The 4Cs: Customer, Competition, Channels, and Cost For India’s Telecom Sector

As the competition in India’s telecom sector heats up, here’s how communication service providers can win new customers, improve engagement, and optimise costs.

Deepak Sabharwal

COVID-19 has pushed Indian telcos to evolve into ‘techcos’. Their focus is no longer just on providing seamless network connectivity, but also on reimagining the way their services are delivered, purchased, and accessed.

India has multiple players in the telecom space that can be broadly categorised as follows:

- Mobility service providers: These companies are capitalising on 4G and upcoming 5G technologies to deliver wireless voice and data services. Many are also looking to wow customers with 100% digital experiences delivered through chatbots, omni-channel customer support, and self-service mobile subscription management apps.

- DTH providers: Direct-to-home (DTH) operators in India face fierce competition from OTT companies like Netflix. To remain relevant, they will have to innovate and adapt.

- Residential broadband and value-added service providers: Their focus is on selling fibre-based internet and streaming service packages. Now that more people are working from home, there is a huge demand for high-speed broadband services. Customers expect a simple ordering, payment, and installation experience, as well as accelerated service delivery.

- SMB-based service providers: India offers fertile ground for small and medium sized businesses to grow and thrive. These companies are looking to telcos for connectivity and communications services, as well as value-added offerings like IoT connectivity, enterprise mobility, and SaaS.

- Tower infrastructure providers: These providers are actively exploring IT ecosystems that can help them digitalise tower management processes, and streamline costs. They’re also paying more attention to lowering energy consumption, reporting transparently on their carbon footprint, and developing more sustainably. .

- Global connectivity service providers: To increase their revenue, global connectivity service providers are striving to become more lean and efficient. However, they’re often hampered by (1) product, process, and IT complexity which delays time-to-market and frustrates customers, (2) a lack of digital self-service tools for customers , and (3) inefficient processes for sales quotations, contracts, order management, and fulfilment.

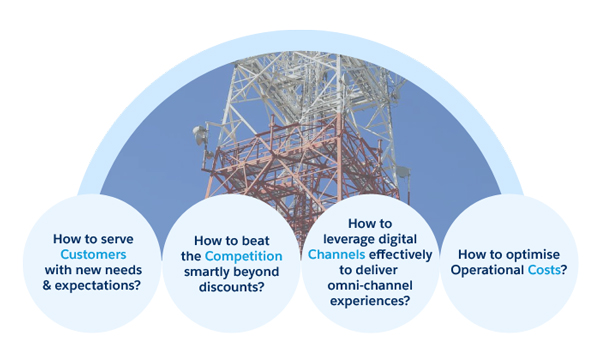

What’s apparent across all the above communication service providers (CSPs) is the intent to redefine business models, reduce complexity, drive automation, and deliver more business value. Competition within the sector is no longer just about price, but also about customer experience, flexibility, and operational ease.

To win more business, CSPs will need to re-strategise, focusing on the 4Cs- Customers, Competition, Channels, and Cost.

