Leaders of Australian consumer goods businesses are turning to AI to help them compete in an increasingly complex market, according to new Salesforce data.

A global survey of 2,400 consumer leaders, including 200 from Australia, reveals 53 per cent of local consumer goods (CG) business leaders say profitable growth will be tougher to achieve this year.

In response, these leaders are betting big on AI, with 85 per cent saying that AI agents — a type of AI that can act autonomously alongside human teams — will be essential to compete within two years, while 83 per cent expect agents to directly boost sales.

The Consumer Goods Industry Insights Report has highlighted how local business leaders are prioritising the importance of customer personalisation, as the industry confronts fluctuating consumer confidence, increasingly complex routes to market, softening returns from traditional revenue-boosting strategies, and wider macroeconomic changes.

“It’s clear that Australian consumer goods businesses need to do more to deliver effective customer engagement,” says Nathan Alexander, the Chief Information Officer of McPherson’s, one of Australia’s leading suppliers of health, wellness and beauty products. “This report reinforces our strategy of leveraging social engagement to build in market brand awareness and enable more personalised brand messaging.”

“Underpinned by Salesforce’s unified ecosystem, we are deploying Agentic AI to drive greater productivity, faster decision-making, and accelerated value creation. Together, these capabilities ensure our brands connect more meaningfully with consumers while delivering measurable commercial outcomes.”

CG leaders turn to AI — including AI agents — for growth, efficiency, and innovation

Even amid external pressures, CG leaders are most focused on AI, citing it as both their number one challenge and number one opportunity this year.

Leaders in Australia expect autonomous agents to be indispensable by 2027:

- 85% believe AI agents will be essential to compete within two years.

- 89% expect their companies to increasingly invest in AI agents.

- 83% believe AI agents will help their company increase sales.

Beyond revenue growth, CG leaders expect AI agents to help with creative work, too — from trade promotion creation and optimisation to new product development — positioning AI as a profitability and innovation engine.

“The message from Australian consumer goods business leaders is clear; maintaining customer loyalty is increasingly challenging, and businesses need to move quickly to implement AI agents to remain competitive,” says Jane Brown, SVP Enterprise, Salesforce ANZ.

“Agentic AI is set to be crucial for Australian businesses as they transform their customer service approach and support internal teams to deliver effective, modern shopping experiences.

Economic policy shifts impact CG leaders

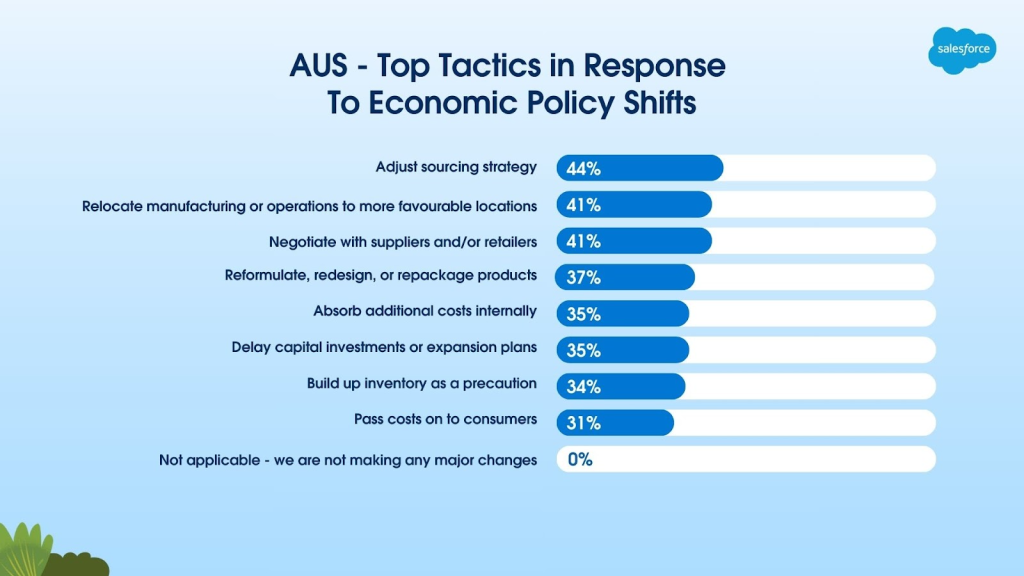

Of the many forces weighing on margins, nearly all CG leaders in Australia (99 per cent) cite exposure to economic policy shifts, such as tariffs, which are impacting sourcing, operations, and margins.

