Unlock data to grow client relationships and AUM with trusted AI.

Personalize client engagement by unlocking data with the leading AI CRM for financial advisors. Leverage data-driven insights that strengthen relationships. Use AI and automation to fuel advisor productivity. Drive satisfaction and grow AUM through modernized experiences, scaled service, and real-time financial engagement.

Now, instead of jumping from one system to another, our advisors and sales teams are using Salesforce Financial Services Cloud for one unified view of their clients, and are able to quickly pull insights and recommendations, servicing them quicker than ever before.

Ken ThompsonHead of Shared Services, TD Wealth

Modernize advisor experiences.

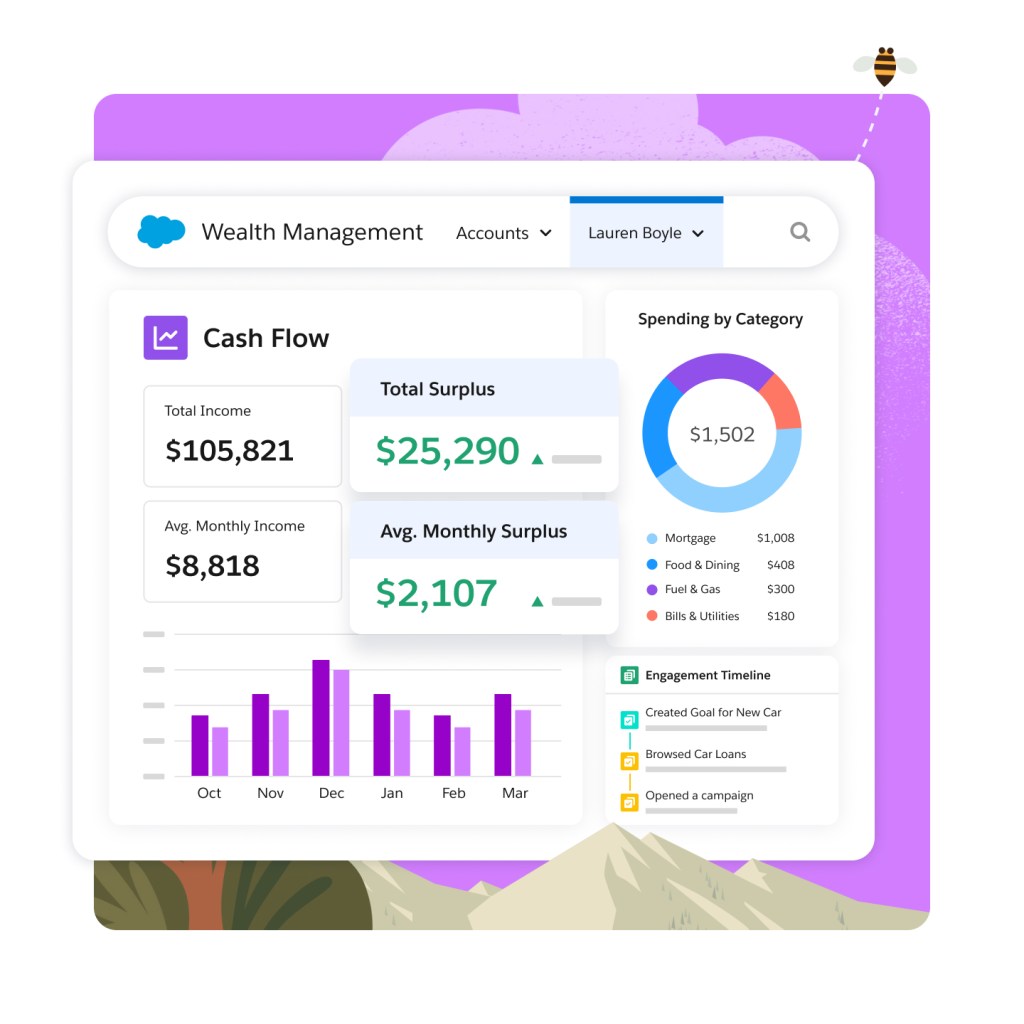

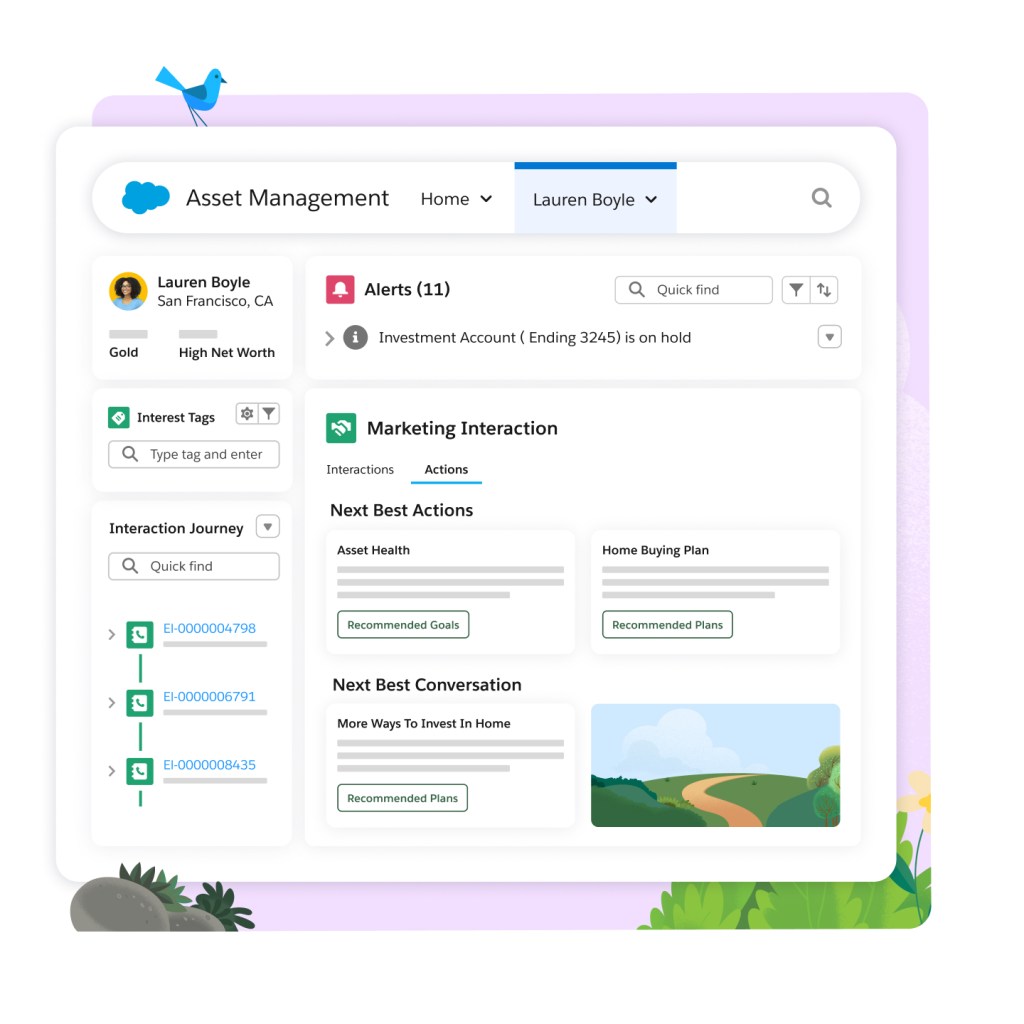

Increase financial advisor productivity and impact with data-driven actionable insights. Improve marketing capabilities through a unified CRM platform for financial advisors.

How it works:

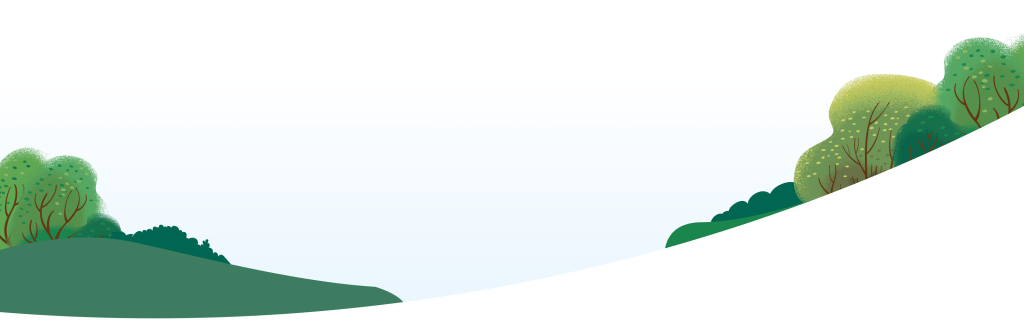

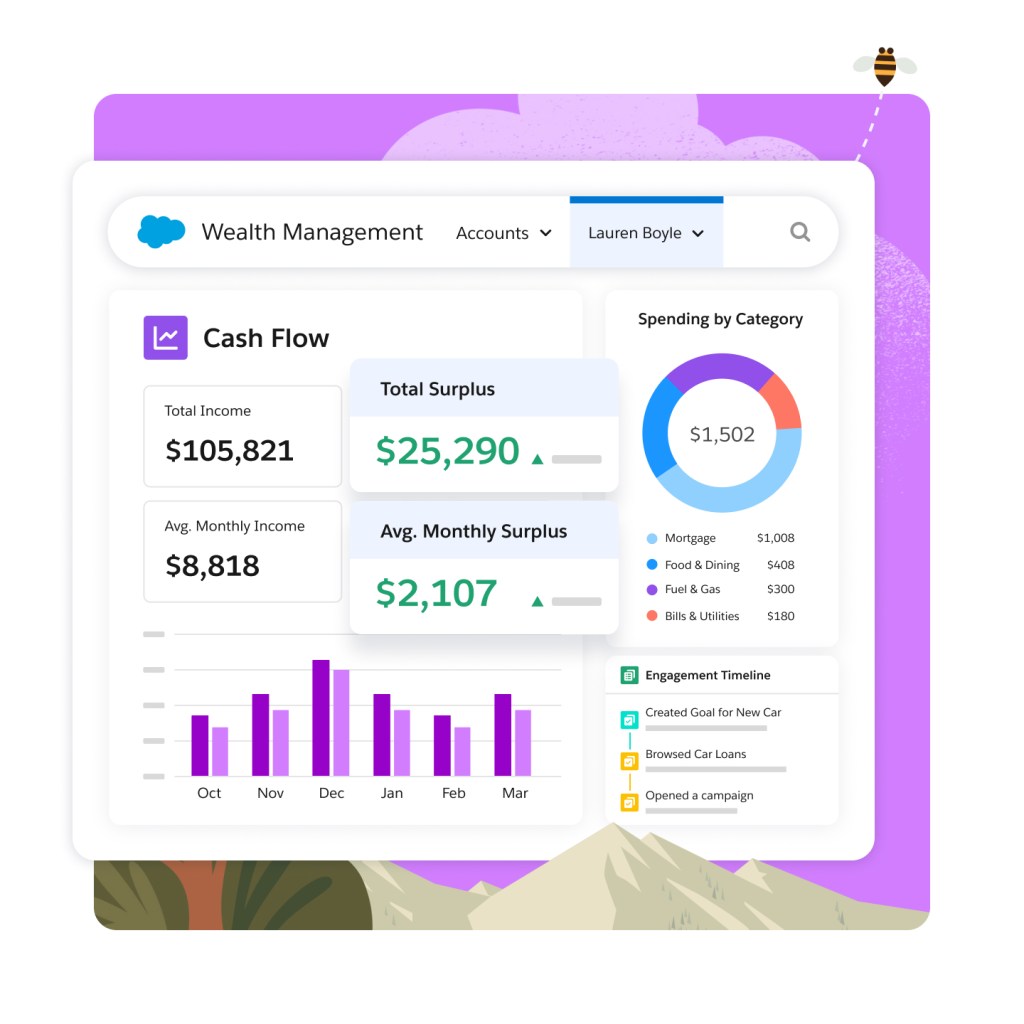

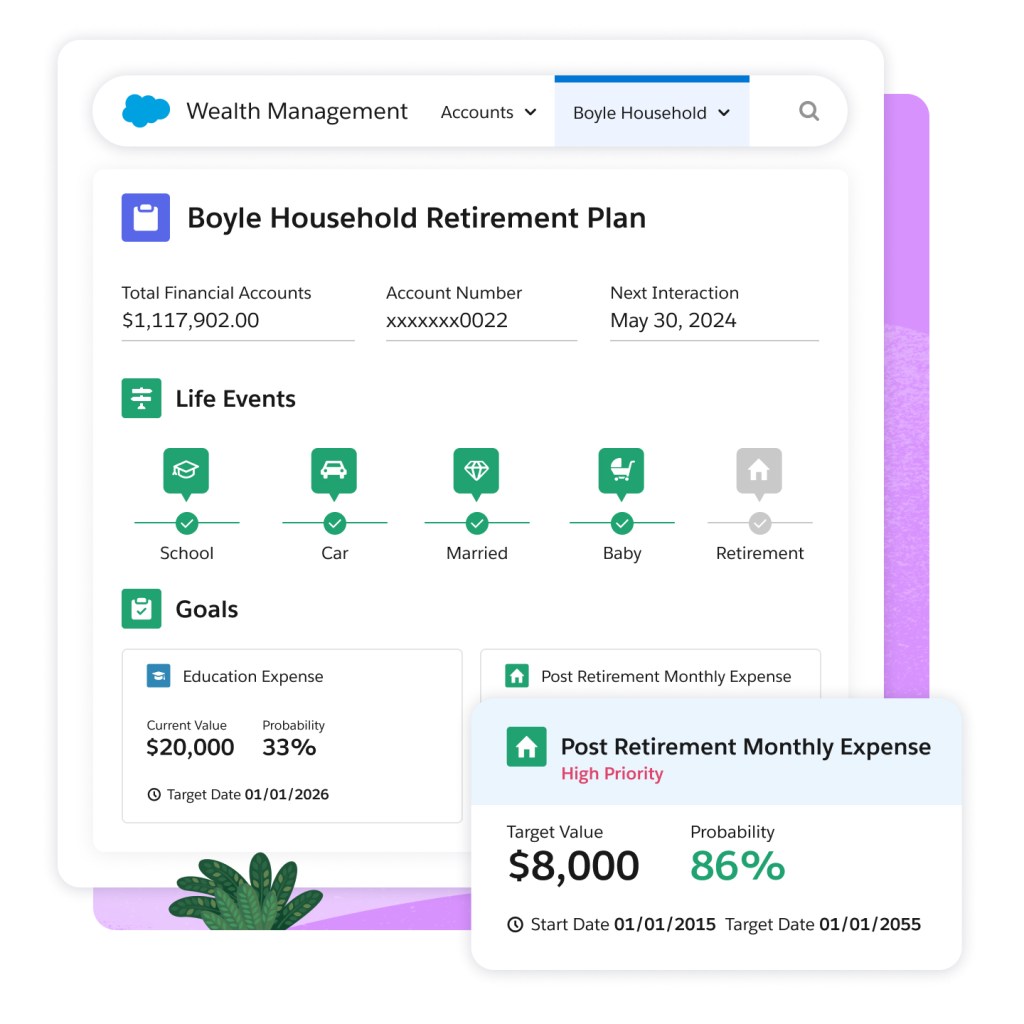

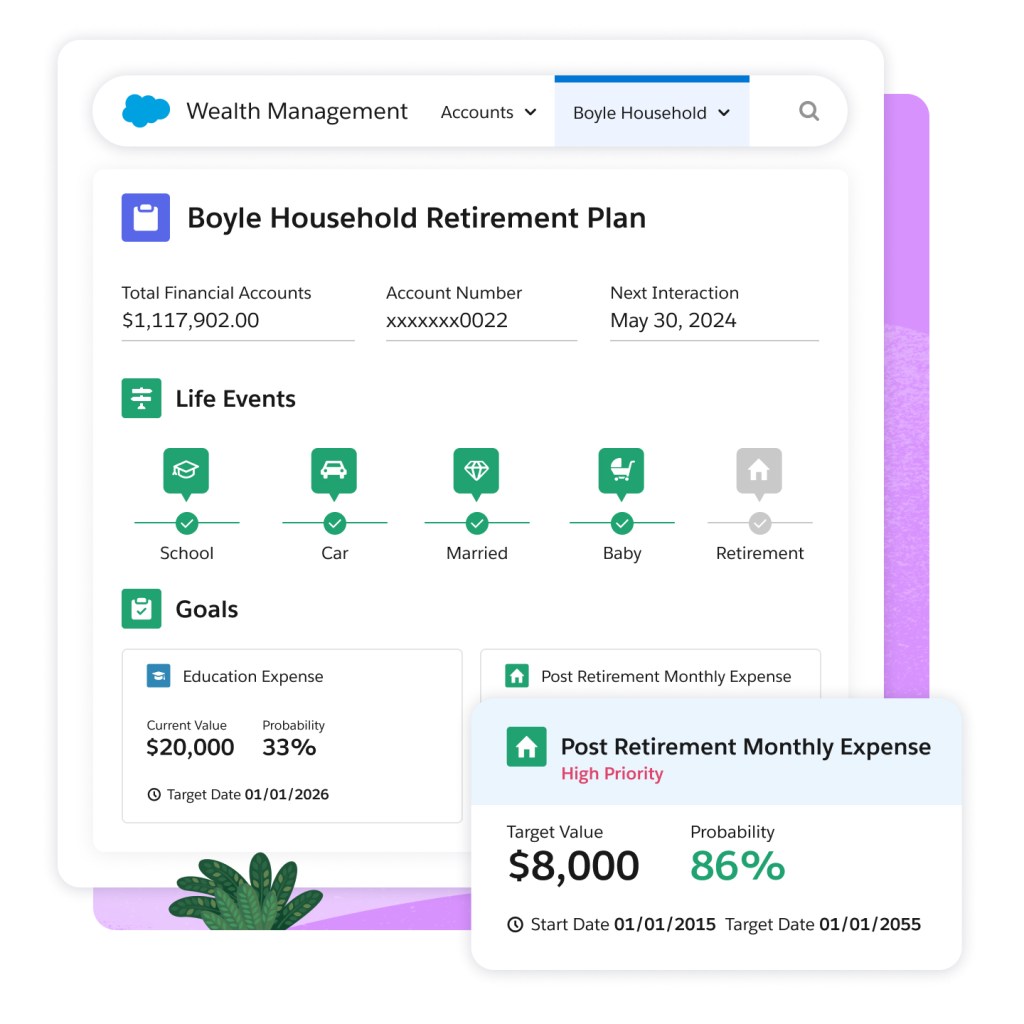

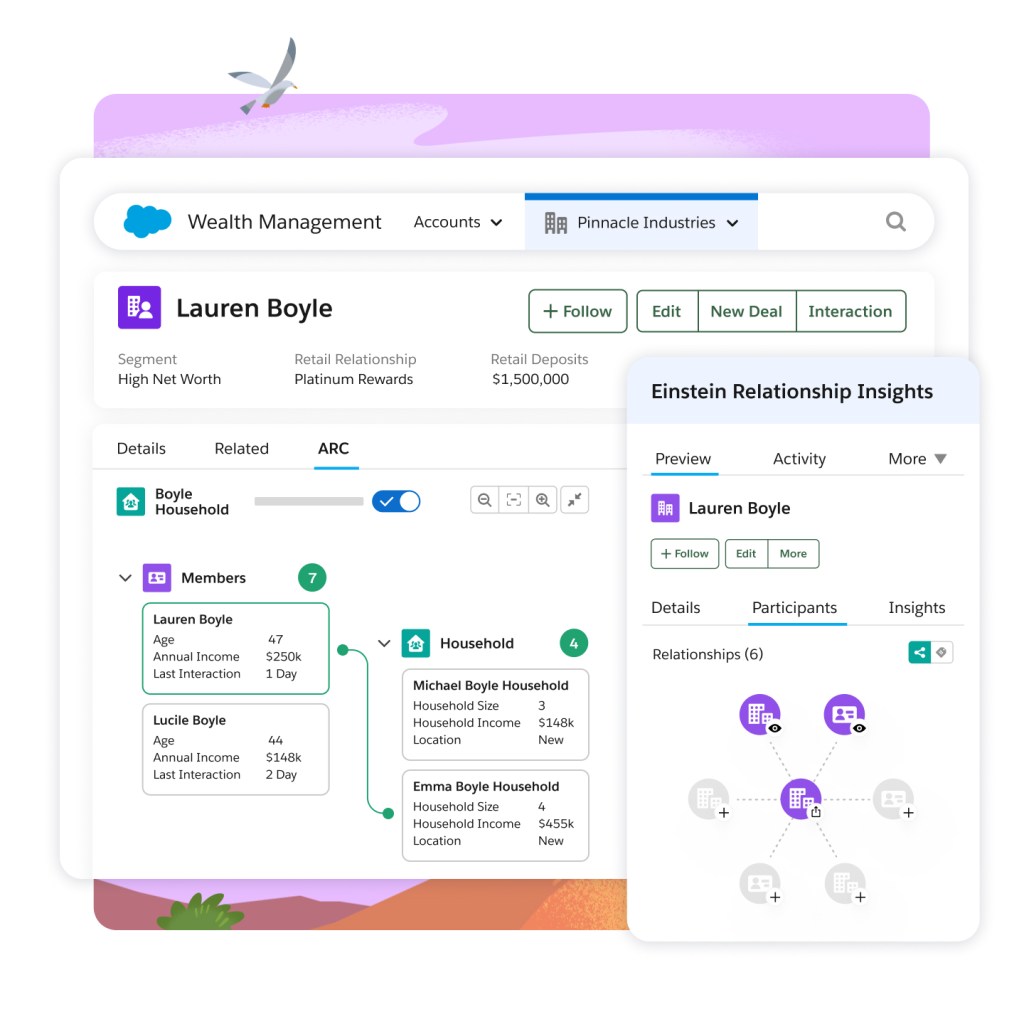

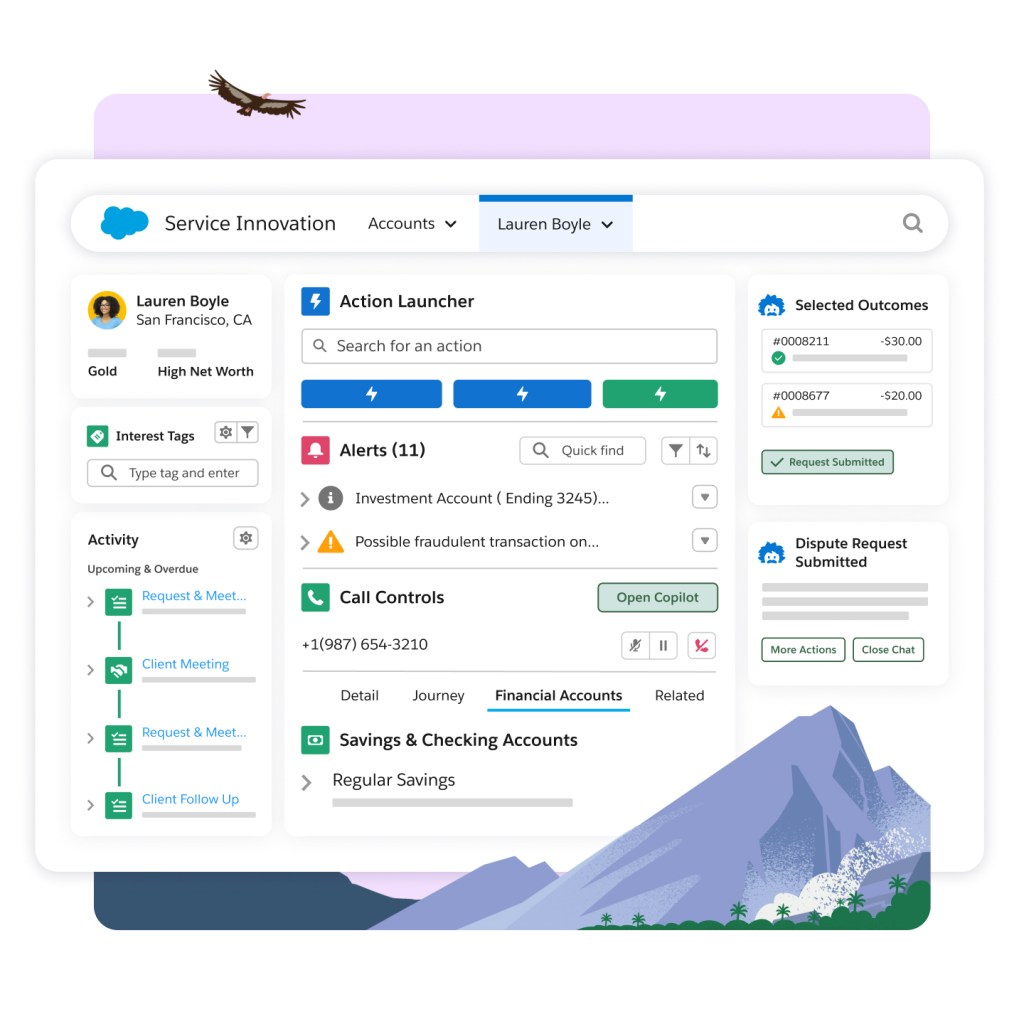

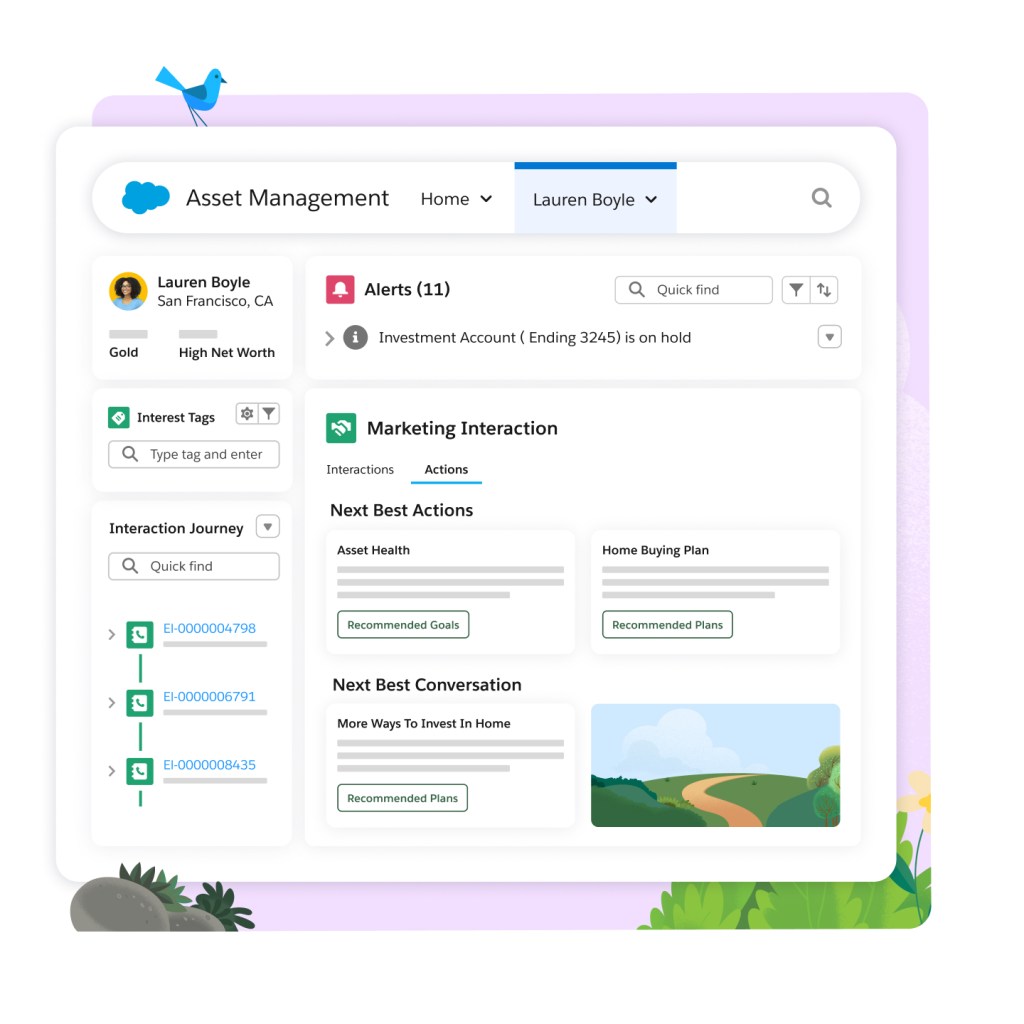

Fragmented systems and disconnected data are a thing of the past. Stop jumping from system to system and unify your data on the Salesforce platform for wealth management. Get an in-depth look at client financial accounts, goals, relationships, life events, and more on a single platform.

Empower your insights with plans that put a wealth of data to work for you.

Help teams deliver personalized advice that grows a robust referral network.

Build your advisor experience solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Marketing Cloud

Get to know your audience through unified profiles. Personalize offers across any channel with AI. Build lasting relationships that drive business growth.

Intelligence for Financial Services Cloud

Help your entire team find important answers and start making data-driven decisions.

Einstein Relationship Insights

Boost sales with an AI-powered assistant that researches people and companies related to your sales opportunities.

MuleSoft Anypoint Platform

Bring MuleSoft flows directly into Salesforce for seamless connectivity and enhanced capabilities for financial institutions.

Scale client service.

Increase financial advisor productivity and impact with data-driven actionable insights. Improve marketing capabilities through a unified CRM platform for financial advisors.