Capitalising on the 4Cs to transform and grow

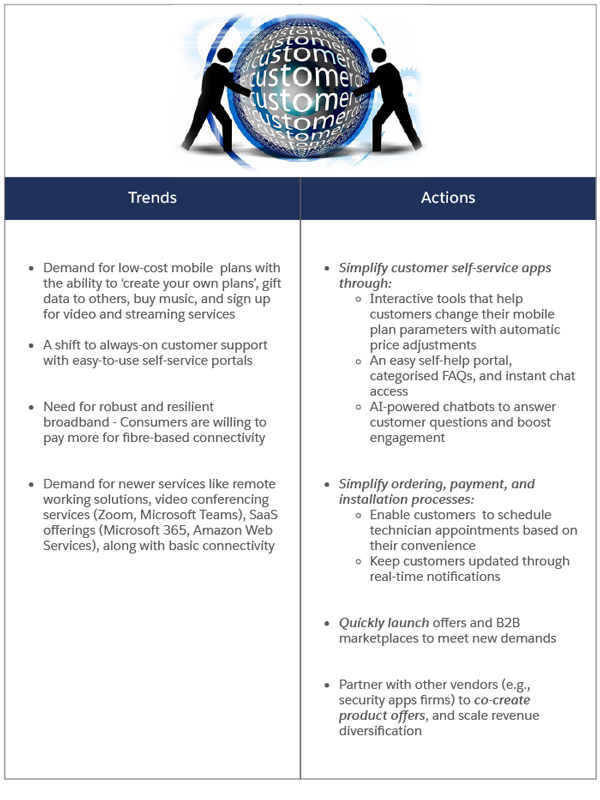

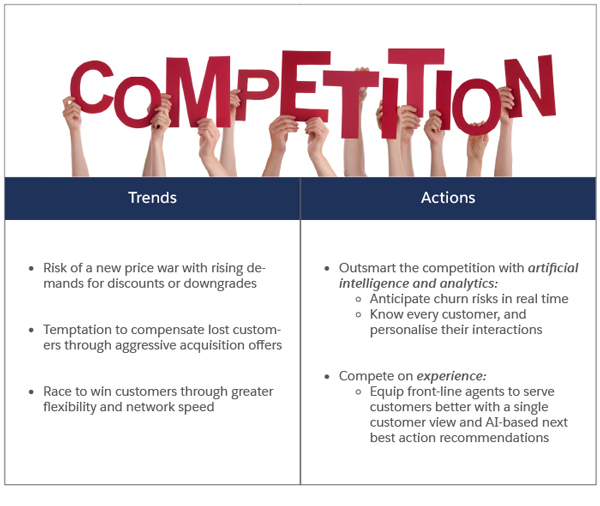

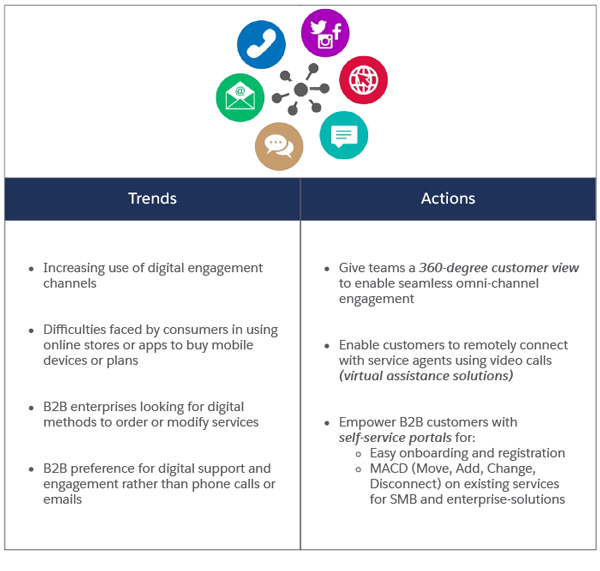

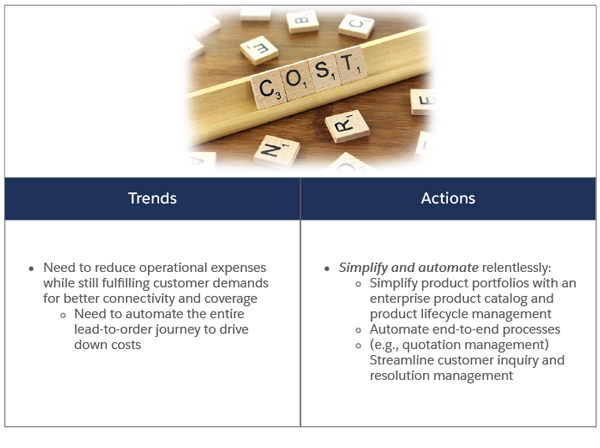

Here’s a look at the trends in each of the 4Cs, along with some actions that CSPs can take to remain relevant and successful.

Customers

Competition

Channels

Cost

How Salesforce can help

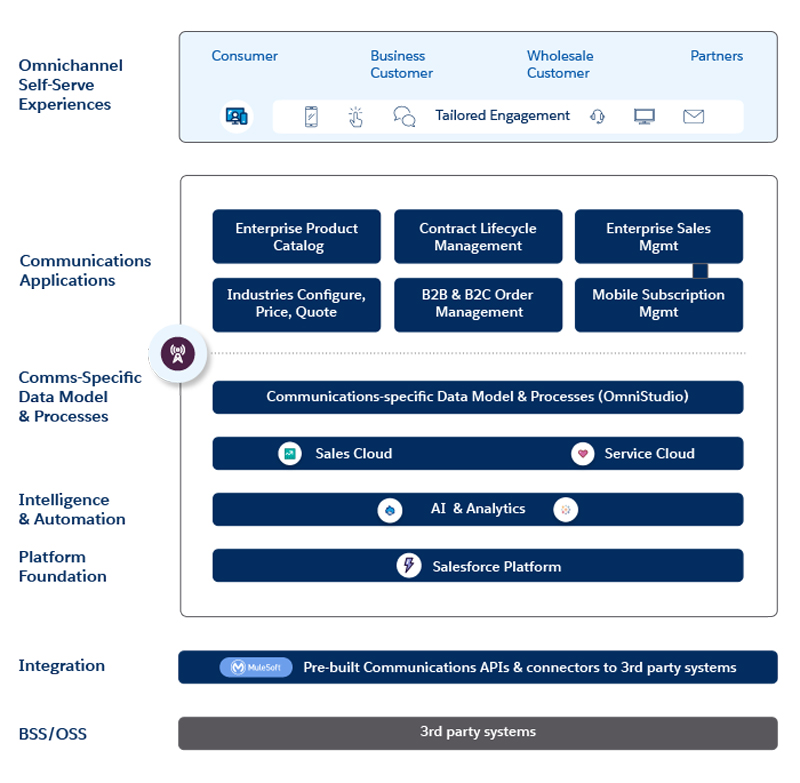

Salesforce empowers CSPs to reinvent their business across all the 4Cs. Through Salesforce Communications Cloud, CSPs can unify their entire organisation around the customer. So everyone – ranging from the call centre, to the sales team – gets a shared, single view of their subscribers, customers, and partners across B2C and B2B channels.

Communications Cloud applications have been built on TM Forum and MEF industry standards, and are engineered to integrate flexibly with third-party systems.

Here are some of the benefits that Communications Cloud offers across the four Cs:

- Create digital-first customer experiences characterised by omni-channel interactions across sales and services

- Deliver personalised and intelligent customer service, transforming your service organisation from a cost centre to a revenue-generating powerhouse

- Launch products (B2C/B2B) faster through a catalog-driven approach and a TM Forum aligned data model

- Launch a B2B2X marketplace where partners can bring their own products and services, and co-sell them with your connectivity-based products

- Enable service agents to gauge subscriber sentiment with an intelligent snapshot of customer interactions and KPIs

- Recommend the right services and products with next best action recommendations

- Streamline the quote-to-order process for internal sales teams, partners, and end customers through guided journeys with real-time price updates

- Standardise and automate quote and order document generation with pre-approved templates

- Streamline the process of authoring, negotiating, approving, executing, and activating commercial agreements, while also ensuring compliance with pricing and terms