Salesforce CPQ

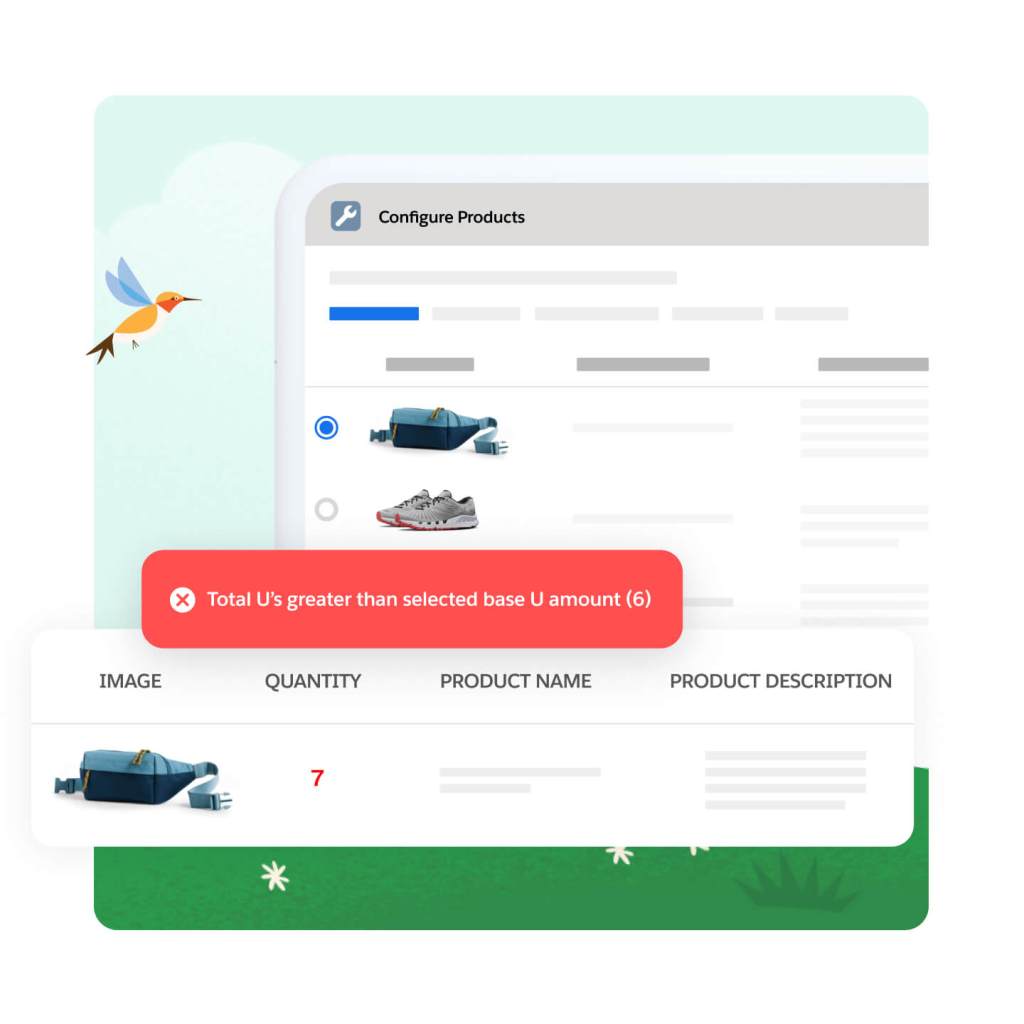

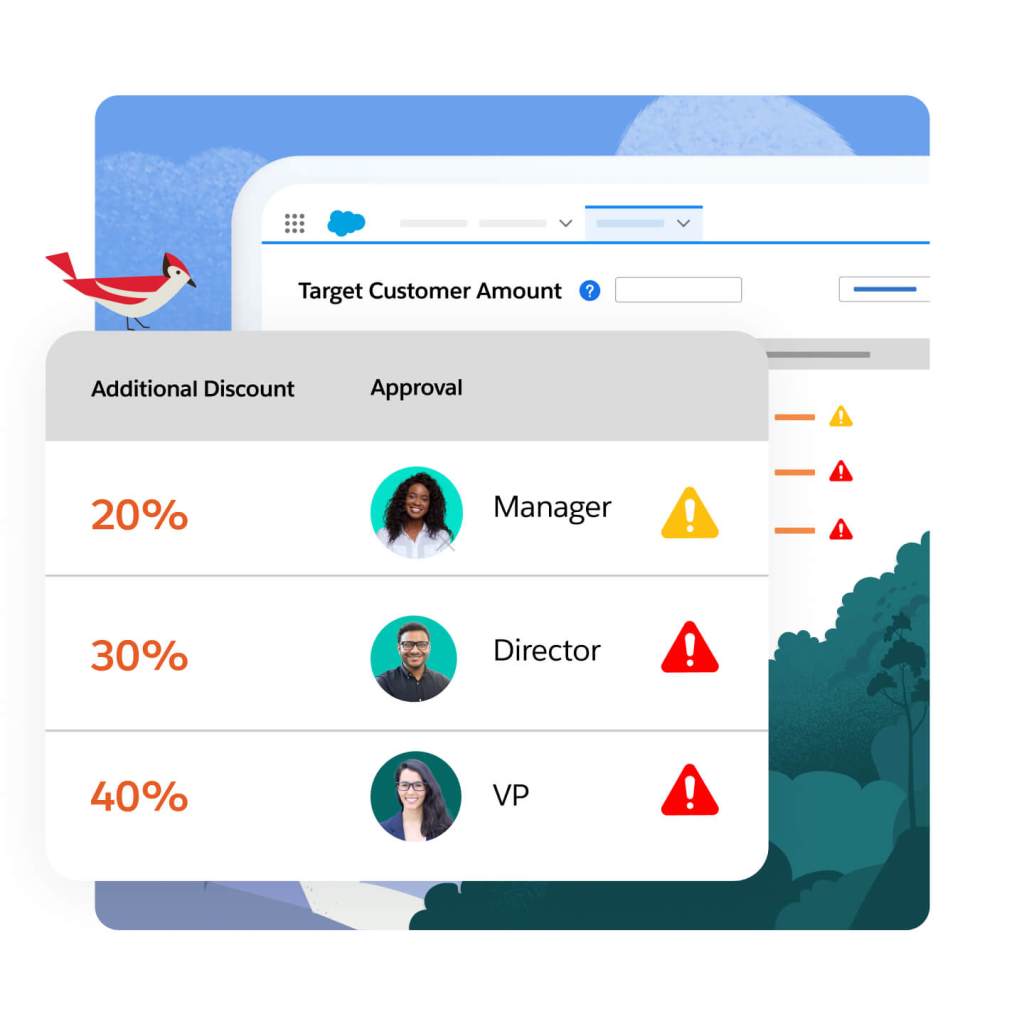

