- Fourth Quarter Revenue of $3.60 Billion, up 26% Year-Over-Year, 27% in Constant Currency

- Full Year Revenue of $13.28 Billion, up 26% Year-Over-Year, 26% in Constant Currency

- Unearned Revenue of $8.56 Billion, up 22% Year-Over-Year, 24% in Constant Currency

- Remaining Performance Obligation of Approximately $25.7 Billion, up 25% Year-Over-Year

- Fourth Quarter Operating Cash Flow of $1.33 Billion, up 27% Year-Over-Year

- Full Year Operating Cash Flow of $3.40 Billion, up 24% Year-Over-Year

SAN FRANCISCO, Calif. — Mar. 4, 2019 — Salesforce (NYSE: CRM), the global leader in CRM, today announced results for its fiscal fourth quarter and full fiscal year ended January 31, 2019.

“We had another year of outstanding revenue growth, surpassing $13 billion in revenue faster than any other enterprise software company in history,” said Marc Benioff, chairman and co-CEO, Salesforce. “As companies of all sizes turn to Salesforce, we’re enabling them to put the customer at the center of their digital transformation through our intelligent Customer 360 platform. I’ve never been more excited about the opportunity ahead.”

“Our relentless focus on delivering innovation and customer success has fueled our growth and solidified our leadership in the enterprise,” said Keith Block, co-CEO, Salesforce. “This is just the beginning, which is why we’re now targeting $26 to $28 billion in revenue by FY23 – organically doubling our revenue again in the next four years.”

Salesforce delivered the following results for its fiscal fourth quarter and full fiscal year 2019:

Revenue:

Total fourth quarter revenue was $3.60 billion, an increase of 26% year-over-year, and 27% in constant currency. Subscription and support revenues were $3.38 billion, an increase of 26% year-over-year. Professional services and other revenues were $228 million, an increase of 16% year-over-year.

Full fiscal year 2019 revenue was $13.28 billion, an increase of 26%year-over-year, and 26% in constant currency. Subscription and support revenues were $12.41 billion, an increase of 27% year-over-year. Professional services and other revenues were $869 million, an increase of 12% year-over-year.

Earnings per Share:

Fourth quarter GAAP diluted earnings per share was $0.46, and non-GAAP diluted earnings per share was $0.70. GAAP diluted earnings per share benefited by $0.17 related to the net benefit of tax adjustments. Mark-to-market accounting of the company’s strategic investments, required by ASU 2016-01, benefited GAAP diluted earnings per share by $0.12 based on the US tax rate of 25% and non-GAAP diluted earnings per share by $0.12 based on our non-GAAP tax rate of 21.5%.

For fiscal year 2019, GAAP diluted earnings per share was $1.43, and non-GAAP diluted earnings per share was $2.75. Mark-to-market accounting of the company’s strategic investments, required by ASU 2016-01, benefited GAAP diluted earnings per share by $0.52 based on the US tax rate of 25% and non-GAAP diluted earnings per share by $0.55 based on our non-GAAP tax rate of 21.5%.

Cash:

Cash generated from operations for the fourth quarter was $1.33 billion, an increase of 27% year-over-year. Cash generated from operations for the full fiscal year 2019 was $3.40 billion, an increase of 24% year-over-year. Total cash, cash equivalents and marketable securities ended the fourth quarter at $4.34 billion.

Remaining Performance Obligation:

Remaining performance obligation, representing future revenues that are under contract but have not yet been recognized, ended the fourth quarter at approximately $25.7 billion, an increase of 25% year-over-year. This includes approximately $450 million related to the remaining performance obligation from MuleSoft. Current remaining performance obligation, which represents the future revenues under contract expected to be recognized over the next 12 months, ended the fourth quarter at approximately $11.9 billion, an increase of 24% year-over-year.

Unearned Revenue:

Unearned revenue on the balance sheet as of January 31, 2019 was $8.56 billion, an increase of 22% year-over-year, and 24% in constant currency.

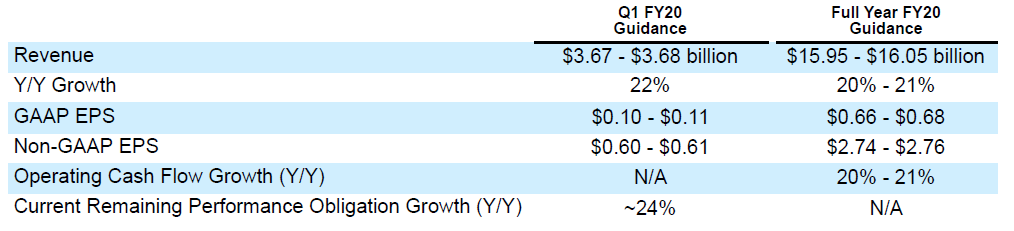

As of March 4, 2019, the company is initiating revenue, earnings per share and current remaining performance obligation growth guidance for its first quarter of fiscal year 2020. For the full fiscal year 2020, the company is raising its revenue guidance previously provided November 27, 2018, and is initiating earnings per share guidance and operating cash flow growth guidance. The guidance below assumes no change to the value of our strategic investment portfolio resulting from ASU 2016-01 as it is not possible to forecast future gains and losses. While historically our investment portfolio has had a positive impact on our financial results, that may not be true for future periods, particularly in periods of significant market fluctuations that affect the publicly traded companies within our strategic investment portfolio. The impact of future gains or losses from our strategic portfolio could be material. In addition, the guidance below is based on estimated GAAP tax rates that reflect the company’s currently available information, and exclude discrete tax items such as excess tax benefits from stock-based compensation. The GAAP tax rates may fluctuate due to future acquisitions or other transactions.

