For years, OEMs made most of their money when the vehicle was sold, with service and parts bringing in some steady — but fairly modest — revenue afterwards. Now that vehicles are connected, that model is changing. Software subscriptions and data-driven services are creating entirely new ways to generate value over the full life of the vehicle.

In fact, the market for connected cars in India reached $4.3 billion in 2024 and is projected to grow at nearly 20% annually between 2025 and 2033. Not just that, in a 2025 S&P Global survey, 46% of Indian respondents said they were using a connected car service on a free trial, while 33% reported paying for a subscription.

What started as a luxury feature is now standard, even in compact models. What changed? AI, telematics, and over-the-air (OTA) updates are turning vehicles into intelligent, continuously upgradeable platforms that generate value — and revenue — long after they leave the dealership.

Hardware still matters, but software is what will drive the earnings for original equipment manufacturers (OEMs) over time.

How AI transforms the connected vehicle experience

A connected vehicle generates roughly 25 GB of data every hour. That includes everything from braking patterns on inclines to how often drivers skip songs on long highway stretches. For OEMs, the opportunity is significant — but only if the data can actually be used.

On its own, raw data has limited value. It needs the right platforms to organise and process it. Not to mention AI tools that turn it into insights teams can act on and use to inform real business decisions.

The challenge is getting hardware and software to work together at scale. That’s where partnerships between chipmakers and cloud platforms come in. In early 2023, Salesforce partnered with AWS and Qualcomm to combine hardware with cloud intelligence:

- Qualcomm provides the digital chassis — the computing architecture that handles everything from assisted driving to in-cabin controls through its Snapdragon Ride Flex chipset.

- Amazon Web Services ingests and standardises vehicle and fleet data using AWS IoT FleetWise, so automakers can collect telemetry securely and at scale without custom integrations.

- Salesforce layers in cloud-based software — via Agentforce Automotive — to process vehicle data in real time and personalise the driver experience based on usage patterns.

This matters because it allows automakers to deploy connected features without building the entire technology stack themselves. The hardware collects the data. The hardware gathers the data, the cloud brings it together and stores it, and AI tools analyse it to determine what happens next. Whether that’s notifying a driver about low tyre pressure or recommending a feature trial based on how they actually drive.

