Empower your customers’ financial success with trusted AI.

Grow trusted relationships, increase productivity while reducing cost to serve, drive personalization, and scale compliance on the #1 AI CRM for financial services. Unlock the value from your data and deliver personalized insights that show you know your customer. Explore transformative financial services software for banking, insurance, and wealth management built on the Einstein 1 Platform.

The proof is in the numbers.

* Nucleus Research ROI Case Study. ** FY23 Customer Success Metrics.

Discover the world's most innovative AI CRM for financial services companies.

Explore a complete portfolio of best-in-class apps and financial services software, purpose-built for the industry.

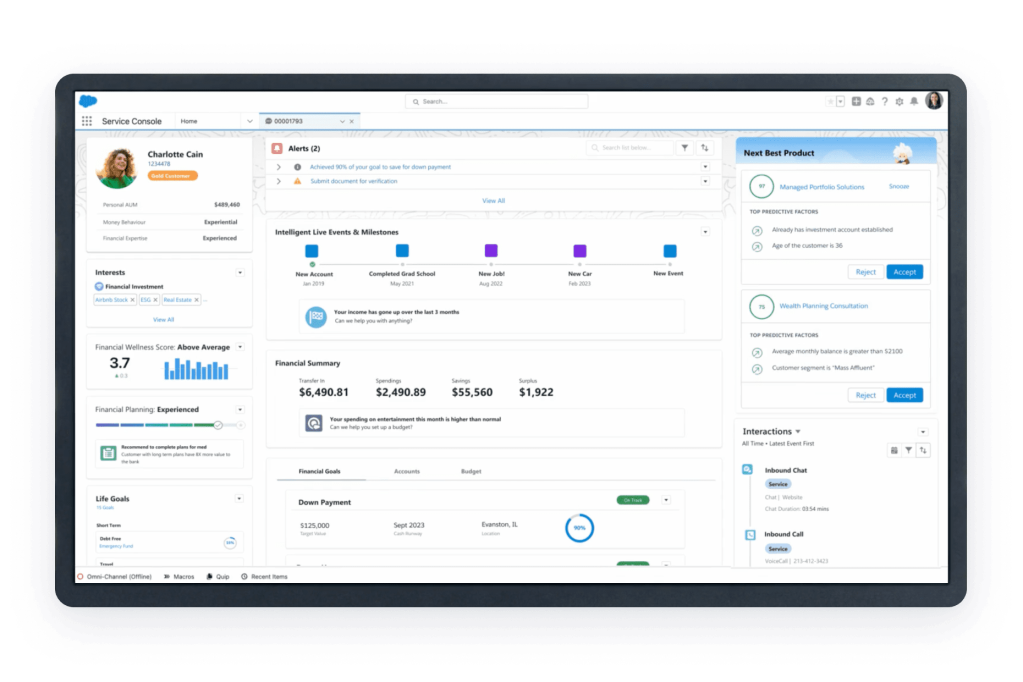

Scale Service

Automate service engagements across digital and in-person experiences.

