Empower clients to achieve their business goals, powered by AI and data.

Personalize commercial banking experiences with a powerful commercial banking CRM. Use AI and data to strengthen relationships, improve onboarding, and generate referrals. Reduce operational costs, scale with automation, and innovate faster with commercial banking solutions built on a trusted platform.

Simplify commercial banking client onboarding.

Connect and streamline commercial banking client onboarding processes across your front, middle and back office. Create efficient, gratifying, and compliant onboarding experiences for customers and bankers alike with a purpose-built commercial banking CRM.

How it works:

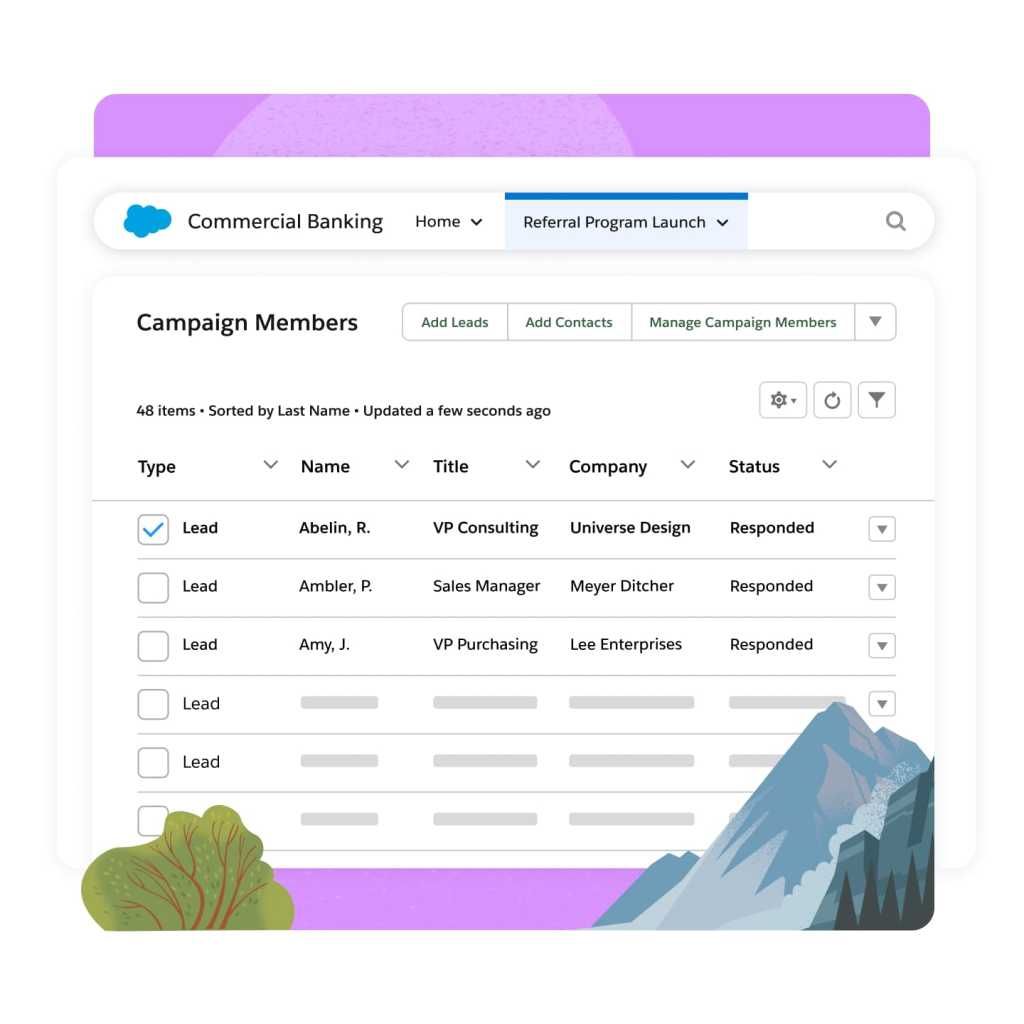

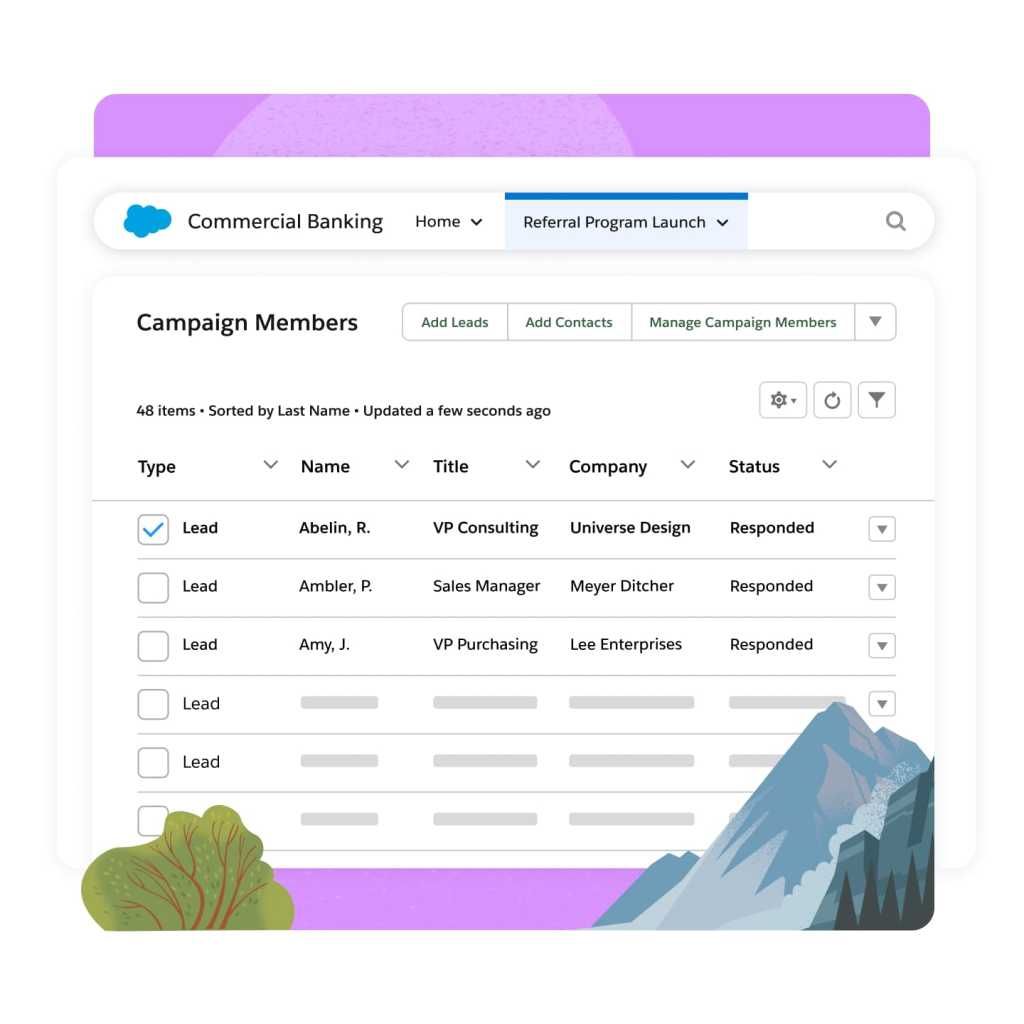

Create campaigns, identify leads, mature prospects, and get to that all important "yes." Begin building customer profiles from the first touch for a smoother commercial banking client onboarding process.

