Consumer goods (CG) companies have traditionally been separated from end consumers, operating primarily in the B2B realm by selling to retailers and other indirect channel partners.

But with ecommerce, brands can (and should) sell directly to consumers. Given this growing opportunity, CG leaders are increasingly focused on direct-to-consumer (D2C) revenue. A new Salesforce survey of 500 global leaders says a full 99% are investing in D2C sales. Only 1% said this is not a priority — making this focus for the industry crystal-clear.

Want to better understand this migration toward D2C? Watch our video, then check out these five charts from our study explaining the industry shift.

1. D2C sales: A major financial incentive

Despite online sales comprising only 5% of the total U.S. fast-moving consumer goods (FMCG) market, those online sales account for 40% of the market’s sales growth. That’s a big indicator for where the future of CG is headed.

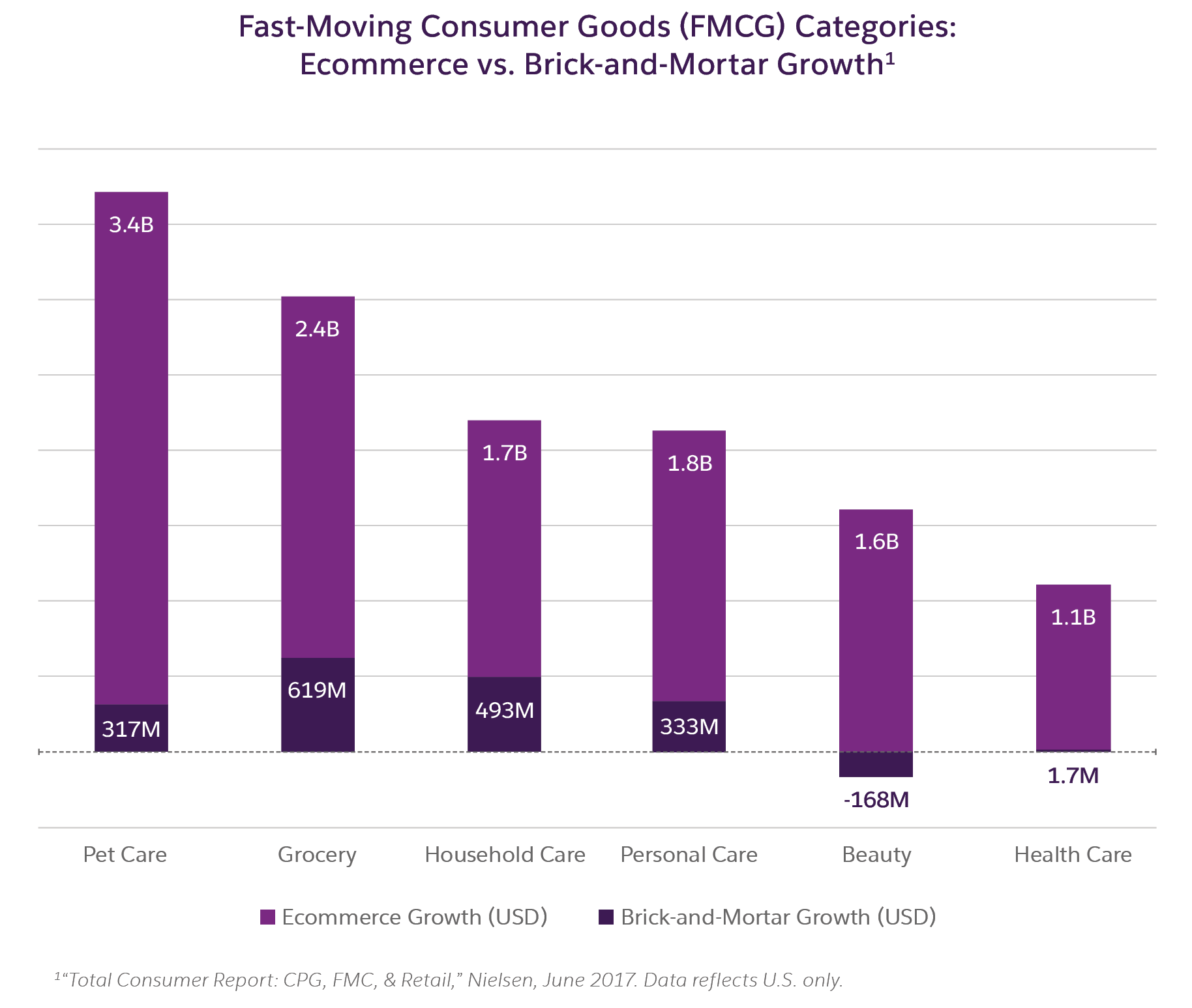

2. Pet care and grocery rack up D2C growth

Today’s biggest ecommerce growth categories within CG are pet care and grocery — and essentially all beauty product category growth is now driven by ecommerce. Physical stores remain on a growth trajectory in general, with grocery being the biggest physical-store stronghold.

3. With D2C opportunity comes new challenges

The D2C transition won’t happen overnight — particularly as it pertains to delivering the elevated experiences today’s consumers demand. Consumer experience has not been a focus or differentiator for CG companies, and many feel they have catching up to do. Over half (55%) of CG leaders perceive barriers in turning the customer data they own into insights — and 54% report siloed departments that make collaboration difficult.

4. Majority of CG leaders say their D2C strategy is “on par” with industry

Despite the inherent challenges in selling D2C, the majority of CG leaders are optimistic about the results of their legwork thus far. Fifty-four percent view their D2C strategy as on par with the industry, and 36% rate it as best-in-class. Only 11% say it is nonexistent or below industry standard.

For that 11%, the mandate to improve D2C operations is clear. But this imperative applies to the 54% of leaders who say they’re just average, too. In the battle for sales against marketplace juggernauts, budget-friendly private labels, and lightning-fast digital natives, average performance isn’t a strong indicator of future success.

5. CG is a balancing act

CG leaders say they’re continuing to optimize traditional retail and channel partner relationships while testing the waters with D2C strategies. Mapping the right people and technology to both B2B and B2C relationships is mission-critical. This chart shows CG leaders’ top objectives as they manage both sides of this balancing act.

Every CG company should be thinking about D2C sales as they prepare for the future. For more insight into the priorities and challenges of 500 global industry leaders, download the new report: Consumer Goods and the Battle for B2B and B2C Relationships.