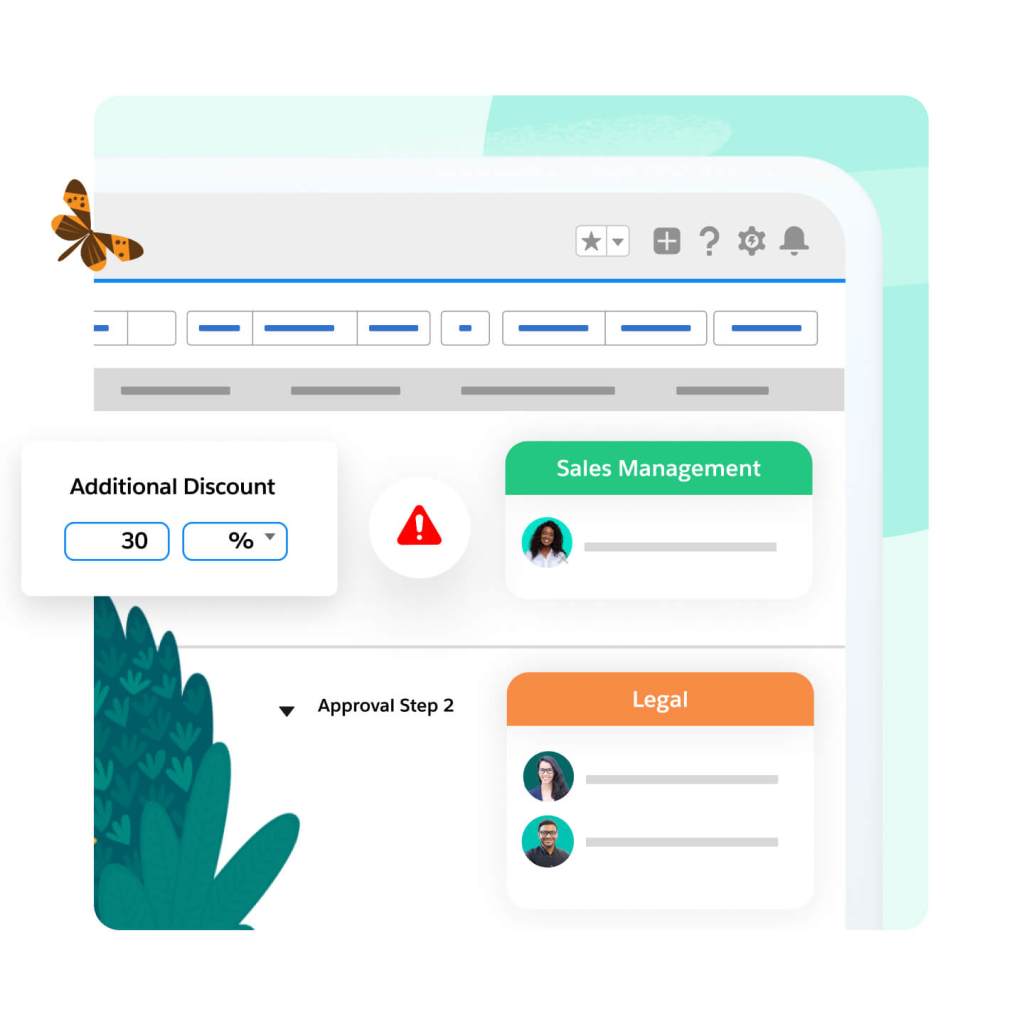

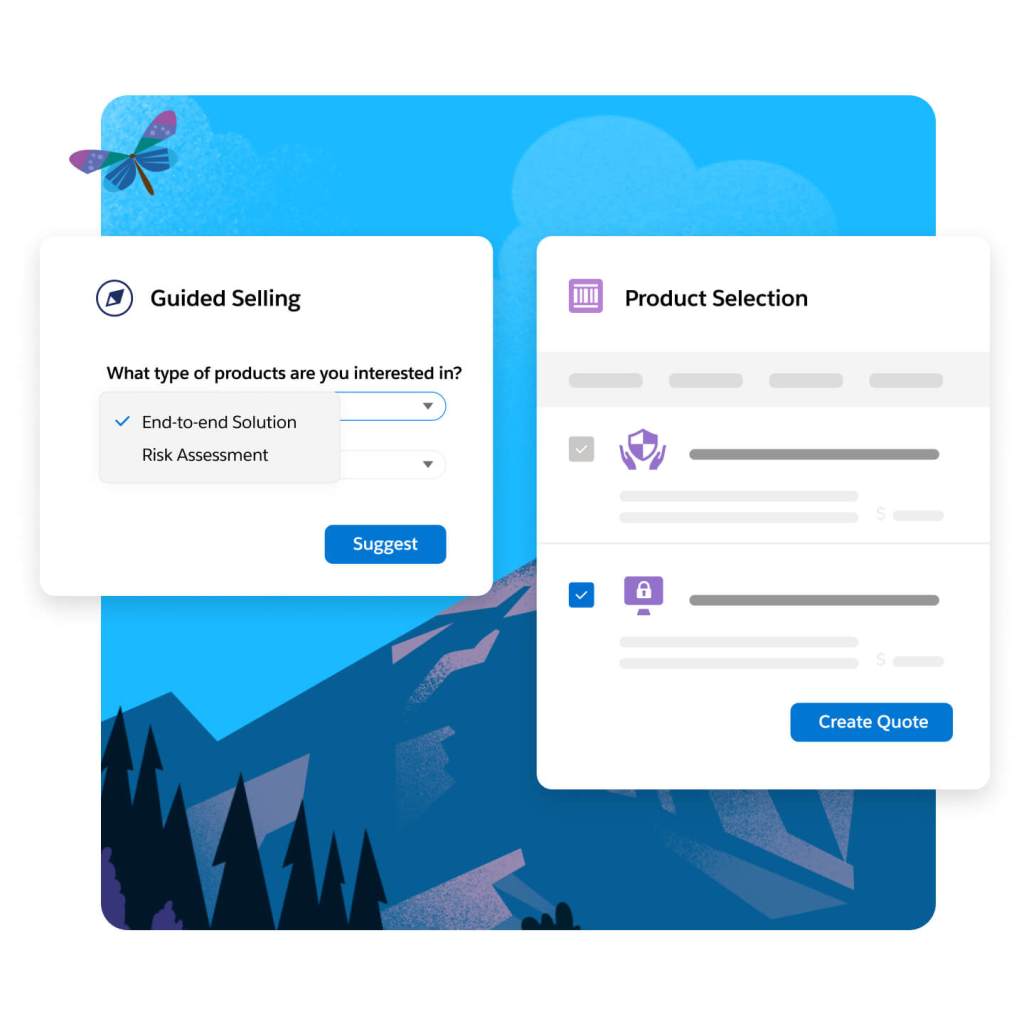

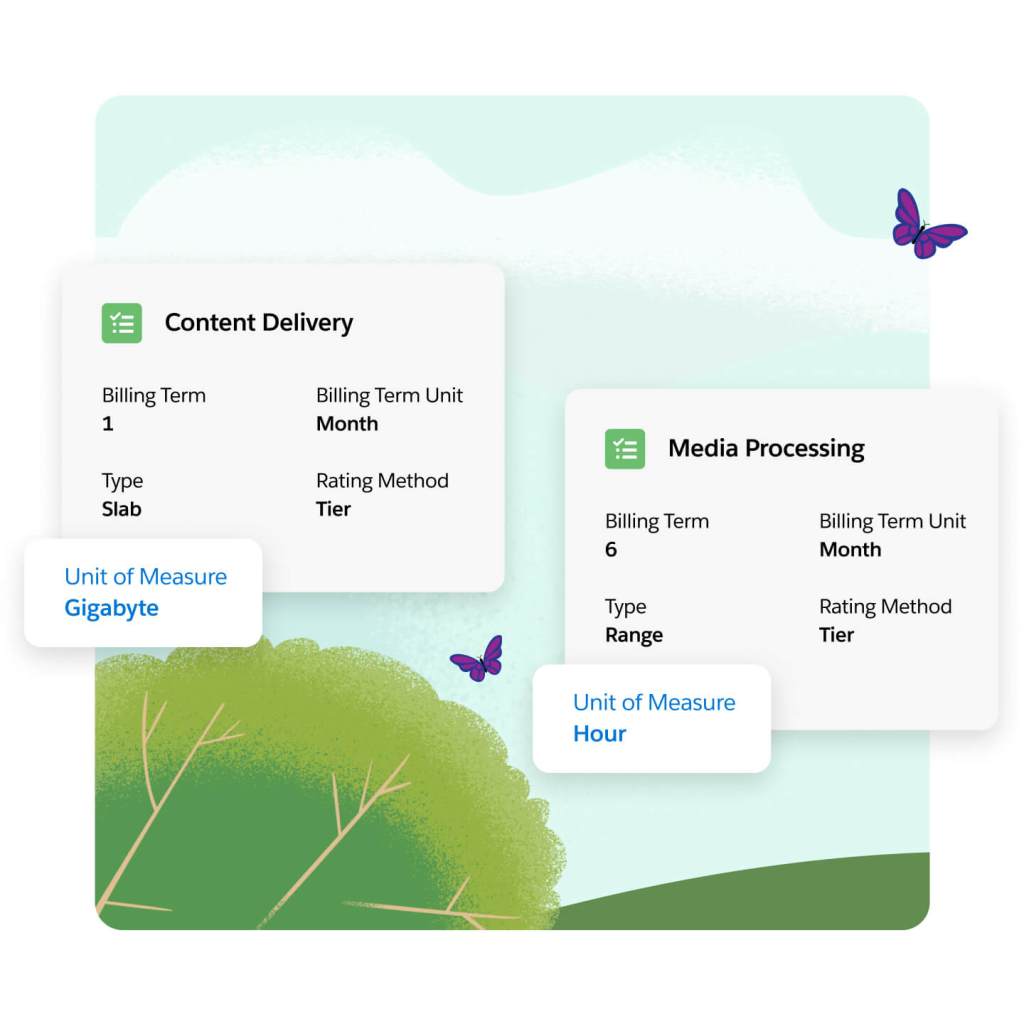

