Salesforce Ventures Impact Fund Spotlight: This Startup Wants to Crush Student Debt

FutureFuel.io wants to “crush” student debt — and obliterate the confusing, wonky tools that are currently in place. Find out why Salesforce Ventures is investing in them via our Impact Fund.

Jonah Freedman

Salesforce believes business is a powerful platform for change. That’s why Salesforce Ventures, the company’s global corporate investment group, created a $50 million Impact Fund, which invests in companies that drive positive societal impact by addressing challenges across workforce development, equality, sustainability, and the social sector. In this series, we’ll be featuring companies in the portfolio and telling their stories. We start with fintech startup, FutureFuel.io.

What they do

FutureFuel.io wants to “crush” student debt — and obliterate the confusing, wonky tools that are currently in place. The Boston-based startup makes a simple platform as an employee benefit to help users manage their debt, see where they are in the process of paying it off, and set real, actionable strategies around spending and income.

Focus area of investment

Diversity, Equity, Inclusion, and Workforce Development

Their story

In early 2014, FutureFuel.io founder and CEO Laurel Taylor was less than a year into her sales leadership role at Google when the math hit her like a ton of bricks — and it didn’t add up. She had perfect credit and a good salary, yet still got an astronomical quote of 9% interest on a loan to pay for her tuition at the MIT Sloan School of Management.

Not only did that number seem woefully incongruous with her personal situation, it occurred to her that Google didn’t offer a solution or tool to address paying back or refinancing student debt. And that was no outlier: Just 4% of employers offer such a benefit, according to a study by the Society for Human Resource Management.

As Taylor saw it, modern employers offer great benefits, like free meals, on-site fitness facilities, and fantastic retirement programs. But if an estimated 70% of U.S. college graduates are saddled with debt issues, there was an opportunity to provide something arguably more valuable.

Her epiphany was recognizing that there was “a gap in the financial wellness stack,” as she says. And she was ready to do something about it.

Her epiphany was recognizing that there was “a gap in the financial wellness stack,” as she says. And she was ready to do something about it. In 2016, she founded FutureFuel.io as a solution to help chip away at an issue that plagues some 45 million Americans carrying an average of nearly $40,000 in student loans — a dizzying $1.5 trillion total, according to data collected by the Federal Reserve Bank of New York.

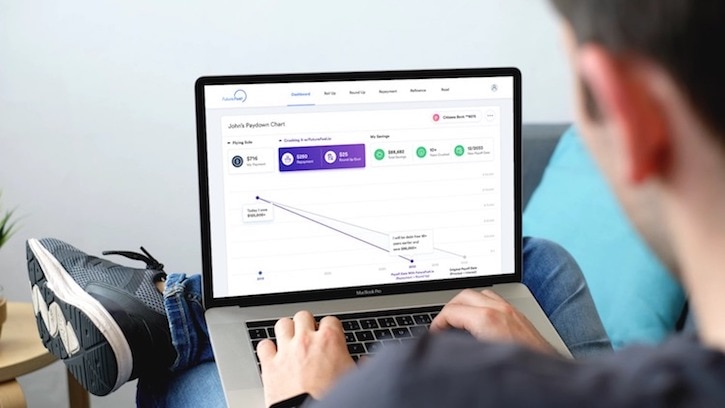

The FutureFuel.io app is elegant, clean, and gamified. It aggregates your debt into a simple interface, shows you a burndown chart of exactly how long it will take to pay off your debt, and includes features you won’t find anywhere else — such as the “village” function, in which you can recruit friends and family to help contribute to your payments. The app also motivates employers to take a more active role in helping their employees pay down their debt, including functionality to redirect unused vacation days or bonuses.

“Our goal is not only to help the user with better strategies to pay down their debt, we also want to enable employers to address the broader spectrum of financial wellness across the organization,” says Taylor. “Not everyone is ready to jump into a 401(k) offering. Employees with debt are eight years behind their peers in terms of spending and saving.”

The app is going through a full redesign for a relaunch this month that will further streamline the process, Taylor reports. FutureFuel.io’s next goal is scale, she says. The startup currently works with around 100 companies, some of which are as big as 24,000 employees. And it’s received a healthy amount of funding. In addition to the Salesforce Ventures Impact Fund, Taylor has secured investments from a number of socially conscious venture capital funds, including Rethink Impact and Reach Capital. And they all get it, she says.

“This issue is so pervasive, it’s the new normal,” she explains. “In the next three to five years, every employer will have to offer tools and capability to address student debt. The lending solutions today really don’t address the problem, which is real and visceral to people — and it’s only getting worse. We want to not just enable financial wellness [for them], we want to enable a path to eventual wealth, too.”

They said it

Together with the private sector, FutureFuel.io is introducing what’s essentially a modern-day GI Bill. Employers who are willing to meet our workforce where they are — and provide them with the debt relief they need — will win the war for talent.” — FutureFuel.io founder and CEO Laurel Tayl