Editor’s Note: This story was first published on the World Economic Forum site.

As the Fourth Industrial Revolution makes business more and more complex, many executives feel the pressure to focus on satisfying the immediate demands of shareholders and delivering the current or next quarter’s results.

In this climate, it is tempting to take an ever more short-term view of financial performance. It’s also tempting, especially for CFOs, to try to limit the number of groups you’re seeking to please, prioritizing shareholder interests above the interests of others.

In fact, there are many forces that encourage business leaders to work this way. Those include quarterly financial reporting and its associated analyst and media attention, and the thoughts of early business leaders and academics.

A great example of the latter is the Nobel Prize-winning economist Milton Friedman. In his now-famous statement about corporate responsibility, Friedman argued in 1962: “There is one and only one social responsibility of business – to use its resources and engage in activities designed to increase its profits so long as it stays within the rules of the game, which is to say, engages in open and free competition without deception or fraud.”

However, I believe there is both a moral and business imperative to do more than increase profits. My fellow CFOs and other leaders should respond to today’s rapid technological and societal change by taking a long-term view.

Companies that take a long-term view and consider a wide range of stakeholders – such as customers, employees, partners, the environment, and the communities in which we serve – have been shown to be more sustainable, innovative, and profitable.

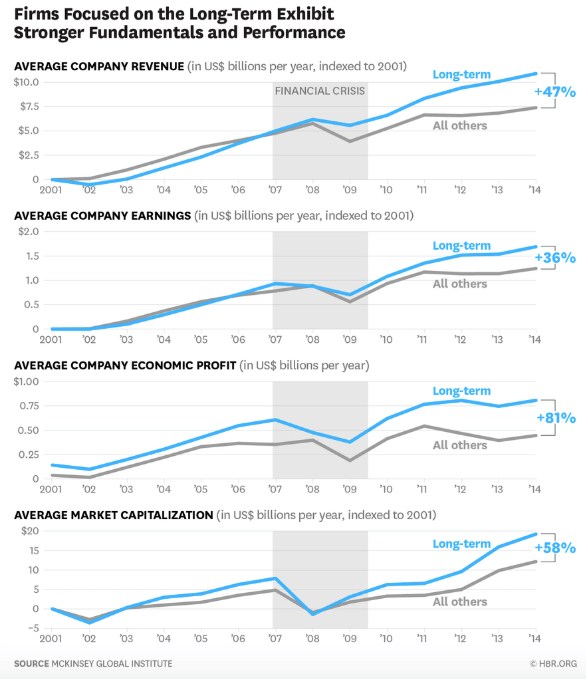

In 2017, the McKinsey Global Institute published research showing that “companies deliver superior results when executives manage for long-term value creation”. The group analysed the performance of 615 large US non-finance businesses from 2001 to 2015 and found that those with a long-term focus had delivered 47% higher average revenue growth, and 36% better earnings growth than those with a shorter-term focus. They also outperformed on market capitalization growth and their contribution to society through job creation.

The authors of the study note that the relationship between a company’s time horizon and performance is complex. Even so, they point to common sense reasons why companies that take a long-term view tend to outperform those that do not. For example, they don’t slash investments that may take time to deliver results, such as research programs, just to meet a quarterly earnings target.

Another reason to focus on longer-term value creation and broaden our view of stakeholders is that investors are beginning to see the benefits more clearly. Those investors include Larry Fink, chairman and chief executive of BlackRock, which manages a world-leading $6.3 trillion in assets.

In a recent open letter to chief executives, Fink emphasised that shareholders such as BlackRock and its clients want and expect companies to serve a social purpose beyond simply making a profit. In his view, companies must show how they “benefit all of their stakeholders, including shareholders, employees, customers, and the communities in which they operate”.

Fink argues that it’s simply good business to have long-term plans, invest for growth, and have a sustainable business model. That sustainability comes from companies meeting their full range of responsibilities to all their stakeholders, so they retain their so-called “license to operate”. That concept covers formal permissions from regulators and informal ones, such as a business enjoying enough approval from a local community where its operations aren’t opposed.

This has certainly been our approach at Salesforce, where our culture is built around the Hawaiian concept of “Ohana”, or family. Through this stakeholder framework, we focus on trust, customer success, innovation, and equality. From our inception two decades ago, we have also invested 1% of our equity, 1% of our profit, and 1% of our employees’ time into philanthropic activities. Since 1999, our employees have volunteered more than 3 million hours helping non-profits and educational institutions achieve their goals.

Our success shows it is possible not only to have a strong sense of social purpose but also to thrive even in a highly competitive and fast-changing industry. In fact, we are confident that our strong cultural values have been a core driver of competitive advantage and our growth.

CFOs face many challenges and carry enormous responsibilities. However, I would encourage all my peers to step back from time to time and consider their approach to business. What is your purpose? Which stakeholders do you really consider? How secure is your license to operate? And, as your business changes at an ever-faster pace, what are the core values and attributes that will remain timeless?