Key Takeaways

Distribution reach isn’t what’s holding Indian FMCG companies back anymore. Most brands already have a presence across markets. What slows growth now is execution. The missed store visits, delayed replenishment, wrong orders, and routes that simply don’t scale.

That gap is widening because demand is shifting to places that are harder to serve. Rural India has become the volume engine, growing 8.4% in Q4 FY25 (versus 2.6% in urban markets). Government schemes like MGNREGA are putting steady cash into rural households, increasing purchase frequency beyond staples. But the operating model hasn’t evolved. Systems built for dense urban beats are now expected to serve hundreds of scattered kirana stores.

Software won’t fix this unless they remove the actual constraint. As the Theory of Constraints says, throughput only improves when you address the bottleneck. In FMCG distribution, that bottleneck isn’t simply siloed data or manual work—it’s how fast you can put that data into action.

How retail distribution actually happens in India today

FMCG retail distribution in India runs on fragmented systems, role-based workflows, and slow coordination across the chain. And more often than not, people compensate for disconnected tools and processes.

Sequential handoffs break decisions into pieces

You can optimise each role—better routes for your reps, inventory software for distributors—but performance still lags because the handoffs from A to B are slow.

India’s distribution infrastructure adds another layer of complexity:

- Field reps often operate offline for long stretches in Tier 2 and Tier 3 markets

- Distributors fall back on WhatsApp and phone calls because that’s what works for them

- Kirana stores run on relationships and credit, not workflows or apps

When that’s the reality on the ground, coordination naturally shifts out of systems and onto people.

Visibility doesn’t always mean action

Managers see distributor performance on dashboards, but they can’t act in the moment. Information sits in separate systems with no way to close the loop. A manager flags a stockout risk in a store but can’t see the current inventory. A rep visits a retailer without knowing which schemes are live. Information exists, but it doesn’t translate into action.

The September 2025 GST rate cuts showed this clearly. Companies had to manage pricing transitions across hundreds of thousands of distributors holding stock with old MRPs. Without shared systems, coordination fell back to calls, emails, and WhatsApp. A policy change that should have been straightforward reveals the “coordination maze” brands and distributors navigate in India.

The start of retail distribution 4.0 in India

This isn’t an edge case. It’s becoming the norm—just as the industry enters what the Economic Times calls retail distribution 4.0. According to their analysis:

- General trade’s share is expected to fall from 85–90% today to about 50% by 2030, with kirana stores moving closer to modern trade standards.

- They also predict distributor churn to run at 15–30% annually and sales force attrition to reach 30–40%.

The old model—brands plan, distributors execute—doesn’t hold at this scale. What’s needed is a system where decisions don’t wait for handoffs. You need the ability to act immediately by removing the delay between spotting a problem, communicating it, and fixing it.

5 Smart Strategies to Unlock Retail Distribution Success in India

Get your roadmap to overcoming distribution network-related challenges and unlocking the full potential of your retail business.

