Welcome to the Agentic Era of Financial Services

Explore how Agentic AI is redefining financial services, helping institutions scale trusted intelligence and deliver business value.

The rapid advancement of AI has ushered in a new phase of technology, introducing countless possibilities for the financial services industry to enhance customer experiences and deliver real, measurable impact.

A New Era of Technology for Financial Services

Financial organisations have always evolved through distinct waves of innovation. The mainframe era digitised ledgers and scaled transactions. The digital era brought online banking and self-service, accelerating services and putting power directly in customers’ hands.

Now, the industry is entering its third major shift — the agentic era. This new phase of technology is transforming how institutions operate, how work gets done, and how value is created.

According to McKinsey, 43% of all banking hours could eventually be automated. Yet the real opportunity extends beyond just automation. It’s in reinvention.

Many financial institutions have used AI to enhance existing processes: streamlining routine tasks, boosting productivity, and improving efficiency. These gains matter. They’ve built confidence and delivered quick wins. But the next chapter is about something more.

The shift to an Agentic Enterprise is about reimagining how work happens, how teams collaborate, and how technology drives outcomes across the business.

Delivering Value at Speed

The time for isolated pilots and proof of concepts is over. Today, boards and executive teams want measurable, enterprise-scale results. They want AI that delivers value today, not tomorrow.

Over the past 12 months, financial institutions have learned what works — and what doesn’t. The most successful programs are those that tie directly to business outcomes: improving advisor productivity, reducing service costs, or accelerating onboarding.

Real progress comes from moving fast with purpose. That means focusing on use cases that create immediate commercial or customer impact, building trust at every stage, and scaling success across the organisation.

Leaders who take this approach are moving from experimentation to execution. They are evolving their mindset, architecture, and operations to become fully Agentic Enterprises.

Discover the next chapter of AI in financial services

Learn how leading institutions are scaling AI with trust, data, and architecture built for the future.

Real-World Impact: What Makes Agentic AI Different?

Generative AI showed us what was possible with Large Language Models (LLMs) — creating content, insights, and answers in seconds. Agentic AI takes that promise even further. It introduces intelligent agents that can reason, plan, and act independently, all while collaborating seamlessly with people and systems.

These agents operate autonomously and improve over time. They can orchestrate complex workflows, connect across departments, and deliver outcomes faster and more accurately.

Because they learn and improve over time, every interaction makes them smarter. Here’s what that looks like in practice:

- In commercial banking, agents generate meeting briefs in seconds, saving hours of manual preparation.

- In insurance, agents triage claims and provide real-time risk analysis.

- In wealth management, agents surface tailored insights and compliance-ready summaries for advisors.

Repetitive tasks are taken care of, allowing people to focus on what they do best — bringing empathy, judgment, and expertise to every client interaction, building trust and long-term relationships. Companies are already recognising the real business value that it brings in the business:

- RBC Wealth Management created an AI-powered meeting prep tool that distils a year of CRM data into a personalised brief. This cut down prep time from an hour to under one minute and reduced management costs by 50%.

- Invest Blue is exploring how AI can help advisors create client notes more efficiently, giving them more time to focus on meaningful client conversations.

Why Trust, Scale, and Architecture Matter More Than Ever

Adopting Agentic AI requires rethinking how systems, data, and governance work together.

It starts with a composable architecture that introduces an “agentic layer” on top of existing platforms. This layer connects securely to your data, orchestrates workflows across systems, and ensures every agent operates in line with organisational policies.

Success depends on unified data. Most institutions already have the information they need – it’s just trapped in silos. With tools like Salesforce Data 360, structured and unstructured data can be unified in real time, creating a single, trusted source of truth that powers every intelligent agent across the business.

Trust remains the foundation. Your organisation’s architecture must uphold the highest standards of compliance, governance, and control at every step. AI should never compromise customer relationships. It should strengthen them.

