Key Takeaways

Across the Private Equity ecosystem, value creation has never been under more pressure. Firms are sitting on record dry powder, portfolio holding periods are stretching, and exit markets remain selective. Yet the best-performing investors are not waiting for conditions to improve. They are using technology as a lever to accelerate exit readiness today.

Across our Global Private Equity & VC Practice, we see this shift play out consistently. Portfolio companies are using connected data and AI driven workflows to scale more efficiently, reduce risk, and build predictable, compliant operations that stand up to diligence pressure.

Why exit readiness is under strain

Tech-driven portfolios face a wide set of competing priorities on the path to exit: revenue growth, forecast accuracy, efficiency at scale, reduced SG&A, stronger compliance, and the ability to introduce and monetize products faster. Challenges like stagnant revenue growth, fragmented systems, and rising security requirements increase complexity at a moment when predictability matters most.

The firms that outperform are operationalizing exit readiness well before a sale process begins.

How agentic workflows create always-on exit readiness

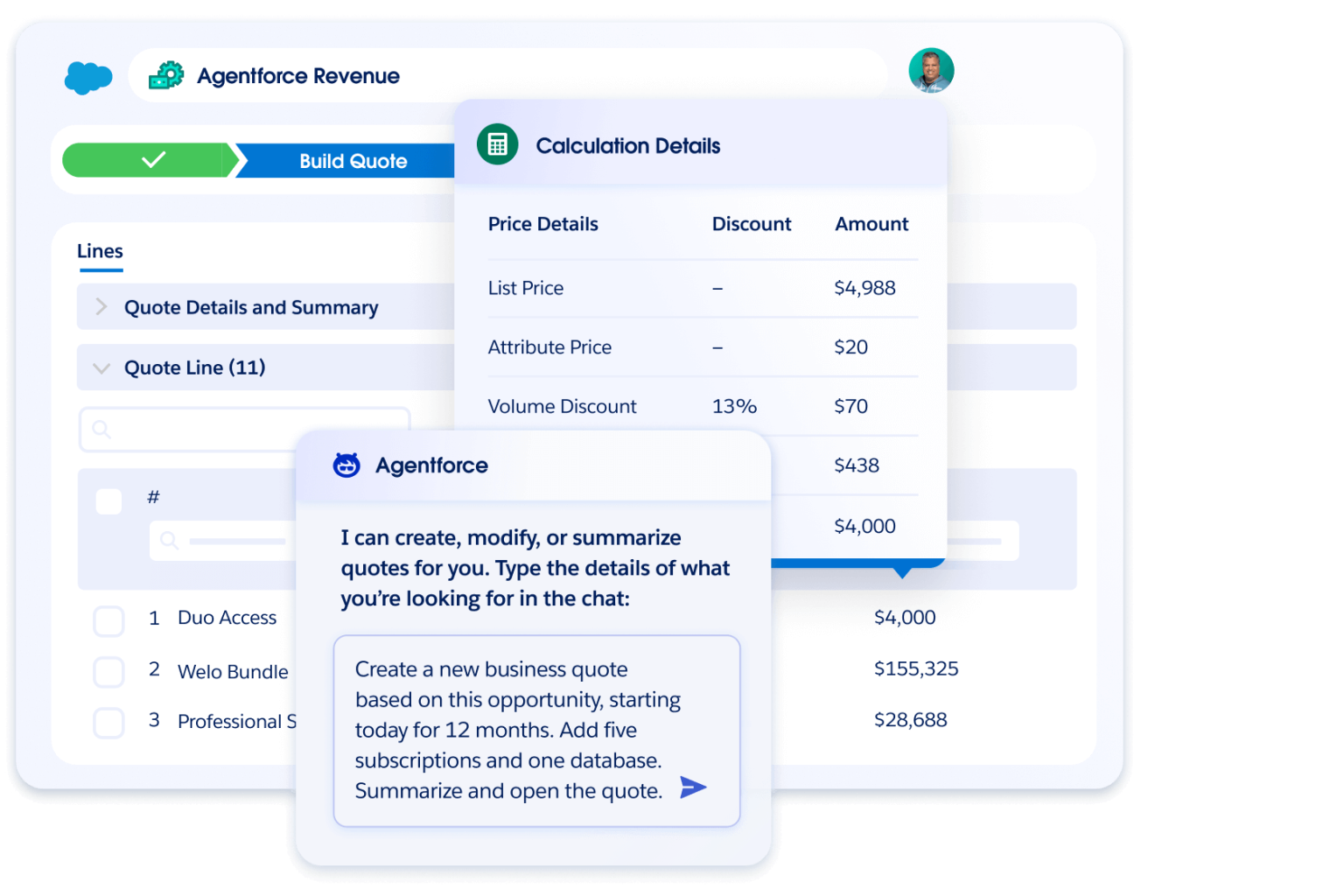

A growing number of portfolio companies are adopting agentic workflows that reason, decide, and take actions across systems. These workflows operate in the flow of work, use trusted, unified data as context, and execute work end to end across systems to support continuous exit readiness. Many start with one high-volume workflow—often in service, sales, or revenue operations- where agentic execution takes action autonomously, resolves issues, advances deals, surfaces risk, and triggers downstream action without manual handoffs.