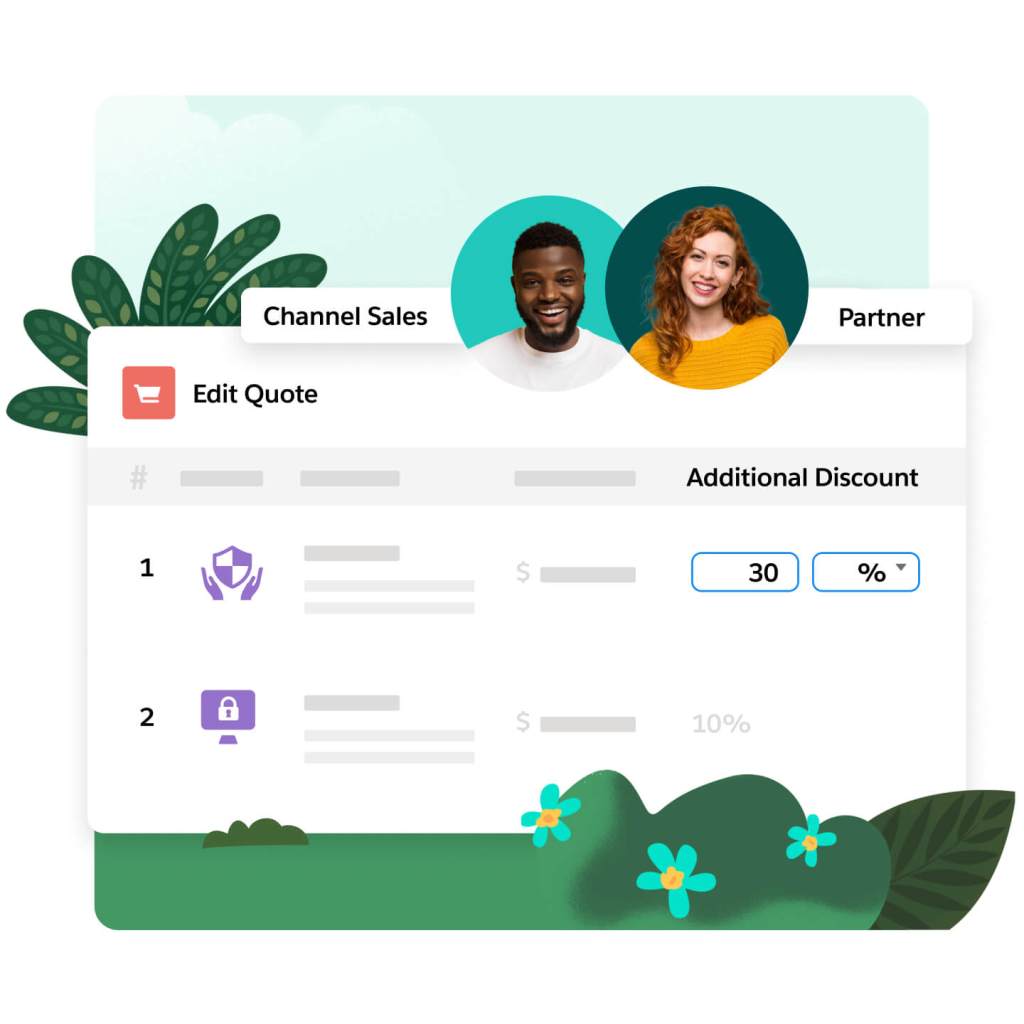

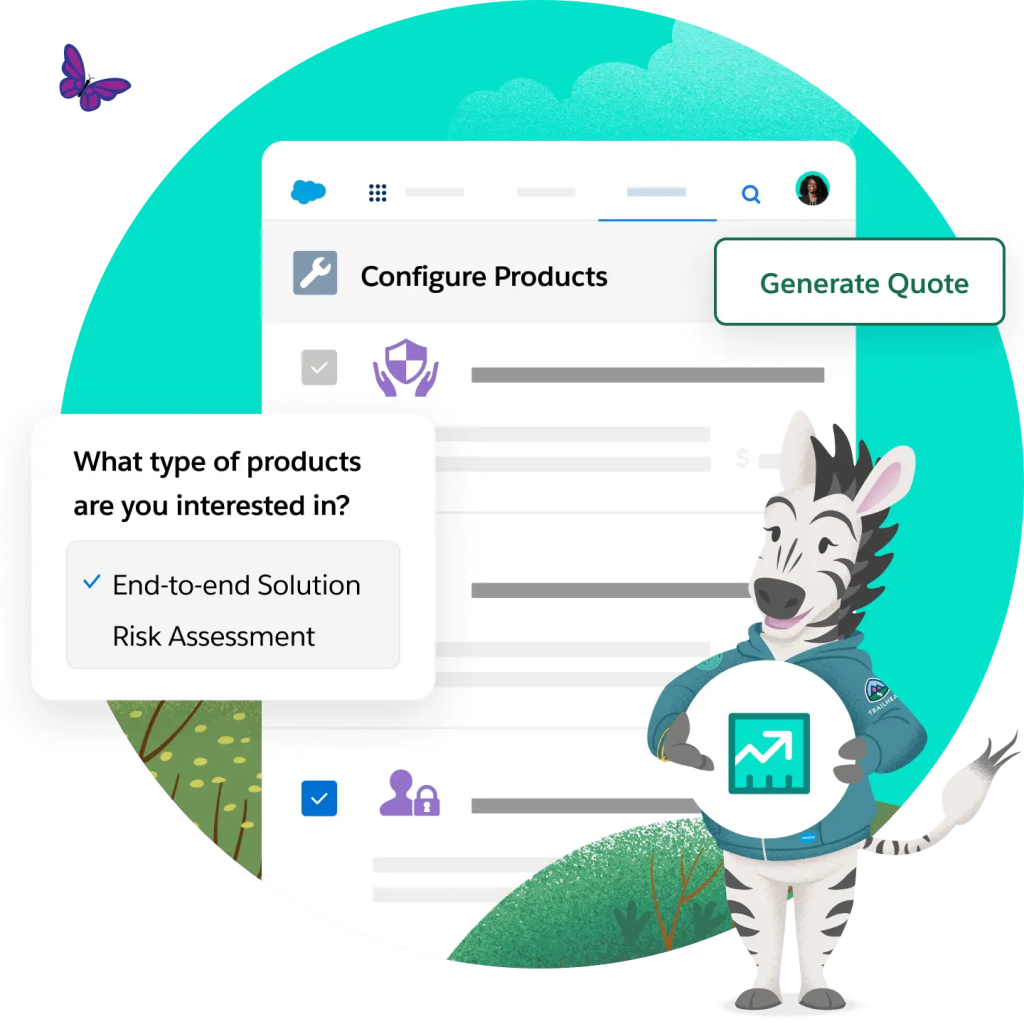

Sell faster and boost sales productivity with configure, price, and quote capabilities that flow straight from CRM. Quote quickly and accurately with guided selling flows, product bundles, and discounting rules for sellers. Mitigate business risk with controls, approval workflows, and compliance built into the quoting process.