Earnings

Salesforce Announces Strong Fourth Quarter and Full Year Fiscal 2021 Results Raises FY22 Revenue Guidance to $25.65 Billion to $25.75 Billion

- Fourth Quarter Revenue of $5.82 Billion, up 20% Year-Over-Year, 19% in Constant Currency

- FY21 Revenue of $21.25 Billion, up 24% Year-Over-Year, 24% in Constant Currency

- Current Remaining Performance Obligation of Approximately $18.0 Billion, up 20% Year-Over-Year, 18% in Constant Currency

- FY21 GAAP Operating Margin of 2.1% and Non-GAAP Operating Margin of 17.7%

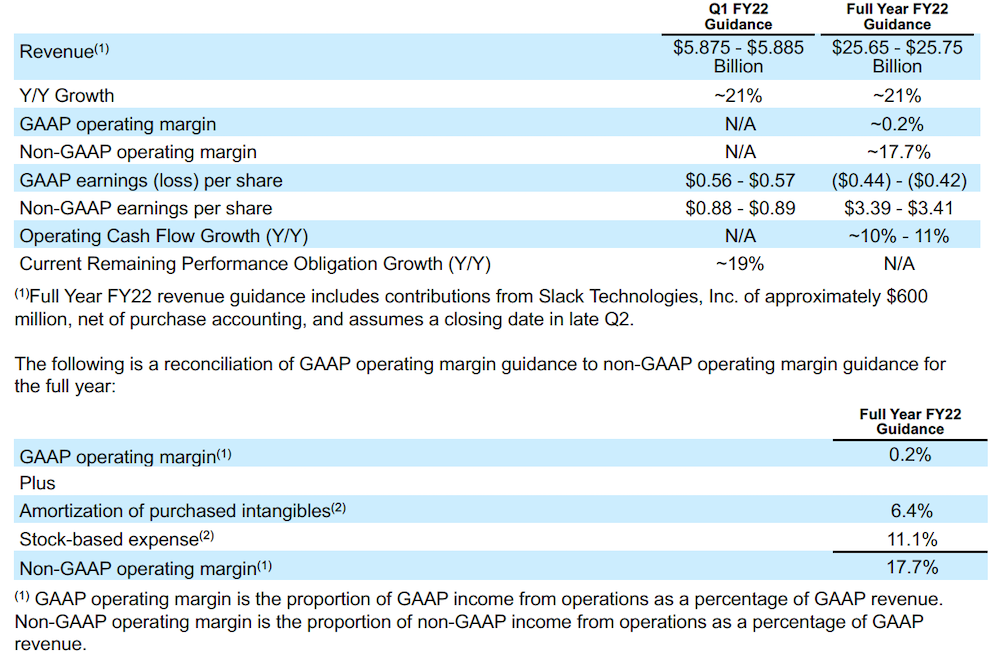

- Raises First Quarter FY22 Revenue Guidance to Approximately $5.875 Billion to $5.885 Billion, up Approximately 21% Year-Over-Year

- Initiates FY22 GAAP Operating Margin Guidance of Approximately 0.2% and FY22 Non-GAAP Operating Margin Guidance of Approximately 17.7%

SAN FRANCISCO, Calif. – February 25, 2021 – Salesforce (NYSE: CRM), the global leader in CRM, today announced results for its fiscal fourth quarter and full year fiscal 2021 ended January 31, 2021.

“We never could have predicted a year ago what was in store, which makes me incredibly proud of how well we pivoted our company to adapt to this pandemic world,” said Marc Benioff, Chair & CEO of Salesforce. “We had a record quarter and year by innovating more and faster than ever, enabling our customers to be successful from anywhere, and becoming more relevant and strategic than ever. And we continued to serve all of our stakeholders in a time when they needed it most.”

