Quick Take: The eighth edition of Salesforce’s State of Marketing report reveals how marketers are evolving priorities and adopting innovative tactics amid macroeconomic headwinds. Based on a global survey of marketing leaders and aggregated platform data from Salesforce’s Marketing Cloud, this report also highlights how marketers are leveraging automation to deliver more with less while delivering personalized experiences in the face of changing privacy regulations.

Feeling swamped? If you’re a marketer, there’s a good reason why. As Salesforce’s Chief Marketing Officer Sarah Franklin sees it, “We’re in a time of tremendous transformation that requires us to reimagine how we connect with customers.”

To assess how marketers are navigating this new landscape, Salesforce today released the eighth edition of the State of Marketing report. Drawing from a survey of 6,000 marketers across 35 countries, and an analysis of trillions of outbound marketing messages sent using the Salesforce platform, the report explores how marketers are:

- Doing more with less in the face of macroeconomic uncertainty.

- Working to meet customers’ evolving digital-first expectations.

- Adapting to new privacy regulations while still delivering exceptional personalized experiences.

Here are some of the findings:

Marketers stay determined amid macroeconomic and labor headwinds

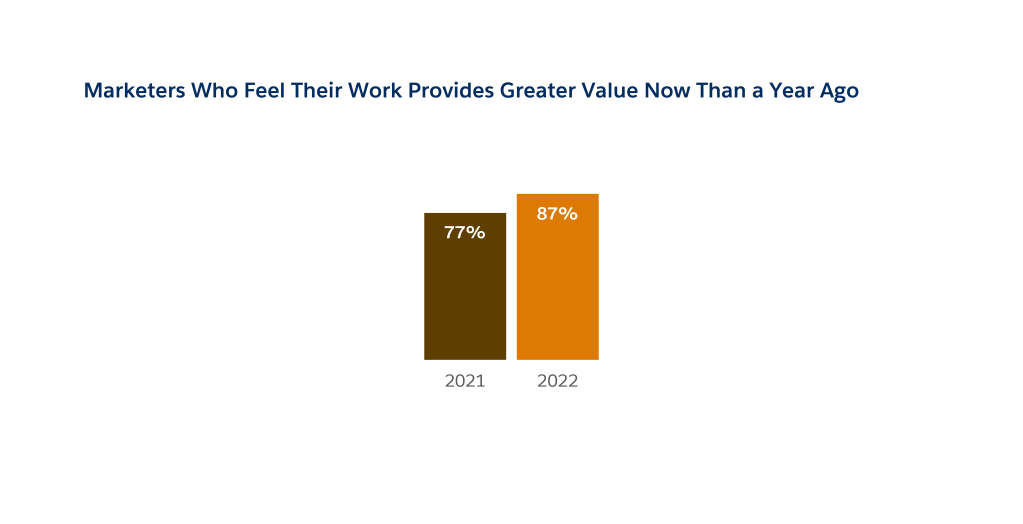

Macroeconomic uncertainties may have teams reexamining budgets and fine-tuning tech stacks, but marketers remain bullish about their contributions to the success of their businesses. Eighty-seven percent of marketers say their work provides greater value now than it did a year ago — a 10 percentage point leap from last year.

That’s not to say the job itself has gotten easier. Quite the opposite: one in three marketers is feeling the squeeze of tightening budgets, all while consumer expectations continue to soar, with those in life sciences, manufacturing, and technology sectors particularly feeling the pinch. Indeed, 71% of marketers say meeting customer expectations is more difficult than just a year ago.

33% of marketers say budgetary constraints are a challenge.

Gaps in employee resourcing are partially to blame for an increasingly challenging marketing landscape. Trends like the “Great Resignation,” “Quiet Quitting,” and layoffs are making waves across company talent pools and marketing teams are feeling the impact.

71% of marketing leaders have more trouble retaining talent this year compared to last year.

In the face of heightened demands and limited resources, marketers are looking closely at which capabilities they need, and how they can extract value from their existing investments.

