European regulations requiring financial institutions to account for their Environmental, Social and Governance (ESG) efforts in their annual reports are in the pipeline. Salesforce’s Net Zero Cloud is a highly suitable tool for documenting this non-financial information. What’s more, it also helps financials make better sustainable choices in the future.

From insurers that electrify their vehicle fleet to banks that work towards equal pay for men and women, the financial world is increasingly recognising its corporate social responsibility.

Take tangible steps to achieve carbon neutrality with Customer 360 solutions.

Reduce emissions with trusted analytics from a trusted platform. Formulate a climate action plan from a single source of truth on Customer 360. Then easily measure and manage your plans.

ESG assurance by KPMG

The next step will be for financials to disclose how they define socially responsible investments and what proportion of the portfolio that amounts to so that this can be included in the auditor’s ESG assurance statement. KPMG and Salesforce have come together to offer financials a high-quality total solution in this area.

‘In terms of governance and social issues, we are already pretty much in control. But sustainability, in particular, is still uncharted territory. There is much to gain there,’ says Robin Claushuis, Senior Sustainability Consultant at KPMG.

Efficient management of real-time sustainability data

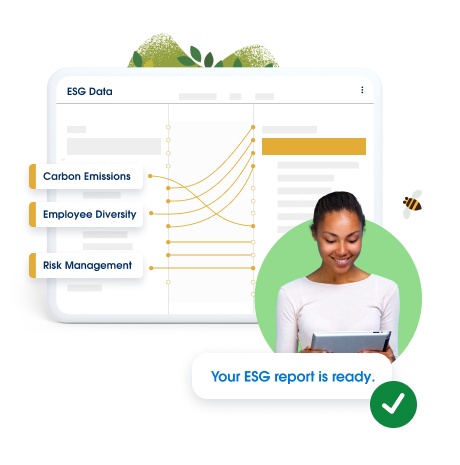

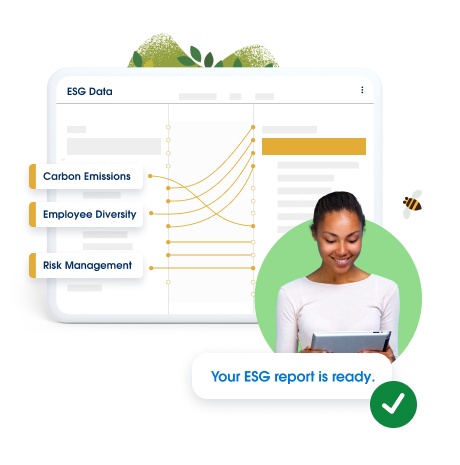

Net Zero Cloud was born out of Salesforce’s ambition to reduce its own carbon footprint to “net zero”. As a forerunner, Salesforce entered uncharted territory but managed to make clever use of its own technology. Net Zero Cloud is a platform that brings together all data on emissions in real-time, giving you a dashboard to make data-driven decisions around sustainability at any time, for example, concerning employees’ air travel.

‘Until now, the sustainability departments at many companies have kept this data in Excel sheets and shared it with directors in aggregate afterwards. This way, you keep looking in the rear-view mirror and can never take immediate action,’ says Erwin Boeren, Industry Solutions Lead Banking at Salesforce.

What impact and goals can you monitor with Net Zero Cloud?

You can link your travel systems to Net Zero Cloud and other data sources that can help analyse things like the gender pay gap. Erwin: ‘It makes clear what impact you already have as a financial institution. This will also help you determine what impact you still want to have and how you will achieve it. It looks back as well as ahead. Are we going to fly less and consult more online? Or does it make more sense to make our purchasing more sustainable or adjust our diet? Those discussions can culminate in setting goals that you, in turn, monitor in Net Zero Cloud. You then complete the circle.’

Robin continues: ‘A system like Net Zero Cloud also reduces the risk of making mistakes by guiding you through a process in an orderly way. Once, I saw that a company with a fleet of buses had accidentally entered petrol instead of diesel as fuel in its reporting. That makes quite a difference in CO2 emissions and “pollutes” all subsequent calculations. With the attention there is now – and will be in the future – on sustainability, that will work against you.’

Conscious investment in CO2 reduction

The interesting thing about the financial sector is that its sustainable impact extends beyond its own operations. One of the financial institutions’ core activities is providing loans and investments. According to Robin, these will also be weighted more heavily towards sustainability. But that’s where the problem lies. Translating the complete financial valuation system into companies’ and organisations’ environmental footprints is complicated.

‘A start-up has a negative value; so, does it also have a negative CO2 footprint? Of course not. An investment in, say, a tanker, halves in value over time; does that also halve CO2 emissions? And suppose this ship is also partly privately financed; how do you split the environmental burden? Put it this way. My point is: if you want to untangle that knot, you first have to get the facts straight.’

Net Zero Cloud makes ESG efforts transparent

What is certain is that financials are also working to encourage sustainability in their relationship networks. Robin says, ‘Much of the industry has joined an official agreement to this effect: the Climate Commitment. How can we support companies and organisations to reduce their CO2 emissions to zero by 2050, as mandated by the Climate Agreement? Participants lend force to this commitment with action plans.’

KPMG and Salesforce believe in the added value of Net Zero Cloud to adequately visualise the ESG efforts of financials. That goes beyond sustainability, Erwin emphasises once again. ‘It also includes affordable consumer policies and a secure payment system, protecting you from cybercrime. Net Zero Cloud is flexible enough to support such ESG KPIs with valuable insights.’

Do you also want to take concrete steps towards carbon neutrality? Read more on Net Zero Cloud.

Embed Net Zero goals into strategies and operating models.

Integrate data-driven insights into everything you do. Prove to customers, employees, and investors your commitment to carbon-conscious and sustainable practices.