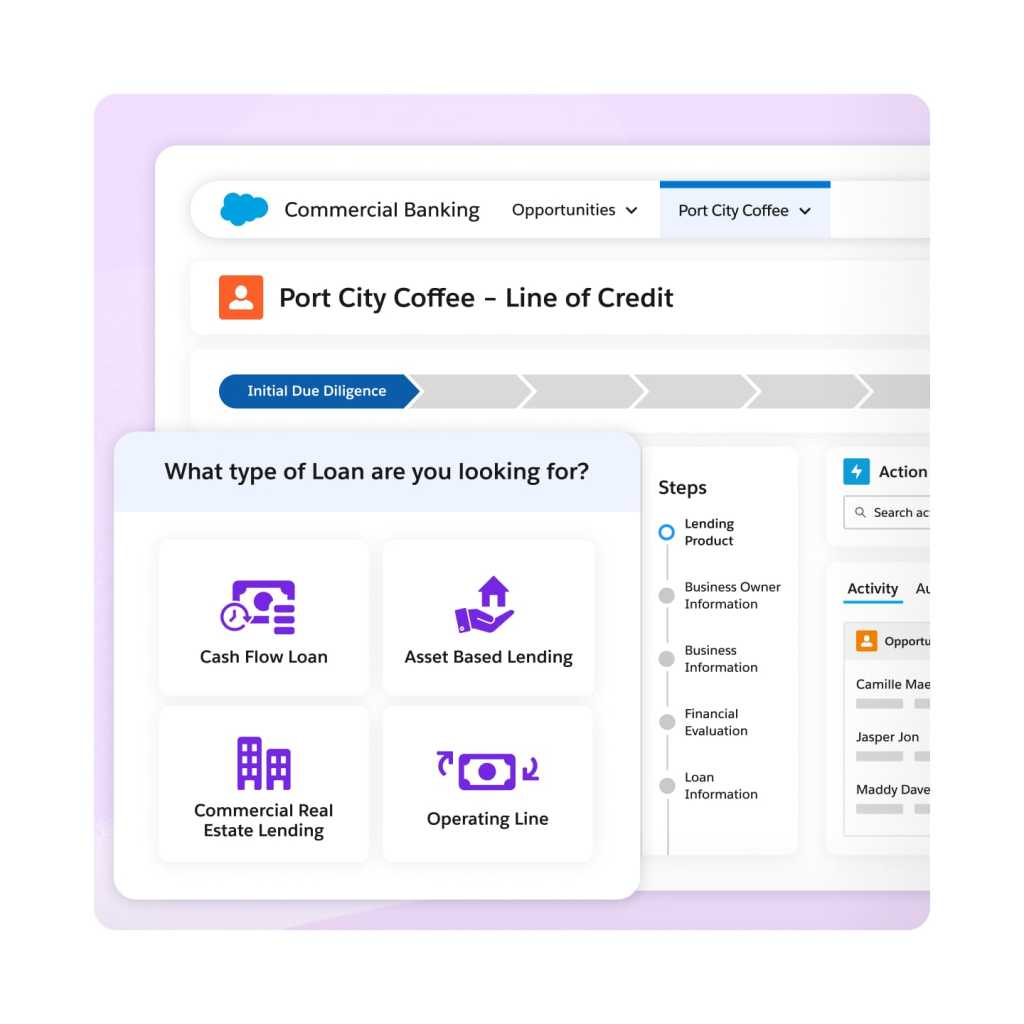

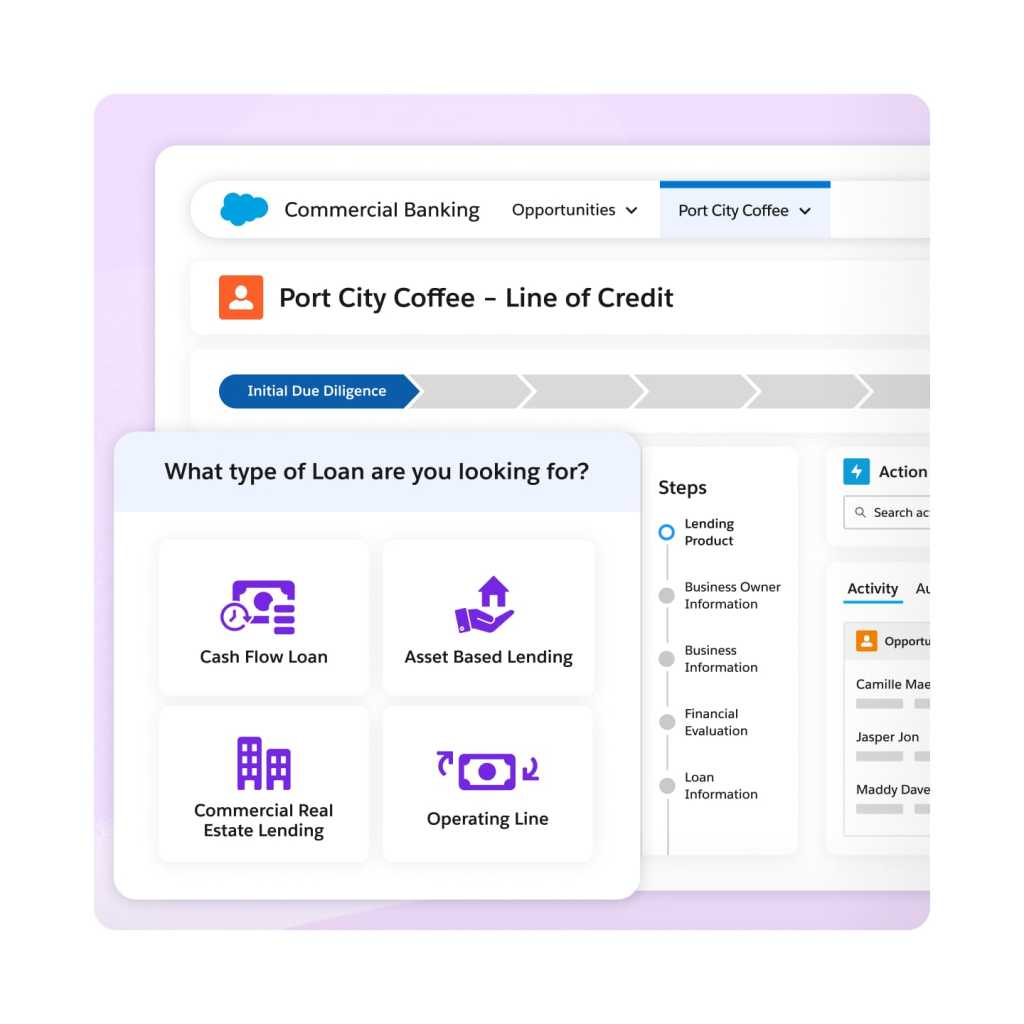

Use guided discovery to get the information you need to to satisfy KYC requirements. Help your customer select the products and services that best fit their needs.