Salesforce delivered the following results for its fiscal fourth quarter and full fiscal year:

Revenue: Total fourth quarter revenue was $5.82 billion, an increase of 20% year-over-year, and 19% in constant currency. Subscription and support revenues for the quarter were $5.48 billion, an increase of 20% year-over-year. Professional services and other revenues for the quarter were $0.34 billion, an increase of 18% year-over-year.

Total fiscal 2021 revenue was $21.25 billion, up 24% year-over-year, and 24% in constant currency. Subscription and support revenues for the year were $19.98 billion, up 25% year-over-year. Professional services and other revenues for the year were $1.28 billion, up 21% year-over-year.

Operating Margin: Fourth quarter GAAP operating margin was 3.3%. Fourth quarter non-GAAP operating margin was 17.5%. Fiscal 2021 GAAP operating margin was 2.1%. Fiscal 2021 non-GAAP operating margin was 17.7%.

Earnings per Share: Fourth quarter GAAP diluted earnings per share was $0.28, and non-GAAP diluted earnings per share was $1.04. Mark-to-market accounting of the company’s strategic investments, required by ASU 2016-01, benefited GAAP diluted earnings per share by $0.21 based on a U.S. tax rate of 25% and non-GAAP diluted earnings per share by $0.22 based on a non-GAAP tax rate of 22%.

Fiscal 2021 GAAP diluted earnings per share was $4.38, and non-GAAP diluted earnings per share was $4.92. Mark-to-market accounting of the company’s strategic investments, required by ASU 2016-01, benefited GAAP diluted earnings per share by $1.75 based on a U.S. tax rate of 25% and non-GAAP diluted earnings per share by $1.82 based on a non-GAAP tax rate of 22%.

Cash: Cash generated from operations for the fourth quarter was $2.17 billion, an increase of 33% year-over-year. Total cash, cash equivalents and marketable securities ended the fourth quarter at $11.97 billion. Cash generated from operations for fiscal 2021 was $4.8 billion, an increase of 11% year-over-year.

Remaining Performance Obligation: Remaining performance obligation ended the fourth quarter at approximately $36.1 billion, an increase of 17% year-over-year. Current remaining performance obligation ended the fourth quarter at approximately $18.0 billion, an increase of 20% year-over-year, 18% in constant currency.