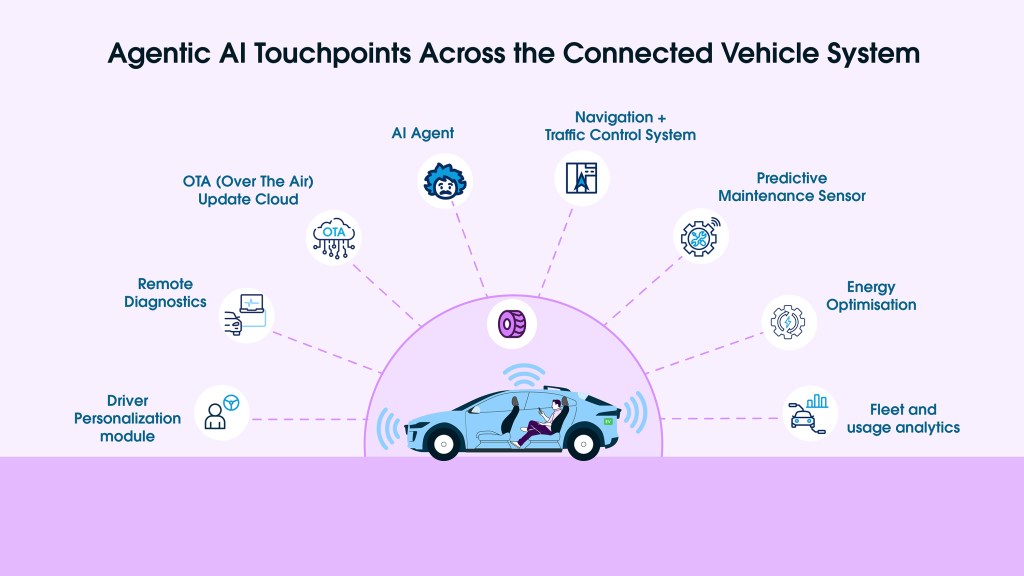

Where Agentic AI fits in connected vehicles

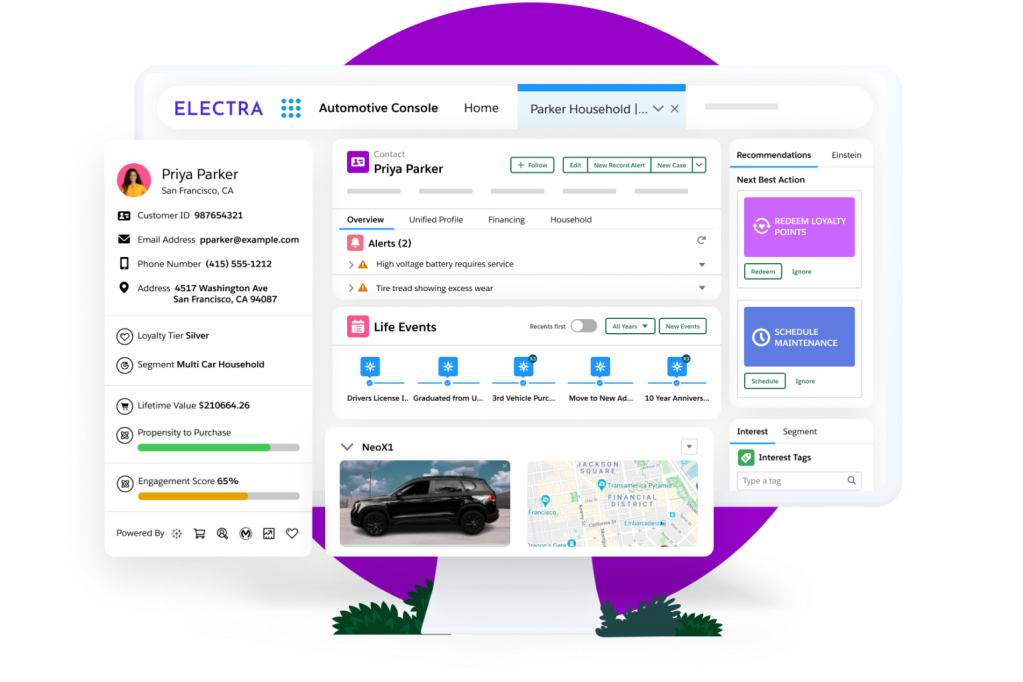

For OEMs, this means knowing how customers use their vehicles, and using that to personalise services and anticipate what they’ll need next. In India, TVS Motor is using Salesforce to unify data from its dealerships, service centres, and vehicles into a 360-degree customer view. This lets them track a buyer’s journey beyond the purchase.

TVS Motors uses integrated customer data to build a connected customer journey.

This intelligence is also speeding up how vehicles improve. Traditionally, meaningful design changes took years of R&D and only reached customers with a new model launch. Today, engineering teams have access to real-world data from millions of drivers operating in real-world conditions.

So, whether it’s designing infotainment systems with smart displays for software-led in-cabin experiences, or building wireless update capabilities in their driver-assistance system, automakers can now deliver improvements to customers in hours through over-the-air (OTA) updates.

What used to take a year (or two) and a next-model refresh now happens in weeks, with automakers responding to actual usage patterns rather than projected ones.

Using AI to turn real-world driving data into predictive experiences

AI doesn’t only benefit automakers, it also changes the driver experience. For example, real-time telematics can alert a driver if tyre pressure drops suddenly or if engine temperature spikes before it becomes a breakdown.

These small, targeted interactions build a sense that the car is paying attention, which over time turns occasional buyers into repeat customers.OEMs in India are already building on this. Ather Energy, which already uses Salesforce to run its dealer network, is now deploying Agentforce to personalise customer journeys and predict customer needs before they become obvious.

Ather Energy uses Agentforce Automotive to create personalised customer journeys to unlock predictive insights.