The results mirror what we see across the portfolio landscape:

- 15–20% faster sales cycles as agentic workflows move opportunities forward

- 40% higher forecast accuracy with unified revenue data and centralized planning

- Lower operating costs through tech stack consolidation and no-touch/low-touch service

- Reduced risk exposure with improved governance, audit trails, and consistent processes

Unify sales, finance, and legal on the #1 AI CRM with Agentforce Revenue Management

When sales, finance, and legal are disconnected, the customer feels the pain. Learn how Agentforce Revenue Management can help.

But the biggest unlock comes from organizing people and data in a way that makes clean operations repeatable. Leading companies centralize data ownership, align definitions across teams, and treat AI-driven workflows as part of the extended workforce—measured, monitored, and continuously improved.

This creates a model where exit preparation becomes ongoing operating practice, not a scramble.

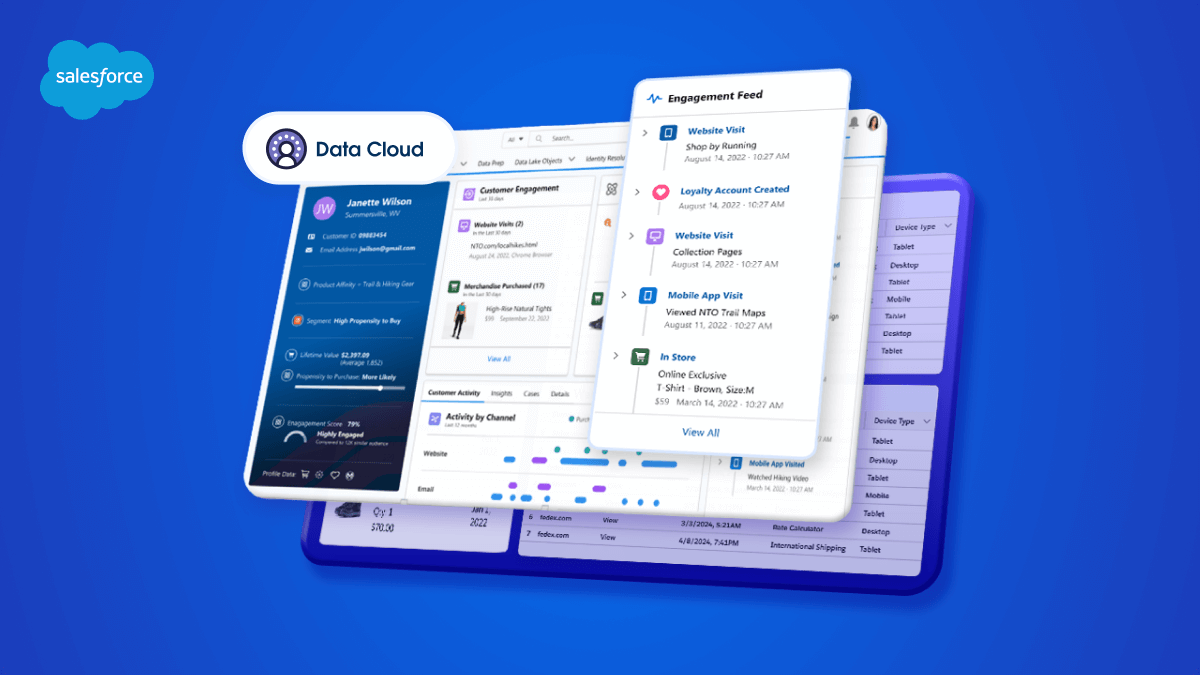

Activate Trusted Data Everywhere

Make all your enterprise data ready for action without moving it. Data 360 transforms fragmented data scattered across your enterprise into one, complete view of your business to fuel real-time workflows, better decision making, and more intelligent agents.

