Key Takeaways

If you’re running a small or medium-sized business (SMB) or a startup, you know that managing finances is about far more than just tracking transactions. It’s the lifeblood of your operation — and often your biggest headache. For too long, “finance” has been synonymous with stressful tax seasons and frantic attempts to balance your books. But it doesn’t have to be this way.

You can stop seeing finance as a necessary evil and start seeing it as your strategic advantage. The secret? Building a powerful, integrated finance tool stack connected with your customer relationship management (CRM) platform. This is about more than replacing spreadsheets with software: it’s about connecting your financial data to every facet of your business so you can pave the way for sustainable scaling.

Why you need a finance tool stack for your startup or SMB

Many SMB owners start with a basic bookkeeping system: a simple online ledger, or even just a spreadsheet. This works until it doesn’t. As you grow, complexity explodes, as more customers, more employees, more expenses, and more complex regulatory requirements quickly make a basic system a bottleneck.

A dedicated finance tool stack allows you to go beyond simple bookkeeping and craft a financial strategy. You get immediate, real-time visibility into your finances, and you get a clear, current snapshot of cash flow, allowing for proactive, rather than reactive, decisions.

Also, automation minimizes human error in data entry, ensuring better accuracy in your financial reports. Processes like invoicing, payroll, and expense reporting become automated too, freeing up countless hours for you and your team to focus on strategic initiatives — like selling more or improving your product. You’ll also be in compliance with tax regulations, tracking contractor versus employee classifications, and managing sales tax, significantly reducing audit risk.

Start with SMB Basics

What should SMBs have in their finance tech stack?

Your finance stack should be a seamless, integrated system designed to support your entire business operation. Here are the three core pillars:

1. Accounting management

Data is the cornerstone of your finance stack. Accounting management software goes beyond simple numbers to handle the complexities of double-entry bookkeeping, generating key financial statements like profit and loss, balance sheets, cash flow, and managing tax compliance.

- Key features: Automated bank feeds, invoicing, accounts payable or receivable tracking, multi-currency support (if applicable), and reporting features.

- Growth impact: Accounting management software is the single source of truth for your financial health. It’s also essential for communicating with investors, lenders, and your certified public accountant (CPA).

Get Salesforce. FREE for small businesses.

Connect sales, service, and analytics on one platform. Save time, stay organized, and fuel growth with the CRM that scales for small teams.

2. Expense management

As your business grows, so do business expenses. Relying on manual reports and receipts is inefficient and error-prone, so automating this process will cut down on confusion down the road.

- Key features: Employee expense reporting with mobile apps, automated receipt capture, corporate card management with spending limits, and seamless integration with your accounting software.

- Growth impact: Speeds up expense reconciliation, gives leadership real-time insight into budgets, and boosts employee satisfaction by simplifying the reimbursement process.

3. Payroll and HR management

Once you hire your first employee, a dedicated payroll system is a must-have. Payroll must be accurate and on time, and it involves sensitive data and complex tax and compliance rules. Furthermore, integrating HR functions like onboarding, time tracking, and benefits administration is vital for scaling.

- Key features: Automated tax filing (federal, state, and local), direct deposit, employee self-service portals, benefits administration, and integration with time-tracking tools.

- Growth impact: Guarantees compliance and drastically reduces the administrative burden of paying employees. Integrated HR management ensures a smooth, compliant experience for new hires, which is crucial for high-growth companies.

How a CRM brings it all together

While the tools above manage internal financial operations, a customer relationship management CRM system is the bridge that connects your finance stack to your revenue engine. For SMBs, the right CRM isn’t just a customer database; it’s a financial management powerhouse. Here’s how you can make your CRM work for your business’s financial future:

1. Sales forecasting: predicting your revenue

Accurate revenue forecasting is impossible without a CRM. Think about it this way: finance tools tell you what you have made, while the CRM tells you what you are going to make.

How it works: A CRM tracks every deal through your sales pipeline, assigning a probability of closure and an expected close date.