Despite a primary focus on maximizing the value of existing tools and technology, innovation remains top-of-mind for marketers. Awash in emerging channels and attuned to shifting consumer trends, marketers are flexing their creative muscles, citing “experimenting with new strategies and tactics” as their #2 priority.

The march toward digitally led engagement treads new and familiar paths

According to recent research, over half (56%) of customers now expect offers to always be personalized — no matter the channel. In turn, brands are investing in a combination of channels and technologies to tailor outreach and build lasting relationships wherever their audiences spend time.

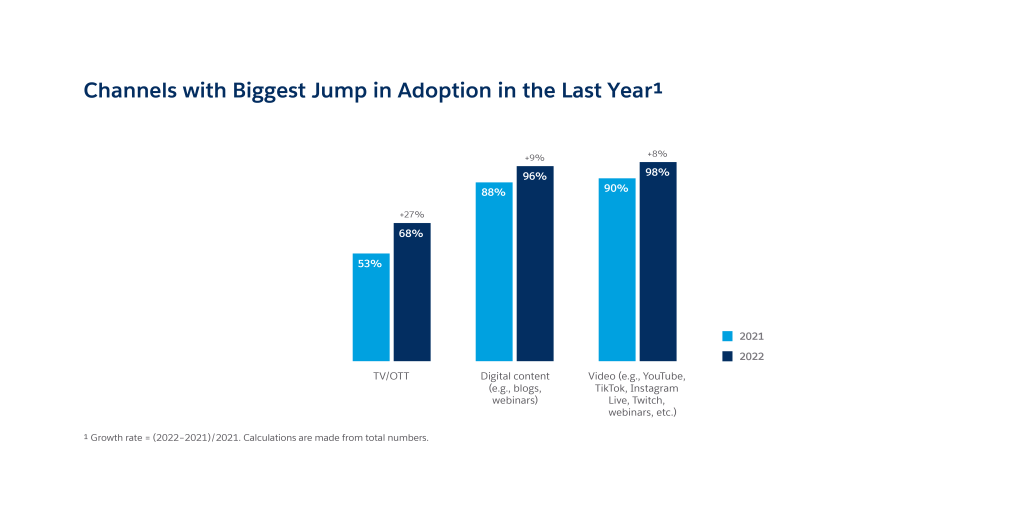

While email remains a dominant channel — accounting for over 80% of all outbound marketing messages — marketers are exploring newer watering holes. Take over-the-top media services (OTT). As streaming services continue to dominate the media landscape and beef up targeted ad offerings, marketers are following suit. Channels like TV/OTT, digital content, and video experienced the biggest growth in marketing adoption overall. However, healthcare, life sciences and biotechnology, and retail sectors are bucking the trend with audio channels like podcasts seeing the largest jumps in adoption.

Marketers navigate a complex technology and regulatory landscape

Marketers’ data needs are growing as they expand their reach across more channels. With each new channel comes additional usage and performance data to be tracked, analyzed, and optimized. Undaunted, marketers predict they’ll use nearly twice as many data sources in 2023 than they used in 2021.

In addition to transaction data and known digital identities, 75% of marketers still use third-party data like device identifiers and cookies from aggregators or data brokers. While not all third-party data is cookie related, marketers will need to reconcile this strategy with impending changes to privacy regulations.

Despite this continued reliance on third-party information, the majority of marketers have a plan in place to adapt. Sixty-eight percent already have a fully-defined strategy to shift toward first-party and zero-party data. And, more than half of marketers are providing information-sharing incentives for customers (56%) and investing in new technologies like customer data platforms (51%) to enrich customer data profiles without third-party cookies.

As the reality of new privacy regulations kicks in, today’s marketers are reassessing whether they need to go above and beyond these new industry standards: 51% say they go beyond regulations and industry standards to protect customer privacy, down from 61% last year.

Most popular AI use-cases center around automation

Marketers faced with heightened expectations, limited human resources, and an influx of data are increasingly turning to artificial intelligence to maximize their efforts. Sixty-eight percent say they have a fully-defined AI strategy — a steady climb from 60% in 2021 and 57% in 2020.