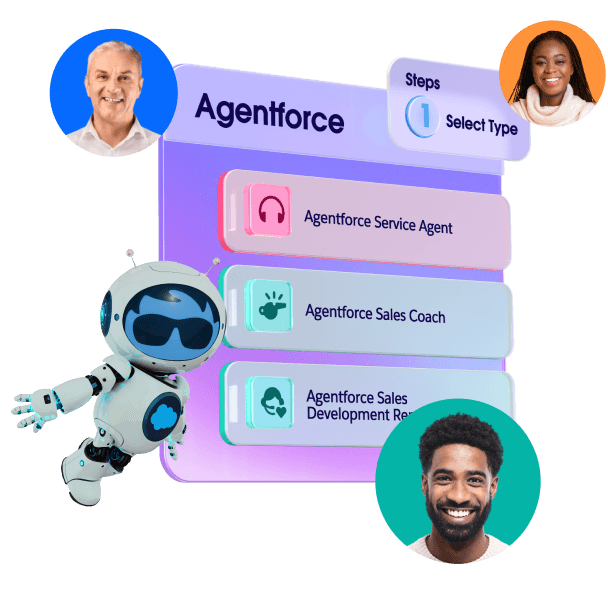

For example, with Agentforce Automotive, automakers can build and deploy AI agents that deliver accurate, reliable information to customers. Let’s say an issue arises with a vehicle. The autonomous agent can proactively notify the driver and schedule a service appointment on their behalf.

Service is also moving in the same direction. AI now tracks everything from tyre wear and battery health to brake condition. These are components that degrade predictably but often go unnoticed until something fails. Instead of reacting to breakdowns, drivers receive maintenance alerts in advance.

This shift from reactive to predictive service cuts downtime, improves safety, and builds trust. This matters because reliability still drives brand loyalty.

From vehicle to ecosystem: Connecting every touchpoint in the automotive system

The real opportunity isn’t in individual features but in connecting them. When AI links data across the customer journey, every interaction becomes more informed:

- Sales teams can tailor financing offers based on actual driving behaviour

- Insurance pricing can reflect real usage rather than broad demographics

- Service can be scheduled before something fails

The car, the app, the dealership, and the service centre stop operating in silos.

Making this work requires infrastructure capable of ingesting data from many sources and making it usable across the automotive ecosystem. That’s where platforms designed for interoperability come in.

Salesforce’s Connected Vehicle app, part of Agentforce Automotive, is built around this bring-your-own-data approach. Automakers aren’t locked into a single data format, vendor, or system. Developed in partnership with Amazon Web Services and Qualcomm, the platform integrates vehicle telemetry, customer data, and retail information from the systems an OEM already uses.

All of this is also built on the Automotive Industry Foundation, which supports standard data formats across the industry, including connected vehicle protocols and dealer lead exchanges.

Predict next steps with unified customer and vehicle data with Agentforce Automotive

India’s connected vehicle advantage for consumers, infrastructure, and execution

India has the fundamentals in place. According to Deloitte’s 2025 Global Automotive Consumer Study:

- 82% view AI integrated in vehicle systems to be beneficial

- 87% of Indian customers consider vehicle-smartphone connectivity important—the highest among surveyed economies

- ~80% are willing to share personal data and pay extra for services like personalised insurance offers, infotainment, and more

The appetite is there, and so is the infrastructure. Smartphone penetration is high, 4G/5G networks are expanding, and EV adoption is climbing.

But consumer readiness is only part of it. India has the largest pool of software engineers globally and an established manufacturing base. The government is also backing this shift. The National Semiconductor Mission, for example, has allocated ₹76,000 crore by 2029 to build chip production capacity.

The implementation layer is also coming together. IT service companies are partnering with cloud solutions — like Wipro with Salesforce — to help OEMs deploy custom connected vehicle platforms.

The question isn’t whether connected vehicles will take off in India. It’s whether Indian OEMs will lead the category. Because the ones building AI-powered connected platforms are securing long-term customer relationships in a market where post-purchase engagement now determines brand loyalty.

The advantage goes to the ones who drive out first.

The Automotive Game Changer’s Guide to Dealership Success

Learn how OEMs can fuel customer delight through connected dealer experiences