When it comes to money, who would you trust — a stranger reading numbers off a screen, or a friend who knows your family, your milestones, and your dreams?

In India, financial decisions aren’t just transactions. They’re personal and emotional commitments, tied to family, security, and pride. Which is why customers expect relationship managers (RMs) to bring the old-school touch: face-to-face conversations, honest advice, and personalised guidance.

But instead of preparing for those moments, RMs lose most of their day to manual prep, system updates, and compliance checks.

From admin to advice: What an RM’s day looks like with Agentforce

Take the example of Anjana, a relationship manager at a leading private bank in Mumbai. Like most RMs, her day is packed with meetings, portfolio reviews, and follow-ups. Yet, more than two-thirds of her time goes into manual preparation, compliance checks, and administrative tasks.

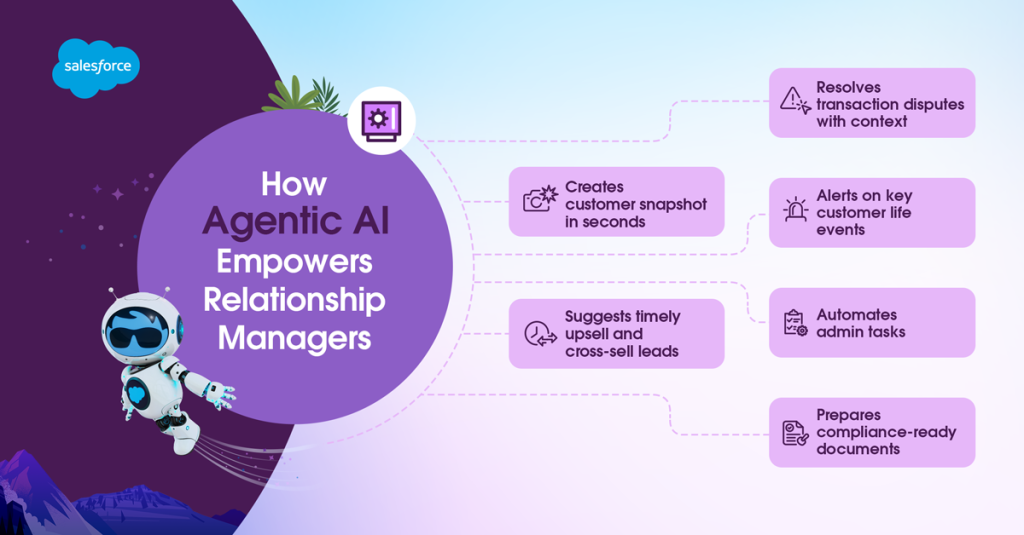

Fed up with endless prep and paperwork, Anjana turns to Agentforce — an agentic layer built on the unified Salesforce platform. With Agentforce, companies can build autonomous AI agents that connect with enterprise data in real time, reason over the details, and take action across workflows, all within trusted compliance guardrails.

Here’s how Agentforce helps Anjana turn time into her strongest asset.

Starting the day with insights instead of spreadsheets

Usually, Anjana’s mornings meant juggling a hundred little tasks: digging through portfolios, cross-checking them against customer goals, and piecing together life events scattered across disconnected systems. Preparing a single briefing could take hours — stealing time from the very conversations that build trust.

Now imagine the same start to her day — but with Agentforce running quietly in the background. Anjana sets up a customised AI agent that handles the prep for her, transforming hours of work into seconds by:

- Consolidating customer accounts, portfolios, and life events into one briefing

- Summarising allocations and highlighting changes since the last interaction

- Offering proactive nudges about expiring products, lapsed conversations, or unusual activity

- Packaging insights into actionable talking points, ready for immediate use

The payoff: Instead of starting the day buried in admin tasks, Anjana uses the time to prepare for her meetings, shifting her focus from chasing details to building trust.

Less scribbling, more listening: Making client conversations actionable with AI

With Agentforce, customer conversations shift from notetaking to decision-making. Earlier, Anjana had to split her focus between listening to the customer, taking notes, remembering tasks, and later spending hours updating the CRM. Important details often got lost, and compliance documentation piled up.

Today, with AI in banking, she can easily:

- Summarise discussions in real time

- Create CRM notes, follow-up tasks, and compliance logs automatically

- Surface contextual cross-sell and upsell suggestions based on the conversation

- Prepare compliance-ready documentation instantly, reducing regulatory risk

The result: meetings end with actions already in motion, records logged securely, and Anjana empowered to strengthen customer relationships.

Turning portfolio reviews into personalised advice sessions

By midday, Anjana is knee-deep in portfolio reviews. With traditional wealth management software, this would have meant scanning allocations, cross-checking recent interactions, and hunting for ideas to bring to the table. The process was slow, limiting how many customers Anjana could serve meaningfully.

With AI for client relationship management, she gets insights already packaged and prioritised. Her AI agent surfaces what matters most in the moment by:

- Showing allocation gaps at a glance with contextual summaries

- Flagging life events automatically (e.g., a customer welcoming a newborn) and linking them to next-best actions

- Recommending timely strategies like protection cover or college funds, tailored to goals

- Creating opportunities and routing them directly into CRM workflows

- Providing grounded answers to product or policy questions instantly

The shift: what used to be a paperwork-heavy review becomes a focused advice session. Less hunting, more human connection.

Solving transaction disputes in minutes

Afternoons are when the toughest calls come in — like a transaction dispute from a high-value customer. For Anjana, these used to be the most stressful moments of the day. Hours would slip away as she hunted through systems for data, cross-checked policy rules, and tried to draft a compliant response — all while the customer grew impatient.

With Agentforce, the process flows seamlessly end-to-end. It:

- Pulls transaction data, rules, and customer context into a single view

- Initiates the chargeback and issues a provisional credit automatically

- Drafts a compliant response email for review

- Keeps a secure audit trail of every step, ensuring transparency and trust

The result: disputes shift from being costly escalations to loyalty-building moments — resolved quickly, logged securely, and handled with context.

Closing the day with clarity, not catch-up

Evenings once meant a long list of mundane tasks for Anjana — drafting notes, updating CRM records, and double-checking compliance long after her customer calls were done.

Agentforce reduces the wrap-up process to a matter of seconds by:

- Compiling relationship snapshots on demand, with customer health, pending actions, and key opportunities

- Flagging next-day priorities proactively, so nothing slips overnight

- Providing at-a-glance productivity insights, from meetings completed to opportunities created

- Automating compliance notes and documentation, removing the admin tasks that once dragged her evenings

The payoff: Anjana can close her day with a quick call to a customer, plan tomorrow with confidence, or simply log off on time — knowing her customers, her book, and her compliance are already covered.

The next chapter in relationship management

Great relationship management has never been about the paperwork — it’s about the trust built in every conversation. Agentforce clears the noise so RMs can focus on what matters most: delivering advice that feels timely, personal, and built for growth.

Explore how relationship managers in the AI era can use Agentforce to deepen customer trust, surface timely insights, automate compliance tasks, and resolve cases faster — all from one intelligent platform.

Drive customer success

with Agentforce