Streamline your business and let your team focus on clients.

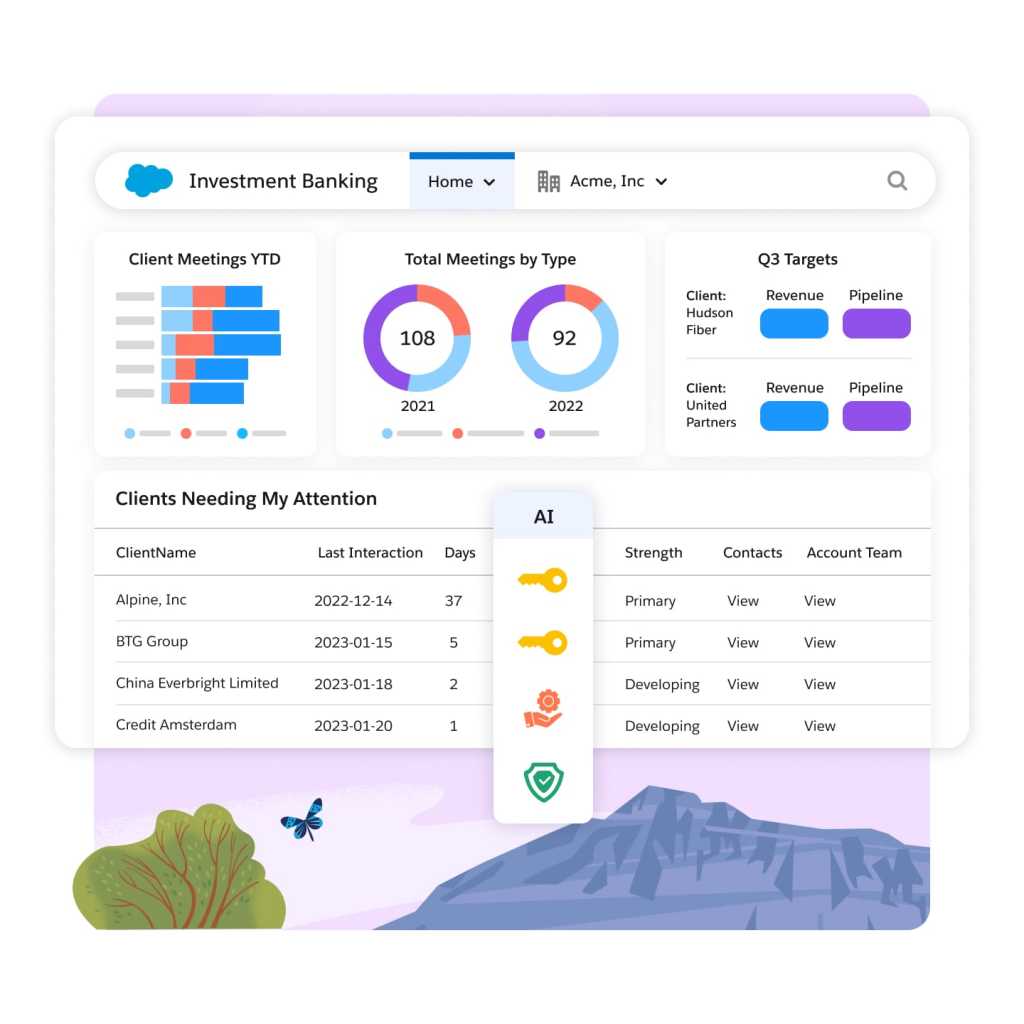

Optimize your deal flow by leveraging unique client insights and ensuring compliant deal management with a powerful investment banking CRM. Cut down operational expenses and drive innovation at a faster pace with tailored solutions designed specifically for corporate investment banking needs.

Activate actionable insights with a powerful investment banking CRM.