From Generative to Agentic AI in Financial Services

Join our webinar to discover how Banking, Insurance & Wealth organisations are moving from experimentation to execution.

The Evolve Mindset: What Early Adopters are Doing Differently

Becoming an Agentic Enterprise starts with a shift in thinking – the evolve mindset.

The evolve mindset is about progress, not perfection. It means leading with use cases and outcomes, not with technology. It also means balancing speed with safety, and experimentation with governance.

Early adopters showcase what this looks like in practice:

- They focus on outcomes, not tools. Success starts with solving specific business challenges.

- They activate the data they already have. Rich data is only valuable when it’s unified and actionable.

- They integrate with existing systems. Rather than rebuilding, they connect agents to the platforms they use today — from CRM to core banking to compliance workflows.

- They bring business and IT closer together. These solutions span functions, so collaboration across risk, compliance, operations, and technology is critical.

- They start small but build for scale. Early wins build momentum. Targeted use cases expand fast once value is proven.

- They treat AI like a product, not a project. Continuous feedback, testing, and optimisation keep agents relevant and trusted.

- They deploy agents that understand financial work. Domain-specific agents outperform generic ones because they reflect how work actually gets done in banking, insurance, and wealth.

The Agentic Enterprise in Financial Services

Scaling AI across the enterprise starts with a connected foundation. The Agentic Enterprise unites data, AI, automation, and trust within one framework that enhances the systems financial institutions already rely on.

