88% of UK CG leaders believe AI agents will be essential to compete within two years

2025 is proving to be one of the toughest years for consumer goods companies, according to Salesforce’s new Consumer Goods Industry Insights Report. Weak consumer confidence, increasingly complex routes to market, softening returns from traditional revenue boosting strategies, and macroeconomic changes, all threaten to squeeze margins. Perhaps unsurprisingly, 57% of UK CG leaders say profitable growth will be tougher to achieve this year.

In response, leaders are betting big on AI. Nearly 9 in 10 believe AI agents — a type of AI that can act autonomously without human oversight — will be essential to compete within two years, and 80% expect them to directly boost sales.

“There are a lot of financial pressures on our consumers. The more efficient we can be with our operations, the better,” said Dave Dohnalik, SVP, Technology Strategy & Enterprise Solutions at PepsiCo. “Regardless of the complexity of the go-to-market mosaic, we’re really looking for that digital channel enablement and retailer experience to come to life through our relationship with Salesforce.”

Economic policy shifts impact CG leaders

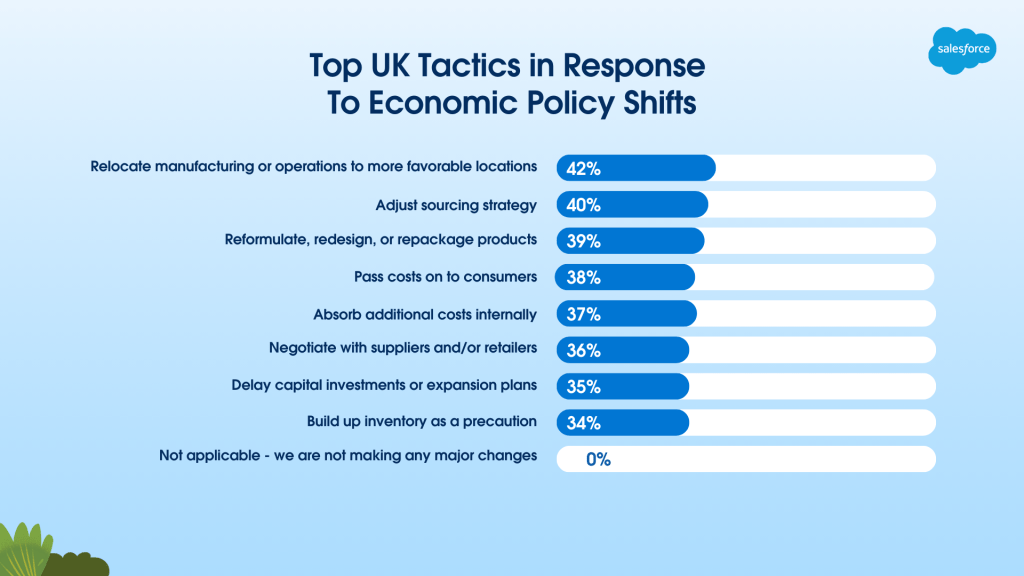

- Of the many forces weighing on margins, all UK CG leaders (100%) cite exposure to economic policy shifts, such as tariffs, which are impacting sourcing, operations, and margins.

- In response, companies are adjusting sourcing strategies, repackaging products, or relocating operations.

- “AI’s ability to accelerate and augment our efforts is crucial amid change,” says Michelle Grant, Director RCG Insights at Salesforce. “Whether companies are adjusting sourcing strategies, negotiating with suppliers, or absorbing additional costs, AI can analyse demand patterns to optimise which products to prioritize, guide field teams on retail execution strategies, and predict demand more accurately so brands make smarter decisions across all these tactics.”

CG leaders turn to AI — including AI agents — for growth, efficiency, and innovation

- Despite external pressures, CG leaders in the UK are most focused on AI, citing it as both their #1 challenge and #1 opportunity this year.

- They expect autonomous agents to be indispensable by 2027:

- 88% of UK CG leaders believe AI agents will be essential to compete within two years.

- 87% expect their companies to increasingly invest in AI agents.

- 80% of UK CG leaders believe AI agents will help their company increase sales.

- Beyond revenue growth, UK CG leaders expect AI agents to help with creative work, too — from trade promotion creation and optimisation to new product development — positioning AI as a profitability and innovation engine.

- Interestingly, UK survey respondents rank product innovation as their second-highest opportunity after AI, whereas globally it ranks only fifth.