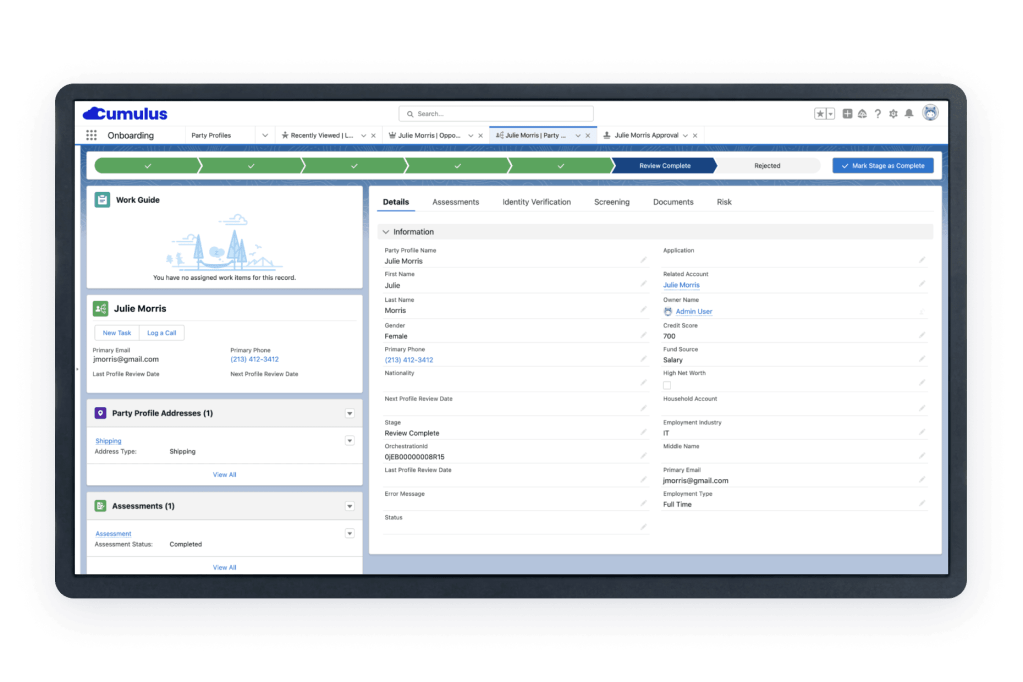

Streamline Onboarding

Deliver a frictionless experience and make a great first impression.