Finance integration: By integrating this data with your financial planning tools, you can generate reliable cash flow projections, informing critical decisions like when to hire, when to invest in inventory, or when to launch a new product.

Boost sales with a CRM made for growing businesses

Try Starter Suite for free to close more deals and win more customers, today.

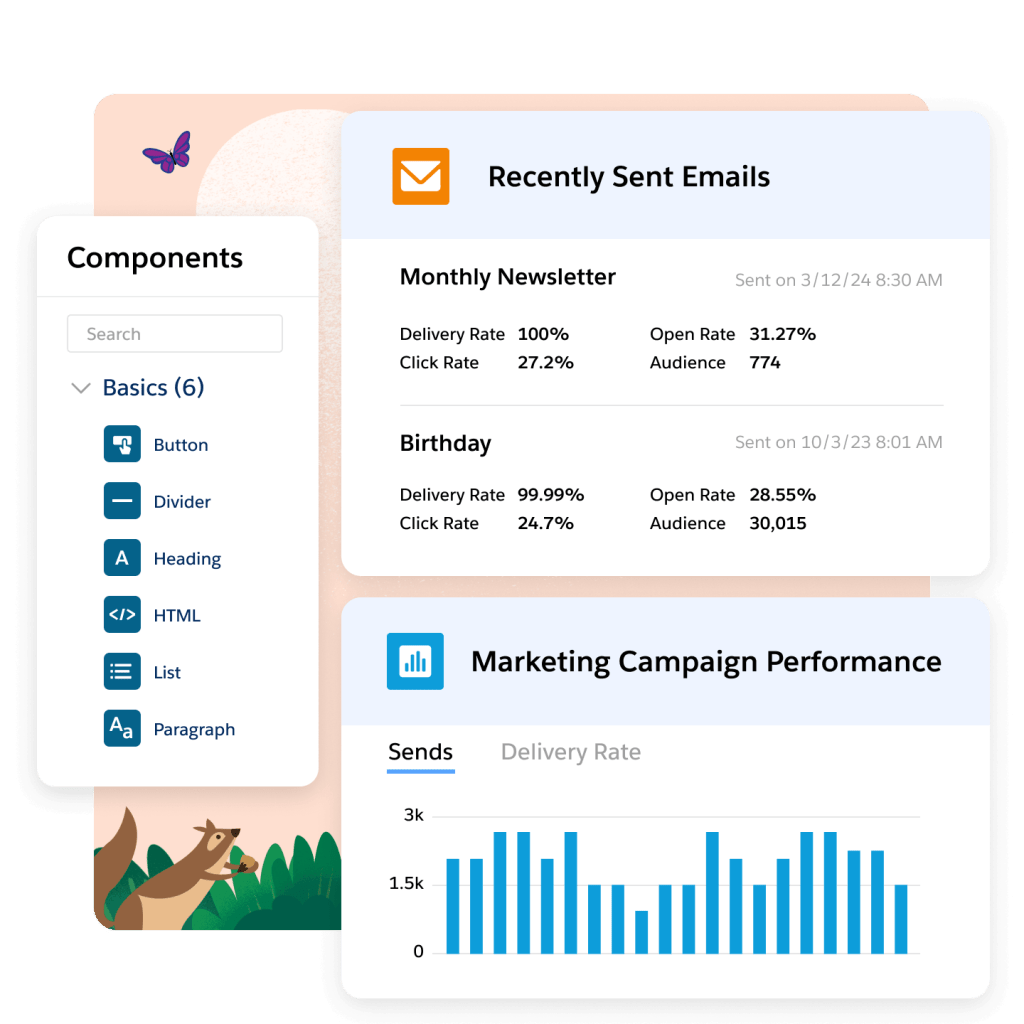

2. Automating accounts receivable (AR): ensuring cash flow

The quickest way to slow growth is to have your money tied up in outstanding invoices. Automating accounts receivable (AR) is a huge cash flow win.