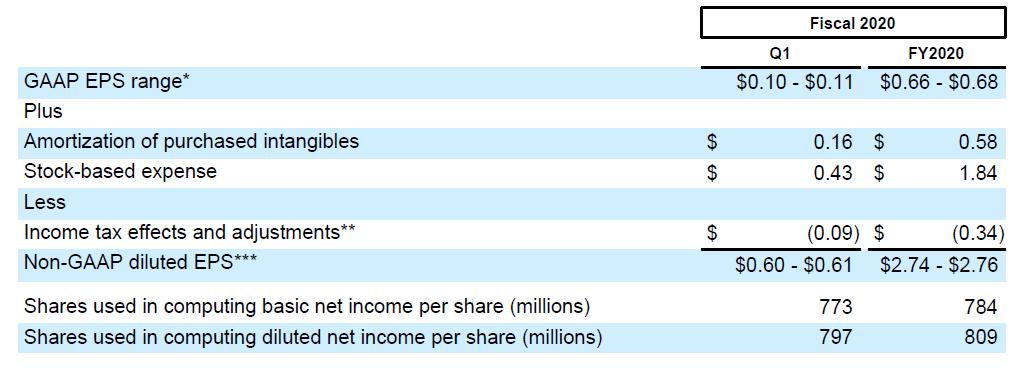

The following is a per share reconciliation of GAAP diluted earnings per share to non-GAAP diluted earnings per share guidance for the next quarter and the full year:

** The company’s non-GAAP tax provision uses a long-term projected tax rate of 22.5%, which reflects currently available information and could be subject to change.

*** The company’s projected non-GAAP basic and diluted EPS assumes no change to the value of our strategic investment portfolio resulting from ASU 2016-01 as it is not possible to forecast future gains and losses.

For additional information regarding non-GAAP financial measures see the reconciliation of results and related explanations below.

Quarterly Conference Call

Salesforce will host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) today to discuss its financial results with the investment community. A live web broadcast of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor. A live dial-in is available domestically at 866-901-SFDC or 866-901-7332 and internationally at 706-902-1764, passcode 9678599. A replay will be available at (800) 585-8367 or (855) 859-2056 until midnight (ET) April 3, 2019.

###

“Safe harbor“ statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements about our financial results, which may include expected GAAP and non-GAAP financial and other operating and non-operating results, including revenue, net income, diluted earnings per share, operating cash flow growth, operating margin improvement, expected revenue growth, expected tax rates, stock-based compensation expenses, amortization of purchased intangibles, amortization of debt discount and shares outstanding. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the company’s results could differ materially from the results expressed or implied by the forward-looking statements we make.

The risks and uncertainties referred to above include — but are not limited to — risks associated with the effect of general economic and market conditions; the impact of geopolitical events; the impact of foreign currency exchange rate and interest rate fluctuations on our results; our business strategy and our plan to build our business, including our strategy to be the leading provider of enterprise cloud computing applications and platforms; the pace of change and innovation in enterprise cloud computing services; the competitive nature of the market in which we participate; our international expansion strategy; our service performance and security, including the resources and costs required to prevent, detect and remediate potential security breaches; the expenses associated with new data centers and third-party infrastructure providers; additional data center capacity; real estate and office facilities space; our operating results and cash flows; new services and product features; our strategy of acquiring or making investments in complementary businesses, joint ventures, services, technologies and intellectual property rights; the performance and fair value of our investments in complementary businesses through our strategic investment portfolio; our ability to realize the benefits from strategic partnerships, joint ventures and investments; our ability to successfully integrate acquired businesses and technologies; our ability to continue to grow unearned revenue and remaining performance obligation; our ability to protect our intellectual property rights; our ability to develop our brands; our reliance on third-party hardware, software and platform providers; our dependency on the development and maintenance of the infrastructure of the Internet; the effect of evolving domestic and foreign government regulations, including those related to the provision of services on the Internet, those related to accessing the Internet, and those addressing data privacy, cross-border data transfers and import and export controls; the valuation of our deferred tax assets and the release of related valuation allowances; the potential availability of additional tax assets in the future; the impact of new accounting pronouncements and tax laws; uncertainties affecting our ability to estimate our tax rate; the impact of future gains or losses from our strategic investment portfolio, including gains or losses from overall market conditions which may affect the publicly traded companies within our strategic investment portfolio; the impact of expensing stock options and other equity awards; the sufficiency of our capital resources; factors related to our outstanding debt, revolving credit facility, term loan and loan associated with 50 Fremont; compliance with our debt covenants and capital lease obligations; current and potential litigation involving us; and the impact of climate change.