How it works:

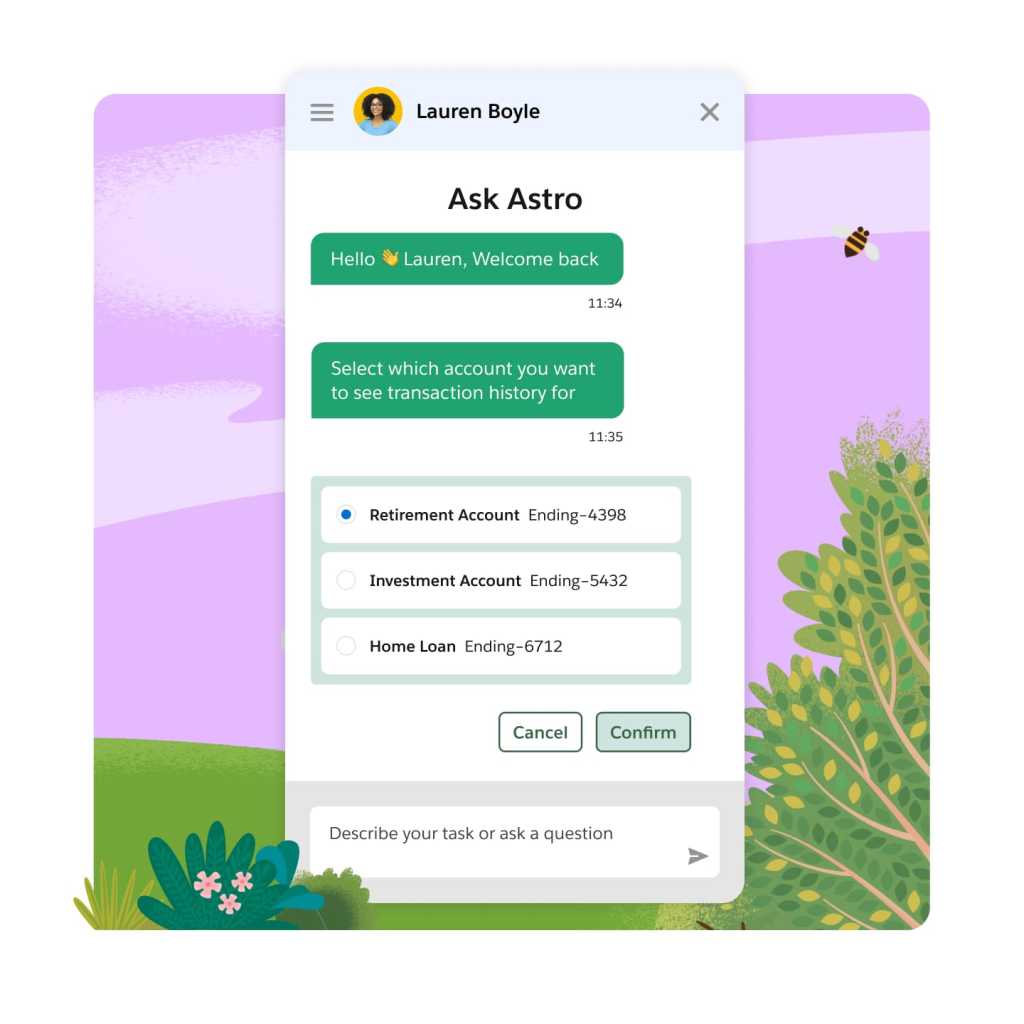

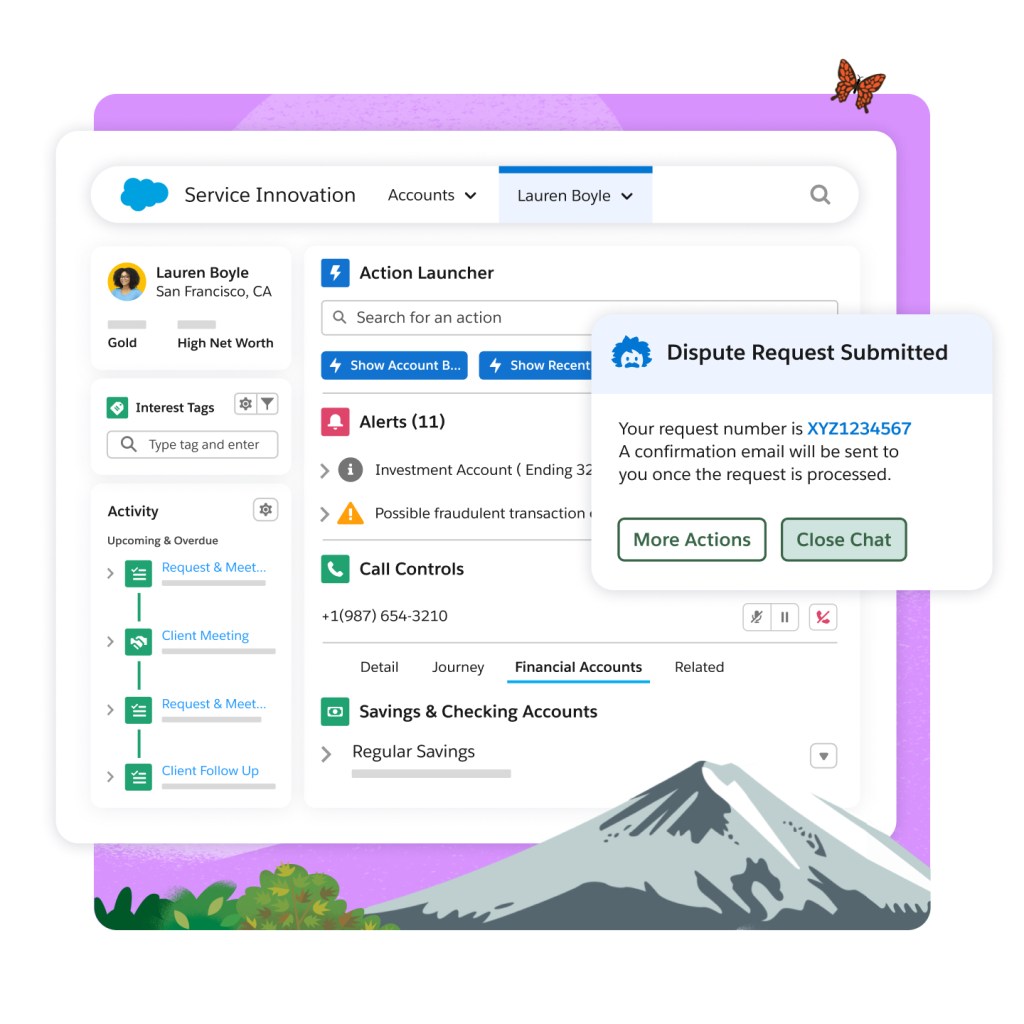

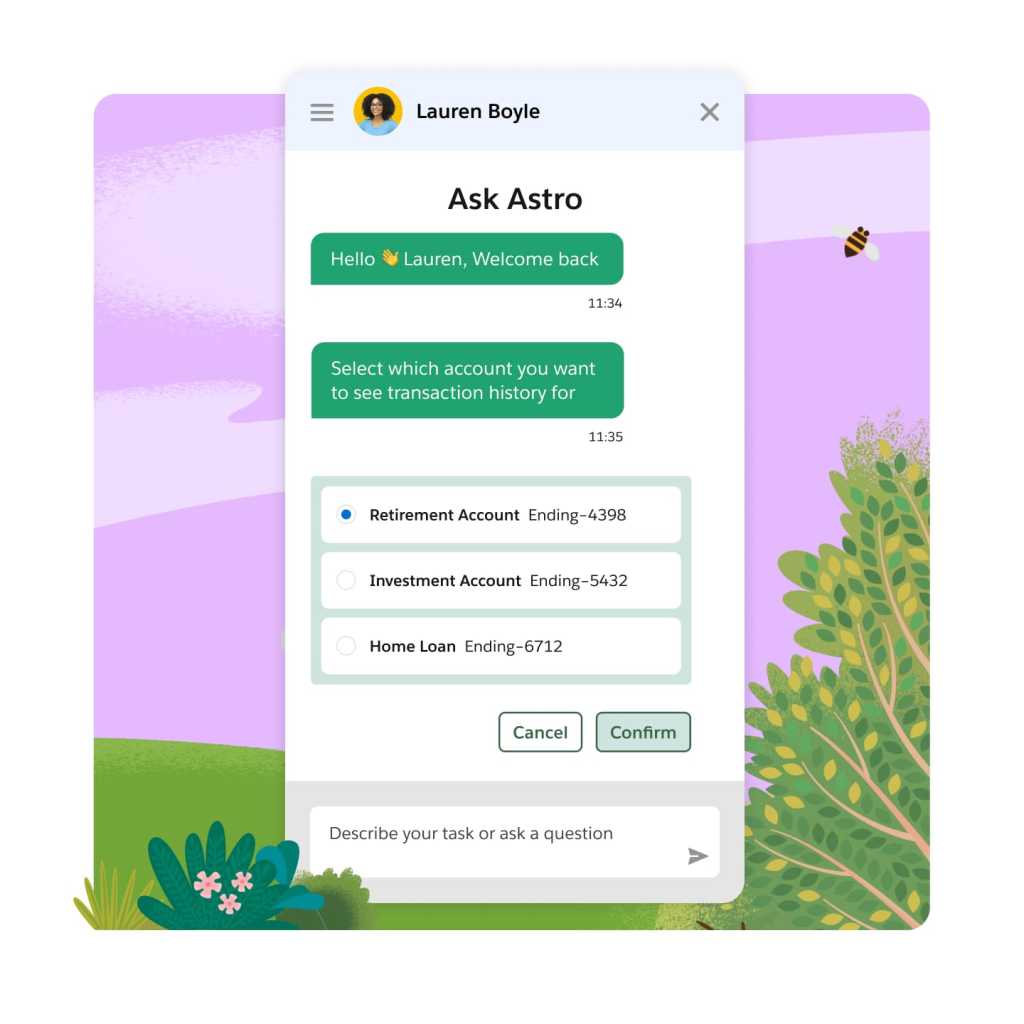

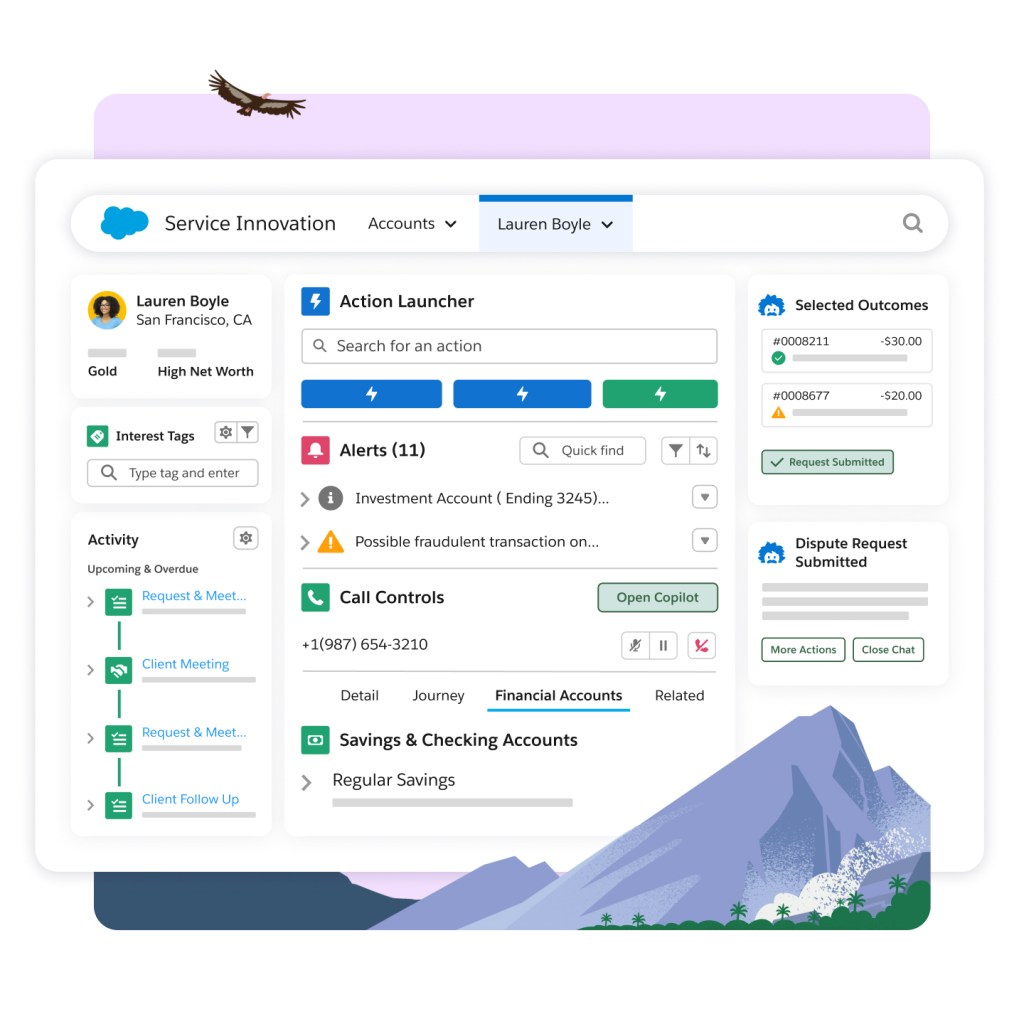

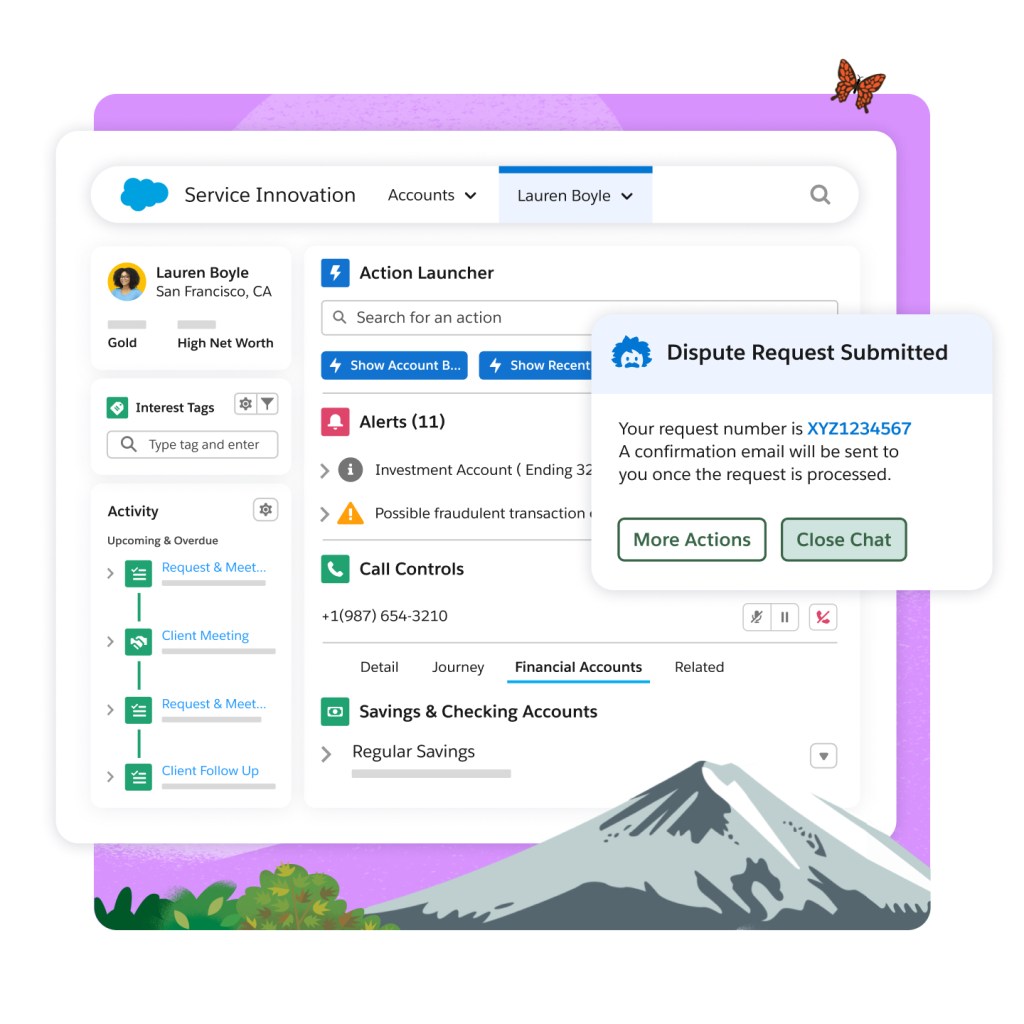

Provide knowledge base and chatbots with modern, conversational UI to boost client service satisfaction and reduce time to serve.

Allow CSRs to pull up information right away, all in a unified system, with wealth management software.

Connect the middle and back office workflow for improved orchestration among teams.

Understand what's important to your clients with unified interaction data and AI.

Build your scalable service solution with these Salesforce products:

Financial Services Cloud

Unify customer experiences across channels, geographies, and both consumer and commercial lines of business.

Service Cloud