Teams already leveraging AI are using it to accelerate existing tasks. Three of the top four AI use-cases center around task automation.

These teams view AI as more than a temporary Band-Aid: 70% of marketers who updated investments in their process/workflow automation view this as a long-term strategy shift.

Web3 authors a new chapter in marketing

Experimentation is in marketers’ DNA. It starts at the top: 91% of CMOs say they must continually innovate to remain competitive.

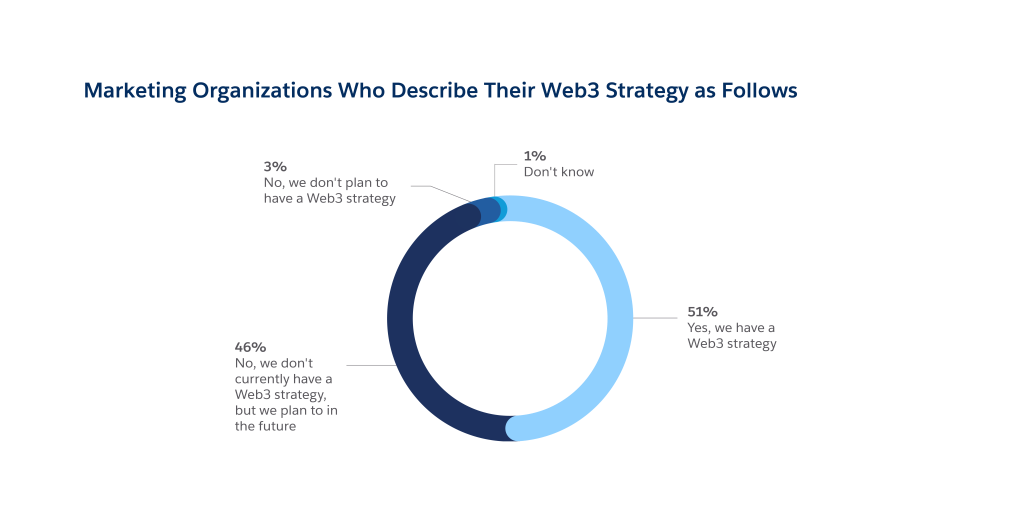

Cue the latest test lab: Web3, a decentralized online ecosystem based on a blockchain. While still relatively new territory, 51% of marketers claim to already have a strategy for Web3, with virtual products and virtual reality (VR) and/or augmented reality (AR) use-cases listed as the most common technologies tapped.

For the 46% of marketers who have yet to draw up a Web3 strategy, unique digital assets like non-fungible tokens (NFTs) or the metaverse could present new opportunities for brands to collect first-party data.

Successful marketers lead with values

For many of today’s consumers, products and services are only part of what brands have to offer. Principles matter too. In fact, 88% of customers expect companies to clearly state their values.

Top marketing teams are rising to the occasion. Ninety-three percent of high-performing marketers say their external messaging reflects their corporate values, compared to 70% of their underperforming competition. As the amplifiers for key company messages, marketers are in a unique position to show how business can be a platform for change.

Go deeper:

- Read the full State of Marketing report.

- Read a blog post by Shannon Duffy, EVP of Cloud & Industry Marketing at Salesforce, for deeper analysis of the survey results.

Methodology

Data in the State of Marketing report is based on a third-party, double-blind survey conducted from June 30 to August 8, 2022 that generated 6,000 responses from marketing managers, directors, VPs, and CMOs across North America, South America, Europe, Africa, and Asia Pacific.

Platform data referenced in this report comes from aggregated data from the activity of over two trillion messages sent using the Salesforce platform between Q12022 to Q2 2022. Additional data hygiene factors are applied to ensure consistent metric calculation. The Salesforce Shopping Index and related datasets are not indicative of the operational performance of Salesforce or its reported financial metrics including gross merchandise value (GMV) growth and comparable customer GMV growth. For further detail, see the State of Marketing Report.