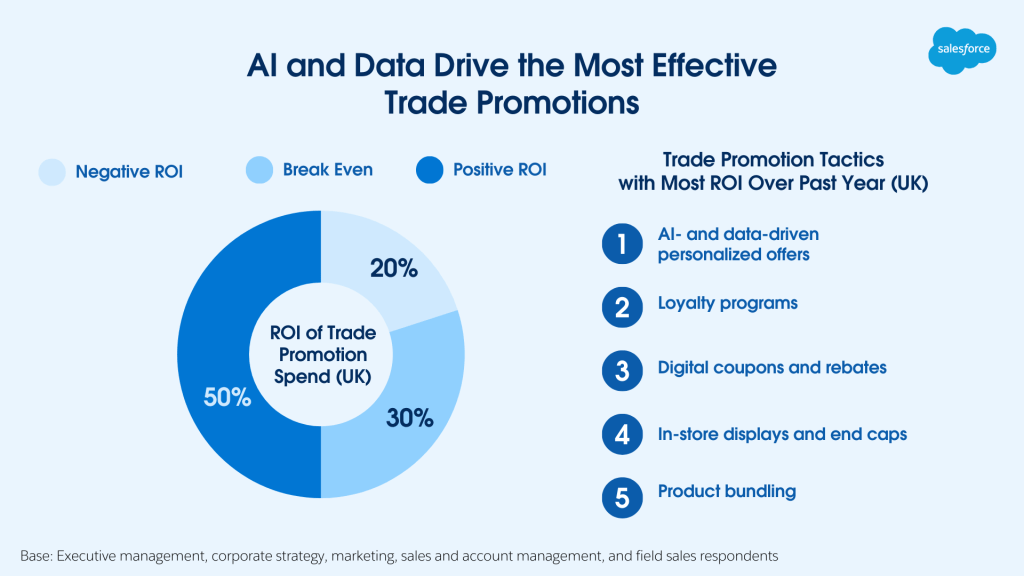

Traditional trade promotion profitability plateaus, but AI-driven personalisation is a bright spot

- Trade promotions are one of the biggest expenses in consumer goods, yet only 50% deliver a positive ROI in the UK – a figure that hasn’t budged for years.

- While vital for competing in-store and driving sales, trade promotions’ steep costs and uneven returns suggest traditional tactics may have hit their limits.

- Newer tactics, like AI- and data-driven personalised offers, deliver the strongest results of any trade promotion tactic.

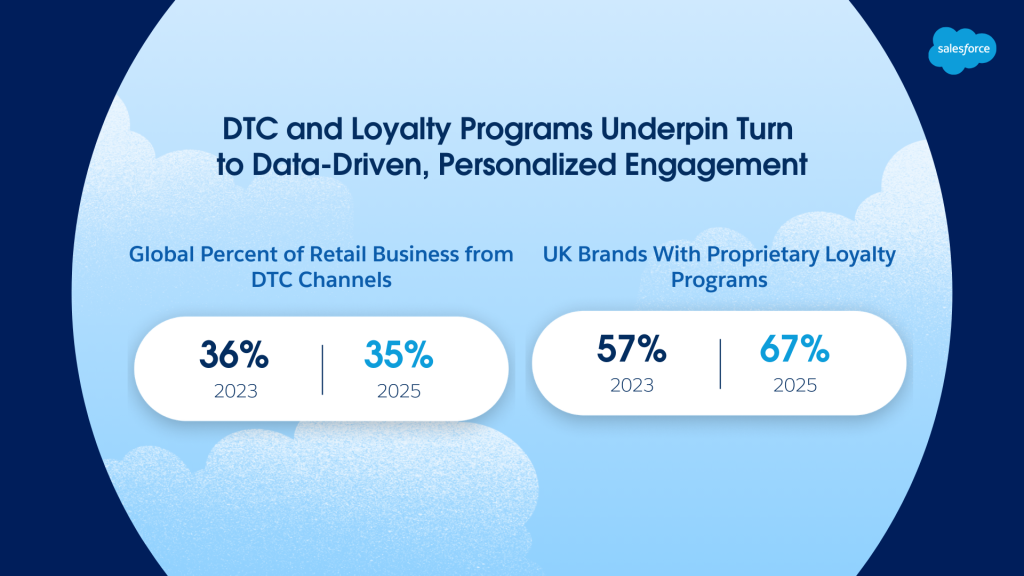

With Direct-To-Consumer (DTC) and loyalty momentum slowing, leaders are investing more in personalised digital offers and social media spend

- After years of chasing growth through DTC channels and loyalty programs, consumer goods leaders find DTC levers reaching a ceiling.

- 59% of UK CG leaders say it’s harder than ever to maintain consumer loyalty, with 74% of consumers worldwide switching brands in the past year.

- Despite slowing loyalty, UK brands with proprietary programs have increased 10% since 2023 — in sharp contrast to a 17% decline in the US.

- As customer journeys splinter across more channels than ever, brands are turning to personalisation, social media, and AI to better connect with customers wherever they are.

- UK companies are boosting spend across social (58%) and digital ads (48%), signaling a broader push to meet consumers where they are to drive growth.

- 71% of UK CG leaders are investing more in personalisation.

“In 2025, price hikes, blanket promotions, and standard assortments can’t guarantee growth. Winning now means precision: using data, strategic trade promotions, and agentic AI to turn every step from the factory to the shopper into a revenue generating opportunity.” said Michelle Grant, Director RCG Insights at Salesforce.

Explore further:

- Read the full Consumer Goods Industry Insights Report

- Learn more about Salesforce Consumer Goods Cloud

- Find more insights on the Salesforce Stat Library

Methodology

Data is from a double-anonymous survey of 200 consumer goods industry decision makers in Australia, Brazil, Canada, France, Germany, India, Italy, Japan, Mexico, France, Spain, United Kingdom. The survey was conducted from May 1 to June 12, 2025. All respondents are third-party panelists. Additional information can be found in the report.