Click here to explore data across demographics and geographies.

Small- and medium-sized businesses represent over 90% of the business population, over 60% of employment, and over 50% of GDP in developed economies, and they are disproportionately impacted by the effects of COVID-19. Consumers are rallying around their beloved and vulnerable small businesses, but will that alone be enough?

Our latest survey of global consumers takes the pulse of how small businesses are fairing in their communities, if and how they’re supporting them, and what steps businesses can take to bring customers back.

Here are some key findings.

Consumers are concerned with small business survival, despite signs of adaptation

Stories of resilient small businesses have showcased the many ways entrepreneurs have rapidly shifted their operations, go-to-market strategies, and even their fundamental business models. Consumers have taken notice of these efforts, with 52% of global respondents believing that most small businesses in their area have adapted to the challenges brought by the pandemic. Yet nearly as many (48%) say most small businesses in their area are struggling.

Most consumers (53%) say they can think of at least one small business they bought from that has closed due to the pandemic.

With disparate public health and economic policy responses to the spread of COVID-19, citizens of different countries have varied perceptions of how much of a crisis small businesses face. Notably, those in the U.K. and Australia are the least likely to believe the majority of their communities’ small businesses are in trouble, whereas a sizable majority of French residents believe small businesses’ struggles are widespread.

Despite tightened wallets, consumers are mobilizing to support small businesses

An earlier survey of U.S. consumers during the peak of shelter-in-place orders found a general sentiment that small businesses were more important than ever. As economies continue to reopen, that sentiment is being put into practice.

Consumers expect their spending across various categories to be flat or down compared to last year, but they are evidently making an exception for small businesses. 56% of consumers say they’re spending more at small businesses than they did last year. This claim is especially common among the largest consumer segment, millennials, 62% of whom say they’re spending more.

While time will tell if this enthusiasm for small businesses will outlast the current crises, outlooks are hopeful. 67% of consumers — including 72% of millennials — say they’re committed to supporting small businesses more than they did before the pandemic.

“While there’s no easy road ahead, consumers of all ages have a newfound appreciation of small businesses and a deeper understanding of the role they play in communities,” observed Meredith Schmidt, Executive Vice President and General Manager of Salesforce Essentials and SMB. “Younger generations, in particular, are becoming more mindful about buying from small businesses, which is a good sign that these habits will carry into the future.”

Digital investments attract young consumers — and advocates

Following through on commitments to support small businesses looks different during the pandemic. Several months into the crisis, consumers continue to spend increased time browsing the internet, shopping online, using social media, and other digital activities. What’s more, a majority of them expect a long-term shift towards ecommerce and other forms of digital business engagement even after the threat of COVID-19 has subsided.

63% of millennial consumers — and 61% of Gen Z consumers — say they’re more likely to support a small business that has a digital presence. A sizable minority of these younger consumers, particularly Gen Zers, also say they’ve shared or liked social media content from a small business or written a positive online review for one.

“It comes as no surprise that digital experiences are necessary for small businesses to attract customers at a time when reopening physical locations can be complex and confusing.” said Enrique Ortegon, Senior Vice President of Small and Medium Size Business Sales North America at Salesforce. “Websites, reviews, and social media give small businesses a way to interact with customers, encourage purchases, and create a sense of trust and loyalty in a time of uncertainty.”

For companies with a customer base that skews older, a digital presence alone may not lure customers back. While millennials and Gen Zers cite online shopping and customer service options among the most important aspects of shopping with a small business, baby boomers and Gen Xers are more likely to prioritize an updated in-store experience — such as with contactless payments and social distancing measures.

Citizens call on governments and large businesses to help Main Street

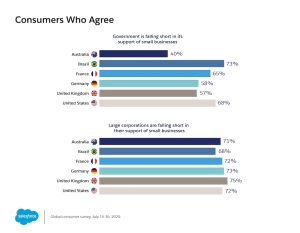

Consumer support and digital transformation may help many small businesses navigate this crisis, but citizens around the globe share the view that large corporations must do more to help. Yet Australians buck what would otherwise be a global consensus that governments are also falling short.

To learn more about how small businesses can navigate this radically different era, listen to stories of entrepreneurs reinventing their businesses.

Salesforce conducted a double-blind survey of adults in the United States, United Kingdom, France, Germany, Brazil, and Australia. Data was collected on July 15 and July 16, 2020 and yielded 3,619 responses. Data is weighted to accurately represent the general population.

Click here to explore data across demographics and geographies.