The new playbook for value creation

Traditional levers still matter, such as revenue growth, margin expansion, and multiple uplift but the force multipliers have changed. Our work across hundreds of portfolio companies shows four themes consistently drive exit readiness:

1. Become an Agentic Enterprise with AI

Accelerate go-to-market execution, reduce manual work, and augment teams with AI, agentic workflows and digital labor. The most effective portfolio companies focus on the Last Mile execution, embedding AI directly into sales, service, revenue, and finance workflows where work actually happens.

This is what defines an Agentic Enterprise in practice, where humans and AI operate side by side, with agents handling repeatable tasks, enforcing rules, and surfacing next-best actions in real time. The result is faster execution, higher productivity, and more consistent customer experiences without adding headcount.

By prioritizing operational AI over broad pilots, companies create durable performance gains that show up in EBITDA and exit readiness well before a sale process begins.

Become an Agentic Enterprise: A Step by Step Guide

At Salesforce, we’ve guided startups to Fortune 500s through AI evolution. Get our practical roadmap and navigate this exciting era with confidence.

2. Unify data for financial predictability

Financial predictability requires more than data centralization. Unifying data on a single platform doesn’t mean moving all data into one place. Leading companies connect sales, service, and financial data where it already lives and bring that context together for execution.

That context is delivered at the last mile, directly into the flow of work, so employees and AI can act on trusted information. With shared definitions, governed metadata, and embedded controls, teams operate from a consistent source of truth.

The result is more accurate forecasting, reduced revenue leakage, and faster board- and buyer-ready reporting, with governance and compliance embedded into daily execution.

3. Consolidate technology to reduce cost & complexity

Simplify the tech stack to lower total cost of ownership, remove redundant systems, and reduce operational complexity. A unified platform reduces complexity, streamlines maintenance and support, and speeds innovation by eliminating the patchwork of multiple systems that increase support burden and make it harder to upgrade features across interdependent tools. This allows companies to unlock powerful insights, reduce redundancies, and increase productivity, enabling teams to move faster and get more value from AI.

4. Reinforce trust, security, & compliance

Meet SOX, ASC 606, and data governance requirements with centralized controls, activity tracking, audit trails, and secure data policies—critical elements that directly influence diligence outcomes. A trusted platform ensures consistent policies, protects sensitive data, and delivers the transparency that reduces diligence friction and improves buyer confidence.

When companies execute against these priorities, we consistently see improvements in EBITDA, predictability, and operational resilience,translating directly into stronger exit multiples.

When companies execute against these priorities, we often see 15-20% faster sales cycles, 40% higher forecast accuracy, and significant reductions in SG&A, all of which translate directly into higher EBITDA and stronger exit outcomes.

What great looks like in practice

Across our portfolio work, common characteristics emerge among the companies that are truly exit-advantaged:

- Operationalized go-to-market motions with scalable, repeatable processes

- A unified revenue lifecycle that connects quoting, forecasting, recognition, and reporting

- Self-service and low-touch service models that reduce cost-to-serve

- Central data governance with clear lineage, auditability, and ownership

- Digital labor embedded into daily workflows across sales, service, product, and finance

- Consolidated IT architecture that simplifies diligence and accelerates integration

These markers aren’t cosmetic—they reduce diligence friction, accelerate integration planning, and improve buyer confidence.

The bottom line

Private equity’s advantage has always been speed and precision. Today those strengths come from building portfolio companies into Agentic Enterprises- businesses that harness unified data, AI agents, and digital labor to operate more efficiently, improve productivity, and unlock entirely new revenue streams.

Companies are using trusted data foundations, agentic workflows that take action, and AI-driven decisioning to reduce manual work, accelerate execution, and strengthen financial performance. The impact goes beyond efficiency: AI is helping teams increase margins and topline growth through new revenue streams that AI can bring to companies.

Digital labor is no longer aspirational. It is measurable, durable, and central to how companies improve EBITDA, reduce risk, and present well in a sale process. The firms embracing this shift aren’t just preparing for better exits, they have a competitive differentiator that compounds long before a sale process begins.

They’re not just exit-ready, they’re exit-advantaged.

Unlock what’s next in value creation

Discover customer stories, insights, events, and playbooks redefining the future of private equity and venture capital.