In response, companies are adjusting sourcing strategies, repackaging products, or relocating operations. Passing costs on to consumers remains a last resort, though intensifying margin pressures may soon leave companies little choice.

Traditional trade promotion profitability plateaus, but AI-driven personalisation is a bright spot.

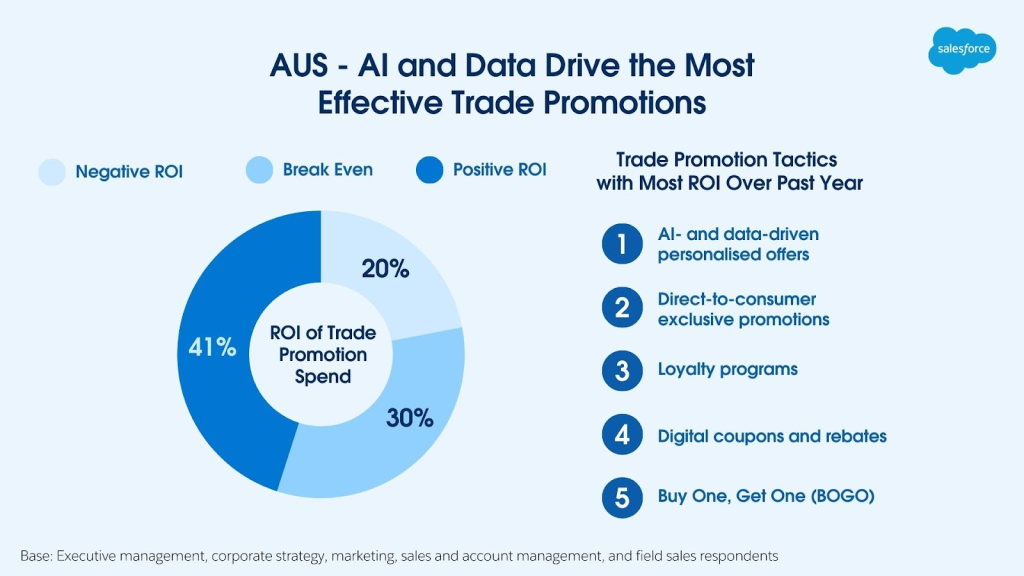

Trade promotions are one of the biggest expenses in consumer goods, yet only 41 per cent in Australia deliver a positive ROI.

While vital for competing in-store and driving sales, trade promotions’ steep costs and uneven returns suggest traditional tactics may have hit their limits.

Newer tactics, like AI- and data-driven personalised offers, deliver the strongest results of any trade promotion tactic, outperforming loyalty programs by nearly 15 percentage points in Australia.

With Direct-To-Consumer (DTC) and loyalty growth slowing, leaders are investing more in personalised digital offers and social media spend

After years of chasing growth through DTC channels and loyalty programs, consumer goods leaders find those levers reaching a ceiling; 59 per cent of CG leaders in Australia say it’s harder than ever to maintain consumer loyalty, with 74 per cent of consumers switching brands in the past year.

As customer journeys splinter across more channels than ever, brands are turning to personalisation, social media, and AI to better connect with customers wherever they are:

- In Australia, companies are boosting spend across social (63%) and digital ads (51%), signaling a broader push to meet consumers where they are to drive growth.

- 67% of leaders in Australia are investing more in personalisation.

“In 2025, price hikes, blanket promotions, and standard assortments can’t guarantee growth. Winning now means precision: using data, strategic trade promotions, and agentic AI to turn every step from the factory to the shopper into a revenue generating opportunity.” said Michelle Grant, Director RCG Insights at Salesforce.

Explore further:

- Read the full Consumer Goods Industry Insights Report

- Learn more about Salesforce Consumer Goods Cloud

- Find more insights on the Salesforce Stat Library

Methodology

Data is from a double-anonymous survey of 2,400 consumer goods industry decision makers in Australia, Brazil, Canada, France, Germany, India, Italy, Japan, Mexico, France, Spain, United Kingdom, and the United States. The survey was conducted from May 1 to June 12, 2025. All respondents are third-party panelists. Additional information can be found in the report.