It was only five years ago when Amazon launched its now-famous shopping event, Prime Day, to its loyal members. In five years, Prime Day has transformed from a rogue event in the dog days of summer to the holiday shopping season’s official kick-off. But 2020 has brought challenges, including to Amazon. With supply chains seriously severed and consumers facing lingering economic uncertainty, events like Prime Day were on the line.

Faced with these challenges as well as unprecedented demand and resource constraints, Amazon postponed Prime Day and threw retailers and consumers into a waiting pattern to see if and when Prime Day would return this year. Finally, after months of whispers on when the event would actually take place, Amazon announced that the manufactured holiday would finally start on October 13.

What does an October Prime Day mean for holiday shopping? Positioned just 44 days before Black Friday, Salesforce predicted the later than usual event had the potential to migrate 10% of Cyber Week’s spending volume into October. So now that Prime Day is officially in the books, what did we learn?

Finding #1: Prime Day spend sets a new record for digital

Last year we established that the Amazon Prime Day “halo-effect” is real, meaning even non-Amazon sites benefitted from the flood of shoppers opening their wallets for the shopping holiday. But, this year the stakes were higher. With Prime Day only six weeks before Black Friday, non-Amazon sites needed to engage weary shoppers who have been burned by shipping delays and supply issues for the better half of the year.

Non-Amazon brands and retailers came out in full force this year. Marketing communications increased by 20% on the first day of Prime Day (October 13) over the previous day (October 12). What were they emailing about? An analysis of marketing emails sent from the IR500 on October 13 and October 14 revealed that at least 18% of Tuesday and Wednesday messages referenced either “Prime” or “holiday.”

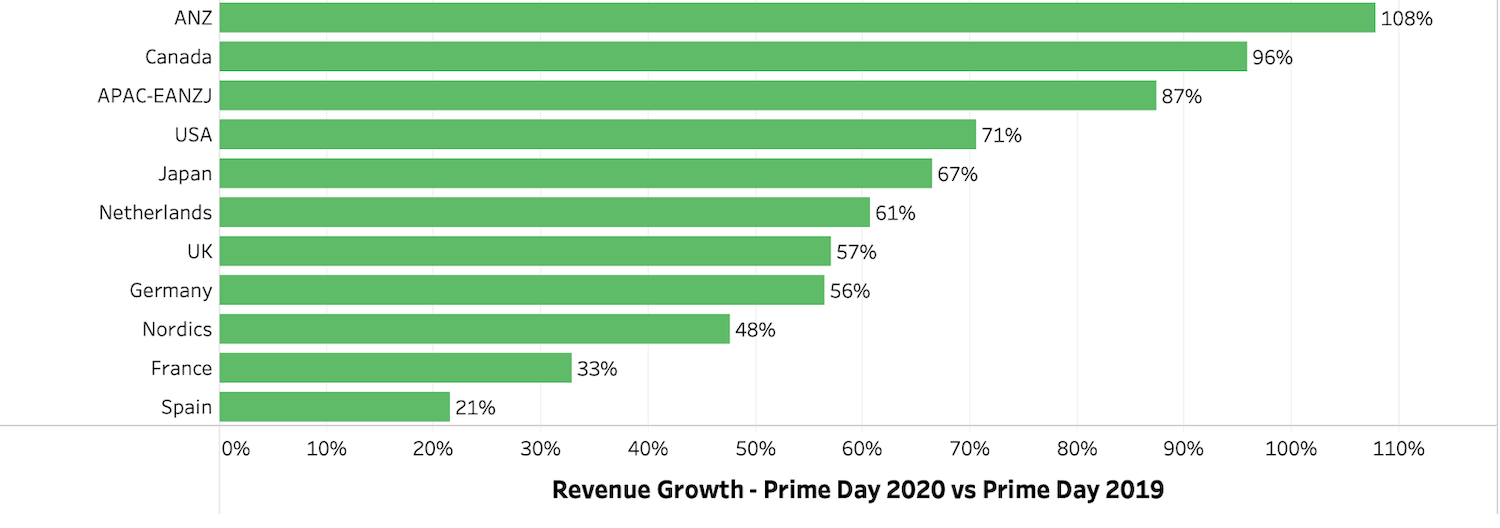

The result? Shoppers were ready to buy. Compared to 2019’s Prime Day, global digital spend increased by a staggering 66%. The growth was even more significant in the U.S., where shoppers spent 71% more than the 2019 July holiday.

But this growth also begs the question, how does Prime Day 2020 compare to the already accelerated digital growth we are experiencing this year? Comparing October 6 and 7 (same days last week) to October 13 and 14 (Prime Day), shows there was a significant increase in spending on Prime Day versus a non-Prime Day. Global digital spend increased by 8% week over week, with Tuesday seeing the biggest increase (12%) compared to Wednesday (4%). The data also shows Prime Day is clearly more of a North American event. Week over week spending increases for Canadian and U.S. sites grew by 26% and 21%, respectively, with the Nordics capturing the highest weekly growth at 87%.