Transform how service teams deliver value at every touchpoint — including customer experience, engagement, processes, automation, and service operations.

Einstein AI

Experience AI built into the flow of work, for any workflow, user, department, and industry.

Flow

Generate real-time, intelligent workflows with Data + AI + CRM + Trust.

Slack

Bring together the right people, information, and tools to drive business.

Intelligence for Financial Services Cloud

Help your entire team find important answers and start making data-driven decisions.

Experience Cloud

Quickly launch data-powered sites, portals, and apps, connected across the customer journey.

Keep up with the latest wealth management trends, insights, and conversations.

Ready to take the next step with the world's #1 AI CRM for financial services?

Start your trial.

Try Financial Services Cloud free for 30 days. No credit card. No installations.

Talk to an expert.

Watch a demo.

Learn how Salesforce for financial services empowers customers' financial success.

Wealth Management FAQ

Salesforce is used by wealth management firms, RIAs, broker dealers, and investment managers for portfolio management, compliant onboarding, communications, service capabilities, and more. Our purpose-built CRM for financial advisors streamlines operations and improves client relationships.

Wealth management firms who use the right CRM see benefits such as increased operational efficiency, enhanced productivity, better decision-making through analytics, improved collaboration, and automated workflows.

Yes, Salesforce supports ESG initiatives by providing tools that enable firms to track, measure, and report on their ESG performance. This includes solutions for data management, reporting, and stakeholder engagement.