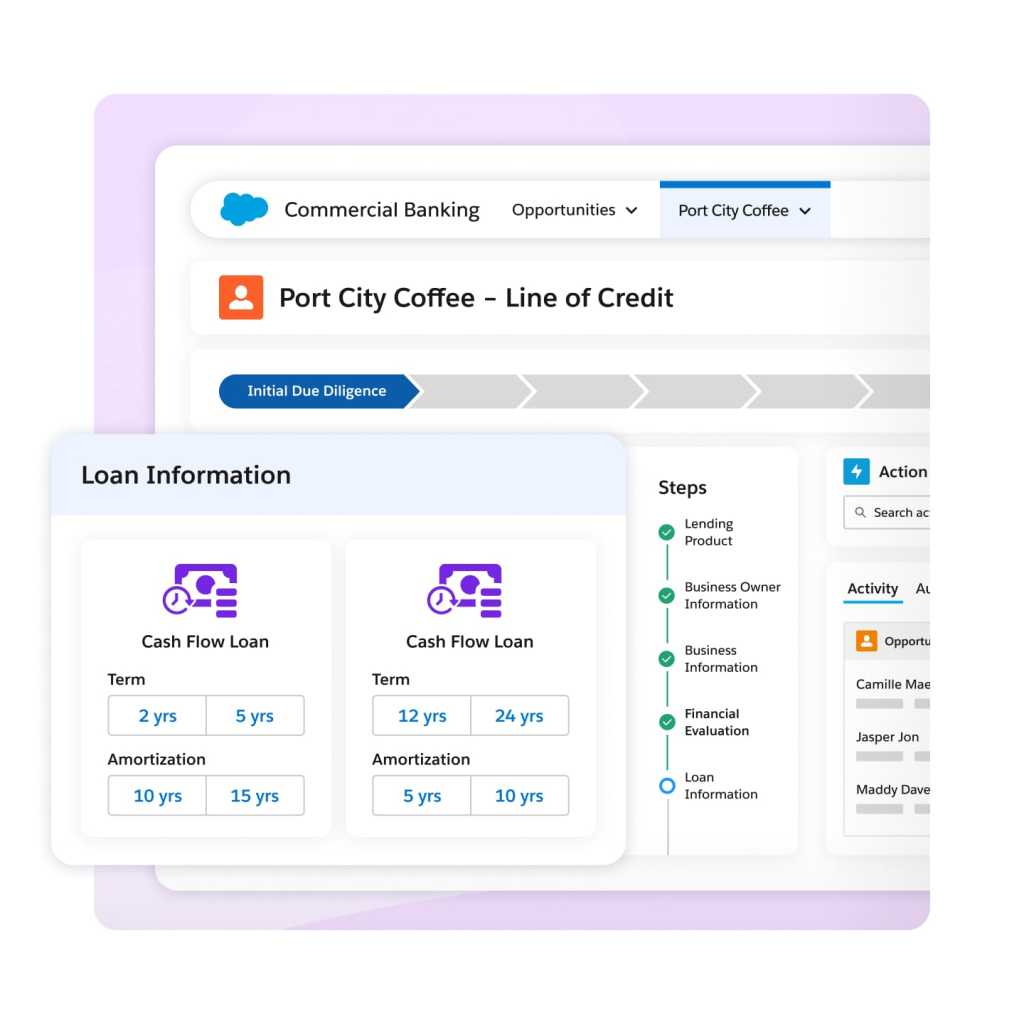

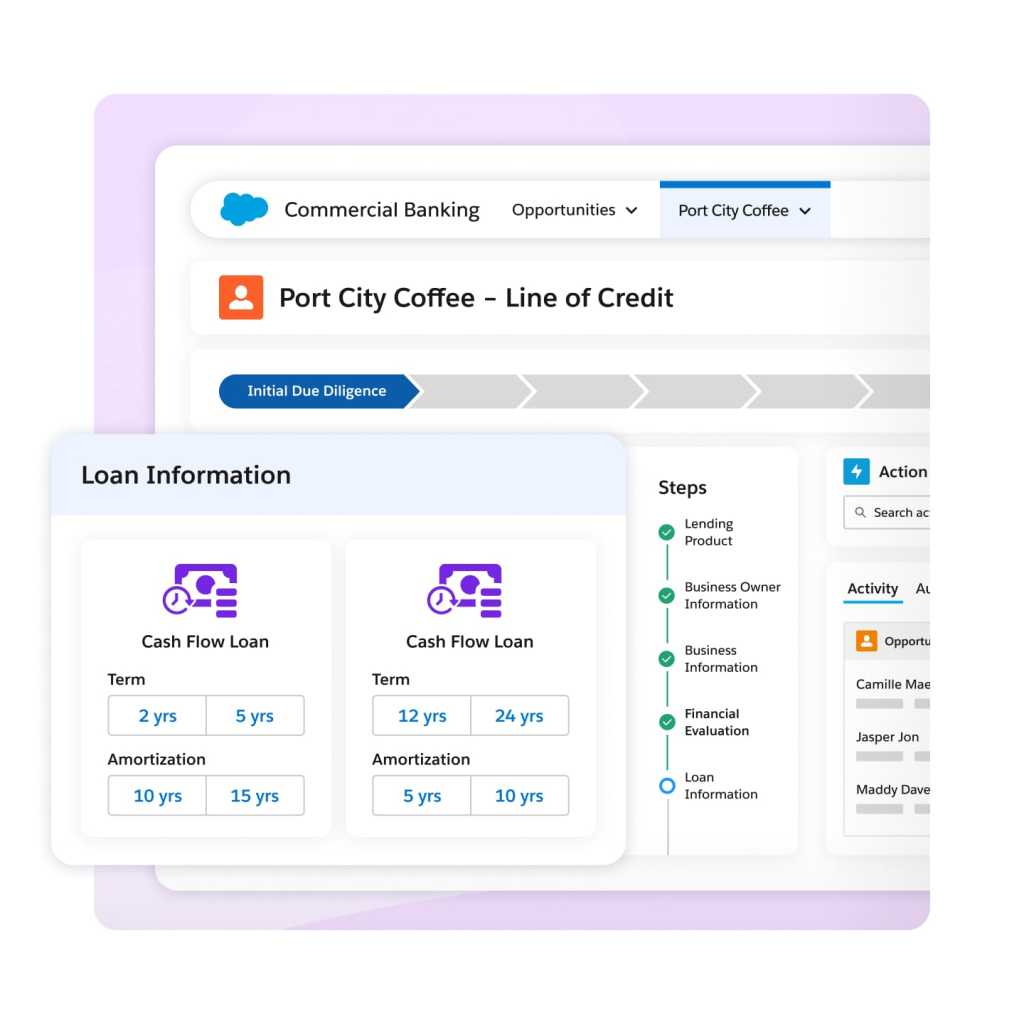

Match the customer to appropriate products based on your new knowledge of their needs, preferences, and qualifications, all while looking out for their financial wellbeing.