Finding #2: A strong Prime Day could mean a softer Cyber Week

What does this shift to an October Prime Day mean for Cyber Week? Earlier this fall, we predicted 10% of Cyber Week revenue would shift into October. Why? The later than usual shopping event, coupled with shipping issues, health concerns, and product scarcity, is likely to convince consumers they should begin their holiday shopping earlier this year.

Our Shopping Index data shows consumers are flocking to digital sites in record numbers. Across the globe, traffic to digital sites increased by 40% this Prime Day compared to the same event in 2019. Compared to last year’s Black Friday (9% growth) and Cyber Monday (11% growth), digital traffic is growing at magnitudes far greater than we’ve seen before. Even compared to Q2 and Q3, which saw traffic increase by a record 45% and 39%, respectively, this week’s traffic far exceeded the new digital baseline we established since the onset of the pandemic.

What does this mean for Cyber Week? We’re anticipating a heavily promotional October and November with brands and retailers manufacturing demand to encourage early shopping and bypass last-mile challenges that will surely arise. This year’s Cyber Week has the potential to be softer than previously anticipated between the flood of holiday communications and the pressure to avoid late-season shipping delays.

Finding #3: Not even Amazon is immune to last-mile challenges

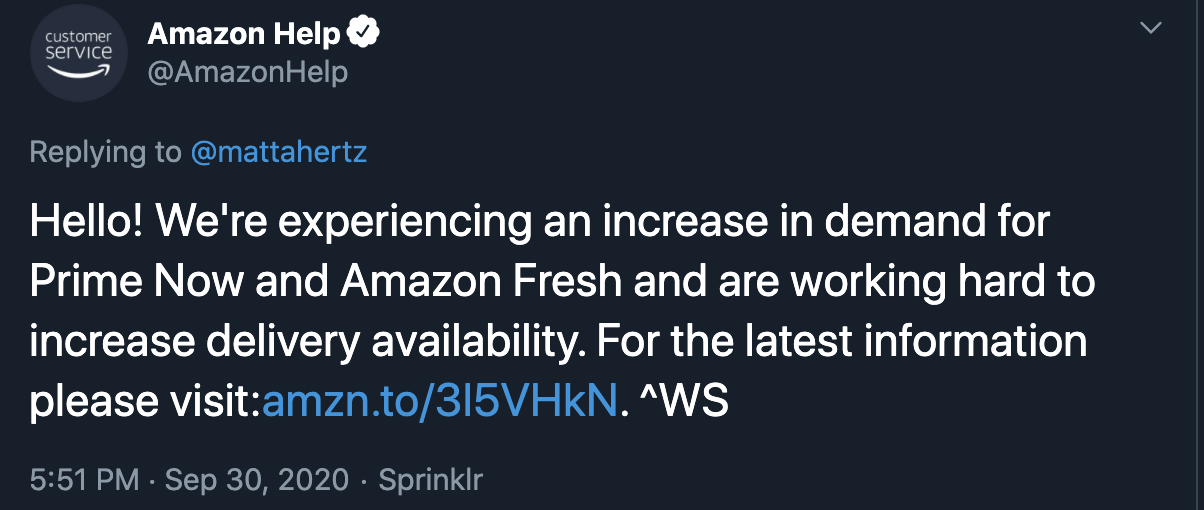

Speaking of last-mile, the surge in digital demand has overloaded the traditional carriers. A flood of residential parcels has left both traditional last-mile carriers, and Amazon’s network of deliverers overworked and stretched thin.

What does this mean for consumers? They’re worried. Data from Salesforce’s Snapshot Research Series indicates the closer we get to the holidays, the more consumers are worried about product availability and deliverability. Between May and August, product availability quickly became the number one factor affecting purchasing decisions and loyalty.

For brands and retailers, the risks are real. We project parcels shipped by traditional delivery providers — such as FedEx, UPS, DHL — will exceed capacity by 5% across the globe between the week before Cyber Week and Boxing Day. That’s potentially 700 million gifts that are at risk of not arriving in time for the holidays. In addition, billions of dollars are on the line in COVID-related surcharges. What options are available when traditional last-mile services are experiencing unprecedented strain? We suggest tapping into crowdsourcing options or leveraging your store associate network. Read more about this here.

Is Prime Day the official start of the holiday season? In 2020 that is certainly the case. Expect a steady drumbeat of marketing communications and promotional activities leading up to Cyber Week to pull demand earlier in the season. One thing is for sure; Prime Day isn’t a standalone event this year; it’s embedded tightly into the holiday season for the entire industry. Which begs the question, will an October Prime Day stick? The jury is still out on that. Check out this conversation and let us know what you think.

The multi billion dollar question. What do you think?

In the meantime, follow along with Salesforce here as we report the latest findings from the 2020 holiday shopping season in real-time.