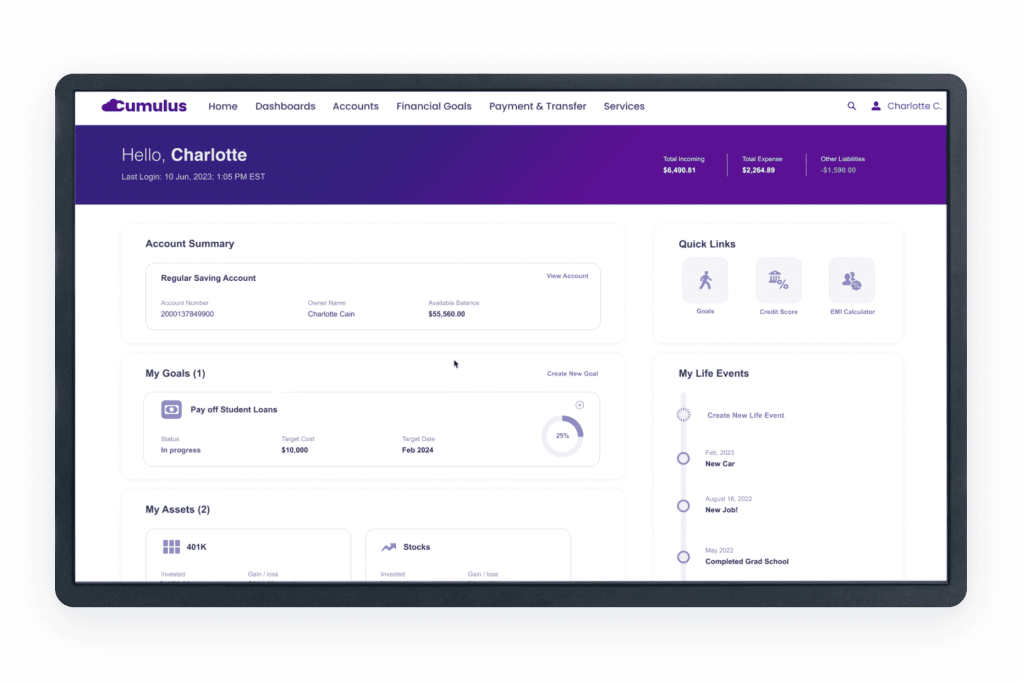

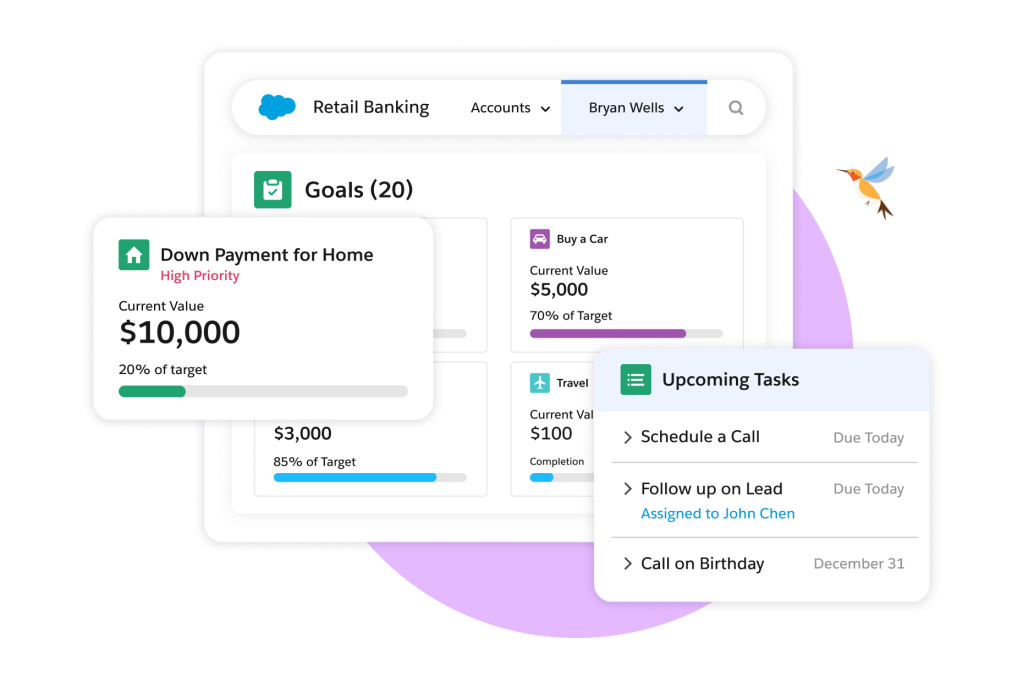

Personalize Engagement

Empower financial success with actionable financial goals powered by data and AI.

Achieve customer satisfaction goals and drive lifetime loyalty.

Banking

Retail Banking

Deliver connected and personalized experiences to customers with automation.

Commercial Banking

Customize experiences and simplify onboarding to strengthen relationships, generate referrals, and scale fast.

Mortgage and Lending

Create operational efficiency and simplify the experience for borrowers by bringing the entire lending lifecycle online.

Corporate Investment Banking

Deepen relationships and create operational efficiency with differentiated insights and compliant deal management.

Insurance

Property and Casualty

Put policyholders first and deploy faster with interactions designed to help you stay ahead in increasingly digitized markets.

Agencies and Brokerages

Deliver success now by empowering your agency or brokerage with digital-first technology, unified insights, and automated workflows.

Life and Annuity

Connect with customers and give them the support they need without complicated software or distractions.

Group Benefits

Manage the entire benefits lifecycle by connecting your teams, reducing unnecessary steps, and scaling fast.

Wealth and Asset Management

Wealth Management

Modernize client engagement, increase client satisfaction, and fuel advisor productivity by delivering automated, data-driven experiences on an integrated platform.

Asset Management

Deliver a unified experience, scale sales team productivity, reduce costs, and automate service experiences for clients.

Engage your customers and employees with Financial Services Cloud.

Accelerate digital process innovation across the front, middle, and back office and put your customer at the center of everything. Unlock data and insights to build customer trust and increase employee productivity with Financial Services Cloud – a single, connected financial services AI CRM.

Salesforce named a leader in The Forrester Wave™: Financial Services CRM, Q3 2023 report.

Maximize ROI with the #1 Success Ecosystem.

From support, expert guidance, and resources to our partners on AppExchange, the Success Ecosystem is here to help you unlock the full power of your investment.

Being able to see all the communication – chat transcripts, emails, phone calls – on the member's profile page has totally transformed agent and member experiences.

Olivia BolesDirector, Operations Projects, PenFed

Learn new skills with free, guided learning on Trailhead.

Keep up with the latest financial services trends, insights, and conversations.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Salesforce for Financial Services FAQ

With Salesforce for financial services, financial firms can achieve lifetime value with their customers. Financial services software makes it easier to grow and maintain trusted relationships, drive personalization at scale, and reduce their cost to serve.

Salesforce offers a complete portfolio of best-in-class business apps that are purpose-built for financial services institutions. Our solutions address sales, service, marketing, and data needs for customer satisfaction goals, client onboarding, personalized financial engagement, underwriting, and claims processing, to name a few.

Financial institutions across the globe utilize varying financial services software in Salesforce's Customer 360, including Financial Services Cloud, Data Cloud, MuleSoft, Sales Cloud, Service Cloud, Marketing Cloud, Tableau, and Slack.

Users can improve efficiency and reduce risk by reusing business processes across channels and automating data collection, document generation, and workflows. Additionally, use financial services software to connect financial, transaction, and CRM data using a range of prebuilt-to-custom accelerators that scale for high volume.

Choose the financial services product that's right for you by evaluating the individual needs of your business. Consider if you need to personalize customer engagements, scale service interactions, or streamline your onboarding experience. Salesforce Financial Services Cloud has a variety of editions you can customize to your business needs. See details here.