Further information on these and other factors that could affect the company’s financial results is included in the reports on Forms 10-K, 10-Q and 8-K and in other filings we make with the Securities and Exchange Commission from time to time. These documents are available on the SEC Filings section of the Investor Information section of the company’s website at www.salesforce.com/investor.

Salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

© 2019 salesforce.com, inc. All rights reserved. Salesforce and other marks are trademarks of salesforce.com, inc. Other brands featured herein may be trademarks of their respective owners.

###

Non-GAAP Financial Measures: This press release includes information about non-GAAP diluted earnings per share, non-GAAP tax rates and constant currency revenue and constant currency unearned revenue growth rates (collectively the “non-GAAP financial measures”). These non-GAAP financial measures are measurements of financial performance that are not prepared in accordance with U.S. generally accepted accounting principles and computational methods may differ from those used by other companies. Non-GAAP financial measures are not meant to be considered in isolation or as a substitute for comparable GAAP measures and should be read only in conjunction with the company’s consolidated financial statements prepared in accordance with GAAP. Management uses both GAAP and non-GAAP measures when planning, monitoring, and evaluating the company’s performance.

The primary purpose of using non-GAAP measures is to provide supplemental information that may prove useful to investors and to enable investors to evaluate the company’s results in the same way management does. Management believes that supplementing GAAP disclosure with non-GAAP disclosure provides investors with a more complete view of the company’s operational performance and allows for meaningful period-to-period comparisons and analysis of trends in the company’s business. Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the company’s relative performance against other companies that also report non-GAAP operating results.

Non-GAAP diluted earnings per share excludes, to the extent applicable, the impact of the following items: stock-based compensation, amortization of acquisition-related intangibles, and previously the net amortization of debt discount on the company’s convertible senior notes, as well as income tax adjustments. These items are excluded because the decisions that give rise to them are not made to increase revenue in a particular period, but instead for the company’s long-term benefit over multiple periods.

Specifically, management is excluding the following items from its non-GAAP earnings per share, as applicable, for the periods presented in the Q4 FY19 financial statements and for its non-GAAP estimates for Q1 and FY20:

- Stock-Based Expenses: The company’s compensation strategy includes the use of stock-based compensation to attract and retain employees and executives. It is principally aimed at aligning their interests with those of our stockholders and at long-term employee retention, rather than to motivate or reward operational performance for any particular period. Thus, stock-based compensation expense varies for reasons that are generally unrelated to operational decisions and performance in any particular period.

- Amortization of Purchased Intangibles: The company views amortization of acquisition-related intangible assets, such as the amortization of the cost associated with an acquired company’s research and development efforts, trade names, customer lists and customer relationships, and in some cases, acquired lease intangibles, as items arising from pre-acquisition activities determined at the time of an acquisition. While these intangible assets are continually evaluated for impairment, amortization of the cost of purchased intangibles is a static expense, one that is not typically affected by operations during any particular period.

- Gains on Strategic Investments, net: Upon the adoption of Accounting Standards Update 2016-01 on February 1, 2018, the company is required to record all fair value adjustments to its equity securities held within the strategic investment portfolio through the statement of operations. As it is not possible to forecast future gains and losses, the company assumes no change to the value of its strategic investment portfolio in its GAAP and non-GAAP estimates for future periods.

- Income Tax Effects and Adjustments: The company utilizes a fixed long-term projected non-GAAP tax rate in order to provide better consistency across the interim reporting periods by eliminating the effects of items such as changes in the tax valuation allowance and tax effects of acquisition-related costs, since each of these can vary in size and frequency. When projecting this long-term rate, the company evaluated a three-year financial projection that excludes the direct impact of the following non-cash items: stock-based expenses, amortization of purchased intangibles, and previously the amortization of debt discount. The projected rate also assumes no new acquisitions in the three-year period, and considers other factors including the company’s expected tax structure, its tax positions in various jurisdictions and key legislation in major jurisdictions where the company operates. For fiscal 2019, the company used a projected non-GAAP tax rate of 21.5 percent. For fiscal 2020, the company uses a projected non-GAAP tax rate of 22.5 percent, which reflects currently available information, as well as other factors and assumptions. The non-GAAP tax rate could be subject to change for a variety of reasons, including the rapidly evolving global tax environment, significant changes in the company’s geographic earnings mix including due to acquisition activity, or other changes to the company’s strategy or business operations. The company will re-evaluate its long-term rate as appropriate.

About Salesforce

Salesforce helps organizations of any size become agentic enterprises - integrating humans, agents, apps, and data on a trusted, unified platform to unlock unprecedented growth and innovation.

Visit www.salesforce.com for more information.