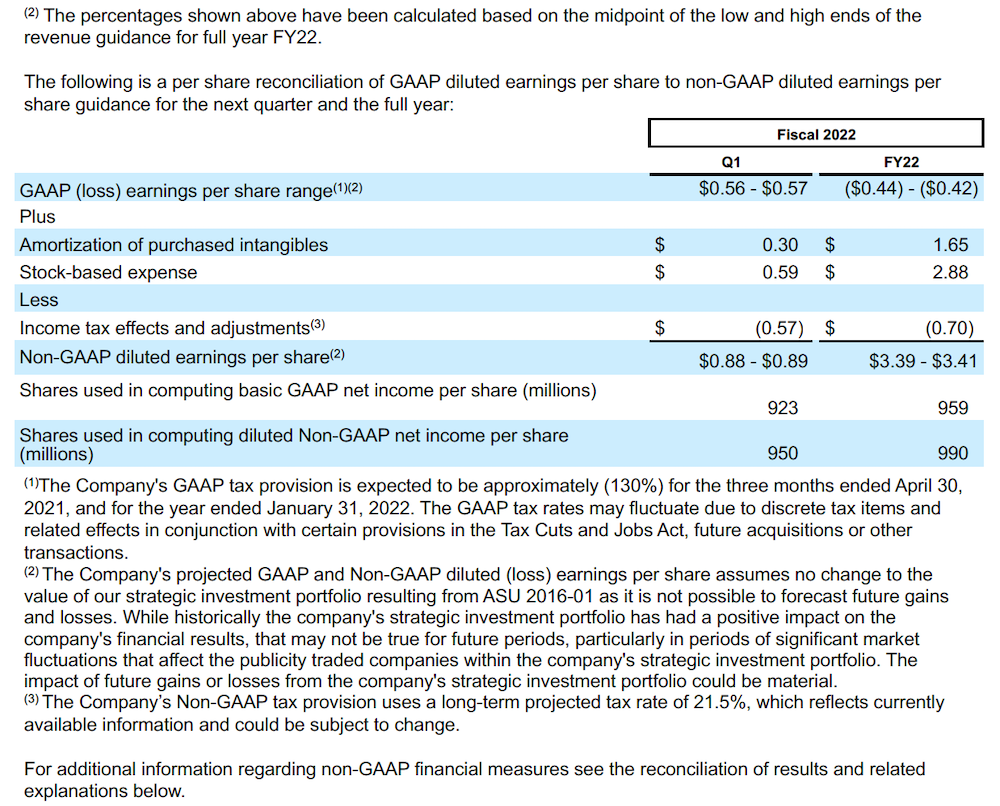

As of February 25, 2021, the company is initiating its GAAP earnings per share guidance, non-GAAP earnings per share guidance, and current remaining performance obligation growth guidance for its first quarter of fiscal year 2022. As of February 25, 2021, the company is raising its revenue guidance previously provided on December 1, 2020 for its first quarter of fiscal year 2022 and full fiscal year 2022. As of February 25, 2021 the company is initiating its operating cash flow guidance, GAAP earnings per share guidance, non-GAAP earnings per share guidance, GAAP operating margin guidance and non-GAAP operating margin guidance for its full fiscal year 2022.

Management will provide further commentary around these guidance assumptions on its earnings call, which is expected to occur on February 25, 2021 at 2:00 PM Pacific Time.

Our guidance assumes no change to the value of the company’s strategic investment portfolio resulting from ASU 2016-01 as it is not possible to forecast future gains and losses. In addition, the guidance below is based on estimated GAAP tax rates that reflect the company’s currently available information, and excludes forecasted discrete tax items such as excess tax benefits from stock-based compensation. The GAAP tax rates may fluctuate due to future acquisitions or other transactions.

Quarterly Conference Call

Salesforce plans to host a conference call at 2:00 p.m. (PT) / 5:00 p.m. (ET) to discuss its financial results with the investment community. A live webcast and replay details of the event will be available on the Salesforce Investor Relations website at www.salesforce.com/investor.

###

“Safe harbor” statement under the Private Securities Litigation Reform Act of 1995: This press release contains forward-looking statements about the company’s financial and operating results, which may include expected GAAP and non-GAAP financial and other operating and non-operating results, including revenue, net income, earnings per share, operating cash flow growth, operating margin, expected revenue growth, expected current remaining performance obligation growth, expected tax rates, stock-based compensation expenses, amortization of purchased intangibles, shares outstanding, market growth, environmental, social and governance goals, expected capital allocation, including mergers and acquisitions, capital expenditures and other investments, expectations regarding closing contemplated acquisitions and contributions from acquired companies. The achievement or success of the matters covered by such forward-looking statements involves risks, uncertainties and assumptions. If any such risks or uncertainties materialize or if any of the assumptions prove incorrect, the company’s results could differ materially from the results expressed or implied by the forward-looking statements it makes.