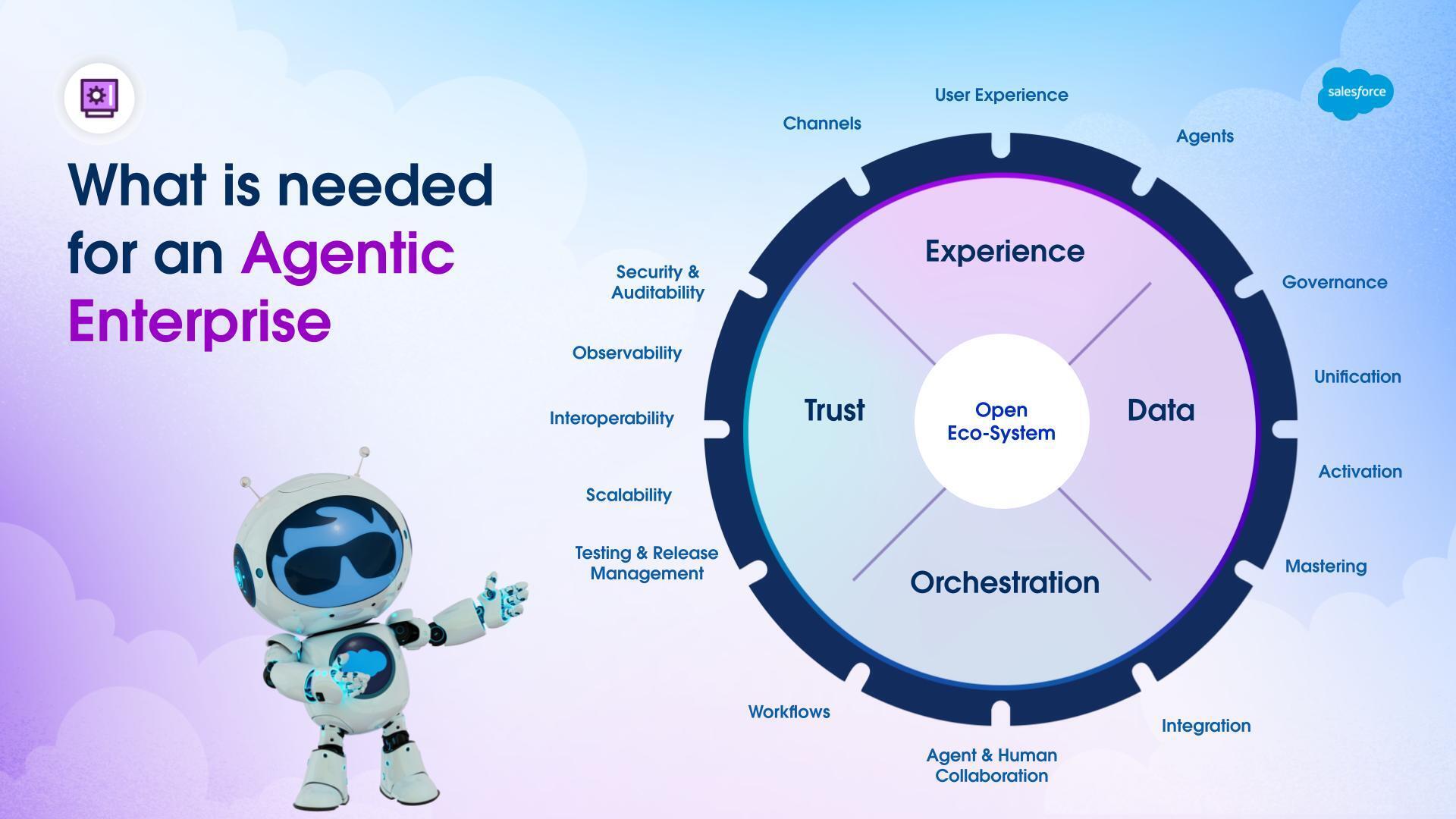

An effective Agentic Enterprise depends on five key elements working in harmony:

- Open ecosystem: Models are becoming commodities. Success depends on choosing the right model for the job and having the flexibility to adapt as technology advances.

- Experience: AI delivers the most value when it is embedded directly in the flow of work. New channels continue to emerge, such as Salesforce’s partnership with OpenAI to make Agentforce available through ChatGPT — bringing trusted intelligence to familiar tools and workflows.

- Data: Unified, activated, real-time data powers intelligent action. Big, complex projects to build a single source of truth no longer work — you need insights that move at the speed of your business.

- Trust: Every layer must be grounded in trust and security. Auditability, observability, and strong data protection ensure AI operates safely and responsibly.

- Orchestration: As organisations adopt multiple AI solutions, governance becomes essential. Defining which agents can act, communicate, and collaborate ensures AI is connected, compliant, and aligned with business goals.

For leaders navigating the Agentic Era, orchestration remains top of mind. It turns complexity into clarity, ensuring that systems are connected, governed, and optimised for impact. Success in this new era depends on balance – combining openness with governance and innovation with trust.

The road ahead

For financial services leaders, it’s no longer a question of whether to scale AI, but how fast.

The institutions that act now will define the next era of customer trust, efficiency, and growth. By combining human expertise with the intelligence of Agentforce, financial services organisations can reinvent how work gets done and expand what’s possible.

Across the industry, progress is being driven by a few clear priorities:

- Start with impact. Focus on use cases that deliver immediate commercial or customer value.

- Move quickly with pre-built agents rather than custom builds that slow innovation and stretch resources.

- Involve stakeholders early to validate workflows, outcomes, and value.

- Activate data from across the business so agents can act with context.

- Iterate with agility. Don’t wait for the perfect blueprint – learn, adapt, and evolve continuously.

Agentforce gives financial institutions the confidence to move faster by combining trusted governance, enterprise-grade compliance, and deep integration with the Salesforce Platform.

Those who act today won’t just keep pace with the future of AI in financial services. They’ll set the standard for it.

Welcome to the Agentic Era

How financial institutions are using Agentforce to scale intelligent automation and transform customer experiences. Get the whitepaper From Generative to Agentic AI: The Next Chapter for Financial Services.

Read more

The AI Imperative: It’s Time for Financial Services to Embrace AI

How Financial Services can win Customer Loyalty with AI

Financial Services Consumers Are Ready For an AI Revolution — Are You?