Salesforce Reports Record First Quarter Fiscal 2026 Results Exceeds Guidance Across All Metrics; cRPO up 12% Y/Y

SAN FRANCISCO, CA — May 28, 2025 – Salesforce (NYSE: CRM), the world’s #1 AI CRM, today announced results for its first quarter fiscal 2026 ended April 30, 2025.

Results

- First quarter revenue of $9.8 billion, up 8% both year-over-year (“Y/Y”) and in constant currency (“CC”)

- First quarter subscription & support revenue of $9.3 billion, up 8% Y/Y and 9% in CC

- Current remaining performance obligation of $29.6 billion, up 12% Y/Y and 11% in CC

- First quarter GAAP operating margin of 19.8% and non-GAAP operating margin of 32.3%

- First quarter operating cash flow of $6.5 billion, up 4% Y/Y, and free cash flow of $6.3 billion, up 4% Y/Y

- Returned $3.1 billion to shareholders, including $2.7 billion in share repurchases and $402 million in dividends

“We delivered strong Q1 results and are raising our guidance by $400 million to $41.3 billion at the high end of the range,” said Marc Benioff, Chair and CEO, Salesforce. “We’ve built a deeply unified enterprise AI platform—with agents, data, apps, and a metadata platform—that is unmatched in the industry. With Agentforce, Data Cloud, our Customer 360 apps, Tableau, and Slack all built on one trusted, unified foundation, companies of every size can build a digital labor force—boosting productivity, reducing costs, and accelerating growth. And, with our agreement to acquire Informatica, we will bring together the industry’s leading AI CRM and AI-powered MDM and ETL platform to create the most complete, intelligent AI and data platform for the enterprise.”

“I’m pleased by our momentum as we capitalize on the exciting agentic AI opportunity,” said Robin Washington, President and Chief Operating and Financial Officer, Salesforce. “Our Q1 performance reflects solid execution, driven by our continued focus on innovation, operational excellence, and maximizing value for our customers and shareholders.”

Business Highlights

- Data Cloud and AI annual recurring revenue over $1 billion, up more than 120% Y/Y

- Nearly 60% of Q1 top 100 deals included Data Cloud and AI

- Salesforce has closed over 8,000 deals since launching Agentforce, of which half are paid

- On help.salesforce.com, Agentforce has handled over 750,000 requests, cutting case volume by 7% Y/Y

- Data Cloud ingested 22 trillion records in Q1, up 175% Y/Y

- More than half of Salesforce’s Q1 Top 100 Deals included 6+ Clouds

Guidance

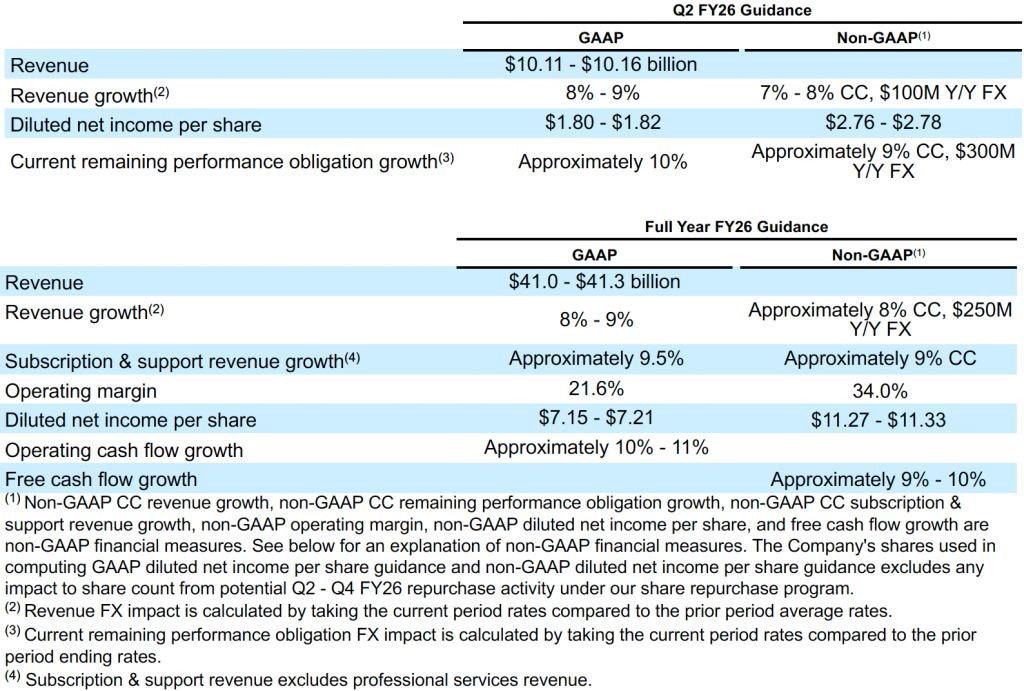

Yesterday, Salesforce announced that the Company signed a definitive agreement to acquire Informatica Inc. There is no anticipated impact to Salesforce’s FY26 guidance as a result of this transaction based on the expected close timing in early FY27.

