The future is here and it's digital first.

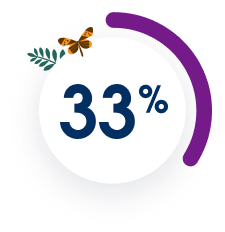

In our 2022 global survey of financial services customers, we found that 78% banking customers want efficient experiences. They crave intuitive, personalised interactions that emphasise their overall financial wellbeing. Find out how to delight your customers, reduce your costs, and unlock new efficiencies with 27%* faster automation of business processes. It's time to invest in experiences that keep customers happy and loyal. Find out more about the future of financial services in our report.

Get the full "Future of Financial Services."

Fill out the form to access the research.

BANKING

Create easy, efficient banking experiences with tactical automation.

"End-to-end automation is too complicated, too expensive, and too uncertain. Automation that is selectively applied to certain problematic spots is where you get the immediate ROI."

The Future of Financial Services

Insurance

Combine digital experiences with stellar service for insurance success.

“[Customers] want FSIs to go beyond just fulfilling their requests to anticipating and delivering what they will want or need next. This can happen through predictive personalisation based on each customer’s unique journey.”

The Future of Financial Services

WEALTH AND ASSET MANAGEMENT

Wow wealth and asset management customers with personalised, digital-first experiences.

“Customers told us that three out of the top five pain points in their digital experiences all tie back to poor personalisation. Our experts say this all stems from scattered information.”

The Future of Financial Services