Click & Mortar Hybrid Banking With Salesforce Financial Services Cloud

Read our blog to find out how Salesforce Financial Services Cloud can help you adopt hybrid digital banking and level up your customer engagement effortlessly.

Salesforce India

With inputs from Deepu Chacko, Senior Director, Solution Engineering

More than half of the world’s population will access banking services digitally in 2026, from 2.5 billion in 2021. In India, 22% of adults (205 million) say they have a digital-only bank account. And 63% of a YouGov survey said they are likely to switch to a digital-only bank in the next few years.

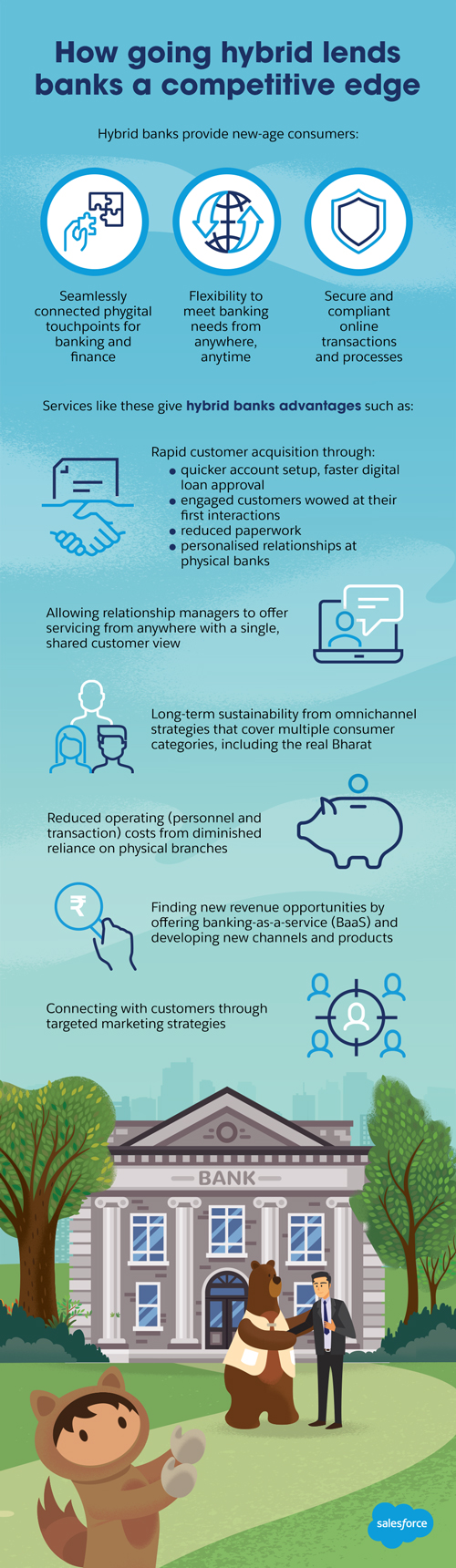

As digital banking becomes mainstream, digital experiences weigh heavily on the customer’s choice of a bank. Yet, new-age customers expect harmony between physical and digital touchpoints. This simply means that the traditional brick-and-mortar banking structure must transform into a hybrid, click-and-mortar model.

Hybrid banking hits the sweet spot for new-age customers

Fintech companies, telecom networks, and e-commerce platforms have caused digital disruptions that are compelling traditional banks to also transform themselves. Hybrid banking, with it’s omnichannel approach (both physical (branches, ATMs) and digital (apps, net banking) presence), is more inclusive and all-pervasive. It enables banks to cater to a larger segment of customers with a wider range of financial products and services.

Traditional banks are in the right position for this transformation: they can build on the established credibility that comes with having a physical presence, and provide customer-first digital services to stay relevant.

What is customer-centric hybrid banking?

Hybrid banking is the coming together of digital and on-premise services to create a customer-centric banking ecosystem. It aims to fulfil customers’ evolving banking needs by providing access to different services through any and all touchpoints they prefer.

For instance, customers can:

- sign up and complete know-your-customer (KYC) processes online before accessing banking services at physical branches

- be onboarded at a physical branch but complete digital KYC via a smartphone

- access physical banking, but apply for loans online

For details on this infographic, please click here.

Salesforce Financial Services Cloud helps banks go hybrid

To go hybrid, your bank needs a BaaS-enabling platform that helps you deliver connected, personalised experiences while meeting the regulatory requirements. Using a customisable platform, it is easier to seamlessly connect digital experiences with physical ones.

Salesforce Financial Services Cloud is designed to drive stronger customer relationships. Equipped with an enhanced set of productivity and engagement features, bankers don’t have to scramble around for their customers’ information. Instead, they can focus on their core responsibility of providing customer-centric, holistic, and goal-based advice.

Financial Services Cloud enables a secure, scalable, and sturdy hybrid banking model by:

-

Creating a unified customer view: Instantly access customer data in one central location so you don’t have to spend time looking for information scattered across multiple sources. These tools and information are also available on the feature-rich customisable mobile app, allowing you to update and access customer data on the go.

-

Automating routine tasks: Use automation tools to complete repetitive and time-consuming tasks like processing documents or checking financial statements. This enables you to focus on more important things, like planning customers’ finances with them or reaching out to customers with new customised offerings.

-

Delivering experiences that drive customer loyalty: Use sharp insights and engagement tools to decide what for and when to contact customers on specific physical or digital channels based on insights into their individual engagement patterns. With real-time insights, you can personalise engagement in the moment and delight customers.

-

Deepening engagement and growing business: Get more visibility into existing household opportunities and get a holistic view of managed and held away assets. Track referrals to transform the bank’s existing customer base into an active referral network. Also, cross- and upsell through service teams across touchpoints.

-

Providing smart recommendations: Salesforce Einstein, the in-built Artificial Intelligence (AI) engine, uses predictive scoring based on a 360-degree customer view. It can help you recommend customers the best next steps to meet their specific financial goals.

Become more customer-centric with Salesforce Financial Services Cloud

Financial Service Cloud helps banks with effortless customer engagement on all channels in real-time and across any device. Banks that earn customer trust with stronger relationships can stay ahead of the competition. And the way to do this is by leveraging digital innovations across the industry to become nimble, futuristic banks. Financial Services Cloud can help your bank establish a personalised, needs-based approach in engaging with your customers.