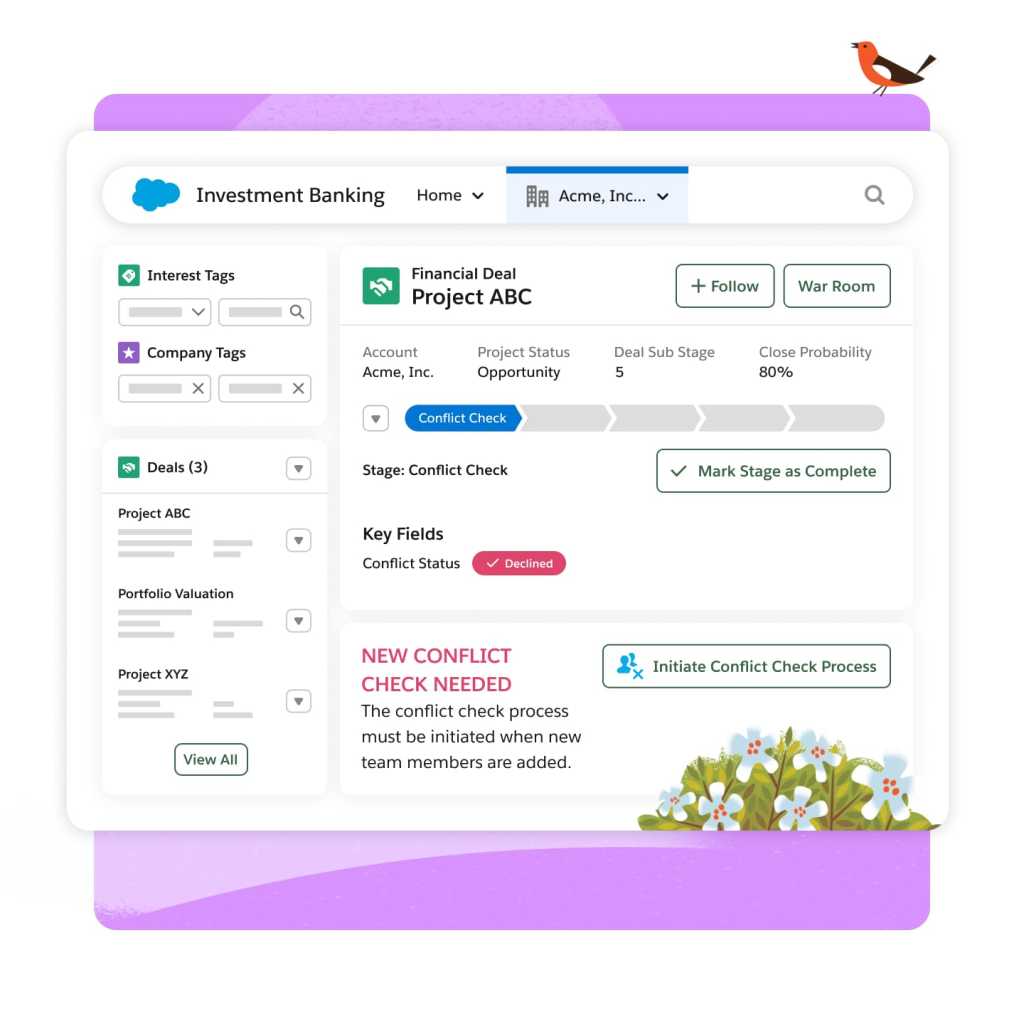

Empower investment bankers with unique insights, compliant deal management, seamless collaboration, and secure information sharing for efficient decision-making. Enhance the pipeline, consolidate data on one screen, and securely share sensitive information with investment banking CRM.

How it works:

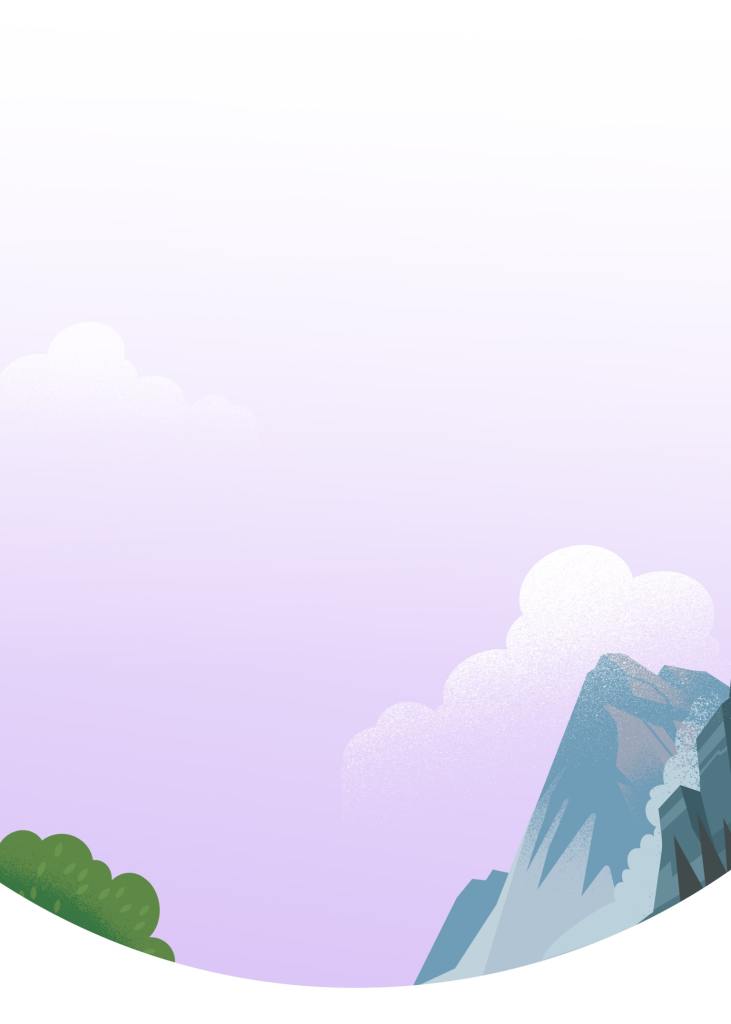

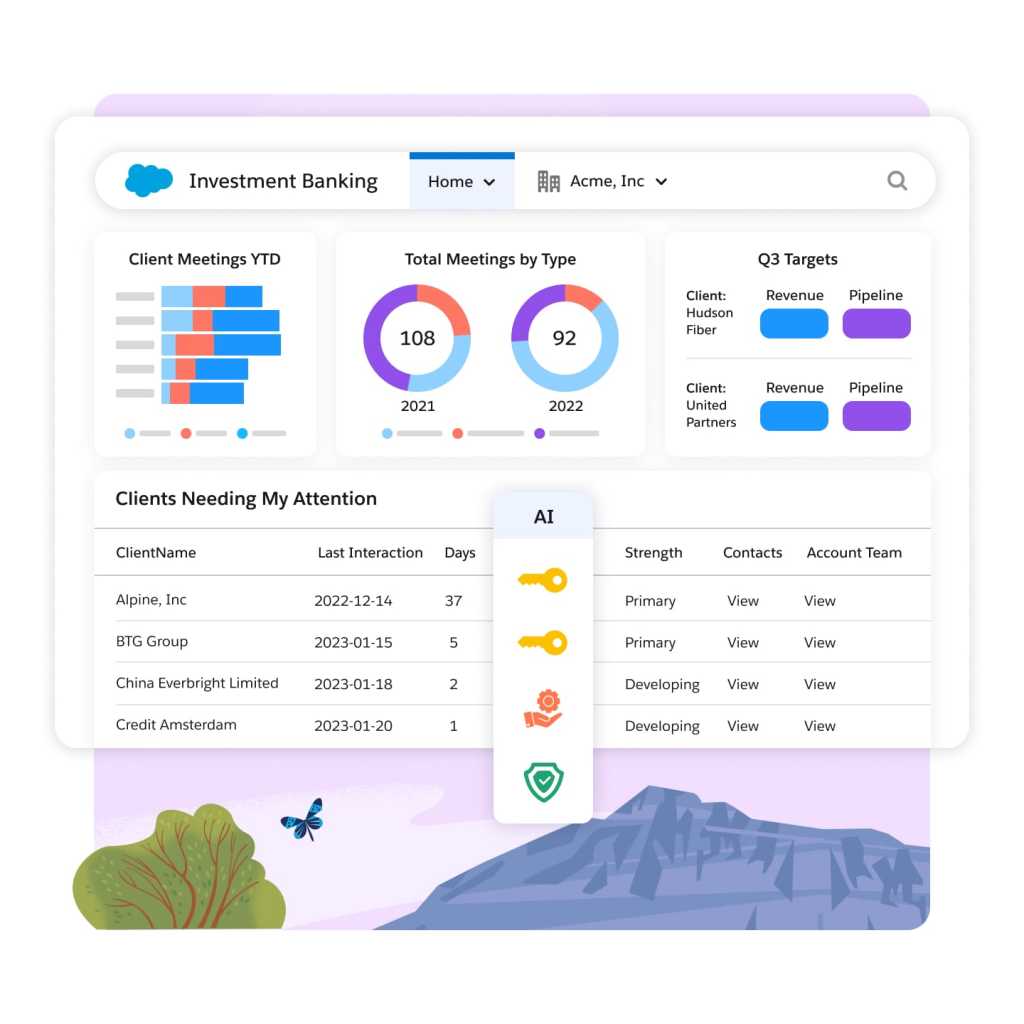

Boost pipeline growth and personalize deal proposals with integrated client insights, complete interaction histories, relationship mapping, and AI-powered recommendations.