The risks and uncertainties referred to above include — but are not limited to — risks associated with the impact of, and actions we may take in response to, the COVID-19 pandemic, related public health measures and resulting economic downturn and market volatility; our ability to maintain service performance and security levels meeting the expectations of our customers, and the resources and costs required to avoid unanticipated downtime and prevent, detect and remediate performance degradation and security breaches; the expenses associated with our data centers and third-party infrastructure providers; our ability to secure additional data center capacity; our reliance on third-party hardware, software and platform providers; the effect of evolving domestic and foreign government regulations, including those related to the provision of services on the Internet, those related to accessing the Internet, and those addressing data privacy, cross-border data transfers and import and export controls; current and potential litigation involving us or our industry, including litigation involving acquired entities such as Tableau, and the resolution or settlement thereof; regulatory developments and regulatory investigations involving us or affecting our industry; our ability to successfully introduce new services and product features, including any efforts to expand our services; the success of our strategy of acquiring or making investments in complementary businesses, joint ventures, services, technologies and intellectual property rights; our ability to complete, on a timely basis or at all, announced transactions, including our proposed acquisition of Slack Technologies, Inc.; our ability to realize the benefits from acquisitions, strategic partnerships, joint ventures and investments; our ability to successfully integrate acquired businesses and technologies; our ability to compete in the market in which we participate; the success of our business strategy and our plan to build our business, including our strategy to be a leading provider of enterprise cloud computing applications and platforms; our ability to execute our business plans; our ability to continue to grow unearned revenue and remaining performance obligation; the pace of change and innovation in enterprise cloud computing services; the seasonal nature of our sales cycles; our ability to limit customer attrition and costs related to those efforts; the success of our international expansion strategy; the demands on our personnel and infrastructure resulting from significant growth in our customer base and operations, including as a result of acquisitions; our ability to preserve our workplace culture, including as a result of our decisions regarding our current and future office environments or work-from-home policies; our dependency on the development and maintenance of the infrastructure of the Internet; our real estate and office facilities strategy and related costs and uncertainties; fluctuations in, and our ability to predict, our operating results and cash flows; the variability in our results arising from the accounting for term license revenue products; the performance and fair value of our investments in complementary businesses through our strategic investment portfolio; the impact of future gains or losses from our strategic investment portfolio including gains or losses from overall market conditions that may affect the publicly traded companies within our strategic investment portfolio; our ability to protect our intellectual property rights; our ability to develop our brands; the impact of foreign currency exchange rate and interest rate fluctuations on our results; the valuation of our deferred tax assets and the release of related valuation allowances; the potential availability of additional tax assets in the future; the impact of new accounting pronouncements and tax laws; uncertainties affecting our ability to estimate our tax rate; uncertainties regarding our tax obligations in connection with potential jurisdictional transfers of intellectual property, including the tax rate, the timing of the transfer and the value of such transferred intellectual property; uncertainties regarding the effect of general economic and market conditions; the impact of geopolitical events; uncertainties regarding the impact of expensing stock options and other equity awards; the sufficiency of our capital resources; risks related to our bridge loan facility and term loan associated with our proposed acquisition of Slack Technologies, Inc., 2023 and 2028 senior notes, revolving credit facility and loan associated with 50 Fremont; our ability to comply with our debt covenants and lease obligations; and the impact of climate change, natural disasters and actual or threatened public health emergencies, including the ongoing COVID-19 pandemic.

Further information on these and other factors that could affect the company’s financial results is included in the reports on Forms 10-K, 10-Q and 8-K and in other filings it makes with the Securities and Exchange Commission from time to time. These documents are available on the SEC Filings section of the Investor Information section of the company’s website at www.salesforce.com/investor.

Salesforce.com, inc. assumes no obligation and does not intend to update these forward-looking statements, except as required by law.

© 2021 salesforce.com, inc. All rights reserved. Salesforce and other marks are trademarks of salesforce.com, inc. Other brands featured herein may be trademarks of their respective owners.

About Salesforce

Salesforce, the global CRM leader, empowers companies of every size and industry to digitally transform and create a 360° view of their customers. For more information about Salesforce (NYSE: CRM), visit: www.salesforce.com.

Any unreleased services or features referenced in this or other press releases or public statements are not currently available and may not be delivered on time or at all. Customers who purchase Salesforce applications should make their purchase decisions based upon features that are currently available. Salesforce has headquarters in San Francisco, with offices in Europe and Asia, and trades on the New York Stock Exchange under the ticker symbol "CRM." For more information please visit https://www.salesforce.com, or call 1-800-NO-SOFTWARE.