How it works: A CRM tracks the sales cycle from prospect to purchase. The integration with your accounting manager automatically triggers invoice creation upon contract signature or product delivery.

Automated nudges: It can then automatically send reminders to customers as payment due dates approach or pass, drastically reducing the time it takes to collect revenue. This simple automation can shave days or weeks off your average payment cycle.

3. Calculating customer lifetime value (CLV): optimizing investment

Customer lifetime value (CLV) is a key metric for scalable growth. It measures the total revenue a business can reasonably expect from a single customer account over the entire relationship. Without an integrated system, this calculation can be a nightmare, but with a CRM, it doesn’t have to be.

How it works: A CRM aggregates all revenue transactions for a specific customer. By integrating this with your expense and operational data, you can accurately compare the cost of customer acquisition (CAC) against CLV.

Growth impact: This insight tells you exactly how much you can afford to spend on marketing and sales, helping you optimize your budget for maximum return. If your CLV is high and your CAC is low, you know where to invest your next marketing dollar.

Ready to go Pro?

Level up your CRM with the top-rated Pro Suite — the customer platform that scales with you.

How to put your finance stack into action for growth

A collection of tools is just a cost center; an integrated strategy is a growth engine. Here’s how you can turn a powerful stack into real, measurable scaling:

Financial planning and analysis

Financial planning and analysis (FP and A) forecasts and analyzes a business’s financial performance, crucial for growth-oriented SMBs. An integrated data stack — including historical data (accounting), projected revenue (CRM), and expenses (payroll/expense tools) — then allows for scenario modeling. This enables questions like, “What is the return on investment (ROI) if we hire two more salespeople?” or “How does a 5% cost of goods sold (COGS) increase impact profit?” This capability shifts focus from reporting past events to confidently predicting the future, allowing proactive adjustments to pricing, staffing, and investment strategies.

Raising capital: proving your model

To secure funding (loan, credit, or venture capital), you must show a strong financial foundation and a clear growth plan. Investor-ready reporting is essential; an integrated finance stack provides the clean, real-time financial statements and metrics investors require to understand your cash position.

And, data-driven projections are key here. Your CRM-fueled sales forecasts and financial planning models provide the data to validate your growth story. Investors must see that projections are based on your pipeline, unit economics (customer lifetime value vs. customer acquisition cost), and a proven operational model, which builds the trust needed for scaling.

Accelerate your startup success with Salesforce Launchpad

We believe that business is the greatest platform for change, and success should be for everyone on Earth and the planet itself. Because the new frontier? It’s right here.

Build your financial growth engine with CRM

For the modern SMB or startup founder, the finance function is no longer a back-office operation. It is a core driver of growth. Moving beyond basic bookkeeping to a fully integrated finance stack — anchored by a powerful CRM that connects your revenue engine to your financial statements — is the critical step toward scalable success.

By automating the mundane, gaining real-time insights, and enabling sophisticated forecasting, you can transform your financial management from a source of anxiety into the most powerful strategic tool in your business.

Start your journey with the Free or Starter Suite today. Looking for more customization? Explore Pro Suite. Already a Salesforce customer? Activate Foundations to try out Agentforce 360 today.

AI supported the writers and editors who created this article.

Frequently Asked Questions (FAQs)

Financial tools streamline accounting, expense tracking, invoicing, and reporting, which helps small businesses maintain accurate records, make informed decisions, and improve overall financial health.

Key considerations include the size and complexity of your business, your specific needs (for example, invoicing, payroll, inventory), ease of use, pricing, integration capabilities, and customer support.

Many modern financial tools are designed with user-friendly interfaces and intuitive workflows, making them accessible even for those without extensive accounting knowledge. They often include tutorials and support resources.

Cloud-based tools offer accessibility from anywhere, real-time data updates, automatic backups, and often integrate with other business applications, providing greater flexibility and efficiency.

AI-powered financial tools can automate data entry, identify spending patterns, detect fraud, provide predictive analytics for cash flow and sales, and offer personalized financial advice, all of which help SMBs make smarter, faster financial decisions.