Facilitate proactive collaboration among analysts and other members of the deal team working on client research, valuation, market data, relationships, deal recommendations, and client pitches.

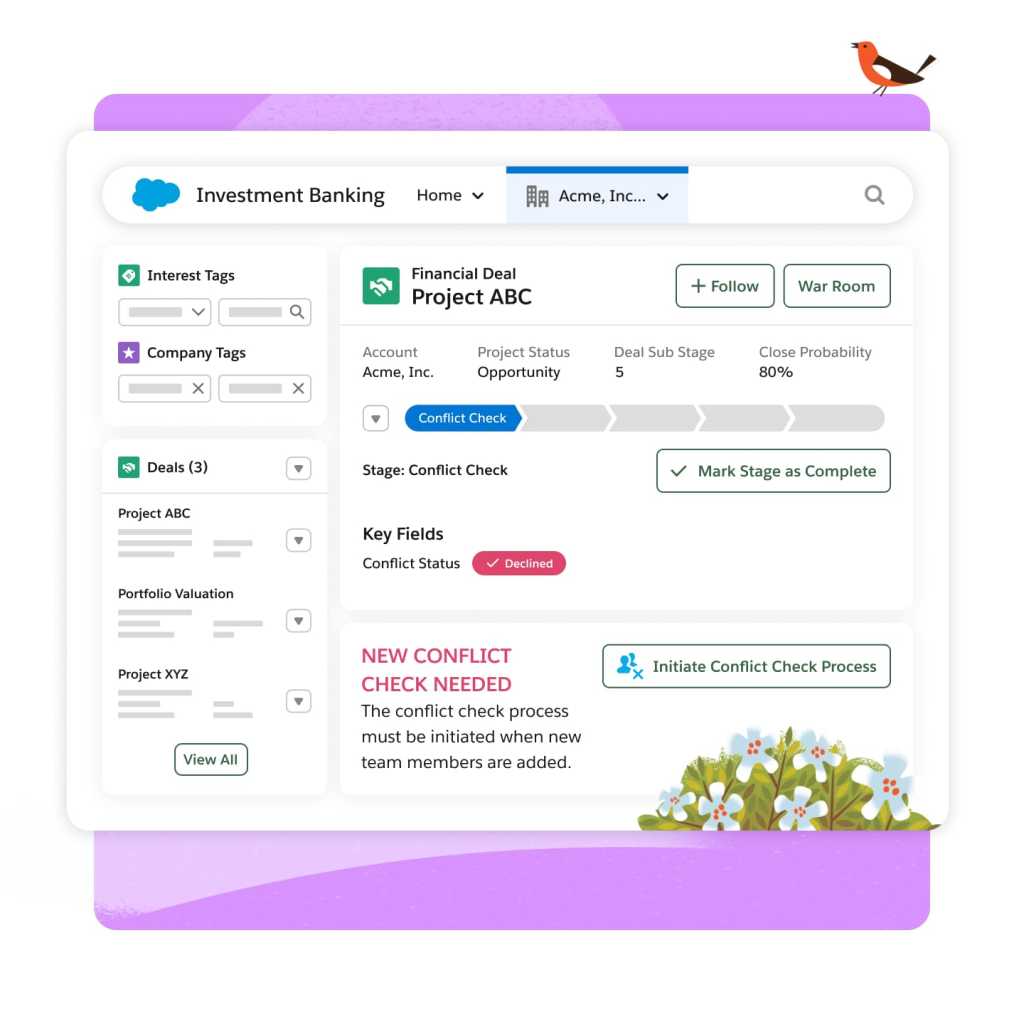

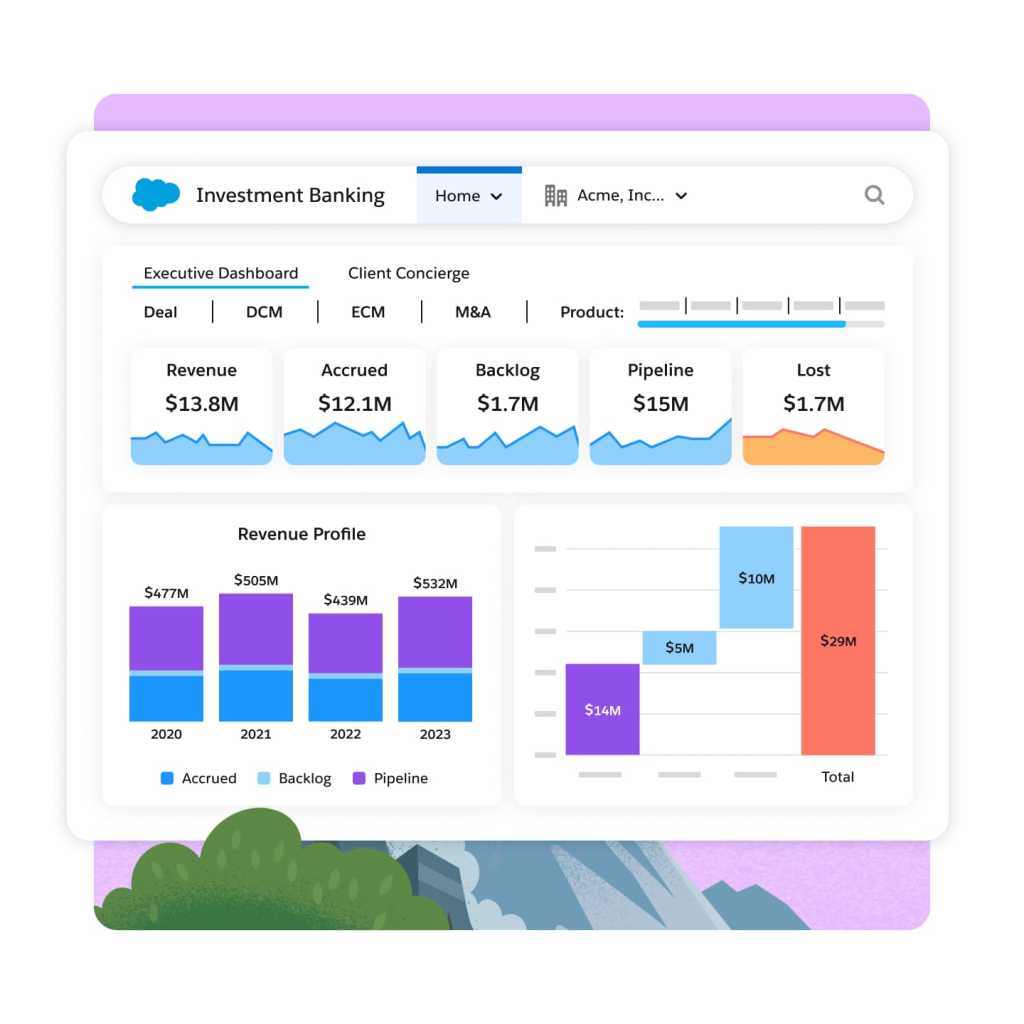

See the big picture, including a complete view of all deals in the pipeline. Review deals in real time. Act swiftly on new opportunities using actionable insights.

Build your investment banking CRM solution with the following Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Intelligence for Financial Services Cloud

Help your entire team find important answers and start making data-driven decisions.

Einstein Relationship Insights

Experience AI built into the flow of work, for any workflow, user, department, and industry.

Salesforce Platform

Seamlessly integrate disparate systems and data sources with API-led services and event-based interactions.

MuleSoft Anypoint Platform

Integrate data from any services system to deliver critical, time-sensitive data – all with a single platform for APIs and integrations.

AppExchange

The world’s leading enterprise cloud marketplace of proven apps and experts. Easily find financial services solutions that are right for you.

Keep up with the latest corporate investment banking trends, insights, and conversations.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Corporate Investment Banking FAQ

Yes. In our investment banking CRM, deal owners and admins have very powerful access control capabilities to ensure that MNPI only reaches the eyes of deal team members that need to know.

Yes, Einstein Relationship Insights scans the open web for articles, press releases, financial filings, and more, to discover relationships that could help connect your company with new prospects.

Yes, our partner Riva integrates with Salesforce's investment banking software and allows us to connect and interact with the Microsoft email and calendar applications.

Investment banking CRM and software streamline client interactions, manage data, and track deals. They aid in client relationship management and deal workflow for investment banking operations.

Investment banking CRM and software enhance client relationships, centralize deal data, streamline workflows, and improve team collaboration, boosting efficiency and deal success.

Consider software flexibility, integration capabilities, user-friendliness, security measures, scalability, and specific features aligning with your investment banking needs before choosing an investment banking CRM solution.