisfaction, and the ability to quickly adapt to evolving needs. This powers customer loyalty and operational efficiency.

Yes, our platform is flexible and can integrate with various banking systems, core banking platforms, and third-party applications to create a cohesive and unified ecosystem.

You can navigate the complexities of risk management and compliance with capabilities like data analytics, AI, workflow automation, risk assessment, monitoring, and mitigation. Our platform lets banks stay ahead of emerging risks and seamlessly adhere to industry regulations.

A banking CRM helps teams manage customer relationships, analyze interactions, centralize data, and so much more. This helps banks better understand customers and provide tailored financial services, while streamlining operations and driving growth.