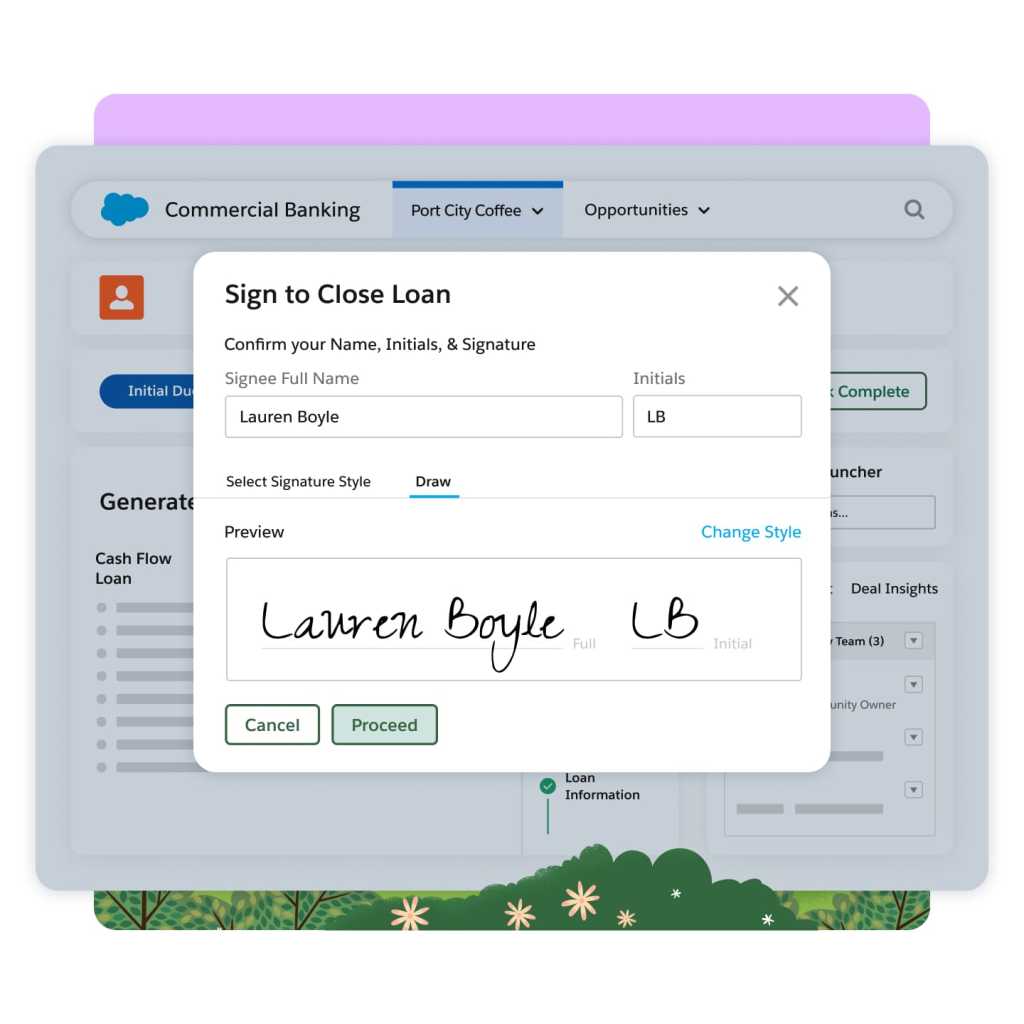

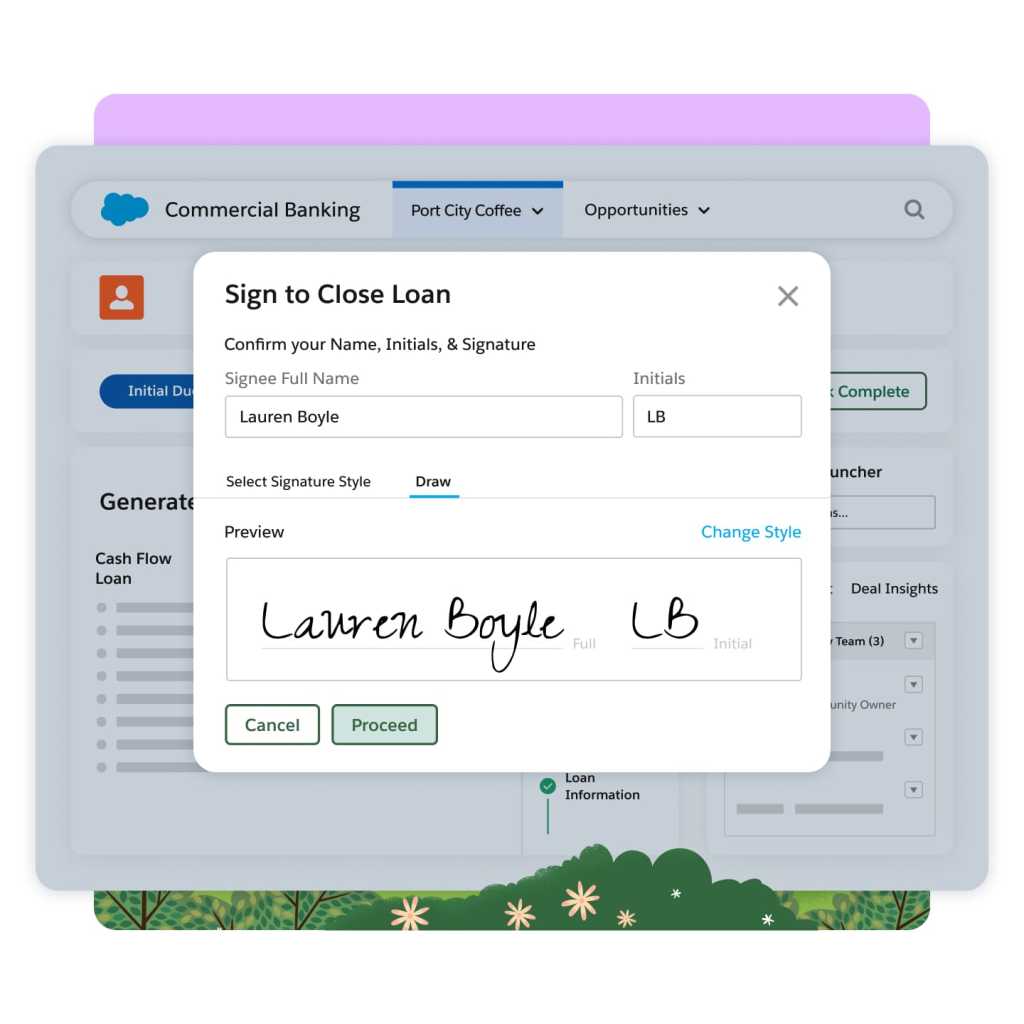

Generate papers, collect signatures, and connect with core systems to instantiate accounts and products. Educate customers on their new products, and encourage adoption and usage.

Build a powerful commercial banking client onboarding solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Marketing Cloud

Personalize customer experiences and optimize each campaign with data-first solutions for any channel and device.

Tableau

Boost productivity and decision-making with the world’s leading AI-powered analytics platform.

Einstein

Boost sales with an AI-powered assistant that researches people and companies related to your sales opportunities.

MuleSoft Anypoint Platform

Integrate data from any services system to deliver critical, time-sensitive data – all with a single platform for APIs and integrations.

Keep up with the latest commercial banking trends, insights, and conversations.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Tell us a bit more so the right person can reach out faster.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Commercial Banking FAQ

Salesforce is actually a suite of products that support the end-to-end lifecycle of a customer. The same tried-and-true automation capabilities used in the front office can be used in the mid/back office to effectively orchestrate work associated with customer onboarding and account opening.

The Salesforce platform has matured to become much more than a commercial banking CRM. Our capabilities lend themselves well to operational roles. Leading analysts recently rated Salesforce as a leader in financial services CRM software, specifically calling out our coverage of front, middle, and back office.

Applications like these are often built as point solutions (e.g. back-office only) resulting in disconnectedness, re-keying, errors, and lack of visibility or transparency to both customers and those that serve them. The Salesforce platform connects the bank's operations front to back.

Onboarding is not a new use case for Salesforce. Customers like Santander in the UK have used Salesforce to reduce their onboarding time up to 80%. PenFed Credit Union uses Salesforce to help onboard its clients and has dramatically reduced its technical debt and oversight of multiple systems.

A commercial banking CRM manages customer relationships, tracks interactions, and centralizes data for better client understanding and tailored financial services in commercial banking operations.

Select a commercial banking CRM based on scalability, integration abilities, user-friendliness, security features, and specific tools aligning with commercial banking needs. Prioritize seamless customer data management and service customization.

Client onboarding in commercial banking ensures compliance, risk mitigation, and personalized service. It sets the foundation for relationships, enabling tailored solutions and efficient financial management for clients.