Salesblazer

Grow your career with the latest in sales content, training, and events — all part of the world’s leading sales community.

Explore by sales role.

Discover the resources you need to grow your career.

Discover the Salesblazer Community:

Where sales professionals everywhere learn, connect, and grow.

Introducing: Agentforce Sales

The AI journey has reached another milestone: autonomous agents that provide specialized, always-on support to employees or customers. Learn all about this new technology and build your own agents on Trailhead.

Sales Trends

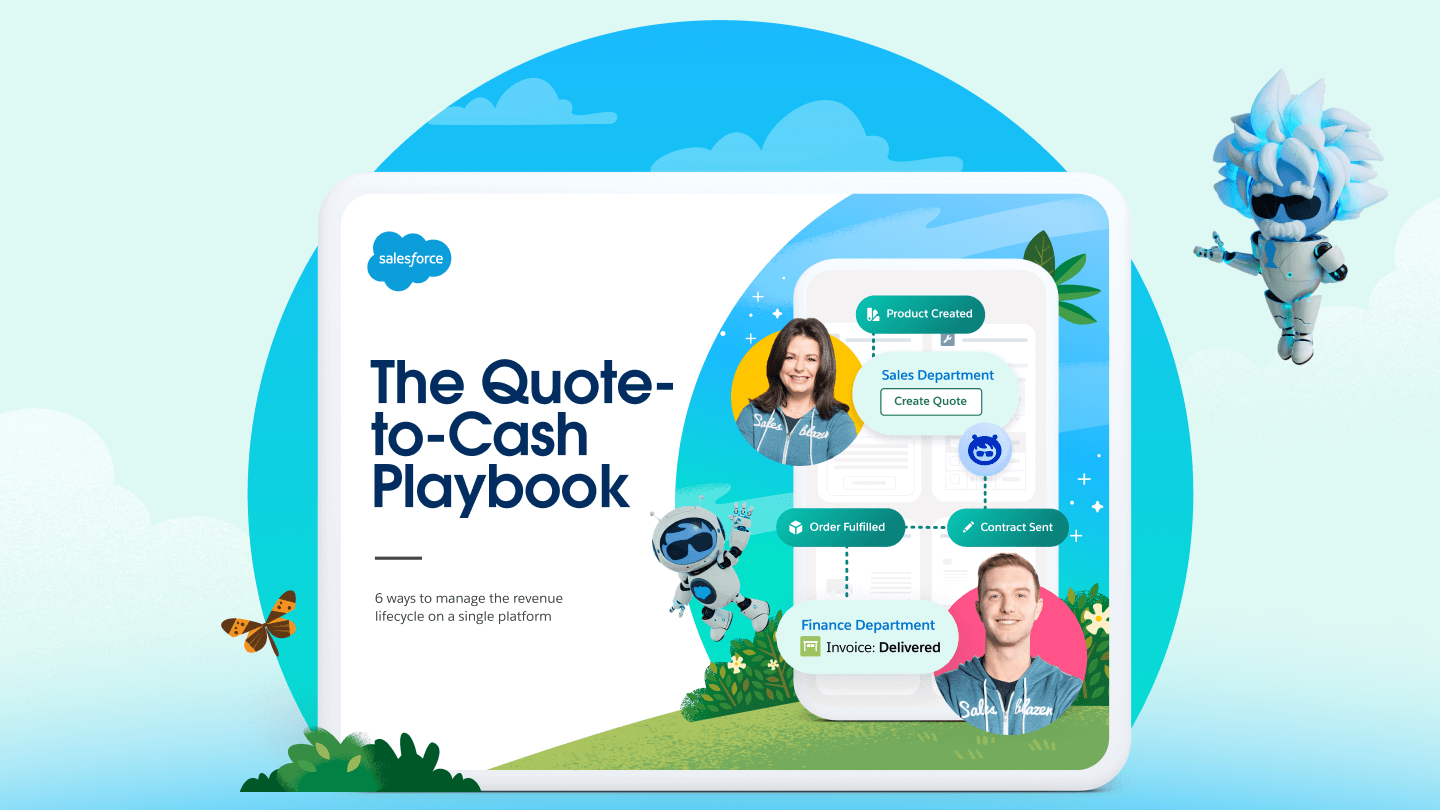

Get free sales templates, workbooks, reports, and guides.

Improve your processes and streamline your sales with these expert-backed resources.

Learn valuable sales skills for free with Trailhead modules.

Follow guided learning paths and get hands-on learning to supercharge your sales career.

Learn Agentforce Sales Fundamentals

Explore Agentforce Sales from accounts and contacts, to leads and opportunities.

Salesforce GO

Discover how Salesforce Go simplifies feature setup, enhances user adoption, and drives sales team productivity for your business.

Become a Selling Specialist

Enhance the sales process with advanced selling and collaboration tools. Implement strategic sales programs and succeed from lead to cash.

Objection-Handling Strategies

Use the 3 Ds method to manage customer objections with ease.

Inspiring events — in-person and streaming.

Catch all the excitement and inspiration from our events, while upping your sales game along the way.