With the U.S. dollar weakening in Q1, Salesforce now expects a currency tailwind for the business. This tailwind has been incorporated into the Company’s updated FY26 guidance

- Initiates second quarter FY26 revenue guidance of $10.11 billion to $10.16 billion, up 8% – 9% Y/Y and 7% – 8% in CC

- Raises full year FY26 revenue guidance to $41.0 billion to $41.3 billion, up 8% – 9% Y/Y and 8% in CC

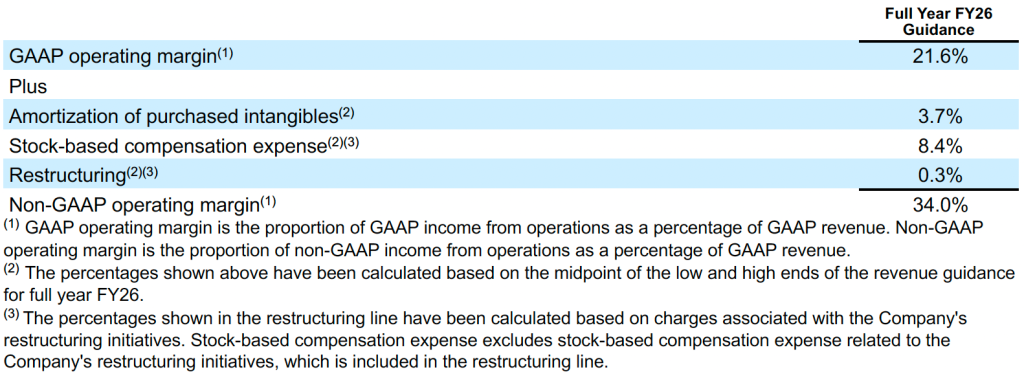

- Maintains full year FY26 GAAP operating margin guidance of 21.6%, and non-GAAP operating margin guidance of 34.0%

- Maintains full year FY26 operating cash flow growth guidance of approximately 10% to 11% Y/Y

Salesforce’s guidance includes GAAP and non-GAAP financial measures. The following tables summarize Salesforce’s guidance for the second quarter fiscal 2026 and full-year fiscal 2026:

The following is a reconciliation of GAAP operating margin guidance to non-GAAP operating margin guidance for the full year:

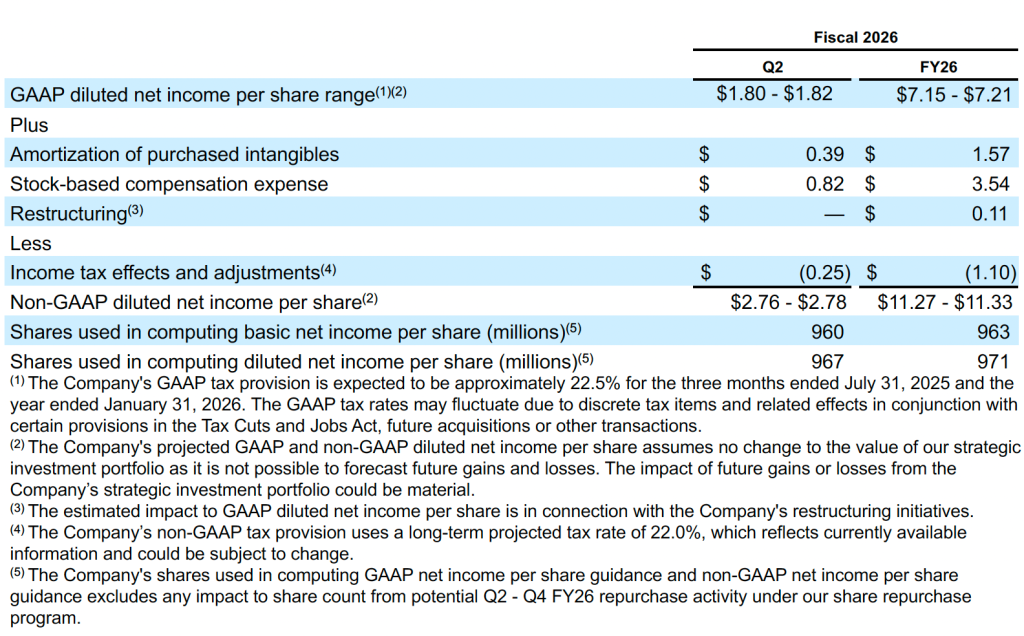

The following is a per share reconciliation of GAAP diluted net income per share to non-GAAP diluted net income per share guidance for the next quarter and the full year:

For additional information regarding non-GAAP financial measures see the reconciliation of results and related explanations below.

Management will provide further commentary around these guidance assumptions on its earnings call.

Product Releases and Enhancements

Salesforce releases major updates for our core platform and apps three times a year, with additional updates happening regularly across our portfolio. These releases are a result of significant research and development investments made over multiple years, and are designed to help customers drive cost savings, boost efficiency, and build trust.

Robin Washington, President and Chief Operating and Financial Officer, along with product leaders, will participate in a Q1 FY26 Product and Innovation Overview webinar on Thursday, May 29, 2025, at 10:00 AM PT / 1:00 PM ET. A live webcast and replay details of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor.

Learn more about our newest innovations and product release highlights, including our latest Spring 2025 Product Release, see FY26 Q1 Product Releases and Announcements and see our latest major release.

Environmental, Social, and Governance (ESG) Strategy

To learn more about our latest initiatives and priorities, review our recently published Stakeholder Impact Report at https://salesforce.com/stakeholder-impact-report.

Quarterly Conference Call

Salesforce plans to host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss its financial results with the investment community. A live webcast and replay details of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor.

About Salesforce

Salesforce helps organizations of any size become agentic enterprises - integrating humans, agents, apps, and data on a trusted, unified platform to unlock unprecedented growth and innovation.

Visit www.salesforce.com for more information.