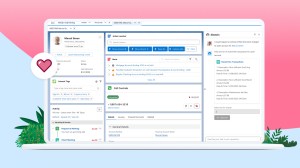

TD Wealth® has tapped Salesforce Financial Services Cloud (FSC) to help advisors automate and quicken client account openings and onboarding with a unified, predictive intelligence console that provides teams with insights and recommendations, such as next best actions and life event alerts.

Why it’s important: Since its integration with Salesforce, TD Wealth® has seen an increase in productivity, helping advisors increase their sales volume by more than 18%.

What’s the impact: TD chose Salesforce because of its ability to connect disparate systems and data. Before its implementation with Salesforce, TD colleagues were using over 60 different applications and systems that were not connected, causing headaches for advisors and slowdowns for clients. With Salesforce, TD addressed key friction points for advisors across sales, onboarding, and services with automated workflows.

- With FSC, TD has eliminated the need to switch between different systems and automated many workflows to provide a more streamlined experience across lines of business. This helps to enhance worker productivity and improve the client experience.

- Now, TD Wealth Advisors can onboard clients and eliminate re-entering client information, making the client account opening process more efficient.

- Advisors have realized the benefits of leveraging integration and automation to augment their work, and as a result, TD reported an adoption rate of 75% among employees.

- TD was also able to streamline cross-selling efforts between retail banking and wealth channels by improving communication and enabling efficient, secure record-keeping of client data.

The customer perspective: “Frontline teams have gained so much time back from automation of a previously manual process. Now, instead of jumping from one system to another, our advisors and sales teams are using Salesforce Financial Services Cloud for one unified view of their clients, and are able to quickly pull insights and recommendations, servicing them quicker than ever before.” – Ken Thompson, Head of Shared Services, TD Wealth®

Now, instead of jumping from one system to another, our advisors and sales teams are using Salesforce Financial Services Cloud for one unified view of their clients, and are able to quickly pull insights and recommendations, servicing them quicker than ever before.

Ken Thompson, TD Wealth

The Salesforce perspective: “Many wealth management firms struggle with disjointed legacy systems. Firms like TD are now leveraging Salesforce and Financial Services Cloud as a unified platform to accelerate advisor productivity, streamline complex business processes, and align their front, middle, and back office for a consistent user experience and set of workflows.” – Michelle Feinstein, VP and GM of Wealth & Asset Management, Salesforce

Explore more: Learn how Salesforce helps financial service institutions automate processes to drive efficiencies

Disclosure

TD Wealth® is a business of TD Bank, N.A., (TD Bank), member FDIC. Banking, investment and trust services are available through TD Bank. Securities and investment advisory products are available through TD Private Client Wealth LLC (TDPCW), a US Securities and Exchange Commission registered investment adviser and member FINRA/SIPC. Epoch Investment Partners, Inc. (Epoch) is a US Securities and Exchange Commission registered investment adviser that provides investment management services to TD Wealth. TD Bank, TDPCW and Epoch are affiliates.