How Salesforce removes the real bottleneck in Indian FMCG distribution

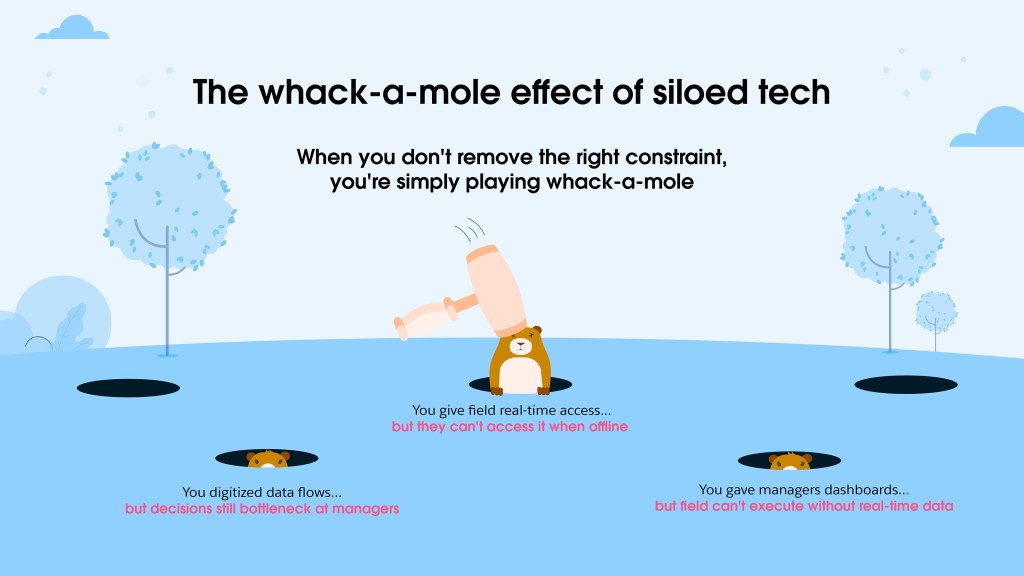

Coming back to the Theory of Constraints mentioned earlier, improving a non-constraint only causes the real constraint to reappear elsewhere. That’s exactly what legacy DMS or ERP software does.

Say your original bottleneck is slow, manual information flow (paper, calls, spreadsheets). Legacy software digitises reporting and transactions. This means:

- The information bottleneck becomes a decision bottleneck: Dashboards now surface issues faster, but only to managers. Reps and distributors still can’t act without instruction. The constraint moves from getting information to waiting for decisions to travel down the hierarchy.

- The decision bottleneck becomes an execution bottleneck: Once decisions are finally communicated, the field can’t respond in time because inventory, schemes, and priorities aren’t synchronised in real time. The constraint shifts again—this time to last-mile execution.

When you don’t remove the actual constraint, you’re playing Whack-a-Mole with different bottlenecks

First blurred mole: You digitised data flows… but decisions still bottleneck at managers

Second blurred mole: You gave managers dashboards… but field reps can’t execute without real-time data

The big mole with hammer: You give field reps real-time access… but they can’t access it when offline.

The whack-a-mole effect: When you optimise around constraints, you’re just moving the problem downstream.

So while things do get digitised, there’s not much improvement because you continue with the “island approach”—optimising around the constraint instead of removing it.

Here’s where Salesforce Consumer Goods Cloud is structurally different. It isn’t a single tool trying to optimise one role or function. It’s a coordinated stack designed to automate and support the entire retail distribution process.

Here’s how each solution hits the constraint directly:

- Data 360 removes the context bottleneck: Distributor inventory, secondary sales, schemes, visits, and exceptions live in one real-time view instead of fragmented systems.

- Agentforce removes the decision bottleneck: Agentforce, the agentic AI layer built on top of Salesforce’s unified platform, both extracts actionable insights and automates routine tasks, so your team can focus on higher-value work.

- Retail Execution removes the field-handoff bottleneck: Sales reps see live priorities, schemes, and actions before and during the visit, not after a review cycle.

- Distributor Management System (DMS) removes the feedback bottleneck: Orders, inventory movements, billing, and fulfilment updates flow back immediately, so the system is synced in real time.

Everything from decision to coordination and execution happens in the same workflow. And that way, the bottleneck is removed rather than shifted.

And the best part is that all of this fits how distribution actually works on the ground in India

Sales managers can see issues and act on them in the same system. Instead of stitching together reports or waiting for end-of-day updates, they can spot issues early, automate hand-offs, and course-correct instantly.

Distributors get a simple, familiar interface with a low learning curve. They can place and track orders, manage outstanding balances, and more without navigating complex menus or workflows. And finally, field reps get an offline mobile app—with AI-generated talking points—that tells them exactly what to do at each store.

So, instead of managing software, your team focuses on strategy and building relationships that matter.

Remove the execution bottleneck—don’t work around it

See how Salesforce Consumer Goods Cloud unifies data, decisions, and execution across managers, reps, and distributors. Watch the demo to see how faster coordination translates into real throughput.